Commercial Heat Pump Water Heater Market Research, 2032

The global commercial heat pump water heater market was valued at $299.4 million in 2022, and is projected to reach $608.5 million by 2032, growing at a CAGR of 7.4% from 2023 to 2032.

Report Key Highlighters:

- The commercial heat pump water heater market scope covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The commercial heat pump water heater market share is highly fragmented, with several players including Ingersoll Rand, Mitsubishi Electric, Midea Group Co., Ltd., Viessmann Group, A.O. Smith Corporation, Bosch Industries, NIBE Energy Systems, Valliant Group, Rheem Manufacturing Company, Inc., and Daikin Industries, Ltd.‐¯ Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the commercial heat pump water heater market.

Heat pump water heaters are used to move heat from the source to a sink, by utilizing electricity instead of generating heat directly. Heat pumps are used to facilitate the movement of thermal energy by absorbing heat from a cold space and release it. Further, several commercial businesses such as hotels, offices, retail stores, and restaurants, are installing heat pump water heater with an aim to lower electricity consumption. Such adoption of heat pump water heater in the commercial buildings is expected to promote the commercial heat pump water heater market during the forecast period.

Rise in urbanization and surge in industrialization specifically in Asia-Pacific is projected to boost commercial heat pump water heater market. However, high cost of heat pump water heater as well as its installation hamper the growth of the commercial heat pump water heater market. Fluctuating prices of raw materials restrain the overall growth of the market. Technological advancement, which helps to develop new products formulation, is expected to offer new growth opportunities to commercial heat pump water heater market.

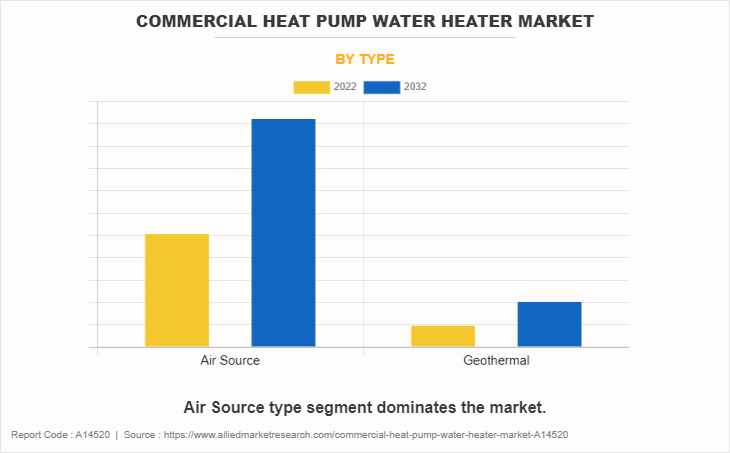

Air source heat pump water heaters offer exceptionally high operational efficiency and require lower installation cost in comparison with geothermal heat pump water heater. They are mainly used in the commercial sector as hotels, offices, retail stores, and restaurants generally have a requirement of heat pump water heater that occupies less space and have low installation cost. The adoption of heat pump water heaters reduces pollution and better alternatives to gas boilers and other heavy emission water heating sources and contribute towards carbon neutrality globally.

Global electricity prices are rising sharply, which is driving demand for energy-efficient water heaters such as heat pump water heaters. The advantages of heat pump water heaters, such as energy efficiency and environmental friendliness, will further fuel the growth of the heat pump water heater market during the forecast period. The utilization of air, water, or geothermal power to generate hot water is one of the prominent features offered by commercial heat pump water heaters market, the adoption of which is expected to increase in the coming years.

In addition, growth of the market is being driven by a number of factors, such as increase in awareness of the benefits of commercial heat pump water heaters industry, growth in demand for hot water in commercial establishments, and supportive government policies. For instance, PHNIX launched its new HeatStar series of commercial heat pump water heaters in the Indian market. The HeatStar series is cost-effective and energy-efficient solution for commercial establishments in India.

