Construction Flooring Market Research: 2032

The Global Construction Flooring Market was valued at $100.2 billion in 2020, and is projected to reach $189.3 billion by 2032, growing at a CAGR of 5.3% from 2023 to 2032. Construction flooring refers to flooring materials and systems used during the construction process to create the final flooring surface in a building.

Construction flooring is essential for creating safe and durable surfaces for construction workers, equipment, and materials. Safety regulations and the need to protect workers drive the adoption of appropriate construction flooring materials. In addition, construction flooring provides a stable and level working surface, facilitating the construction process. It helps with the efficient movement of equipment and materials within the construction site. Moreover, aesthetics play a significant role, in commercial and residential construction.

Market Dynamics

The choice of construction flooring materials and design elements can influence the overall look and feel of a space, driving the adoption of various flooring options. Furthermore, increase in awareness of environmental sustainability has led to the adoption of eco-friendly flooring options. Builders and homeowners are increasingly looking for environmentally responsible construction flooring materials that use sustainable resources and have minimal environmental impact. In addition, advances in flooring technology have led to the development of more innovative and functional construction flooring materials. This includes improved durability, easier installation methods, and innovative design options. Hence, such benefits drives the demand for construction flooring solutions and further drives the growth of construction flooring industry.

However, limited budget is a significant factor that can restrict the adoption of certain flooring materials and systems. High-quality or specialized flooring options can be cost-prohibitive for some projects. In addition, building codes and regulations can limit the choice of flooring materials. Some locations have strict requirements regarding fire resistance, slip resistance, or other safety features that may restrict certain options.

On the contrary, growing environmental awareness is driving the adoption of sustainable and eco-friendly flooring materials, such as bamboo, cork, reclaimed wood, and recycled content products and is expected to offer lucrative opportunities for the expansion of construction flooring market size.

The construction flooring market is segmented on the basis of printing type, material, end-user industry, and region. On the basis of printing type, the market is categorized into digital and traditional. On the basis of material, it is divided into wood, stone, ceramic, laminate, and others. On the basis of end-user industry, it is bifurcated into residential and non-residential.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The major players that operate in the global market have adopted key strategies such as product launch and product development to strengthen their market outreach and sustain the stiff competition in the market.

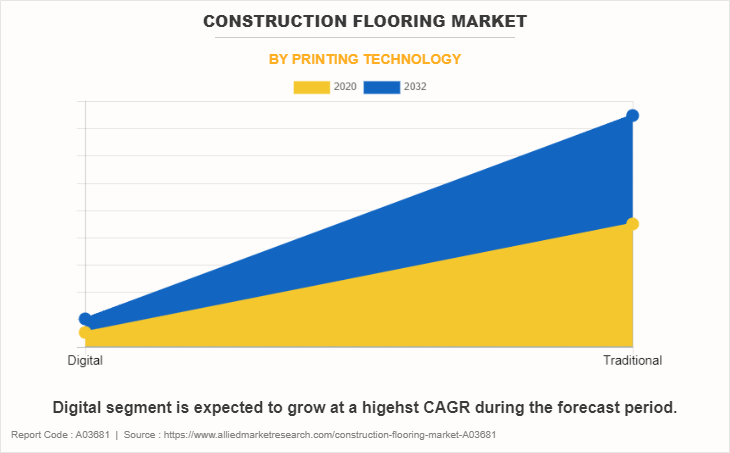

By Printing Type:

In 2022, the traditional segment dominated the construction flooring market, in terms of revenue, and is expected to grow at the highest CAGR during the forecast period. Traditional printed tiles and other flooring solutions are considered premium, owing to it being handmade in nature. In addition, among the masses, it is considered that the rawness of the traditionally printed floorings brings character to the floor. Companies, such as Realonda Ceramica offer a wide range of traditionally printed flooring solutions.

Such factors are accepted to drive the demand for traditionally printed flooring solutions. Furthermore, the cost effectiveness of traditional printing, positively influences the growth of the market. However, digital segment is expected to grow at a highest CAGR as digital printing technology is easy to use, readily available, and offers non-contact method of printing any type of design, pattern, and image on different types of flooring solutions. Moreover, digitally printed flooring solutions are manufactured at a faster rate, and features enhanced design precision and quality. In addition, the manufacturing process yields relatively less waste. Such factors are expected to drive the demand for digitally printed flooring solutions.

