Construction Aggregates Market Research, 2032

The global construction aggregates market size was valued at $375.3 billion in 2021, and is projected to reach $667.8 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032.

Aggregate is the most mined granular product in the world. It is the basic component of composite materials such as concrete and asphalt concrete. These materials are extracted from natural sediments such as granite, limestone, and falling rocks by finely drilling and blasting them. These aggregates are used as foundation materials under airport runaways, highways, railroads, and parking lots. Aggregates are also used for water filtration, purification, and control of soil erosion. As the supply-demand gap for natural sand remains unfilled, construction aggregates have emerged as a viable solution to solve infrastructure problems. Moreover, owing to serious concerns about depletion of natural resources, construction aggregate remains a component of infrastructure, commercial, industrial, and housing development projects.

Market Dynamics

Rapidly growing urbanization and industrialization across the world are positively affecting the construction industry, eventually leading to an increase in demand for various construction materials including construction aggregates. According to the United Nations, the global population will rise to 9.7 billion by 2050, an increase of 1.7 billion as compared to 2023. This will lead to the overcrowding of the cities in the world, which will require new buildings to be constructed and will also increase the built-up area. For instance, according to the World Bank, there were 794,432 Built Up Areas (BUAs) globally in 2016, which it had estimated to reach 849,407 by 2022. Additionally, the construction of residential and commercial buildings such as shopping malls, hospitals, schools, and others are also rising all across the world. For instance, as of January 2023, a well-known building developer ‘Triple Five Group’ has planned to construct American Dream Mall near Everglades National Park in Florida. Furthermore, innovation in the construction sector, and rise in tourism activities, and rapid infrastructural development are some other factors expected to support the growth of the construction aggregates market to a significant extent. For example, the U.S. spends significantly in the construction and repair of new and old road infrastructure, respectively. According to the Council on Foreign Relations of the U.S., the projected investment by public and private entities on the roads between 2016 and 2040 is $3.42 trillion. In addition, the U.S. Bipartisan Infrastructure Law which was passed in November 2021, allocated $110 billion to be spent on construction and repair & maintenance of roads, and bridges as well as other major projects. This and many other such projects are anticipated to have a positive influence on the construction aggregates market.

However, the high transportation cost of construction aggregates is expected to restrict the market growth. Transportation cost amounts to around 50% of the overall administrative cost incurred on construction aggregates as construction locations are far away from mining sites. Hence, high transportation costs of aggregates are expected to negatively affect the construction aggregates market outlook during the forecast period.

Moreover, innovations in technologies for the production of aggregates to increase the efficiency of the manufacturing process and productivity with high-quality products are expected to drive global construction aggregates market growth during the forecast period. For instance, Hydro-Clean washing unit by Haver & Boecker cleans toxic materials from aggregates and reduces water consumption by around 75% as compared to conventional wooden washers. Furthermore, the initiation of Building Information Modeling (BIM) is rapidly accompanying digital transformation in the construction sector. BIM provides support in terms of time management, cost planning, and sustainability for the use of raw materials, waste reduction, and overall project performance improvement. These factors are expected to drive the market growth.

The construction aggregates market witnesses various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced construction activities, eventually leading to reduced demand for construction aggregates. However, COVID-19 has subsided, and the major aggregate producers in 2023 are performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire construction and manufacturing industry. The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of construction aggregates. In addition, the cost of oil & gas has also increased substantially, and in many countries; it has increased the cost of shipping which further negatively affects the construction aggregates market. However, India and China are performing relatively well, and there is no notable decline in the demand for construction aggregates. Inflation has also resulted in increased interest rates, which eventually discourages builders from initiating any construction project. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised, which is expected to end the war between them and reduce the global inflation.

Segmental Overview

The construction aggregates market is segmented into type, applications, transportation mode, and region. By type, the market is divided into crushed stone and sand & gravel. As per application, it is categorized into residential and non-residential. According to transportation method, it is segmented into trucks, trains, and ships. Region wise, the market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

