Construction Drone Market Research, 2032

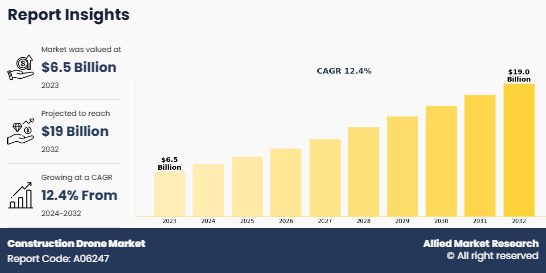

The global construction drone market size was valued at $6.5 billion in 2023, and is projected to reach $19 billion by 2032, growing at a CAGR of 12.4% from 2024 to 2032.

Construction drone is an unmanned aerial vehicle (UAV), which finds its application in construction activities. Manual operations and automated operations of construction drones are possible from remote places. Construction drones enable construction teams to get a view of construction sites, materials, people, and machinery, thereby assuring workplace safety and security. Furthermore, the market growth is supported by rise in demand for drones in applications such as land surveying, infrastructure inspection, security, and surveillance, where they significantly reduce project time and labor costs.

The construction drone market overview includes an analysis of the growing adoption of unmanned aerial vehicles (UAVs) in the construction sector for tasks such as surveying, mapping, site monitoring, and safety inspections. Drones are revolutionizing the industry by offering precise, cost-effective solutions that enhance project efficiency and accuracy. With the integration of advanced technologies like artificial intelligence (AI), LiDAR, and photogrammetry, drones enable real-time data collection and analysis, supporting construction managers in tracking progress, managing risks, and optimizing resource allocation. These capabilities are particularly valuable in large-scale infrastructure projects, where traditional methods can be time-consuming and labor-intensive.

Segment Overview

Rise in demand for construction drones can be attributed to rapid development of the construction industry across the globe, leading to increase in need for surveying vast land mass, which contains uneven ground and rocky obstacles. These tasks can be performed efficiently and quickly by construction drones as compared to humans. In 2024, the construction drone market witnessed significant advancements through various new initiatives and product launches. For example, Gremsy introduced the Pixy LR Gimbal for Sony ILX-LR1 cameras, enhancing aerial and ground-based inspection capabilities. This two-axis gimbal provides advanced stabilization, which is ideal for detailed inspection tasks commonly required in construction projects. In addition, ePropelled launched its Falcon propulsion systems, ranging from 1kW to 20kW, aimed at meeting rise in demand for UAV propulsion solutions, contributing to the growth of construction drone applications. This is expected to drive the construction drone market growth during the forecast period.

Governments around the globe are investing in residential and infrastructural construction to develop their economy and improve the standard of living. This is expected to augment the growth of the construction sector, which, in turn, is likely to contribute toward the growth of the construction drone market during the forecast period.

Growth of population coupled with rapid urbanization has resulted in increase in residential and nonresidential construction activities in the developed and developing countries such as the U.S., Canada, the UK, Russia, India, China, and Brazil. This is expected to drive the construction drone market growth during the forecast period.

Key players in the construction drone industry are continuously making efforts to improve their product offerings to cater to dynamic requirements of the industry. For instance, in 2024, Axon acquired Dedrone, a leader in drone security solutions. The acquisition aims to enhance Axon capabilities in providing counter-drone solutions, particularly for construction and public safety applications. The merger focuses on protecting critical infrastructure, including construction sites, from unauthorized drone activity, and strengthening airspace security.

Construction drone is an assembly of camera, battery, remote control, propeller, and GPS antenna, which expensive, thereby negatively impacting the profit margin of manufacturers. This is expected to hamper the growth of the construction drone market. Furthermore, lack of skilled manpower for designing, development, and operation of drones restrains the growth of the construction drone market.

Advance technologies such as global navigation satellite systems (GNSS), global positioning system (GPS), geographical information system (GIS), Internet of Things (IoT), thermal imaging, and artificial intelligence (AI) are being increasingly adopted in developing drones. For instance, in 2023, DroneDeploy acquired StructionSite, a leader in ground reality capture for the construction industry. This merger unifies aerial and ground reality capture into one integrated platform, enabling comprehensive documentation of construction sites. This deal enhances automation and improves project efficiency for some of the world's largest construction firms. This is expected to boost the growth of the construction drone market during the forecast period.

The construction drone market is segmented into Type, Application and End-user.