Furthermore, the Chinese Government launched a new subsidy program for heat pump water heaters. This program is designed to promote the adoption of heat pump water heaters in the commercial sector. Under this program, commercial establishments can receive a subsidy of up to 30% of the cost of a new heat pump water heater. This initiative reflects the government's commitment to foster energy-efficient and environmentally friendly heating solutions while supporting the commercial sector in reducing energy consumption and carbon emissions.

Recent commercial heat pump water heater trends such as new heat pump water heater products and technologies are being released by manufacturers on a regular basis. For instance, in September 2023, Rheem Manufacturing Company, Inc. launched new ProTerra NX ultra high-performance heat pump water heater. This unit features a number of advanced features, such as a variable-capacity compressor and a built-in energy management system. In addition, government incentives are playing a crucial role in enhancing the affordability of commercial heat pump water heaters.

In the U.S., the federal government provides a tax credit that can cover up to 30% of the expenses associated with the purchase of a commercial heat pump water heater. Overall, the North America commercial heat pump water heater market is experiencing strong growth. The commercial heat pump water heater market size is expected to grow significantly in the coming years, driven by a number of factors, such as increase in energy costs, government incentives, and growth in awareness of environmental benefits.

The Europe market for commercial heat pump water heater market is being driven by factors such as rise in construction spending, government investments in green building initiatives, and fast urbanization. Although the environmental effect of heat pump water heater is now minor, the ownership & consumption of heat pump water heater are likely to increase. Several European heat pump manufacturers announced new product launches and capacity expansions.

For instance, in August 2023, Bosch Thermotechnology announced $130 million investment to expand its heat pump production capacity in Europe. European governments are further fostering the growth of heat pump technology through supportive policies. An illustration of this is the German Government's announcement in July 2023 of a new subsidy program specifically tailored for commercial heat pump water heaters. These initiatives underscore the commitment to promote energy-efficient and environmentally friendly heating and water heating solutions in Europe, which aligns with broader sustainability and climate goals.‐¯

Asia-Pacific is expected to be the largest as well as the fastest growing region during the commercial heat pump water heater market forecast period. This is owing to increase in use of renewable energy and energy-efficient products.

Increase in use of air source heat pump water heater in the Europe market has resulted from rise in demand for energy-saving alternatives. Government encourages energy-efficient models that further accelerates the replacement of old systems with energy-saving alternatives. In recent years, the power consumption of air source heat pump water heater market has increased significantly. As a result, leading manufacturers are embracing green and cutting-edge technology.

The increasing number of commercial infrastructure projects, notably in Germany, France, and Russia, is likely to drive market expansion over the forecast period. The commercial heat pump water heater market is expected to grow significantly in the coming years, driven by a number of factors, such as increase in energy costs, government incentives, and growth in awareness of environmental benefits. The key players in the market are offering a wide range of commercial heat pump water heater to meet the needs of different businesses.‐¯

The restraints, such as lack of awareness regarding benefits of heat pump water heaters in developing & underdeveloped countries hinder commercial heat pump water heater market growth. In addition, the awareness regarding energy efficiency, cost efficiency, and environmental benefits of heat pump water heaters is low among all end-user segments due to its high cost which acts as a restraint. Further, there is lack of awareness regarding the commercial heat pump water heater opportunities that it provides energy conservation and reduce of CO2 emissions.