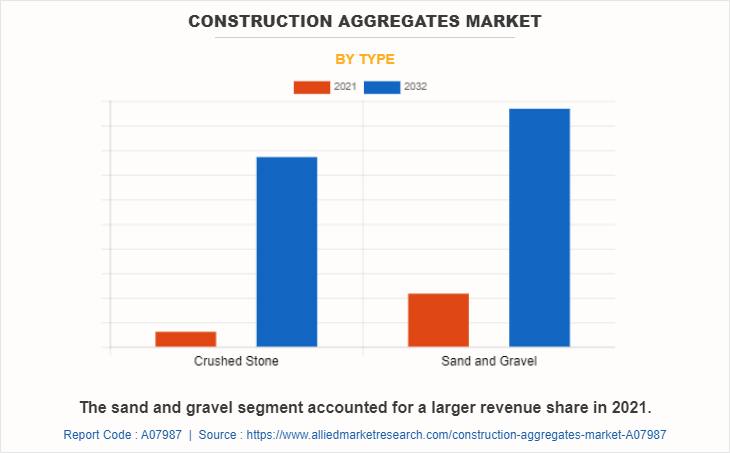

By type: The construction aggregates market is divided into crushed stone and sand & gravel. In 2022, the sand & gravel segment dominated the construction aggregates market share in terms of revenue, and the crushed stone segment is expected to grow with a higher CAGR during the forecast period. Demand for crushed stones is growing, owing to demand from building & construction, and transport infrastructure sectors for different applications such as roadway construction and manufacturing of concrete. Moreover, rapid urbanization and growth in demand for construction materials in different developing countries drive demand for sand and gravel, which is the crucial ingredient. In addition, sand is used for various applications such as sand-blasting, industrial casting, oil & water filtration, coal-burning boilers, foundries, glass making, and paving road.

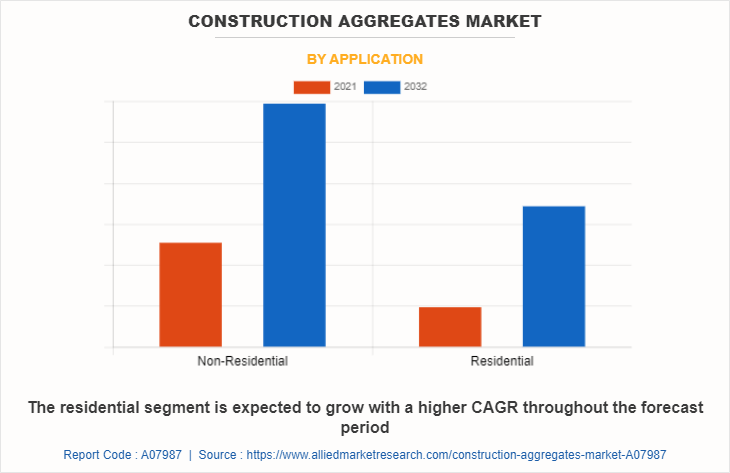

By application: The construction aggregates market is divided into residential and non-residential. In 2022, the non-residential segment dominated the construction aggregates market, in terms of revenue, and the residential segment is expected to dominate the construction aggregates market forecast by growing with a higher CAGR. The saturation of major cities has led governments to expand the boundaries of existing cities or planning of a completely new city to balance the development and economy of all parts of a country. Such city expansion and development plans are likely to result in the building of new residential developments, providing attractive potential for the growth of the construction aggregate industry. Furthermore, commercialization, urbanisation, and industrialisation have resulted in the creation of new and luxury office premises in major cities across the world. In addition, as part of development programmes, numerous new airports and shopping complexes are being developed in several nations.

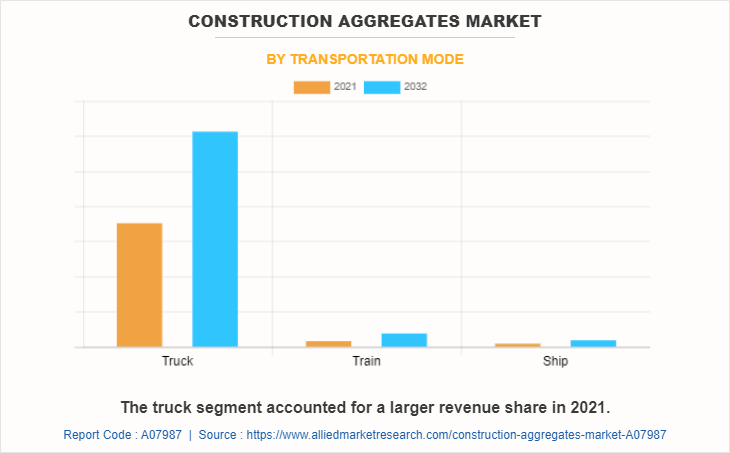

By transportation mode: The construction aggregates market is divided into trucks, trains, and ships. The truck segment accounted for the highest market share in 2022, owing to its ability to reach the last mile, which is impossible with trains and ships. However, the trains segment is anticipated to register a higher growth rate during the forecast period, owing to advancements in trains and ever-increasing distance between the mining site and the construction sites.