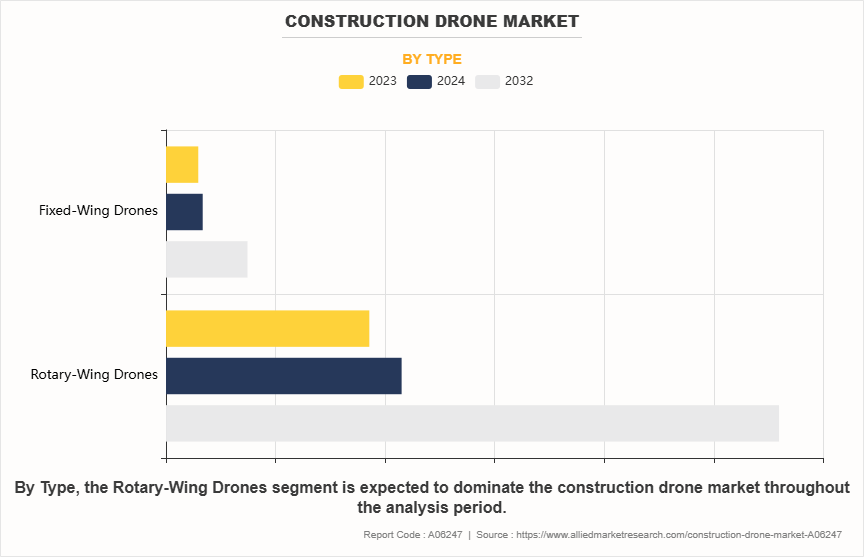

By type, the market is divided into fixed-wing drone and rotary-wing drone.By type, the rotary-wing drone segment was the highest contributor to the market in 2023. Rotary-wing drone has a central frame, which has multiple rotors fixed at its arms. The rotary-wing drone segment has become the highest contributor to the construction drone market primarily due to its versatility, and maneuverability.

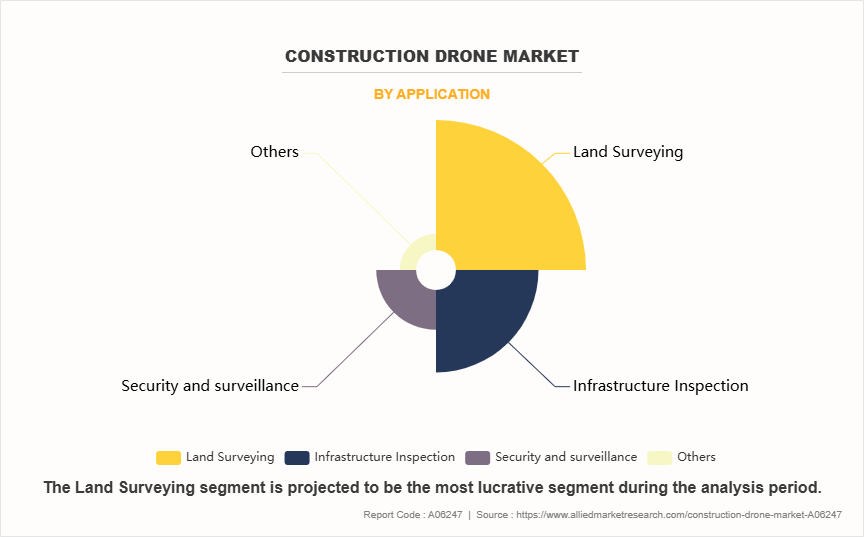

On the basis of application, it is fragmented into surveying lands, infrastructure inspection, security & surveillance, and others.By application, the land surveying segment was the highest contributor to the market, in 2023. Land surveying involves the use of construction drones for aerial photography and aerial mapping of large vacant lands for new construction or for lands with old construction for solving property disputes or for the purpose of refurbishment. Rise in adoption of construction drones for land survey can be attributed to the features such as long range of flight, superior stability, and enhanced maneuverability. Increase in need for aerial mapping of lands for the purpose of record keeping, 3D modelling, and prevention of land disputes is expected to augment the growth of construction drone market during forecast period.