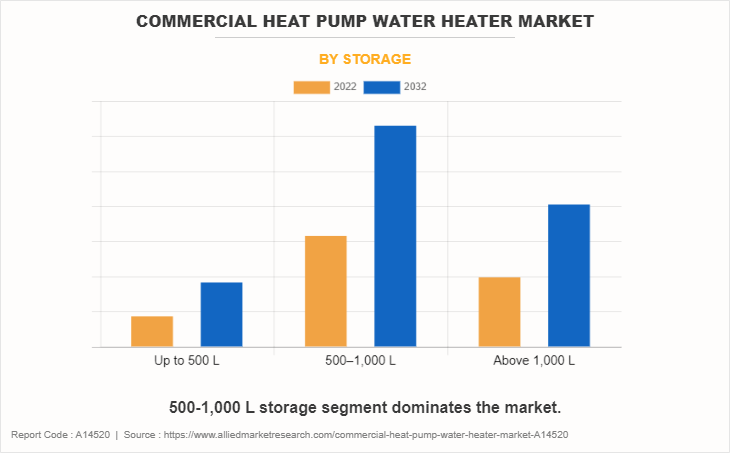

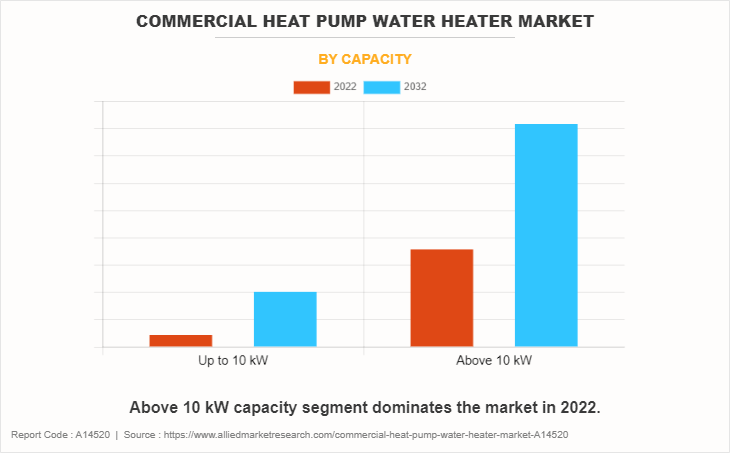

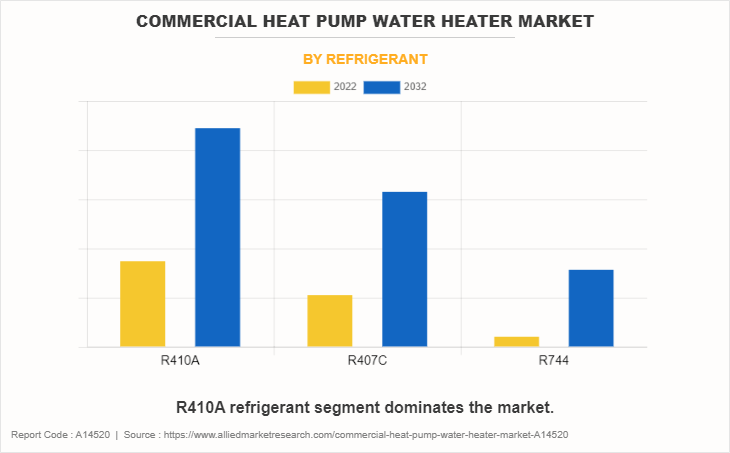

The commercial heat pump water heater market is segmented on the basis of type, storage, capacity, refrigerant type, and region. On the basis of type, it is bifurcated into air source and geothermal. Depending on storage, it is divided into upto 500L, 500L-1000L, and above 1000L. As per capacity, it is bifurcated into less than 10kW and more than 10kW. On the basis of refrigerant type, it is classified into R410A, R407C, and R744. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, the air source segment held the highest market share in 2022, accounting for more than four-fifths of the global commercial heat pump water heater market revenue, and is estimated to maintain its leadership status throughout the forecast period. Owing to the need for energy-efficient and environmentally friendly water heating solutions in various industries.

Based on storage, the 500-1,000L segment held the highest market share in 2022, accounting for more than half of the global commercial heat pump water heater market revenue, and is estimated to maintain its leadership status throughout the forecast period. Owing to rise in commercial heat pump water heater market trends such as demand for smart and connected features, hybrid systems, advancement in refrigerant and compressor technology.

Based on capacity, the above 10 kW segment held the highest market share in 2022, accounting for more than three-fourths of the global commercial heat pump water heater market revenue, and is estimated to maintain its leadership status throughout the forecast period. Heat pump water heaters with a capacity exceeding 10 kW play a significant role in the commercial heat pump water heater market and serves larger-scale applications such as hotels, restaurants, industrial facilities, and other commercial enterprises.