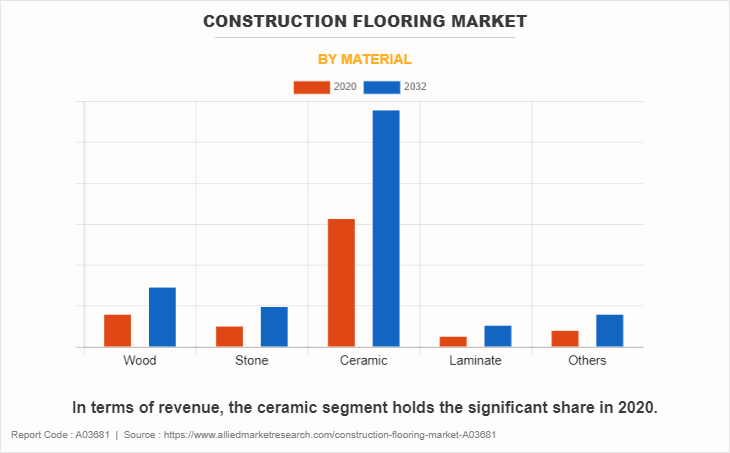

By Material:

The ceramic segment is expected to grow rapidly during the forecast period. Ceramic floorings are in high demand owing to factors such as flexibility, in terms of design, color, and texture of these tiles. Furthermore, ceramic tiles are available in a wide price range and can be effectively used in economical as well as luxurious building construction. Moreover, with the help of technological advancements, ceramic tiles are manufactured with texture and visuals that are identical to wood, concrete, stone, and terrazzo materials.

Further, their versatility, high mechanical susceptibility, low maintenance costs, and durability make them an ideal material for outdoor as well as indoor flooring solutions. Moreover, it is widely used in public and privately owned spaces in urban as well as rural areas. Thus, such applications of ceramic flooring solution are expected to drive the market growth during the forecast period. However, the wood segment is expected to grow at a highest CAGR Wood flooring is highly elegant, offers natural looks, and blends with any kind of interior.

It is highly durable and requires little maintenance; therefore, wood flooring tends to be an inexpensive flooring solution in the long run. In addition, use of wood flooring is often more expensive, owing to scarcity of wood, which in turn, increases the curb appeal of the property and hence, propels the resale value of a property. This encourages customers toward adoption of wood as popular flooring material. In addition, factors such as superior insulation, durability, environment-friendliness, parasite resistance, and longer lifespan of thermally treated wood contribute toward the popularity of wood flooring, which fuels the construction flooring market growth.

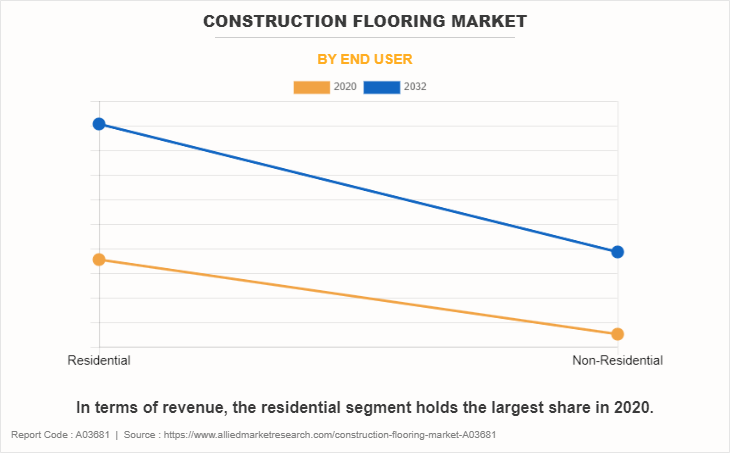

By End-User Industry:

In 2022, the residential segment dominated the construction flooring market, in terms of revenue, and is expected to grow at the highest CAGR during the forecast period. as per the construction flooring market outlook, gradual increase in population and rise in disposable income of majority population in various developing countries, including India and Brazil, boost the growth of the flooring market. Moreover, rise in trend of remodeling and renovations in developed nations, such as the U.S., UK, and Germany is expected to propel the market growth.

For instance, Oxford Properties Group announced a plan to construct mixed-use building complex consisting of four towers. This construction is expected to start in 2023, and according the estimates it will cost around $3.5 billion. It will be one of the largest mixed-use complexes in Toronto's history. Hence, these kinds of projects are expected to create opportunities for flooring companies and provide lucrative growth in the market. However, the non-residential segment is expected to grow at a highest CAGR during the forecast period.

The construction of non-residential buildings for commercial and industrial purposes is in high demand in developed nations of North America and Europe. In addition, due to urbanization and industrialization in developing nations of Asia-Pacific and LAMEA, new commercial and industrial infrastructures are being built. Various governments are taking initiatives to enhance the living standard of citizens.

For example, governments are taking initiatives and investing in quality construction of non-residential sectors, such as schools and health sectors. For instance, in March 2020, DLF, one of the largest construction contractors announced to invest around $2.57 billion, to construct two new shopping malls in Gurugram and Goa. Hence, such investments are expected to create opportunities for flooring manufacturers and therefore provide lucrative market growth during the forecast period

