Composites Testing Market Research, 2033

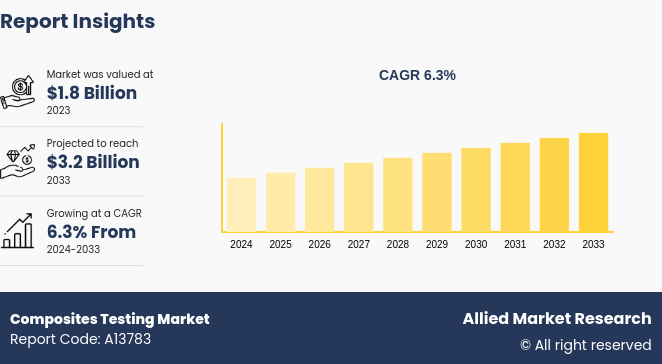

The global composites testing market size was valued at $1.8 billion in 2023, and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

Market Introduction and Definition

Composites testing refers to the comprehensive evaluation of composite materials to assess their performance, durability, and quality under various conditions. This process involves a range of standardized tests designed to measure specific properties such as tensile strength, compressive strength, impact resistance, and fatigue behavior. The testing procedures aim to ensure that composite materials meet the required specifications and performance standards for their intended applications, which can include aerospace, automotive, construction, and more. By simulating real-world conditions and stresses, composites testing helps identify potential weaknesses or failures in the material, providing crucial data for improving material formulations and manufacturing processes.

Key Takeaways

- The composites testing market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major composites testing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

High-performance composites, known for their exceptional strength to weight ratios, durability, and resistance to environmental factors, are increasingly being utilized in critical industries such as aerospace, automotive, and construction. As these industries continue to push the boundaries of performance and efficiency, the need to ensure the reliability and safety of composite materials becomes paramount. This necessity fuels the demand for comprehensive testing solutions that rigorously evaluate the properties and performance of these advanced materials under various conditions. All these factors are expected to drive the composites testing market growth. However, comprehensive testing of composite materials involves sophisticated equipment, advanced technologies, and specialized expertise, all of which contribute to substantial expenses. For many companies, especially smaller manufacturers or startups, these costs can be prohibitive. The investment required for thorough testing strain budgets and deterred some companies from conducting the extensive testing necessary to ensure the safety and reliability of their products. All these factors are expected to hamper the composites testing market growth.

As manufacturers seek to enhance the performance, efficiency, and sustainability of their products, the use of advanced composites, such as carbon fiber-reinforced polymers and glass fiber-reinforced polymers, is on the rise. These materials offer superior strength-to-weight ratios, corrosion resistance, and design flexibility compared to traditional metals. However, to ensure the reliability and safety of these high-performance materials, rigorous testing and quality assurance processes are essential. This necessity is fueling the growth of the composites testing market. The increasing demand for lightweight materials, driven by industries such as aerospace, automotive, and renewable energy, is creating substantial opportunities for the composites testing market.