Based on refrigerant, R410A segment held the highest market share in 2022, accounting for more than two-fifths of the global commercial heat pump water heater market revenue, and is estimated to maintain its leadership status throughout the forecast period. R410A is a more environmentally friendly refrigerant than older types, such as R-22. It has a lower ozone depletion potential (ODP) and global warming potential (GWP).

Based on region, Asia-Pacific held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global commercial heat pump water heater market revenue, and is likely to dominate the market during the forecast period. This is owing to increase in use of renewable energy and energy-efficient products.

The major companies profiled in this report include Ingersoll Rand, Mitsubishi Electric, Midea Group Co., Ltd., Viessmann Group, A.O. Smith Corporation, Bosch Industries, NIBE Energy Systems, Valliant Group, Rheem Manufacturing Company, Inc., and Daikin Industries, Ltd.

The report provides a detailed commercial heat pump water heater market analysis of these key players. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their commercial heat pump water heater market share and maintain dominant shares in different regions. Further, key strategies adopted by potential market leaders to facilitate effective planning have been discussed under commercial heat pump water heater market scope in this report.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial heat pump water heater market analysis from 2022 to 2032 to identify the prevailing commercial heat pump water heater market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial heat pump water heater market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial heat pump water heater market trends, key players, market segments, application areas, and market growth strategies.

Commercial Heat Pump Water Heater Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 608.5 million |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 389 |

| By Type |

|

| By Storage |

|

| By Capacity |

|

| By Refrigerant |

|

| By Region |

|

| Key Market Players | Rheem Manufacturing Company, Inc., Mitsubishi Electric, A.O. Smith Corporation, Viessmann Group, NIBE Energy Systems, Ingersoll Rand, Valliant Group, Midea Group Co., Ltd., Daikin Industries Ltd., Bosch Industries |

Analyst Review

According to CXO perspective, the global commercial heat pump water heater market is expected to witness growth during the forecast period due to rise in construction activity.?

Increase in urbanization and economic growth has led to rise in construction of shopping malls, hospitals, commercial buildings, hotels, and manufacturing facilities. The expansion of commercial spaces, new office surfaces, corporate centres & special economic zones (SEZs), and organized points of sale drives the demand for commercial heat pump water heater in all countries. As natural gas rates increase and the push for more sustainable energy sources intensifies, heat pump water heaters appear poised for massive growth in California and Massachusetts as many countries have regulations to use heat pump water heaters in new construction to reduce pollution. As more cities and regions in the U.S. implement decarbonization regulations, commercial water heating will move from fossil fuel burning gas to zero-emissions heat pump systems.

In this direction, the European Union took various initiatives and introduced projects to reduce energy consumption by commercial heat pump water heater and lowering direct emissions. The Eco-design and Energy label regulations set minimum energy performance standards for various products, including heat pump water heaters. The market has seen an increased focus on meeting these standards and improving efficiency.

In addition, the European F-Gas Regulation led to a phase-down of high-GWP (Global Warming Potential) refrigerants, such as R-410A. Heat pump water heater manufacturers transition to low-GWP refrigerants, which are more environmentally friendly, and in compliance with these regulations.

Energy Efficiency Emphasis, Smart Technology Integration, Government Incentives, Advancements in Refrigerant Technologies, Sustainability Focus are the upcoming trends of Commercial Heat Pump Water Heater Market in the world.

Asia-Pacific is the largest regional market for Commercial Heat Pump Water Heater.

Air source is the leading type of Commercial Heat Pump Water Heater Market.

$608.5 million is the estimated industry size of Commercial Heat Pump Water Heater in 2032.

Daikin Industries, Ltd., Hitachi Ltd., Mitsubishi Electric, Panasonic Corporation, and Midea Group Co., Ltd., are the top companies to hold the market share in Commercial Heat Pump Water Heater.

Loading Table Of Content...

Loading Research Methodology...