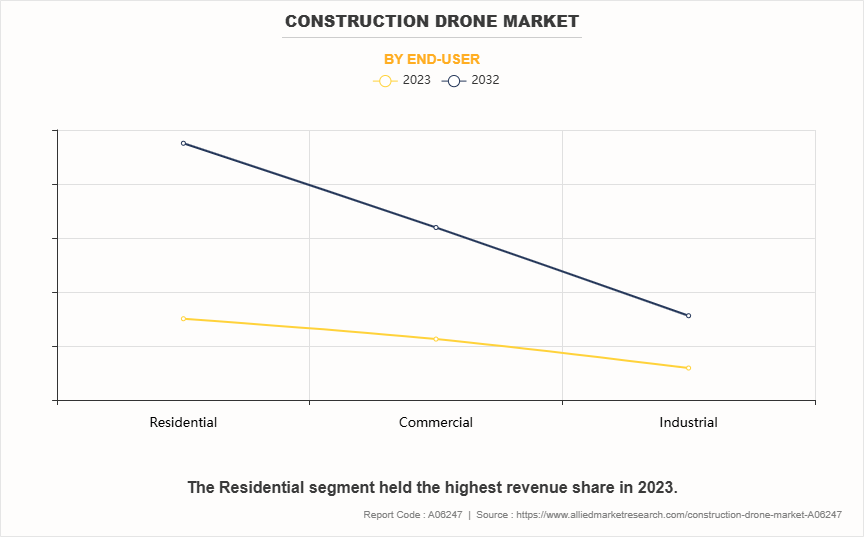

By end user, it is divided into residential, commercial, and industrial. By end user, the residential segment was the highest contributor to the market, in 2023. Rise in adoption of construction drone in the residential sector is attributed to the features such as high maneuverability, compact design, and ease of use. For instance, DJI, based in China, which is one of the key players in the construction drone market, offers a range of drones for residential segment. The range includes drones from the Mavic series and Inspire Series. Rise in residential construction activities across the globe is expected to fuel the demand for construction drones during the forecast period.

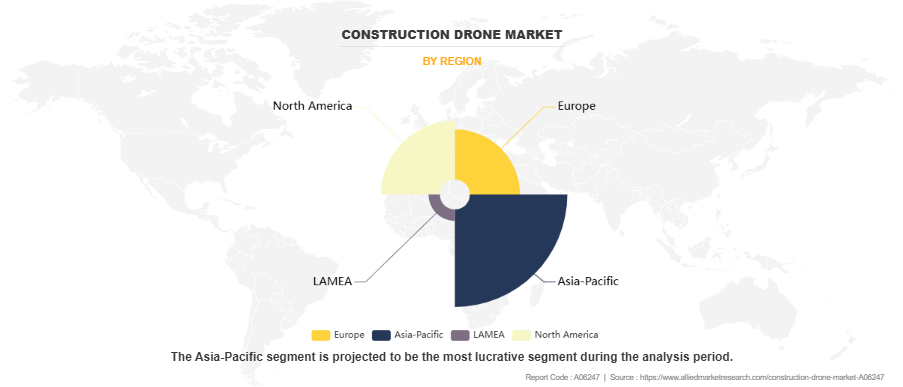

Region-wise, the construction drone market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.Asia-Pacific dominated the market in 2023 and is anticipated to grow with the highest CAGR during the forecast period. Increase in government spending on infrastructure and construction projects is expected to contribute toward the growth of construction drone market in Asia-Pacific during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the construction drone market analysis from 2023 to 2032 to identify the prevailing construction drone market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the construction drone market forecast segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global construction drone market trends, key players, market segments, application areas, and market growth strategies.

Construction Drone Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 19 billion |

| Growth Rate | CAGR of 12.4% |

| Forecast period | 2023 - 2032 |

| Report Pages | 192 |

| By Type |

|

| By Application |

|

| By End-user |

|

| By Region |

|

| Key Market Players | DJI, YUNEEC INTERNATIONAL CO., LTD., FLIR Systems, Inc., Trimble, Inc., PARROT DRONES, 3D Robotics, Inc., PRECISIONHAWK, INC, Wingtra AG |

Efficiency and Cost Savings and Improved Safety are the upcoming trends of Construction Drone Market in the globe

Land Surveying, Infrastructure Inspection, Security and surveillance are the leading application of Construction Drone Market

North America is the largest regional market for Construction Drone

The Construction Drone market was $6.5 billion in 2023

3D Robotics, Inc., AeroVironment, Inc., DJI, FLIR Systems, Inc., Insitu, Inc., Leptron Unmanned Aircraft Systems, Inc., Parrot Drones, PrecisionHawk, Trimble Inc., and Yuneec International Co. Ltd.

Loading Table Of Content...

Loading Research Methodology...