Composites Materials In Tooling Market Research, 2033

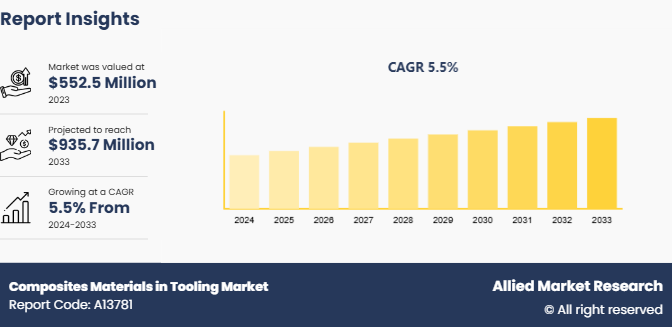

The global composites materials in tooling market size was valued at $552.5 million in 2023, and is projected to reach $935.7 million by 2033, growing at a CAGR of 5.5% from 2024 to 2033.

Market Introduction and Definition

Composite materials in tooling refer to the use of reinforced polymer matrices combined with fibers or particulates to create molds, jigs, fixtures, and other tooling components. These materials are engineered to leverage the strengths of their constituent parts typically, a high-strength fiber such as carbon, glass, or aramid, embedded within a resin matrix such as epoxy or polyester. This combination results in tooling that is lightweight yet exceptionally strong, resistant to deformation under load, and capable of maintaining dimensional stability over time. Composite materials in tooling market are valued for their versatility, allowing for complex shapes and designs, rapid prototyping, and reduced manufacturing lead times compared to traditional metal tooling.

Key Takeaways

- The composites materials in tooling market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major composites materials in tooling industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The increasing emphasis on lightweight construction in various industries has significantly driven the demand for composite materials in the tooling market. This trend is particularly evident in sectors such as automotive, aerospace, and wind energy, where the need for high-performance, durable, and lightweight materials is paramount. Composites, known for their strength to weight ratio, corrosion resistance, and flexibility, are becoming the preferred choice for tooling applications in these industries. The automotive industry, for example seeks to reduce vehicle weight to improve fuel efficiency and meet stringent emission regulations, leading to a surge in the adoption of composite materials for tooling and production processes. All these factors are expected to drive the demand for the composites materials in tooling market forecast period.

However, the production of composite materials involves complex manufacturing processes and specialized equipment, leading to elevated initial expenses compared to traditional materials such as metals and plastics. These costs include raw materials themselves the investment required for advanced machinery, skilled labor, and quality control measures essential for producing high-performance composites. For many companies, especially small and medium-sized enterprises, these upfront financial requirements are prohibitive, slowing the pace of adoption. In addition, the development of composite tooling often involves a longer and more intricate design and production phase. The customization required to create precise and durable composite tools necessitates extensive research and development, adding to the overall cost. All these factors are expected to hamper the composites materials in tooling market growth.

Advances in manufacturing technologies, such as automated fiber placement, 3D printing, and improved curing processes, have significantly shortened the time required to produce composite tools. This reduction in lead times enhances productivity offers a competitive edge to industries that rely on rapid turnaround times, such as automotive, aerospace, and consumer goods. By adopting composites, manufacturers quickly respond to market demands, accelerating product development cycles and enabling faster time to market for new products. All these factors are anticipated to offer new growth opportunities for the composites materials in the tooling market during the forecast period.

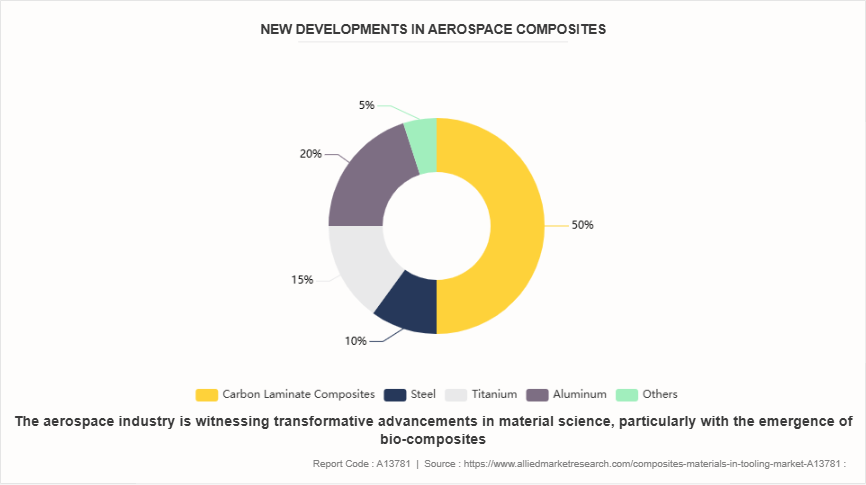

New Developments in Aerospace Composites

The aerospace industry is witnessing transformative advancements in material science, particularly with the emergence of bio-composites. These materials, derived from biological origins such as plants and biomass, offer a sustainable alternative to traditional composites. Bio-composites are increasingly used due to their advantages such as being lightweight, flexible, cost-effective, and recyclable. These materials include natural fibers, biomass carbon fibers, and bio-resins, offering new possibilities for environmental performance in aircraft design.

