Construction Management Software Market Insights, 2031

The global construction management software market size was valued at USD 9.3 billion in 2021, and is projected to reach USD 23.9 billion by 2031, growing at a CAGR of 10.2% from 2022 to 2031.

Growing number of construction projects and need to improve construction productivity are boosting the growth of the global construction management software industry. In addition, rising number of supportive initiates from governments positively impacts the growth of the market. However, high installation and maintenance costs and lack of skilled operators are hampering the market growth. On the contrary, implementation of IoT and AI is expected to offer remunerative opportunities for expansion of the market during the forecast period.

Construction management software is a project management platform that helps companies with processes like budget management, communication, decision-making, and job scheduling, to name a few. Its goal is to make construction business processes a lot easier through automation. It is a project management tool designed specifically for construction professionals. This kind of software offers a range of benefits to members of the construction industry, streamlining processes that used to be done manually, which include communication, decision-making, and job scheduling, among others. These are but some of the benefits that organizations can get from using construction management software. The construction management software market forecast is segmented into Offering, Deployment Mode, Building Type, End-user and Application.

Segment Review

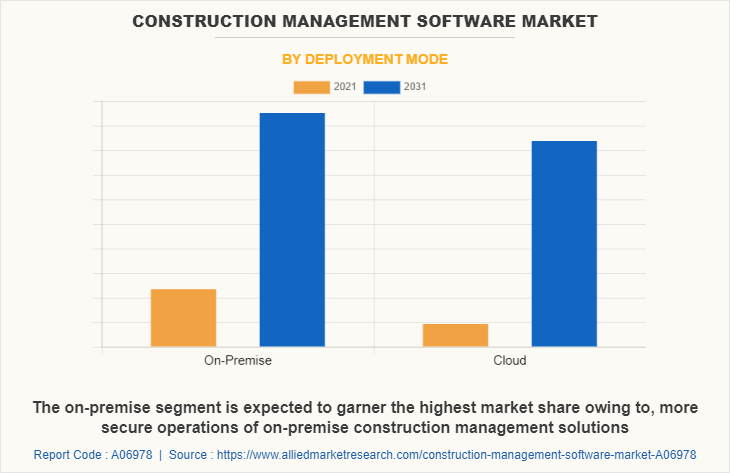

The global construction management software market is segmented based on offering, deployment mode, building type, end user, application and region. By offering, the market is bifurcated into solution and service. By service type, the market is bifurcated into professional services, managed services. By professional services, the market is further divided into training & education, integration & deployment, and support & maintenance. By deployment model, the market is segmented into on-premises and cloud based. By building type, it is categorized into commercial buildings and residential buildings. By industry vertical, the market is divided into BFSI, healthcare, government, manufacturing, retail, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the construction management software market analysis are Autodesk, Inc, Construct Connect, Buildertrend, Bentley Systems, Inc., Oracle corporation, BrickControl.com, CMiC, BuildTools, e-Builder, Inc., Buildstar Technology, Odoo SA, Jonas Construction Software, Inc., Pland Grid, Inc., Sage group plc, Viewpoint, Inc., TRIMBLE, INC., and Systemates, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the construction management software industry.

In terms of deployment model, on premises segment holds the largest share of the construction management software industry, owing to significant investment to purchase and implement interconnected hardware, servers, and software to manage the system. However, the cloud segment is expected to grow at the highest rate during the forecast period, owing to surge in use of cloud-based building information modeling solutions among small and mid-sized businesses.

Region wise, the construction management software market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to an increase in awareness and government mandates toward the use of construction management software. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rapid use of digitalization in the construction industry during the COVID-19 pandemic & ongoing technological advancements and the emergence of new business models.

The report focuses on growth prospects, restraints, and trends of the global construction management software market analysis. The study provides Porter’s five forces analysis to understand impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the global construction management software market share.

Top Impacting Factors

Growing number of construction projects

The increasing global population and the introduction of initiatives like smart cities and high-speed transportation have increased the need for the construction of buildings, malls, and workplaces. Therefore, key players are implementing construction software to run these projects smoothly and effectively. In addition, the epidemic has caused the construction industry to adopt a fresh viewpoint by removing elements like decision-making overlap, duplication of effort, poor communication, etc., the construction management software lowers the number of man-hours needed to finish a project.

Moreover, construction management software addresses every challenge that a construction company can have during the chaotic COVID-19 epidemic. In the Middle East and the majority of the growing nations in the Asia-Pacific region, including India and China, the building sector has experienced fast expansion. For instance, China has received an overall score of 0.67 on GlobalData’s February 2022 Construction Project Momentum Index, which provides an assessment of the health of the construction project pipeline at all stages of development from announcement through to completion. These upcoming projects are expected to drive the adoption of construction management software among end users, which will boost the construction management software market growth.

