Construction 4.0 Market Research: 2031

The Global Construction 4.0 Market Size was valued at $11.9 billion in 2021, and is projected to reach $62.2 billion by 2031, growing at a CAGR of 17.7% from 2022 to 2031. Digitization in the construction industry is termed as construction 4.0, which uses technologies such as building information modeling (BIM), artificial intelligence (AI), and other technologies. Industrial 4.0 technologies are used in the construction industry to avoid human errors, avoid repetitive work, and improve productivity of construction projects Industry 4.0 adopts technologies for decision making, and remain connected with each other through sensors and internet connectivity for construction activities.

Market Dynamics

Growth of the commercial and residential construction industry increases the demand for construction 4.0 concepts. For instance, in September 2021, Germany planned to build 285,900 residential houses by 2030. Hence, Germany's expanding construction sector is one of the key drivers of the country's economic recovery, and as a result, the construction 4.0 industry will grow in the forecast period. In addition, the use of technologies, such as the internet of things (IoT), artificial intelligence, and others, in the construction industry helps to monitor, analyze, and capture information in real-time and reduce facility services costs.

For instance, sensors, 3D printing, and IoT are being used for indoor navigation, maintenance, security, and smart meeting rooms. Such trends drive construction 4.0 industry growth. For instance, in November 2022, Trimble and the Hilti Group, a global leader providing innovative tools, technology, software, and services to the commercial construction industry, has launched its new Hilti ON!Track asset management system will integrate with Trimble Viewpoint Vista, an ERP solution within the Trimble Construction One suite.

Growth during the construction 4.0 market is constrained by a lack of skilled workers and human resources in developing nations. For instance, in emerging nations such as China and India, roughly 48% of individuals still lack literacy. The number of adult illiterates in developing nations including South Asia, West Asia, and Africa is over 781 million.

Moreover, increased security threats in connected devices are restraining market growth. For instance, in January 2023, an article published on ETCIO website by Check Point Research (CPR) company has released new data in 2022 cyber-attack trends showing that global cyber-attacks increased by 38% in 2022, compared to 2021.This compromises the confidentiality and integrity of the data. Such instances hinder the market growth.

The demand for construction 4.0 market has decreased in 2020, owing to low demand from different regions due to lockdown imposed by the government of many countries. The COVID-19 pandemic has shut down production of infrastructure development, building construction and other sectors for the end-user, mainly owing to prolonged lockdowns in major countries globally. This has hampered the growth of the market significantly during the pandemic.

The major demand for market was previously noticed from giant countries including China, the U.S., Germany, Spain, and the UK, which was badly affected by the spread of coronavirus, thereby halting demand for market. This is expected to lead to re-initiation of the manufacturing industry at its full-scale capacities, which is projected to help the construction 4.0 market to recover by end of 2022.

Rise in awareness in developing countries, such as India, Brazil, Russia, and others, are focusing on adopting new construction-related technologies, such as IoT, robot, BIM, and others, to assess knowledge about construction 4.0 technologies. There is rise in adoption of digital technologies in construction activities due to features such as avoiding repetitive work and human error. New technologies, such as 3D scanning, building information modeling, augmented reality, and drones, are used in construction activities. For instance, in June 2022, Government initiatives, such as smart advanced manufacturing, rapid transformation hub (SAMARTH), and Udyog Bharat 4.0 in India, are implemented to strengthen the competition. Such instances are anticipated to provide lucrative opportunities for the construction 4.0 market growth.

Segmental Overview

The Global Construction 4.0 Market is segmented on the basis of solution, technology, application, end user, and region. By solution, the market is fragmented into hardware, software, and services. By technology, the market is categorized into IoT, artificial intelligence, industrial robots, and others. By application, the market is divided into asset monitoring, predictive maintenance, fleet management, wearables, and others. By end user, the market is classified into residential and non-residential.