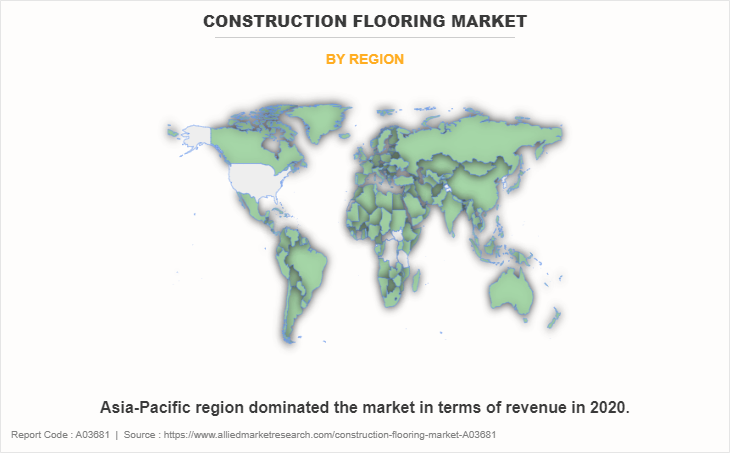

By Region:

In 2022, Asia-Pacific had the highest construction flooring market share and is anticipated to grow at a significant CAGR during the forecast period. Asia-Pacific is one of the fastest growing regions globally, owing to its large population and growing disposable income. China and India are leading in construction of affordable housing.

Furthermore, the building construction and tourism sector in countries, such as Indonesia, Singapore, and Malaysia are experiencing growth. These factors boost the demand for floorings as they are extensively used in the construction of residential and non-residential buildings.

The affordable housing schemes of countries, such as India and China have positively influenced the residential construction sector in the region. Furthermore, increased investment in tourism sector by private as well as public sector has also led to increase in building construction activities, thereby; creating a demand for flooring. Furthermore, increased spending on interior designing of the homes, is also increasing the demand for custom made flooring, thus driving the growth of the flooring market in the region.

However, LAMEA is expected to grow at a highest CAGR as Latin America and Middle East have a large number of developing countries with a huge potential to grow. Many countries in the Middle East region are focusing in rapid development of infrastructure for boosting the tourism industry. This creates a demand for hotels, resorts, and other guests’ accommodation; thereby increasing the demand for doors and windows. Furthermore, in September 2021, Iran’s government announced the implementation of the one-million housing project. These factors offer lucrative growth opportunities for the construction flooring market.

Competition Analysis

Competitive analysis and profiles of the major players in the construction flooring market are J&J Industries, Inc., Shaw Industries Group, Inc., Armstrong, mohawk, Tarkett Group, Beaulieu International Group NV, Interface Inc., Iron Woods, Toli Corporation and Ecore International, Inc. Major players have adopted product launch, collaboration, and acquisition as key developmental strategies to improve the product portfolio of the construction flooring market.

Key Benefits For Stakeholders

- This report provides construction flooring market forecast along with quantitative analysis of the market segments, current trends, estimations, and dynamics of the construction flooring market analysis from 2020 to 2032 to identify the prevailing construction flooring market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the construction flooring market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global construction flooring market trends, key players, market segments, application areas, and market growth strategies.

Construction Flooring Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 189.3 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2020 - 2032 |

| Report Pages | 188 |

| By End User |

|

| By Printing Technology |

|

| By Material |

|

| By Region |

|

| Key Market Players | Armstrong, Beaulieu International Group NV, Interface Inc., Iron Woods, mohawk, J&J Industries, Inc., Toli Corporation, Tarkett Group, Shaw Industries Group, Inc., Ecore International, Inc. |

Analyst Review

The construction flooring market has witnessed significant growth in the past few years, owing to surge in spending on building construction activities.

Rise in the trend of home remodeling activities, particularly in high-income countries in North America and Europe, has fueled demand for flooring. In addition, rise in urbanization is positively influencing residential and non-residential building construction. Furthermore, the global tourism sector is driving the demand for construction of highly elegant guest accommodations. Such factors are expected to play an instrumental role in growth of construction flooring market.

Moreover, various countries, such as China, India, and Canada, are turning toward public-private partnerships (PPPs) as a mode of infrastructure development. Such government initiatives are expected to boost the construction flooring market, especially in the non-residential segment.

Furthermore, the concept of sustainable development is becoming the focus area of everyone across the globe, thus driving the demand for products with a lower carbon foot print. In addition, to support sustainability, key market players are innovating to produce PVC-free flooring solutions. Therefore, rise in demand for sustainable products is anticipated to provide lucrative opportunities for the market growth

The construction flooring market was valued at $100,215.84 million in 2020 and is estimated to reach $189,257.70 million by 2032, exhibiting a CAGR of 5.3% from 2023 to 2032.???

The forecast period considered for the Construction flooring market is 2023 to 2032, wherein, 2022 is the base year, 2022 is the estimated year, and 2032 is the forecast year.

The latest version of Construction flooring market report can be obtained on demand from the website.

The base year considered in the Construction flooring market report is 2022.

The major players profiled in the consumer electronics electric motor market include, J&J Industries, Inc., Shaw Industries Group, Inc., Armstrong, mohawk, Tarkett Group, Beaulieu International Group NV, Interface Inc., Iron Woods, Toli Corporation and Ecore International, Inc.

: The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance, various strategies and recent developments.

By material, the ceramic segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...