Concrete Bonding Agent Market Research, 2033

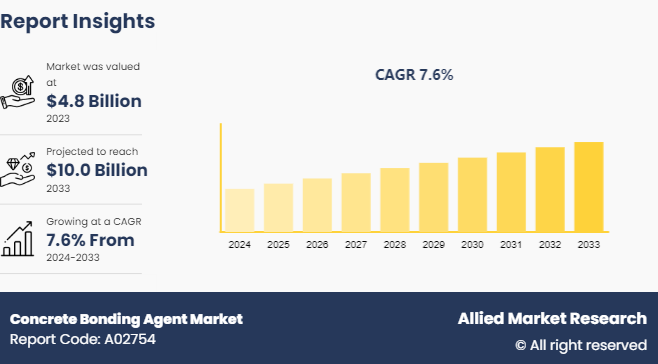

The global concrete bonding agent market was valued at $4.8 billion in 2023, and is projected to reach $10.0 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

Market Introduction and Definition

A concrete bonding agent is a specialized adhesive substance used to join new concrete or plaster to existing concrete surfaces. It improves the bond between the old and new materials, preventing separation, cracking, and failure at the joint. These agents are essential in repair and restoration projects where fresh concrete needs to be applied to a pre-existing structure, such as in patching, resurfacing, or adding overlays. The bonding agent works by enhancing the adhesion properties of the new material, ensuring a strong, durable connection that can withstand stress, moisture, and temperature changes. Common types of concrete bonding agents include latex-based, epoxy-based, and polyvinyl acetate (PVA) formulations, each offering different levels of bonding strength and application methods depending on the specific project requirements.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence, and key strategic developments by prominent manufacturers.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global concrete bonding agent such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3, 100 concrete bonding agent-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global concrete bonding market.

Key Market Dynamics

One of the primary drivers of the concrete bonding agent market is the global trend of rapid urbanization and infrastructure development. As cities expand and new infrastructure projects emerge, the need for durable and reliable construction materials becomes more critical. Governments worldwide are investing heavily in infrastructure to support economic growth and improve the quality of life for their populations. For instance, in the U.S., the Bipartisan Infrastructure Law, enacted in November 2021, allocated $1.2 trillion for infrastructure projects, including roads, bridges, and public transportation systems. Such investments directly fuel the demand for concrete bonding agents, as they are essential in ensuring the longevity and safety of these structures.

Furthermore, in developing countries, urbanization is even more pronounced, with significant investments in new construction projects. For instance, in India, the Smart Cities Mission, launched by the government in 2015, aims to develop 100 smart cities with modern infrastructure. The program's focus on sustainable and resilient urban development has increased the demand for advanced construction materials, including concrete bonding agents. The use of these agents is crucial in extending the life of existing structures and ensuring that new additions integrate seamlessly with old ones, particularly in densely populated urban areas where space is limited.

In addition, aging infrastructure is another significant factor driving the concrete bonding agent market. Many developed countries face the challenge of maintaining and upgrading infrastructure built decades ago. As these structures age, they require regular maintenance and repairs to ensure their continued safety and functionality. Concrete bonding agents are vital in such scenarios, as they allow for effective repairs without the need for complete demolition and reconstruction.

For instance, a considerable portion of the infrastructure was constructed in the post-World War II era and is now in need of extensive repairs. The European Union has recognized the importance of infrastructure maintenance and has allocated substantial funds for renovation projects. The EU's Recovery and Resilience Facility, with a budget of $790.1 billion, includes provisions for infrastructure renovation as part of its focus on sustainable growth. Similarly, in Japan, the government has implemented policies to encourage the maintenance and repair of infrastructure, with an emphasis on earthquake-resistant construction. These initiatives are driving the demand for concrete bonding agents, as they are essential for the effective repair of aging structures.

However, economic uncertainty is a significant restraint on the concrete bonding agent market. Fluctuations in the global economy, driven by factors such as inflation, currency volatility, and geopolitical tensions, can lead to reduced investment in infrastructure projects. Government budget constraints often result in delays or cancellations of planned projects, directly affecting the demand for construction materials, including concrete bonding agents.

For instance, during economic downturns, governments have prioritized essential services over infrastructure spending, leading to a slowdown in construction activity. According to the International Monetary Fund (IMF) , global economic growth has slowed down to 2.8% in 2023, down from 3.4% in 2022, due to inflationary pressures and tightening monetary policies.