Region Wise,

The global construction 4.0 market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

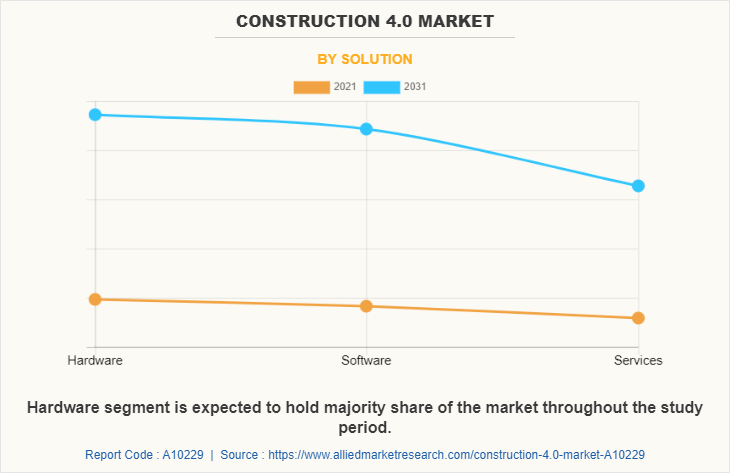

By Solution:

The construction 4.0 market is categorized into hardware, software, and services. Hardware is a heterogeneous system made up of various core equipment and a control panel that are linked together by sensors and RFID to carry out specific functions. RFID tags, sensors, intelligent systems, and other hardware elements are examples of hardware components. Moreover, the software controls and monitors the equipment and linked devices. It consists of remote management & logistics solutions, asset performance management solutions, data & operation management solutions, connection solutions, and analytics solutions. Smart safety & security system software is also included. It incorporates elements such as big data analytics, autonomous robotics, the cloud, virtualization, and simulation.

Services offered include consultancy, system integration, and upkeep of construction operations (deployment services). These services help to maintain the equipment's quality while also enhancing construction operations. The hardware segment is expected to be the largest revenue contributor during the forecast period. The services segment is expected to exhibit the highest CAGR share in the solution segment in the construction 4.0 market during the forecast period.

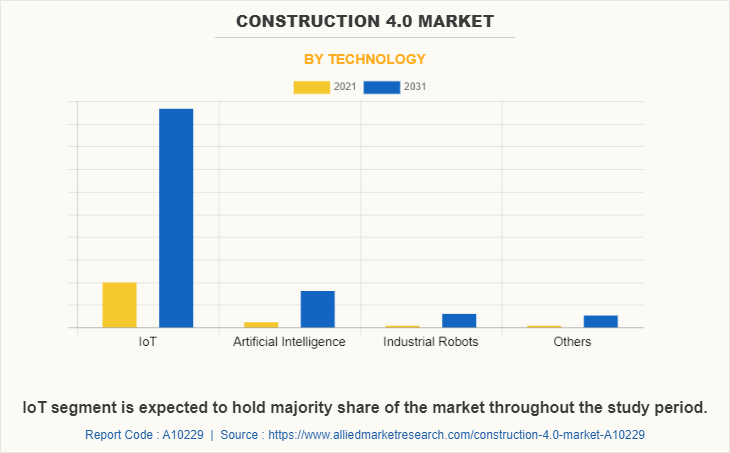

By Technology:

The construction 4.0 market is classified into IoT, artificial intelligence, industrial robots, and others. Construction companies frequently use the Internet of Things (IoT) technologies. It integrates physical devices with online services, sensors, and RFID tags to gather information for the decision-making process. The value and usefulness of the construction business are improved via embedded computing. A general name for activities like problem-solving, making decisions, and pattern recognition is artificial intelligence (AI), which is employed in many different industries. It can keep an eye on a machine or piece of equipment while it's being used on a building site, extending its lifespan and reducing the risk of accidents or project delays due to untimely failure.

It is done by gathering data using a variety of sensors and software. Industrial robots are employed in the construction industry for tasks like constructing machinery, arc welding parts, applying adhesives, installing windows, and putting together doors. The others segment includes the use of augmented reality (AR), 3D printing, remote services, virtual reality (VR) products, operational intelligence, building information modeling (BIM), and other IoT-based technologies utilized on construction sites. IoT segment is expected to exhibit the largest revenue during the forecast period. artificial intelligence segment is expected to exhibit the highest CAGR share in the technology segment in the construction 4.0 market during the forecast period.

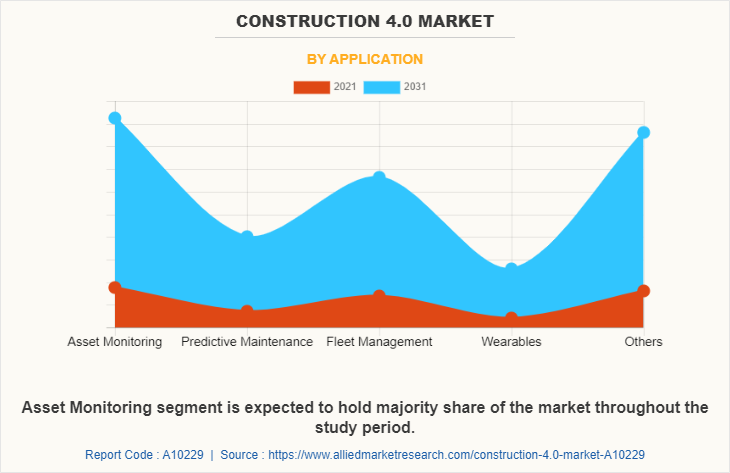

By Application:

