Compliance And Traceability Solutions Market Insights, 2031

The global compliance and traceability solutions market size was valued at $2.8 billion in 2021, and is projected to reach $9.5 billion by 2031, growing at a CAGR of 13.3% from 2022 to 2031.

Surge in need for real-time traceability and compliance audits boosts the growth of supply chain management systems and provides new avenues for the compliance and traceability solution market. Moreover, favorable regulations and standards for serialization implementation, coupled with growth in the number of packaging-related product recalls fuel the market growth. However, high costs and longer implementation timeframe associated with serialization, as well as concerns over data privacy in traceability requirements are some of the factors that hinder the market growth. Moreover, rise in adoption of advanced technologies and digital solutions in the logistics sector is expected to create lucrative growth opportunities for the compliance and traceability solutions industry during the forecast period.

A compliance and traceability solution a software-based solution for loading units and track vehicles, shipments, or products throughout the entire supply chain, from supplier to consumer. These systems have the potential to have a significant impact on the value chain management at each step. Thus, it can proactively be used as real data and to resolve issues associated with production efficiency, product sustainability, regulatory compliance, and risk. This results in ensuring, protecting, and improving customer relationships, thereby finding a wide range of applications across end-use industries, such as IT & telecom, manufacturing, and BFSI sectors. As a result, compliance and traceability solutions are significant factors for business operations.

The report focuses on growth prospects, restraints, and compliance and traceability solution market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the compliance and traceability solution market. The compliance and traceability solutions market is segmented into Component, Deployment Mode, Organization Size and Industry Vertical.

Segment Review

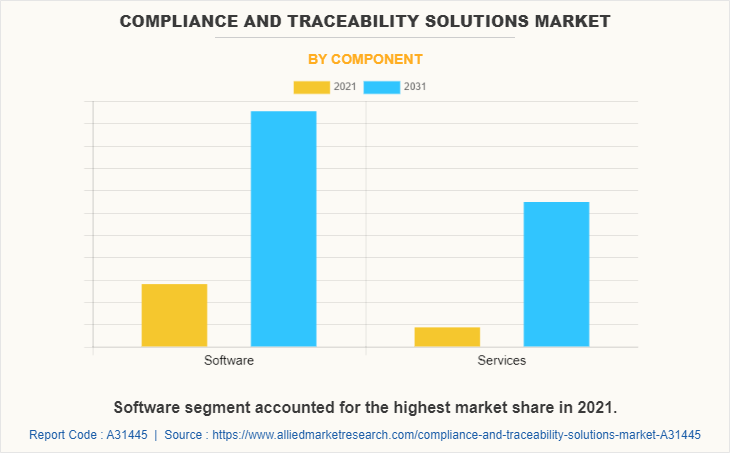

The compliance and traceability solution market is segmented on the basis of component, deployment mode, organization size, industry vertical, and region. By component, it is categorized into software and services. By deployment mode, it is categorized into on-premise and cloud. By organization size, it is bifurcated into large enterprises and small and medium-sized enterprises. By industry vertical, it is segmented into IT & telecom, BFSI, healthcare, food and agriculture, government, manufacturing, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By component, the software segment captured the largest market share in 2021, and is expected to continue this trend during the forecast period. This is attributed to several advantages provided by the software such as reduced risks, more secure operations, and identifying gaps in documentation and risk analysis, which has resulted in increase in the implementation of compliance and traceability software. Further, rise in awareness regarding secure packaging, increase in number of counterfeit drugs and related products, and growth in awareness related to brand protection are anticipated to fuel development of the software segment across the globe.

Region-wise, the Asia-Pacific market is expected to grow at a significant rate in the future on account of increased proliferation of advanced technologies associated with quality control and product recall, particularly in countries such as China, Japan, and India. Moreover, large volume of products is moving between various nations both regionally and internationally, which increases the need for robust monitoring and tracking of product movements in compliance with essential regulations and reduces risks for industrialists and end-users. These changes are anticipated to expand growth of compliance and traceability solutions industry, which, in turn, drive the market growth across the region.

The report analyzes the profiles of key players operating in the Compliance and Traceability Solution Market, such as 4CRisk.ai, Agrilyze, Mettler-Toledo, Omron Corporation, Optel Group, SAP SE, Systech International, Tata Consultancy Services, TraceLink, Inc., and Tuleap. These players have adopted various strategies to increase their market penetration and strengthen their position in the compliance and traceability solution market trends.

Top Impacting Factors

Favorable regulations and standards for serialization implementation demand for compliance and traceability solution

Globally, compliance tools and traceability solutions are gaining significant traction among businesses to comply with legal, regulatory, security, and industry requirements. The deployment of efficient tracking and traceability solutions in compliance with regulatory norms is gradually driven on account of the increasing counterfeits, improving supply chain visibility, and complexities in tracking returns or product recall. As a result, several regional governments are working to approve certain laws and mandates for the implementation of serialization in track and trace systems to ensure considerable efficiency in the supply chain process.

For instance, compliance regulations and standards such as Health Insurance Portability and Accountability Act, International Organization for Standardization (ISO), and General Data Protection Regulation (GDPR) are a few regulatory provisions that emphasized on robust implementation of serialization. Moreover, the rise in the acceptance of digital solutions among government and businesses to adhere to the regulations and standard regulatory norms is accelerating the market demand for compliance and traceability solutions to ensure IT, financial, or environmental risks.

