Confidential Computing Market Overview

The global confidential computing market size was valued at USD 4.1 billion in 2022 and is projected to reach USD 184.5 billion by 2032, growing at a CAGR of 46.8% from 2023 to 2032.

Growing need to comply with regulatory standards and growing concerns regarding data security and privacy are driving the growth of the market. In addition, the increasing need for secure cloud computing is fueling the growth of the market. However, implementation and integration challenges cloud limit the growth of this confidential computing market. Conversely, increasing need for secure AI solutions is exploding that is anticipated to provide numerous opportunities for the expansion of the market during the forecast period.

Introduction

Confidential computing technology and technique encrypts and stores an organization’s most sensitive data in a secure portion of a computer’s processor. As a result, it is a fast-growing cloud computing technique that has gotten support from a variety of hardware, software, and cloud vendors. In addition, confidential computing is significant to maintain data privacy and security in various computing scenarios that enables organizations to securely process sensitive information, comply with regulations, and further leverage the benefits of cloud computing without compromising data confidentiality. Therefore, confidential computing enhances trust in cloud environments by allowing data owners to maintain control over their data even when it's processed on remote servers.

Segment Overview

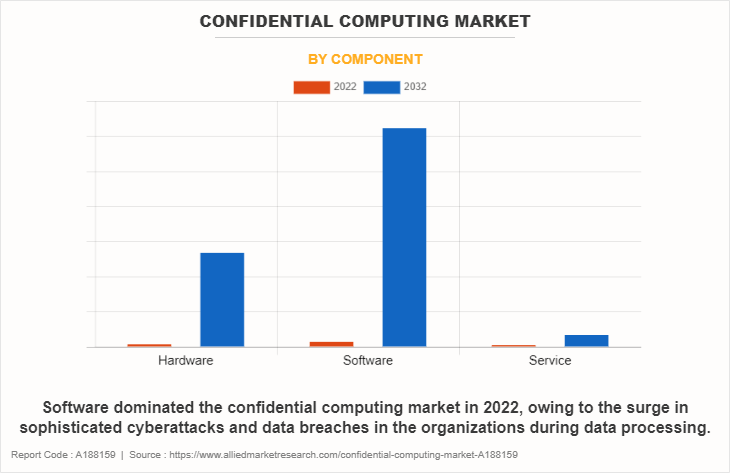

The global confidential computing market is segmented on the basis of component, deployment mode, application, end user, and region. On the basis of component, it is classified into hardware, software, and services. On the basis of deployment, it is segregated into on-premise and cloud. On the basis of application, it is categorized into data security, secure enclaves, pellucidity between user, and others. On the basis of end user, it is fragmented into BFSI, IT and telecom, retail and e-commerce, healthcare, government and public sector, manufacturing, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, software segment dominated the confidential computing market share in 2022 and is expected to maintain its dominance in the upcoming years, owing to a safe and secure environment in which delicate data and computations be carried out without being exposed to the underlying infrastructure or outside dangers is crucially aided by this program propels the market growth significantly. However, the hardware segment is expected to witness the highest growth, owing to improve the security and privacy of data and computations by enabling the creation of secure enclaves or trusted execution environments (TEEs) where sensitive information be processed and shielded from unauthorized access or tampering.

Region wise, the confidential computing market size was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the rise in investment in advanced technologies, such as cloud-based services and increase in digitalization are anticipated to propel the growth of the market. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to the increase in investments in IT, ML, AI, IoT and connected devices.

Key Confidential Computing Companies

The global confidential computing industry is dominated by key players such as Advanced Micro Devices, Inc., Amazon Web Services, Inc., Alibaba Cloud, Cyxtera Technologies Inc., Fortanix, Google LLC, Intel Corporation, International Business Machines Corporation, Microsoft Corporation and Ovh SAS. These players have adopted various strategies to increase their market penetration and strengthen their position in the confidential computing industry.

Top Impacting Factors

Growing Need to Comply with Regulatory Standards

Businesses must safeguard the data of their consumers in accordance with data privacy laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). A safe and private processing environment is offered by confidential computing, which assist organizations in adhering to these rules. For instance, the GDPR mandates that processing of personal data take place in a way that ensures the data's proper security, including protection from unauthorized or unlawful processing. By ensuring that data is processed safely and confidentially, confidential computing assist organizations in meeting this need. Moreover, organizations are required to protect sensitive data by a number of compliance rules in several areas, including healthcare, banking, and government.

Healthcare organizations must safeguard patient data, for instance, in accordance with the Health Insurance Portability and Accountability Act (HIPAA). Therefore, by providing secure processing environments for sensitive data, confidential computing aids these organizations in complying with HIPAA regulations. Cloud service providers must implement security controls to protect client data under cloud security laws such as the Federal Risk and Authorization Management Program (FedRAMP) and the Cloud Security Alliance (CSA). For cloud service providers, confidential computing adds an extra degree of protection by ensuring that customer data is processed in a private and safe setting. Organizations are able to safeguard their intellectual property owing to confidential computing. For instance, firms are required to take reasonable precautions to secure trade secrets, which are protected by law. Thus, to prevent unauthorized people from accessing or compromising an organization's trade secrets, confidential computing offers a safe processing environment.

