Composite Doors & Windows Market Research, 2033

The global composite doors & windows market was valued at $865.0 million in 2023, and is projected to reach $1, 775.8 million by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

Market Introduction and Definition

Composite doors and windows are advanced building materials engineered to offer superior performance, combining the best qualities of various materials. Typically, they consist of a core made from materials such as fiberglass, foam, or engineered timber, reinforced with durable external layers such as uPVC, aluminum, or high-performance laminates. This multi-layered construction enhances thermal efficiency, security, and durability while requiring minimal maintenance. Composite doors and windows resist warping, rotting, and weathering, making them ideal for diverse climates. They also offer excellent insulation properties, contributing to energy efficiency. Available in a wide range of styles, composite doors and windows provide both aesthetic appeal and practical benefits, making them a popular choice for modern construction and renovation projects.

Key Takeaways

- The composite doors & windows market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other documents of major composite doors & windows industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The growth in residential and commercial construction, coupled with increasing urbanization and population growth, significantly drives the composite doors and windows market. As cities expand and new housing and commercial projects emerge, the demand for durable, energy-efficient, and aesthetically pleasing building materials rises. Composite doors and windows, known for their superior insulation, low maintenance, and versatility, meet these needs effectively. Urbanization also leads to higher living standards and increased consumer spending, further boosting the adoption of these advanced materials in both new constructions and renovation projects, thereby fueling market growth.

However, high initial costs restrain the growth of the composite doors and windows market. Despite their superior performance and long-term benefits, these products often require a larger upfront investment compared to traditional materials such as wood, aluminum, or uPVC. The advanced manufacturing processes and high-quality materials contribute to higher prices, deterring budget-conscious consumers and builders. This financial barrier leads to a preference for cheaper alternatives, even if they offer lower durability and efficiency. As a result, the adoption of composite doors and windows is slower, limiting market expansion despite their potential for better performance and lower lifetime costs.

Technological advancements in composite materials present a lucrative opportunity for the composite doors and windows market by enhancing product performance and expanding design possibilities. Innovations such as improved thermal insulation, increased durability, and advanced manufacturing techniques lead to superior energy efficiency and security features. Additionally, the development of eco-friendly composites aligns with growing sustainability trends, attracting environmentally conscious consumers. These advancements enable manufacturers to offer more customizable and aesthetically appealing products, meeting diverse customer preferences and driving market growth in both residential and commercial sectors.

Market Segmentation

The composite doors & windows market is segmented into type, end user and region. By type, the market is divided into fiber reinforced plastics (FRP) , wood-plastic composites (WPC) , carbon fiber composites, and others. Based on end user, the market is classified into residential, commercial, and industrial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The key market players operating in the composite doors & windows market include Yashashri Polyextrusion Pvt. Ltd., Exel Composites, Fiber Tech Composite Pvt. Ltd., Ecoste, Dortek Ltd, ANDERSEN CORPORATION, Pella Corporation, Vello Nordic AS, Hardy Smith, and Special-Lite.

Regional Market Outlook

In North America and the Asia-Pacific region, countries like India, China, and the U.S. are experiencing rapid population growth, urbanization, and rising residential and commercial construction activities. These factors significantly boost the demand for composite windows and doors. As urban areas expand and new buildings emerge, the need for durable, energy-efficient, and aesthetically versatile building materials increases. Composite windows and doors, known for their performance and low maintenance, are well-suited to meet these demands. This trend drives the market's growth, as developers and homeowners seek solutions that offer both functional benefits and modern design features.

- The International Trade Administration predicts a consistent 8.6% average growth rate in China's construction sector from 2022 to 2030. In addition, the Make in India campaign, spearheaded by the Government of India, aims to achieve infrastructural investments totaling $965.5 million by the year 2040.

- According to the Associated General Contractors (AGC) of America, construction plays a significant role in the U.S. economy, with over 919, 000 construction establishments reported in the first quarter of 2023. Industry provides jobs for 8.0 million workers and generates nearly $2.1 trillion in annual value through the creation of structures.