The construction 4.0 market is divided into asset monitoring, predictive maintenance, fleet management, wearables, and others. Asset monitoring solutions include asset tracking and management using RFID tags, QR codes, and others. Asset management uses IoT and big data technologies in the construction industry. Predictive maintenance is used in construction sites to improve the working life of the equipment and helps in avoiding untimely failure, which can cause project delays or accidents.

Fleet management, commonly referred to as telematics, provides services like GPS-based services, vehicle monitoring, driver management, fleet safety, and management of driver behavior and safe driving practices. Modern electronic gadgets known as construction wearables can be worn on the body or on the clothing of construction workers as personal protective equipment. The others segment includes the use of big data, 5G, Wi-Fi, machine learning, and others. Asset Monitoring is expected to exhibit the largest revenue share in the application segment in the construction 4.0 market during the forecast period. The wearables segment is expected to exhibit the largest CAGR during the forecast period.

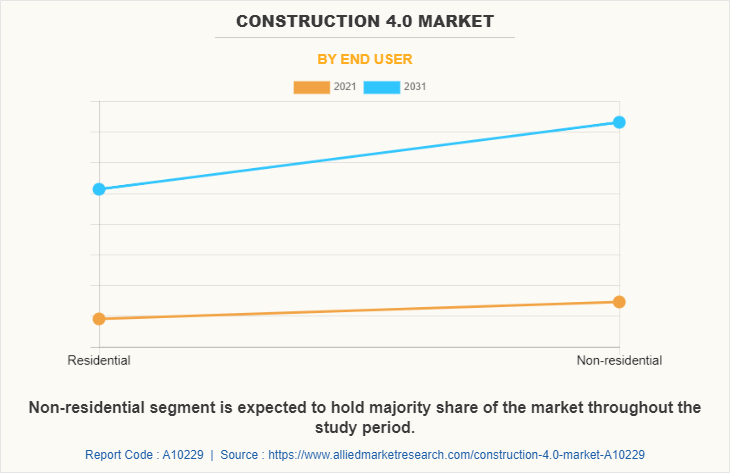

By End User:

The construction 4.0 market is divided into residential and non-residential. Residential buildings include construction of residential complexes, condos, independent houses, and others. 3D printing and virtual reality are some of the technologies used in this segment. Construction projects, such as hospitals, hotels, industrial buildings, infrastructure, and others, are considered in the non-residential segment. AutoCAD, BIM, IoT, and other technologies are used in this segment. Non-residential is expected to exhibit the largest revenue share in the end user segment in the construction 4.0 market during the forecast period. The residential segment is expected to exhibit the largest CAGR during the forecast period.

By Region:

The automatic shot blasting machines is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America had the highest revenue in construction 4.0 market share. And Asia-Pacific is expected to exhibit highest CAGR during forecast period.

Competition Analysis

The major players profiled in the construction 4.0 market include Advanced Opto-Mechanical Systems and Technologies Inc, ABB Ltd, Autodesk Inc, CalAmp Corporation, Hexagon AB, Hilti Corporation, Mitsubishi Electric Corporation, Oracle Corporation, Topcon Corporation, and Trimble, Inc. Major companies in the market have adopted product launch, acquisition and partnership as their key developmental strategies to offer better products and services to customers in the construction 4.0 market.

Some examples of product launch and product development in the market.

In January 2022, Hexagon launched a disruptive open innovation start-up platform to accelerate technology commercialization in the global manufacturing industry.

In June 2021, CalAmp's Tracker has Launched iOn Fleet Management Software to Accelerate the Speed of Smart Decision Making for Fleets Across the U.K.

In January 2021, Autodesk Inc launched a new cloud-based technology for improving the infrastructure project. Arcadis harnessed cloud collaboration and 3D modeling to provide a resilient water system for the city of Toledo, Ohio.

In January 2023, Topcon has expanded its Compact Solutions Portfolio with 2D-MC automatic grade control solution for compact track loaders by means of this business expansion company expands it product portfolio in throughout North Americas. 2D-MC is a low-cost 2D machine control system that is designed to be installed directly onto select grading attachments.