Increasing Need for Secure Cloud Computing

By offering a private and secure computing environment within the cloud, confidential computing reduces the security concerns. Traditional cloud computing models depend on trust in the cloud service provider and the supporting infrastructure, which might not always be enough to safeguard sensitive data from outside intrusion or insider threats. Confidential computing makes use of tools such as trusted execution environments (TEEs) or secure enclaves to build private, safe environments inside the cloud architecture. Confidential computing makes use of secure enclaves to protect sensitive data and computations from the rest of the cloud environment, including the cloud service provider. Thus, even if the cloud infrastructure is hacked, the secure computing environment will still maintain the data's integrity and secrecy. For businesses adoption of cloud computing while maintaining control over their sensitive data, such secure functionality is essential.

The demand for secure computing has also increased as multi-cloud and hybrid cloud settings have grown. To streamline their operations, businesses frequently use many cloud service providers or integrate on-premises infrastructure with cloud services. It is difficult to manage security and privacy across many cloud systems, though. A standardized way to secure cloud computing is provided by confidential computing, allowing businesses to maintain uniform security protections across different cloud deployments. Concerns about data privacy and security have fueled the demand for secure cloud computing, which has accelerated the adoption of confidential computing solutions. Businesses are seeking technology that protects the privacy, confidentiality, and integrity of their sensitive data when it is processed or stored in the cloud.

End-User Adoption

Confidential computing involves a combination of hardware, software, and services that collectively enable the protection of data during processing. Therefore, end users seek to maintain data confidentiality and integrity while still being able to perform necessary computations and analysis. In addition, organizations that use cloud computing services from providers offer confidential computing capabilities. As a result, these users seek to secure their data and workloads while taking advantage of cloud infrastructure.

For instance, in July 2020, Google launched cloud confidential computing with confidential virtual machines to keep data encrypted in memory and elsewhere outside the central processing unit. Moreover, financial institutions, healthcare facilities, and research institutions are examples of companies that frequently use confidential computing to process sensitive data without exposing it to potential dangers. For instance, in August 2021, IBM Corporation enhanced its cloud computing services through IBM hyper protect software development kit for iOS, which helps developers build healthcare applications that are HIPAA-ready running on Apple devices. Such advancements encourage end users to adopt confidential computing that further driving the confidential computing market growth.

Confidential Computing Market Regional Insights

North America confidential computing market dominated the market and accounted for a 37.39% share in 2023. The market is expected to continue its strong growth in North America, maintaining the region's global leadership position. This prominence is driven by a robust ecosystem of major technology companies and cloud service providers, serving a dense population of businesses seeking advanced secure data processing technologies. The region's sophisticated IT landscape and emphasis on digital transformation reinforce its market dominance. Moreover, the implementation of strict data protection laws serves as a key driver for the widespread adoption of confidential computing technologies across various industries in North America.

The market of the U.S. is witnessing a robust upward trend fueled by heightened awareness of data privacy risks and stringent regulatory requirements. Companies are increasingly adopting confidential computing technologies to ensure the protection of sensitive data throughout its lifecycle, from processing to storage. This trend is driving innovation in secure computing solutions and fostering collaborations between tech giants and cybersecurity firms to meet the growing demand for robust data protection measures.

Europe Confidential Computing Market Trends

Europe confidential computing market is expected to witness a significant rise during the forecast period.Rising cyber threats are prompting European organizations to invest in advanced data protection technologies. Confidential computing offers a new layer of security by protecting data in use, and addressing a critical vulnerability in the data lifecycle. This technology is increasingly seen as a vital component of comprehensive cybersecurity strategies for European businesses.

Asia Pacific Confidential Computing Market Trends

The market of Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The data security segment holds the largest confidential computing market share in the Asia Pacific region, as confidential computing can isolate sensitive data in protected CPU enclaves during processing. This enables organizations in the Asia Pacific to leverage the benefits of cloud computing, such as scalability and cost-effectiveness, while maintaining robust data protection and addressing concerns around data residency, vendor lock-in, and regulatory compliance.

Key Industry Developments:

In May 2023, Microsoft partnered with Habu, a data clean room software provider, to integrate Habu's Data Clean Room applications with Azure confidential computing. This partnership aims to enable organizations to achieve a more secure environment for processing sensitive data. By leveraging Azure confidential computing, the integrated solution will allow organizations to unlock insights from sensitive data without compromising privacy, performance, or security. The partnership highlights the growing demand for confidential computing technologies that enable secure data collaboration and insights while maintaining robust data protection.