India Composites Industry Overview

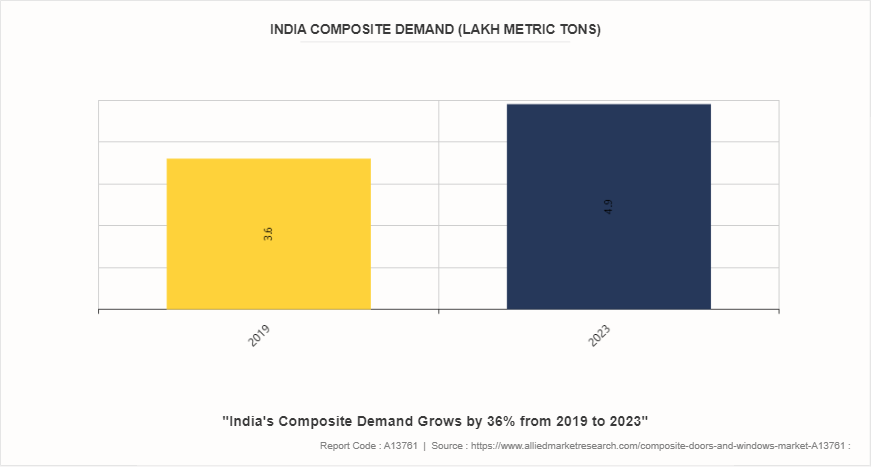

According to the report published by FRP institute, India's increasing demand for composite materials, with a rise from 3.6 lakh metric tons in 2019 to 4.9 lakh metric tons in 2023, underscores a significant growth trajectory, driven by a robust CAGR of 8.20%. This upward trend reflects a burgeoning market for composite doors and windows, fueled by expanding urbanization, infrastructural development, and rising construction activities. The growing demand highlights a shift towards advanced building materials that offer durability, energy efficiency, and low maintenance. As India continues to invest in residential and commercial projects, the composite doors and windows market is set to benefit from this accelerating growth.

Industry Trends

- Thermally efficient composite doors, such as those from Andersen Windows, are designed with high-performance glass and insulating cores to minimize heat transfer. This advanced insulation reduces the need for heating and cooling, leading to significant energy savings. According to the U.S. Department of Energy, energy-efficient windows can cut energy bills by 12%-15% annually, making these doors a cost-effective choice for homeowners seeking to lower their energy costs.

- Marvin Windows and Doors integrates smart home technology into its composite windows and doors, enhancing convenience and security. For example, Marvin's Smart Glass technology allows users to control window tinting through a mobile app, optimizing natural light and privacy. Additionally, their windows can be equipped with sensors that alert homeowners to potential security breaches or energy inefficiencies.

Key Sources Referred

- International Trade Administration

- World Trade Organization

- FRP Institute

- India Brand Equity Foundation

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the composite doors & windows market analysis from 2024 to 2033 to identify the prevailing composite doors & windows market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the composite doors & windows market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global composite doors & windows market trends, key players, market segments, application areas, and market growth strategies.

Composite Doors & Windows Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1775.8 Million |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 245 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Yashashri Polyextrusion Pvt. Ltd., Special-Lite, ANDERSEN CORPORATION, Ecoste, Hardy Smith, Pella Corporation, Vello nordic as, Dortek Ltd, Fiber Tech Composite Pvt. Ltd., Exel Composites |

The global composite doors & windows market was valued at $865.0 million in 2023, and is projected to reach $1,775.8 million by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

Asia-Pacific is the largest regional market for Composite Doors & Windows

The leading application of the Composite Doors & Windows Market is in residential construction, driven by demand for energy-efficient and durable materials.

Technological advancements in composite materials is the upcoming trends of Composite Doors & Windows Market in the globe

The key market players operating in the composite doors & windows market include Yashashri Polyextrusion Pvt. Ltd., Exel Composites, Fiber Tech Composite Pvt. Ltd., Ecoste, Dortek Ltd, ANDERSEN CORPORATION, Pella Corporation, Vello Nordic AS, Hardy Smith, and Special-Lite.

Loading Table Of Content...