The business expansion and collaboration in the market.

In December 2022 ABB has collaborated with Boliden, the Swedish mining and smelting company, to build a strategic co-operation to use low carbon footprint copper in its electromagnetic stirring (EMS) equipment and high-efficiency electric motors. The aim is to reduce greenhouse gas (GHG) emissions while driving the transition to a more circular economy.

In October 2022 ABB has invested US$13 million in order to expands it business products division Iberville manufacturing facility in Saint-Jean-sur-Richelieu, Quebec, to increase production capacity and establish a research & development facility at its global center of excellence for cable tray manufacturing. This will support rising global demand, especially in the data center segment, and is ABB’s second multimillion-dollar investment in a Canadian site in the last 12 months.

In April 2022, Mitsubishi Electric Corporation has acquired Sweden-based Motum AB, which operates an elevator and automatic door business mainly in Sweden. Through the acquisition, Mitsubishi Electric aims to strengthen its capabilities to service and modernize elevators and escalators in Sweden and other countries not limited to Europe.

In November 2022 Trimble and HP has collaborated to provides latest robotic total station with HP's new SitePrint robotic layout solution. The solution focuses on transforming the layout process for indoor construction projects.

In November 2022 Trimble and the Hilti Group, a global leader providing innovative tools, technology, software, and services to the commercial construction industry, has launched it news Hilti ON!Track asset management system will integrate with Trimble Viewpoint Vista, an ERP solution within the Trimble Construction One suite.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the construction 4.0 market forecast, current trends, segments, estimations, and dynamics of the construction 4.0 market from 2021 to 2031 to identify the prevailing construction 4.0 market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing construction 4.0 market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global construction 4.0 market trends, key players, market segments, application areas, and market growth strategies.

Construction 4.0 Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 62.2 billion |

| Growth Rate | CAGR of 17.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 209 |

| By Solution |

|

| By Technology |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Autodesk Inc., Hilti Corporation, Mitsubishi Electric Corporation, CalAmp Corporation, Trimble, Inc., ABB Ltd., Oracle Corporation, Topcon Corporation, Advanced Opto-Mechanical Systems and Technologies Inc., Hexagon AB |

Analyst Review

The global construction 4.0 market witnessed a huge demand in North America followed by Europe. The highest share of the North America market is attributed to increasing demand for infrastructure development by means of smart construction including IoT, artificial intelligence, asset monitoring and other software in residential and non-residential construction.

The construction industry is digitizing by adopting information and communication technology (ICT). Digitization in the construction industry is termed construction 4.0. Construction 4.0 uses concepts such as IoT, 3D printing, virtual reality, and others. This technology includes the use of design, construction, and operation to improve productivity. The use of technologies, such as the internet of things (IoT), artificial intelligence, and others, in the construction industry, is driving the construction 4.0 market. In addition, the growth of the commercial and residential construction industry increases the demand for construction 4.0 concepts. For instance, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, in February 2021, 1,769,000 housing units went under construction, which is a 6.8% increase from the revised January estimate of 1,657,000 housing units. Such instances are expected to drive the market.

However, lack of skilled labor, less capital in developing countries, and absence of security to avoid cyber-attacks on connected devices are anticipated to hamper the growth of the market. Furthermore, a rise in awareness about construction 4.0 technologies and technological advancement are projected to provide lucrative opportunities for the growth of the construction 4.0 market.

The major players profiled in the construction 4.0 market include Advanced Opto-Mechanical Systems and Technologies Inc, ABB Ltd, Autodesk Inc, CalAmp Corporation, Hexagon AB, Hilti Corporation, Mitsubishi Electric Corporation, Oracle Corporation, Topcon Corporation, and Trimble, Inc.

The global construction 4.0 market was valued at $11,851.4 million in 2021, and is projected to reach $62,164.1 million by 2031, registering a CAGR of 17.7% from 2022 to 2031.

The forecast period considered for the global construction 4.0 market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global construction 4.0 market report can be obtained on demand from the website.

The base year considered in the global construction 4.0 market report is 2021.

The major players profiled in the construction 4.0 market include Advanced Opto-Mechanical Systems and Technologies Inc, ABB Ltd, Autodesk Inc, CalAmp Corporation, Hexagon AB, Hilti Corporation, Mitsubishi Electric Corporation, Oracle Corporation, Topcon Corporation, and Trimble, Inc.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on technology, IoT segment dominated the market in 2021.

Loading Table Of Content...