Market Segmentation

The composites materials in tooling market is segmented by resin type, material type, end-use industry, and region. Based on resin type, the market is classified into epoxy, polyurethane and others. By material type, the market is classified metal alloys, steel, silicon, rubber, fiberglass, and others. By end-use industry, the market is divided into aerospace, automotive, renewable energy, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

North America has emerged as a dominant force in the composites materials market for tooling, driven by a combination of advanced manufacturing capabilities, strong demand from key industries, and a robust innovation ecosystem. The region's leadership in aerospace, automotive, and wind energy sectors significantly contributes to this dominance. These industries require high-performance materials that offer superior strength-to-weight ratios, durability, and design flexibility attributes that composite materials provide. As a result, North American manufacturers have heavily invested in research and development to enhance the properties and applications of composites, that make them indispensable in tooling applications where precision, reliability, and performance are critical. In December 2022, leading aerospace composite material kits supplier named Velocity Composites announced its entry into the U.S. aerospace market with the signing of an agreement with GKN Aerospace, expected to be worth more than $100 million in revenue over next five years. Velocity Composites' entry into the U.S. aerospace market with a major agreement is likely to boost the demand for advanced tooling solutions as they ramp up production of aerospace composite material kits.

Competitive Landscape

The major players operating in the composites materials in tooling market include Hexcel Corporation, Toray Industries, Inc, Solvay S.A., Huntsman Corporation, Mitsubishi Chemical Holdings Corporation, Owens Corning, Teijin Limited, Barrday Inc, SABIC, Jushi Co., Ltd.

Industry Trends

- The global commitment to achieving zero emissions by 2050 is a major driver for the automotive industry's adoption of composites. This push towards sustainability is accelerating the development, innovation, and production of electric vehicles (EVs) , as composites offer lightweight and efficient solutions that help reduce vehicle weight and improve energy efficiency.

- High specific strength and modulus, composites have long been considered the materials of the future, especially attractive for aircraft applications. In the latest Boeing 787 Dreamliner, the use of composites has increased significantly, now comprising 50% of the aircraft. Drive the demand for advanced tooling solutions that handle the complexities of composite fabrication, such as precision molds and specialized machining tools.

- In October 2022, Luxembourg's Cargolux Airlines placed an order with Boeing for 10 B777-8 freighters, with an option for 6 more aircraft. Currently, China ranks as the second-largest air freight market globally, trailing only the United States. According to Boeing's Commercial Market Outlook 2022, China's commercial air fleet is projected to expand from 3, 900 to 9, 600 aircraft by 2041. The increase aircraft order driving demand for advanced composite tooling solutions to support the production of more sophisticated and lightweight aircraft components.

Key Sources Referred

- Invest India

- International Renewable Energy Agency (IREA)

- India brand Equity foundation (IBEF)

- Australian Academy of science

- Composites Knowledge Network

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the composites materials in tooling market analysis from 2024 to 2033 to identify the prevailing composites materials in tooling market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the composites materials in tooling market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global composites materials in tooling market trends, key players, market segments, application areas, and market growth strategies.

Composites Materials in Tooling Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 935.7 Million |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Resin Type |

|

| By Material Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Hexcel Corporation, Teijin Limited, Owens Corning, Solvay S.A., Huntsman Corporation, SABIC, Jushi Co., Ltd, Toray Industries, Inc, Mitsubishi Chemical Holdings Corporation, Barrday Inc. |

Lightweight construction demands, Improved durability and longevity are the upcoming trends of Composites Materials in Tooling Market in the world.

Aerospace is the leading application of Composites Materials in Tooling Market

North America is the largest regional market for Composites Materials in Tooling

$935.7 million is the estimated industry size of Composites Materials in Tooling by 2033.

Hexcel Corporation, Toray Industries, Inc, Solvay S.A., Huntsman Corporation, Mitsubishi Chemical Holdings Corporation, Owens Corning, Teijin Limited, Barrday Inc, SABIC, Jushi Co., Ltd are the top companies to hold the market share in Composites Materials in Tooling.

Loading Table Of Content...