Construction Equipment Rental Market Overview

The Global Construction Equipment Rental Market Size was valued at $93.5 billion in 2018, and is projected to reach $220.7 billion by 2032, growing at a CAGR of 6.6% from 2023 to 2032. Rising demand for earthmoving equipment has further boosted market growth. This trend is supported by increasing infrastructure development, cost-effective rental solutions, and the flexibility offered by renting over purchasing, making equipment rental a preferred choice across various sectors.

Market Dynamics & Insights

- The construction equipment rental industry in Asia-Pacific held a significant share of over 42.3% in 2020.

- The construction equipment rental industry in Germany is expected to grow significantly at a CAGR of 5.8% from 2023 to 2032.

- By type, loaders is one of the dominating segments in the market and accounted for the revenue share of over 39.1% in 2020.

- By application, material handling segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2018 Market Size: $93.5 Billion

- 2032 Projected Market Size: $220.7 Billion

- CAGR (2022-2032): 6.6%

- Asia Pacific: Largest market in 2020

- LAMEA: Fastest growing market

What is meant by Construction Equipment Rental

Construction equipment rental is the service to rent out construction equipment to end users for a certain period by signing contracts with terms and conditions about their usage. Construction equipment is majorly used at construction mining sites to facilitate heavy operations.

Construction Equipment Rental Market Dynamics

In developing countries in Asia, Africa, and Latin America, malls and office buildings are currently undergoing construction. For instance, Brazil experienced the construction of more than 13 shopping mall in 2021. These shopping centers are multistory and built on several acres of land, which increases the need for large construction tools.

Furthermore, the construction of brand-new, opulent office buildings in several nations and significant cities is a result of the rising industrialization of developing nations. For instance, in 2021, over 17 significant IT parks are currently being constructed in India's major cities of Mumbai, Delhi, Pune, Bangalore, and Hyderabad.

In addition, heavy construction equipment tends to become damaged or undergo destruction regularly given the demanding tasks performed at construction sites. Heavy construction equipment, like any other vehicle, needs to be timely maintained by going through routine servicing and maintenance to keep it operating properly. In addition, there are labor costs and operational costs, which cover things such as the cost of hiring skilled, experienced drivers and fuel costs for running the equipment. However, equipment rental businesses employ and train their own staff of Construction equipment operators.

Furthermore, some businesses offer to pay the cost of the diesel, which is deducted from the customer's payment. These factors make it easy for customers to hire heavy and expensive equipment with well-trained operators only when needed. This helps to minimize the expense in the form of wages of operators as well as expenses incurred due to their maintenance. Hence such an advantage of construction rental equipment propels the growth of the Construction equipment rental market.

Moreover, several housing developments are also being built throughout Africa. For instance, in February 2022, six new mega social housing projects are planned for South Africa in the coming few years. In addition, in 2021, Africa's largest 3D-printed affordable housing project started in Kenya. To operate, such infrastructure projects require heavy construction machinery. This equipment is rented and used at these sites, which drives the construction equipment rental industry market growth.

However, in developed countries in North America and Europe, there is a saturation of new construction activity due to the already constructed infrastructure, the recent industrial slump, and the high cost of development. As a result, substantial investments in brand-new building projects have declined, which is anticipated to eventually constrain expansion of the construction equipment rental market share for renting heavy construction equipment in developed countries.

Moreover, at new construction sites, large cranes are inexpensive for rent instead of buying, simple to disassemble, and easy to move. In addition, rental firms can now easily follow the locations and operations of their equipment thanks to modern technology like IoT embedded in heavy construction equipment. IoT assists in addressing a lack of experienced labor, increasing task accuracy, guaranteeing on-time delivery within budget, and addressing equipment safety concerns. Thus, it is anticipated that throughout the projection period, the introduction of new internet-connected equipment will promote market growth for the rental of heavy construction equipment.

Furthermore, several commodities, including food items, oil, and gas, saw a surge in price due to the Russia-Ukraine conflict. Due to supply chain interruptions, there are now more expensive shipping costs, fewer available containers, and less warehouse space. Since there have been delays in shipments and congestion, certain ports have been closed, and orders are being retracted, which influences industry and consumers globally. The decline in investor confidence has also increased stock market volatility. Economic instability has risen due to the strained commercial ties between Russia, Ukraine, and their different trading partners. Hence, all such factors have reduced export possibilities.