High costs and longer implementation timeframe associated with serialization

High cost of serialization and aggregation coupled with the longer timeframe for installation of compliance and traceability solution is a big threat to the widespread adoption of such solutions around the world. Serialization of individual products and aggregation needs a significant capital investment from a range of end-users, especially pharma companies, contract manufacturers, and packaging manufacturers.

Further, the serialization cost can vary depending on serialization requirements and company size, making it possible the Total Cost of Ownership (TCO) can be 10 times or more than the initial acquisition cost. Thus, the need for proper planning must be undertaken by taking into account the key cost factors, including software license or subscription fees, variable transaction fees, and the cost of adding surplus hardware and infrastructure to support on-site or private services for data storage, processing, and access. These factors lead to an increase in the cost of serializing cartoning lines to the item level can cost between $47,000 and $268,000, restricting the market growth during the forecast period.

Growth in adoption of advanced technologies in logistics sector

Growth in adoption of advanced technologies and digital solutions in the logistics sector has proliferated the implementation of compliance and traceability solution. This digital solution has a revolutionary and radical effect in the logistics sector worldwide as it enables seamless monitoring of product deliveries within the value chain. Compliance and traceability solutions further make it possible to track and report departure and arrival of the product, irrespective of whether it is a pallet, a container, or a vehicle, thereby these solutions are gaining significant prominence for the trade of goods at both national and international levels. In addition, the rapid economic development in the logistics sector coupled with the need for intelligent traceability systems are the factors expected to drive the market growth over the forecast period. Such advancements will significantly pave numerous opportunities for market growth during the forecast period.

COVID-19 Impact Analysis

The COVID-19 outbreak had a negative impact on the compliance and traceability solution industry. With the introduction of COVID-19, there were disruptions in the supply chain for track and trace activities and limited operations of logistics and transportation in a bid to mitigate the impact of COVID-19 outbreak. These factors are expected to decline the market growth prospect in the short run.

Moreover, compliance and traceability solution are expected to gain traction in the long-run outlook, owing to continued surge in demand for traceability solutions in different industry verticals, especially the food and pharma sector, in the wake of a pandemic. Following the COVID-19 outbreak, innovations and advancements in compliance and traceability solution, such as real-time monitoring and RFID technology have aided the market growth. Rise in digital transformation initiatives in supply chain models has considerably expanded the growth outlook of the compliance and traceability solutions market forecast.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the compliance and traceability solutions market analysis from 2021 to 2031 to identify the prevailing compliance and traceability solutions industry opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the compliance and traceability solutions market growth assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global compliance and traceability solutions market trends.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global compliance and traceability solutions market share, key players, market segments, application areas, and market growth strategies.

Compliance and Traceability Solutions Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 9.5 billion |

| Growth Rate | CAGR of 13.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 271 |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Tata Consultancy Services, TraceLink, Inc., Optel Group, 4CRisk.ai, Omron Corporation, Agrilyze, Mettler-Toledo, Tuleap, Systech International, SAP SE |

Analyst Review

Enterprises have perceived various changes in business processes, operations, and industrial automation. This is driven by rapid shift toward digitalization, increase in mobile penetration, hyperconnectivity, and various other related trends. These factors eventually create significant deployment of compliance and traceability solutions in a variety of industry verticals for security purposes and to monitor status of product movements. Furthermore, ongoing trend of smart tracking and traceability facilitates suppliers to control inventory by visualizing their valuable products at each stage of the supply chain, thus ensuring product safety and avoiding revenue loss. As a result, compliance and traceability solutions find an increased application with rapid growth of smart tracking and increased acceptance across industry verticals due to digitalization initiatives.

Furthermore, increase in partnership among different enterprises for expanding business presence and product developments related to compliance and traceability solutions propel the market growth. For instance, in May 2022, the global leader in supply chain traceability systems, OPTEL Group strengthened its strategic partnership with Korber, the Business Area Pharma of the international technology group. This partnership will enable both companies to expand their full-stack solution and packaging capabilities around the world. This strategic partnership further ensures the continued manufacturing of OPTEL’s track and trace technology solutions. It further reinforces the customer need related to traceability and packaging solutions and allows them to remain competitive and compliant in the recent hypercompetitive market. Thus, continuous innovation and developments in track and trace technology will continue to revolutionize business automation and supply chain processes, and such developments act as a key driver for the growth of the global compliance and traceability solution market.

On the contrary, prominent market players are expanding offerings related to compliance and traceability solutions and services through collaborations, as well as actively looking forward to integrated real-time and material traceability. For instance, in March 2022, a Stockholm-based SaaS company, TrusTrace unveiled a new TrusTrace Certified Material Compliance solution that allows real-time traceability at a material level. This solution encompasses a broad range of requirements for material compliance, including both certified and non-certified materials, covering single component products to multi-component products, facilitating a diverse chain of custody models, and providing assurances to move to more sustainable portfolios. Hence, such product developments are expected to increase the market capabilities in the future.

The compliance and traceability solutions market is estimated to grow at a CAGR of 13.3% from 2022 to 2031.

The compliance and traceability solutions market is projected to reach $9507.35 million by 2031.

Surge in need for real-time traceability and compliance audits, favorable regulations and standards for serialization implementation, and growth in the number of packaging-related product recalls contribute toward the growth of the market.

The key players profiled in the report include 4CRisk.ai, Agrilyze, Mettler-Toledo, Omron Corporation, Optel Group, SAP SE, Systech International, Tata Consultancy Services, TraceLink, Inc., and Tuleap.

The key growth strategies of compliance and traceability solutions market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...