Need to improve construction productivity

The outbreak of COVID-19 prompted a considerable proportion of routine activities and businesses to shift their operations online, however by considering the current fragile market state, working on a building site is quite difficult. Due to the collaborative nature of the construction industry, construction projects require manufacturing and quality control and understanding amongst the numerous stakeholders engaged in a project. Moreover, A construction project often involves a variety of components, including vendors, engineers, architects, contractors, and the workforce. For many years, tables, graphs, and drawings were used to record the information exchange between these elements.

Additionally, construction professionals also like automated equipment because it can provide outcomes faster, save money, and minimize manual work. For instance, Highrise is the first Internet-ready, specialized construction ERP, also known as an ERP for construction and contracting businesses. An ERP is a software system that integrates all of the enterprise's functional divisions. Highrise has integrated services for purchasing, store and inventory control, project estimation, planning, project management, budgeting, and labor contract management. Additionally, the need for automated systems has increased in the building sector. These systems are expected to decrease human error and offer precision in digital representations of construction models, leading to cost savings and increased productivity. Such factors are influencing the growth of the global construction management software market.

COVID-19 Impact Analysis

The COVID-19 pandemic has enabled challenges, such as low productivity, affected margins, and a drop in R&D investments; therefore, construction firms are being forced to adopt construction management software faster, and the home building and commercial construction industries are expected to flourish during the forecast period.

For instance, in December 2021, Buildern announced the launch of its full residential construction management software for small and medium businesses, which was developed to provide a faultless experience for both the house building and commercial construction industries. It recently made its formal debut on the market, such trends accelerated construction management software during the period of the pandemic. This in turn caused the demand for construction management solutions to raise during the period, as businesses depended upon construction management solutions for faster industrial development.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the construction management software market analysis from 2021 to 2031 to identify the prevailing construction management software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the construction management software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global construction management software market trends, key players, market segments, application areas, and market growth strategies.

Construction Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 23.9 billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 333 |

| By Offering |

|

| By Deployment Mode |

|

| By Building Type |

|

| By End-user |

|

| By Application |

|

| By Region |

|

| Key Market Players | SAP SE |

Analyst Review

The construction management software market share growth by the builders and contractors segment will be significant during the forecast period. Construction management software standardizes the construction process by enabling simplified and streamlined management of labor, site events, data capture, as well as information, and material costs. With the deployment of this software, contractors will increase the profitability and efficiency of their projects. Moreover, a busy contractor can leverage the features of construction management software to enhance the project and the overall performance of the team.

Key providers of construction management software market such as Autodesk, Inc., Bentley Systems, Inc., and Oracle corporation. account for a significant share in the market. With the larger requirement from the corporate culture, various brands are expanding business outlets to automate and simplify data management. For instance, in May 2022, Autodesk, Inc., expanded Autodesk Construction Cloud, a powerful cloud-based construction management solution, in Japan with the introduction of Autodesk Build and Autodesk Takeoff. The expansion builds on the established Asia-Pacific and worldwide success of Autodesk Construction Cloud, which is trusted on more than 2.4 million construction projects globally.

In addition, increasing demand for data-driven problem-solving companies such as Bentley Systems, Inc., has performed strategic acquisition to help the end users. For instance, in April 2022, Bentley Acceleration Initiatives acquired Chennai, India-based Nadhi Information Technologies Pvt. Ltd., a specialist in project controls, analytics, and decision support for construction supply chains. Nadhi serves some of India’s leading construction sector participants, including contractors Larsen & Toubro and Kalpataru Power Transmission Ltd., real estate developers Mahindra Lifespaces and RMZ, and owner-operators DMRC (Delhi Metro) and Welspun Enterprises. This acquisition helps to increase the offering for end users in India.

Furthermore, in July 2022, Oracle Enhances Smart Construction Platform with New Analytics Capabilities by introducing new solution combines data from Oracle Smart Construction Platform applications to give owners and contractors a comprehensive understanding of performance throughout their operations. With this insight, organizations can quickly spot and correct issues and target ways to drive continuous improvement across project planning, construction, and asset operation.

The global construction management software market size was valued at $9.24 billion in 2021, and is projected to reach $23.9 billion by 2031

The construction management software market is projected to grow at a compound annual growth rate of 10.2% from 2022 to 2031.

The key players profiled in the construction management software market analysis are Autodesk, Inc, Construct Connect, Buildertrend, Bentley Systems, Inc., Oracle corporation, BrickControl.com, CMiC, BuildTools, e-Builder, Inc., Buildstar Technology, Odoo SA, Jonas Construction Software, Inc., Pland Grid, Inc., Sage group plc, Viewpoint, Inc., TRIMBLE, INC., and Systemates, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Region wise, the construction management software market was dominated by North America.

Growing number of construction projects and need to improve construction productivity are boosting the growth of the global construction management software industry. In addition, rising number of supportive initiates from governments positively impacts the growth of the market.

Loading Table Of Content...