In January 2023, Intel unveiled its Trust Domain Extension (TDX) solution, which is designed to provide VM isolation and protect data stored within virtual machines. The TDX technology creates a trusted execution environment (TEE) that isolates the VM's data and operations from the underlying hardware, including the hypervisor and other privileged software. This allows organizations to run sensitive workloads on shared infrastructure, such as public clouds while maintaining control and visibility over their data. The introduction of Intel TDX highlights the growing importance of confidential computing solutions that enable the secure processing of sensitive data in virtualized and cloud-based environments.

In February 2022, IBM acquired Neudesic, LLC, a leading U.S. cloud consultancy. This strategic acquisition expands IBM's portfolio of hybrid multi-cloud services, bolstering its capabilities to support clients on their digital transformation journeys. Neudesic's expertise in cloud advisory, application modernization, and data and AI services strengthens IBM's offerings, allowing them to provide more comprehensive solutions. With a focus on hybrid cloud and AI as key growth drivers, IBM is better equipped to help clients navigate the complexities of multi-cloud environments and unlock the full potential of their data and AI initiatives.

Key Benefits for Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the confidential computing market analysis from 2022 to 2032 to identify the prevailing confidential computing market opportunities.

The confidential computing market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the confidential computing market forecast assists to determine the prevailing confidential computingmarket opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of market growth.

The report includes the analysis of the regional as well as global confidential computing market trends, key players, market segments, application areas, and market growth strategies.

Confidential Computing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 184.5 billion |

| Growth Rate | CAGR of 46.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 341 |

| By Component |

|

| By Deployment Mode |

|

| By End User |

|

| By Application |

|

| By Region |

|

| Key Market Players | Intel Corporation, Ovh SAS, Advanced Micro Devices, Inc., Amazon Web Services, Inc., Alibaba Cloud, Microsoft Corporation, fortanix, International Business Machines Corporation, Google LLC, Cyxtera Technologies Inc. |

Analyst Review

The demand for secure and private computing environments drives growth in the confidential computing market. In the current digital era, organizations must contend with a number of difficulties in preventing unauthorized access to sensitive data and calculations. Traditional computing techniques frequently rely on confidence in the underlying infrastructure or third-party services, which leaves them open to privacy problems and data breaches. As a result, there is an upsurge in need for cutting-edge solutions that guarantee data processing's security, integrity, and privacy. Therefore, to solve these issues, confidential computing solutions are essential, for instance, safe enclaves or trusted execution environments (TEEs), secure hardware, encryption techniques, secure multi-party computation (MPC), and homomorphic encryption. When processing sensitive data, these tools offer a secure environment for both storage and use.

They give businesses the ability to safely process data when working with several parties or in unreliable situations without risking the data's confidentiality. Finance, healthcare, government, and cloud computing are a few of the sectors that are driving the market growth for confidential computing. Moreover, these industries are subject to strict regulatory standards and manage enormous amounts of sensitive data. Businesses spend more money on secure computing solutions to comply with laws such as GDPR, safeguard intellectual property, and lower the risk of data breaches. Thus, to solve the changing needs of data protection and privacy, vendors constantly create and present innovative solutions. Furthermore, intense competition in the market drives businesses to offer reliable and all-encompassing solutions that help to safeguard data processing, cloud computing, and communication across various entities. As businesses place a high priority on data privacy and security, the market for confidential computing is anticipated to expand significantly. The capabilities of secure computing environments are anticipated to be progressively improved by technological advancements, making them more available and simpler to install. The market for confidential computing is anticipated to grow as the value of data security continues to rise, providing attractive opportunities for industry participants and developing a safer and more secure digital ecosystem.

For instance, in January 2022, Fortanix Inc., the data-first multicloud security™ company, launched AWS Nitro Enclaves and strengthened its position as a leader in the fast-growing Confidential Computing space. AWS Nitro Enclaves expands on the protection and assurances offered by the AWS Nitro System by providing an isolated and hardened environment to protect code and data in-use. Fortanix customers use AWS Nitro Enclaves to create isolated computing environments to further protect their confidential workloads running on a wide range of Amazon Elastic Compute Cloud (Amazon EC2) instances without having to make any modifications. Enterprises more easily preserve privacy and securely process sensitive data and applications within AWS Nitro Enclaves using Fortanix Data Security Manager and Fortanix Confidential Computing Manager. Fortanix solutions are renowned for their simplicity of deployment and use, and ease of management from a single pane of glass.

The global confidential computing market was valued at USD 4.1 billion in 2022, and is projected to reach USD 184.5 billion by 2032

The global confidential computing market is projected to grow at a compound annual growth rate of 46.8% from 2023-2032 to reach USD 184.5 billion by 2032

The Key Players that operate in the confidential computing market such as Ovh SAS, Cyxtera Technologies Inc., Amazon Web Services, Inc., Google LLC, International Business Machines Corporation, Alibaba Cloud, Intel Corporation, fortanix, Microsoft Corporation, Advanced Micro Devices, Inc.

Region wise, the confidential computing market size was dominated by North America in 2022 and is expected to retain its position during the forecast period

Growing Need to Comply with Regulatory Standards & Increasing Need for Secure Cloud Computing

Loading Table Of Content...

Loading Research Methodology...