Construction Equipment Rental Market Segmental Overview

The global construction equipment rental market overview is segmented into application, product, propulsion system, and region. Based on application,the applications covered in the study include excavation & mining, material handling, earthmoving, and concrete. Based on product, the Construction equipment rental market is divided into backhoes & excavators, loaders, crawler dozers, cranes, forklift, and others. By propulsion system, it is differentiated into electric and ICE. Region wise, the Construction equipment rental market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Applications:

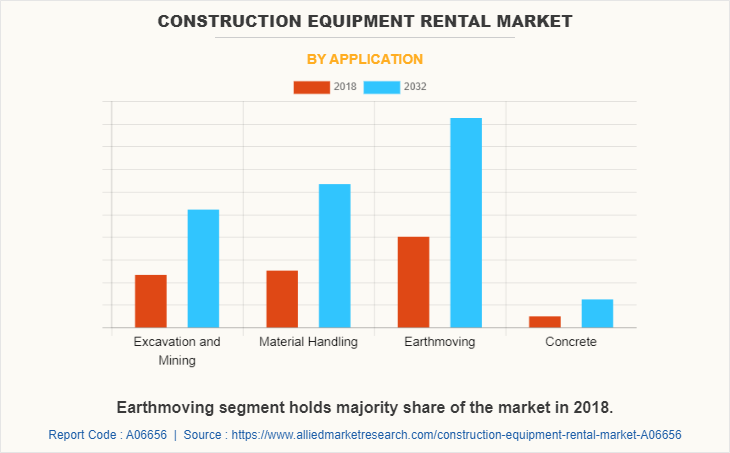

The construction equipment rental market is divided into excavation & mining, material handling, earthmoving, and concrete. Excavation is digging of rock, soil, and raw material usually from archaeological sites, new construction sites, or mining sites. In addition, Warehouses and manufacturing firms use lifting and material handling equipment for moving and shifting the goods. Moreover, mostly loaders are used for earthmoving, including bucket loader, front loader, payloader, and wheel loaders.

Furthermore, increase in construction of new airports, ports, commercial spaces, and residential projects need these concrete mixing machines, which are expected to be fast operating and can produce concrete at faster speed, thus giving superior and faster performance. Earthmoving is expected to exhibit the largest revenue contributor during the forecast period. Concrete is expected to exhibit the highest CAGR share in the applications of segment in the construction edquipment rental industry during the forecast period.

By Product:

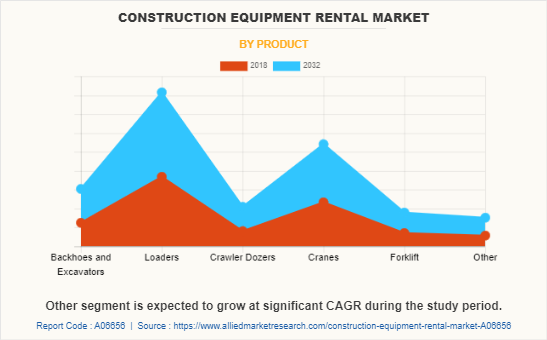

The construction equipment rental market is divided into backhoes & excavators, loaders, crawler dozers, cranes, forklift, and others. Backhoes & excavator are used for digging, material handling, demolition, mining, drilling shafts, and snow removal. This equipment is mainly used in mines, forestry, constructions for demolition, and material handling. In addition, Loader is majorly used for earthmoving operations, which include loading and moving materials such as dirt, demolition, recycled material, raw material, and sand.

Furthermore, Crawler dozers are used at construction sites to move excavated soil, sand, and rocks. High rise buildings need strong footing underneath and hence need deeper excavation while building the base pillars. Moreover, Cranes are commonly equipped with a hoist, wire, ropes, chains, and sheaves. In addition, Forklift, also known as fork truck or lifting truck, is used in warehouse and distribution centers for lifting and moving raw materials and goods. Other segments include lift trucks, compactors and concrete pumps & mixers that are used on construction sites. The loaders segment is expected to be the largest revenue contributor during the forecast period, and the others segment is expected to exhibit the highest CAGR share in the product segment in the construction equipment rental market during the forecast period.

By Propulsion System:

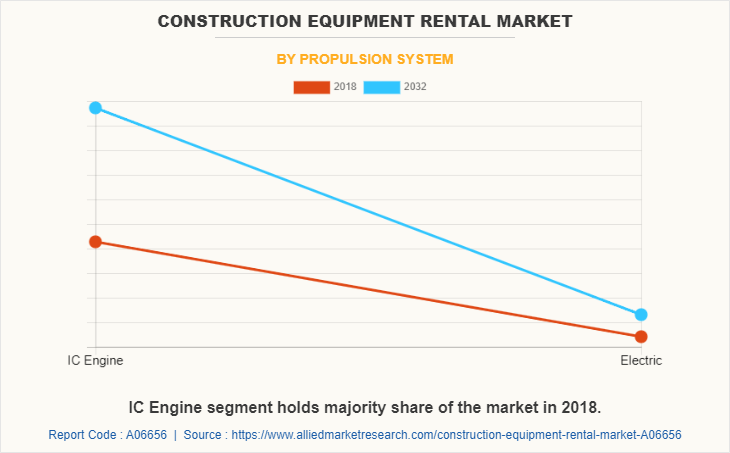

The construction equipment rental market is divided into electric and ICE. Electric construction equipment is driven by electricity. This is a new technology that is being rapidly adopted by the manufacturers, owing to its eco-friendly nature and comparatively cheaper operating cost. In addition, this segment includes traditional construction equipment that is operated on internal combustion engines (ICEs) and are generally diesel operated. ICE segments are expected to be the largest revenue contributor during the forecast period, and the electric segment is expected to exhibit the highest CAGR share in the propulsion system segment during construction equipment rental market forecast period.