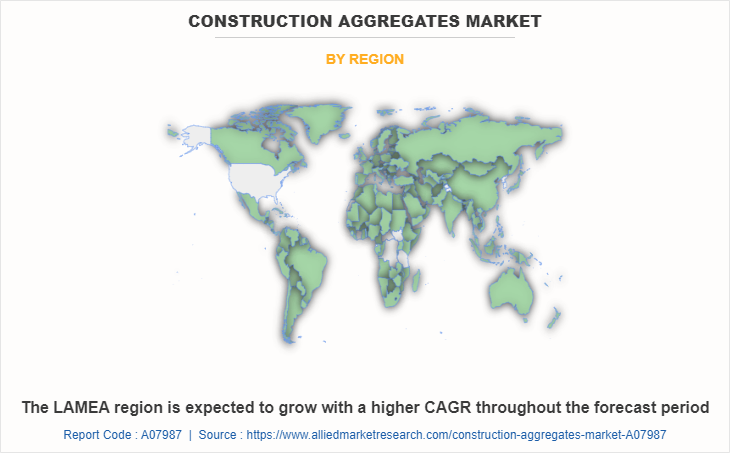

By region: Asia-Pacific accounted for the highest market share in 2022 and LAMEA is expected to grow with the highest CAGR during the forecast period. Asia-Pacific is a highly developing region with the fastest-growing population. According to the United Nations, nearly two-thirds of the world population resides in Asia-Pacific, with China and India alone accounting for one-third of the global population. In addition, the rate of urbanization in Asia-Pacific is also high. Thus, owing to high population growth and urbanization in the region, the construction sector has witnessed a rapid rise, thereby, demand for construction aggregates, which are extensively used in the construction sector is anticipated to rise in the coming years. However, LAMEA holds a greater potential for growth, which is anticipated to be a major reason for the rise in demand for construction aggregates. In addition, countries in Africa are experiencing rapid economic and population growth, which is expected to bring demand for construction aggregates to construct residential and non-residential projects.

Competition Analysis

Competitive analysis and profiles of the major players in the construction aggregates market are provided in the report. Major companies in the report include Adelaide Brighton Ltd., CEMEX S.A.B. de C.V., CRH plc, Heidelberg Cement AG, HOLCIM, Martin Marietta Materials Inc., ROGERS GROUP INC., SIKA Group, Vicat SA, and Vulcan Materials Company.

To remain competitive major players adopt development strategies such as product launches, acquisitions, and expansion. For instance, in January 2023, Holcim US acquired the sand and aggregate operations of Pioneer Landscape Centers. This acquisition is anticipated to help Holcim to acquire a significant aggregates market share of Denver, Colorado Springs, and Phoenix in the U.S. Similarly, in June 2023, Afrimat, a major building materials provider, acquired Lafarge South Africa Holdings (Pty) Ltd. (LSA). This acquisition is expected to help Afrimat expand its product portfolio as well as customer base in Africa region.

Key Benefits for Stakeholders

The report provides an extensive analysis of the current and emerging construction aggregates market trends and historic data.

In-depth construction aggregates market analysis is conducted by constructing market estimations for key market segments between 2021 and 2032.

- Extensive analysis of the construction aggregates market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The construction aggregates market revenue and volume forecast analysis from 2023 to 2032 is included in the report.

- The key players within the construction aggregates market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the construction aggregates industry.

Construction Aggregates Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 667.8 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2021 - 2032 |

| Report Pages | 192 |

| By Type |

|

| By Application |

|

| By Transportation Mode |

|

| By Region |

|

| Key Market Players | Vulcan Materials Company, CEMEX S.A.B. de C.V., HeidelbergCement AG, Sika AG, Holcim Ltd., Rogers Group Inc., Martin Marietta Materials Inc., Vicat SA, CRH, Adelaide Brighton Ltd. |

Analyst Review

The global construction aggregates market witnessed a huge demand in Asia-Pacific followed by Europe & North America. The highest share of the Asia-Pacific market is attributed to increased awareness regarding concrete construction and the use of cheaper crushed stone aggregates.

Global population is increasing with rise in urbanization. Hence, increasing population is leading to challenges for road network and public transportation services. Thus, countries are building smart cities to ease congestion caused due to growing population. In addition, this leads to increasing government expenditures for infrastructural development, such as improvement of roads and bridges. Growth in demand for construction & infrastructure developments largely drives the construction aggregate market.

Industries such as construction and tunnels require construction aggregates and other construction materials. By 2040, the global population is estimated to grow by approximately two billion with the urban population growing by 46%, triggering massive demand for infrastructure support such as roads, subways, tunnels, common areas, and commercial infrastructures. Therefore, this, in turn, is expected to drive the construction aggregates market.

Furthermore, drone-based inspection, autonomous equipment, collaborative robots, and labor terrain mapping helps in reducing labor cost and increasing accuracy along with the productivity of work. This helps in reducing the cost of overall construction project, eventually propelling the construction sector.

Key factors driving the growth of the construction aggregates market include a rise in the construction & infrastructure industry, growth in focus on public-private partnerships (PPP), and technological advancements in construction machinery.

The latest version of the global construction aggregates market report can be obtained on demand from the website.

The global construction aggregates market size was valued at $3,75,269.3 million in 2021.

The global construction aggregates market size is projected to reach $6,67,844.4 million by 2032, registering a CAGR of 5.2% from 2023 to 2032.

The forecast period considered for the global construction aggregates market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year. In addition, 2021 is analysed as a historic year.

Asia-Pacific is the largest regional market for construction aggregates market.

Key companies profiled in the tire recycling market report include Adelaide Brighton Ltd., CEMEX S.A.B. de C.V., CRH plc, Heidelberg Cement AG, HOLCIM, Martin Marietta Materials Inc., ROGERS GROUP INC., SIKA Group, Vicat SA, and Vulcan Materials Company.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...