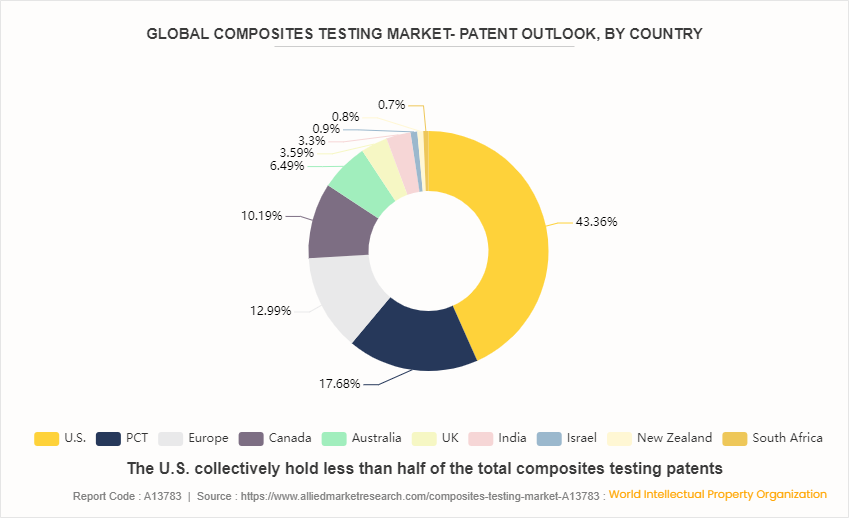

Patent Analysis for Composites Testing Market

The U.S. collectively hold less than half of the total composites testing patents that indicate strong innovation and investment in this technology in U.S. countries. This suggests fierce competition and a significant focus on composites testing R&D in these leading economies. U.S. has the highest patent filed those accounts for 43.3% of the total global patents related to the composites testing market. Europe and PCT, although holding smaller percentages of composites testing patents individually, collectively contribute to the overall Asian dominance in composites testing innovation. This reflects the region's strong presence in materials science and engineering R&D.

Market Segmentation

The composites testing market is segmented into type, test type, end-use industry, and region. By type, the market is classified into ceramic matrics composites, polymer matrics composites, metal matrics composites, fiber renforced composites, and others. By test type, the market is divided into destructive test and non-destructive test. By end-use industry, the market is categorized into aerospace, automotive, construction, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Europe is leading aerospace and automotive industries significantly impact the composites testing market by driving demand for rigorous testing of advanced composite materials, which are crucial for enhancing performance, reducing weight, and improving fuel efficiency. The need for stringent testing protocols, especially in aerospace for critical components like aircraft wings, ensures high standards of safety and reliability. In addition, Europe’s emphasis on innovation and technological advancement further impacts the market, as ongoing development of new composite materials with improved properties requires continuous testing to validate and refine these innovations. This combined focus on industry standards and cutting-edge research fuels robust growth in the composites testing market.

Competitive Landscape

The major players operating in the composites testing market include Intertek Group plc, TA Instruments, Element Materials Technology, Micro Materials, Thermtest Inc., Kinectrics, SGS General Surveillance Company SA., Henkel AG & Co. KGaA, Instron Corporation, R-TECH MATERIALS. In November 2023, Element Materials Technology invested $10 million to enhance its capabilities in hydrogen technology. The first phase of this investment includes the acquisition of cutting-edge hydrogen testing equipment and the expansion of its global hydrogen team. This strategic move is aimed at addressing the growing demand from clients transitioning to cleaner energy solutions and incorporating hydrogen across various product lifecycles and systems.

Industry Trends

- The most common flexural testing of plastics, polymer composites, and large fiber-reinforced plates involves three-point and four-point bend testing as per ISO 178, ASTM D 790, and ASTM D 6272 to ensure suitability under various conditions for better insight into their properties and to ensure that they are suitable for the intended application.

- The mechanical and physical testing of polymers and their composites is vital to determine the material properties for use in the design and analysis of the product, quality control, application performance requirements, and production process.

- Non-destructive testing will remain the largest segment and it is also expected to witness the highest growth during the forecast period due to increasing demand for ultrasonic testing in the aerospace and defense, wind energy and automotive industry.

Key Sources Referred

- Invest India

- International Renewable Energy Agency (IREA)

- International Energy Agency (IEA)

- India Brand Equity Foundation (IBEF)

- ASTM International

- Composite Panel Association

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the composites testing market analysis from 2024 to 2033 to identify the prevailing composites testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the composites testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global composites testing market trends, key players, market segments, application areas, and market growth strategies.

Composites Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.2 Billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Type |

|

| By Test Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Micro Materials, Element Materials Technology, TA Instruments, R-TECH MATERIALS, Kinectrics, Instron Corporation, Thermtest Inc., Intertek Group plc, Henkel AG & Co. KGaA, SGS General Surveillance Company SA |

Increased demand for high-performance composites. Advancements in composite material technologies are the upcoming trends of Composites Testing Market in the World.

Aerospace is the leading application of Composites Testing Market

Europe is the largest regional market for Composites Testing

$3.2 billion is the estimated industry size of Composites Testing by 2033.

Intertek Group plc, TA Instruments, Micro Materials, Element Materials Technology, Thermtest Inc., Kinectrics, SGS General Surveillance Company SA., Henkel AG & Co. KGaA, Instron Corporation, R-TECH MATERIALS are the top companies to hold the market share in Composites Testing

Loading Table Of Content...