By Region:

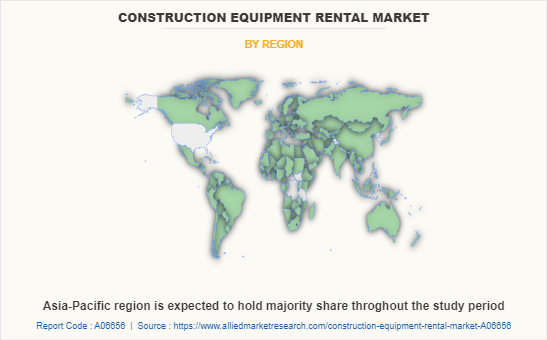

The construction equipment rental market is analysed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, North America held the highest revenue in construction equipment rental industry size. And LAMEA is expected to exhibit the highest CAGR during the forecast period.

Construction Equipment Rental Market Competition Analysis

The major players profiled in the construction equipment rental market include Boels Rentals, H&E Equipment Services Inc., Herc Rentals Inc., Kanamoto Co., Ltd., NESCO Holdings, Inc., Maxim Crane Works, L.P., Mtandt Group, Ramirent AB, Sarens n.v./s.a. and United Rentals, Inc.

Major companies in the Construction equipment rental market have adopted acquisition, product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the construction equipment rentals market.

Whar are the expansion and acquisition on the Construction Equipment Rental Sector

- In April 2023, Boels Rental acquired Norwegian company BAS Maskinutleie making Nordic subsidiary Cramo. By means of this acquisition it expands its rental services throughout the Nordic region.

- In June 2023, H&E Equipment Services Inc. (H&E) expanded its new branch in Houston South branch, its 22nd rental location in the state of Texas. By means of this expansion it is handling a variety of construction and general industrial equipment.

- In March 2022, Herc Holdings acquired Cloverdale Equipment Company to provide general and specialty equipment rental solutions and related services.

- In October 2022, H&E Equipment Services Inc. has acquired of One Source Equipment Rentals Inc. by means of this acquisition it offers it rental services to Midwest and further penetration into the southern U.S. positions H&E for increased participation in the non-residential construction and industrial end-markets.

What are the collaboration on the Construction equipment rental market

- In May 2022, United Rentals, Inc. Ha collaborated with Ford Pro to purchase all-electric vehicles for its North American rental and company fleets. Through this collaboration, 500 F-150 Lightning pickups and 30 E-Transit vans are being ordered, with 120 trucks and all 30 vans scheduled to be delivered in 2022. Customers of United Rentals, as well as the staff members who handle sales, servicing, and deliveries for the company, will use the trucks on industrial and construction job sites.

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the construction equipment rental market segments, current trends, estimations, and dynamics of the construction equipment rental market outlook analysis from 2018 to 2032 to identify the prevailing construction equipment rental market opportunities.

- The construction equipment rental market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the construction equipment rental market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global construction equipment rental market trends, key players, market segments, application areas, and construction equipment rental market growth strategies.

Construction Equipment Rental Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 220.7 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2018 - 2032 |

| Report Pages | 220 |

| By Application |

|

| By Product |

|

| By Propulsion System |

|

| By Region |

|

| Key Market Players | Boels Rentals, United Rentals, Inc., H&E Equipment Services Inc., Sarens n.v./s.a., Ramirent AB, NESCO Holdings, Inc., Mtandt Group, Herc Rentals Inc., Kanamoto Co., Ltd., Maxim Crane Works, L.P. |

Analyst Review

The rise in construction & mining activities in developing countries propels the growth of the construction equipment market. Moreover, decline in expenses such as maintenance cost of the equipment and high labor cost such as wages for skilled labors and operational costs at the time of actual working on the site have led end users to opt for rental equipment. Furthermore, the ownership of this heavy equipment can incur high initial investment, which is not affordable for all end users. In addition, it is inconvenient to hire a full-time skilled operator of this equipment as the wages might be higher.

However, the construction market has saturated in several developed nations and has affected the construction equipment rental market. On the contrary, integration of IOT in the equipment prevents accidents in the workplace and aids in downtime reduction, thereby boosting the growth of the construction equipment rental market during the forecast period. Furthermore, rapid urbanization and industrialization of emerging countries and use of construction equipment is anticipated to provide lucrative opportunities for the growth of the construction equipment rental industry market.

The global construction equipment rental market was valued at $93,545.0 million in 2018, and is projected to reach $220,646.3 million by 2032, registering a CAGR of 6.6% from 2023 to 2032

The forecast period considered for the global construction equipment rental market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global construction equipment rental market report can be obtained on demand from the website.

The base year considered in the global construction equipment rental market report is 2022.

The major players profiled in the construction equipment rental market include Boels Rentals, H&E Equipment Services Inc., Herc Rentals Inc., Kanamoto Co., Ltd., NESCO Holdings, Inc., Maxim Crane Works, L.P., Mtandt Group, Ramirent AB, Sarens n.v./s.a. and United Rentals, Inc.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on product the loaders segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...