On the contrary, the global shift towards sustainable construction practices presents a significant opportunity for the concrete bonding agent market. As governments and organizations strive to reduce the environmental impact of construction activities, there is a growing demand for materials that enable the reuse and refurbishment of existing structures rather than their demolition and reconstruction. Concrete bonding agents, which facilitate the effective repair and retrofitting of existing buildings, align with this trend and are increasingly seen as essential components in sustainable construction.

Governments are enacting regulations and setting standards that promote sustainability in the construction industry. For instance, the European Union’s Green Deal and Circular Economy Action Plan emphasize the importance of reusing and recycling construction materials to achieve climate neutrality by 2050. The European Commission estimates that the construction sector accounts for over 35% of the EU’s total waste generation, and promoting the use of bonding agents in repair and refurbishment projects can significantly reduce this figure. This creates a substantial opportunity for market growth as companies seek to comply with these regulations and adopt more sustainable practices.

Market Segmentation

The concrete bonding agent is segmented on the basis by material type, application, and region. By material type, the market is classified into acrylic, latex, epoxy, and others. Based on application, the market is segmented into building and construction, roads and infrastructure, utility industries, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Asia-Pacific represents a significant market share for concrete bonding agent market. The Asia-Pacific region, particularly India and China, is experiencing rapid urbanization and population growth, which drives the need for extensive construction activities, including residential, commercial, and industrial buildings. Concrete bonding agents are essential in these construction processes, particularly for ensuring the durability and strength of new structures and in the repair and maintenance of existing ones. According to the United Nations, India’s urban population is projected to increase to 600 million by 2030, accounting for nearly 40% of the country’s total population. The Indian government’s Smart Cities Mission, which aims to develop 100 smart cities, further highlights the need for advanced construction materials, including bonding agents.

Furthermore, China’s urbanization rate has been steadily increasing, with the National Bureau of Statistics reporting that the urban population reached 64.7% in 2022, up from 56.1% in 2015. The Chinese government’s focus on urban development, including initiatives like the "New Urbanization Plan (2014-2020) , " has fueled construction activity, increasing the demand for concrete bonding agents. These factors altogether may surge the utilization of concrete bonding agents in the Asia-Pacific region; thus, fueling the market growth.

Competitive Landscape

The major players operating in the concrete bonding agent include Sika AG, BASF SE, Fosroc, Inc, GCP Applied Technologies, MAPEI Corporation, The QUIKRETE Companies, 3M, Resikon Construction Chemicals, CHRYSO India, and Aswani Industries Pvt. Ltd.

Parent Market Analysis

Parent Market Name | Construction Materials Marke |

Market Size in 2022 | $1.2 trillion |

Drivers | Surge in population and urbanization, increasing construction of modern theme-based buildings, and rise in emphasis of construction materials |

Restraints | Technological limitations and performance concerns |

Industry Trends

- In May 2022, researchers from Brunel University London developed novel concrete bonding agent with improved bonding properties and performance. The new concrete bonding agent is best-suited for retrofitting applications in building and construction sector. This event may surge the demand for novel concrete bonding agent in the growing building and construction sector; thus, fueling the market growth.

- The construction sector is the largest industry in the world, contributing to around 13% of the global GDP has undergone various technological evolvements such as emergence of modelling and simulation tools for constructing modern-theme-based buildings wherein a wide range of pre-treatment and post-treatment construction chemicals are used to provide structural integrity to the buildings. This factor may augment the utilization of concrete bonding agents in the growing building and construction sector during the forecast period.

- According to a report published by the U.S. Census Bureau in 2023, modular housing development industry is growing rapidly in several parts of the U.S. which in turn has led general contractors (GC’s) , architects, and developers to increasingly utilize a wide range of construction chemicals including concrete bonding agents for shortening the construction and repair timeline. This factor may fuel the growth of the concrete bonding agent market during the forecast period.

Key Sources Referred

- National Promotion and Facilitation Agency

- United States Bureau of Statistics

- U.S. Development Authority

- United States Environmental Protection Agency

- Invest In India

- Press Information Bureau

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the concrete bonding agent market analysis from 2024 to 2033 to identify the prevailing concrete bonding agent market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the concrete bonding agent market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global concrete bonding agent market trends, key players, market segments, application areas, and market growth strategies.

Concrete Bonding Agent Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 10.0 Billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 383 |

| By Material Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | 3M, GCP Applied Technologies, BASF SE, Aswani Industries Pvt. Ltd, Fosroc, Inc, MAPEI Corporation, Sika AG, Resikon Construction Chemicals, CHRYSO India, The QUIKRETE Companies |

Loading Table Of Content...