Construction Materials Market Outlook - 2032

The global construction materials market size was valued at $1.2 trillion in 2022, and is projected to reach $1.7 trillion by 2032, growing at a CAGR of 3.8% from 2023 to 2032. Technological advancements in building materials drive the demand for construction materials by introducing innovative solutions that enhance the performance, durability, and sustainability of building products. Thus, leading to rise in demand for construction materials during the forecast period.

Introduction:

Construction materials are essential substances used in the building and assembly of structures. These materials form the physical components of buildings, roads, bridges, and other infrastructure, contributing to their durability, safety, and functionality. The choice of construction materials depends on various factors, including the type of structure, environmental conditions, and budget constraints.

Report Key Highlighters:

- The construction materials market is highly fragmented, with several players including Ambuja Cements Ltd; ArcelorMittal; Grasim Industries Limited; LIXIL Corporation; Sika AG; CRH; Knauf Digital GmbH; CEMEX, S.A.B. de C.V.; Holcim; and Boral.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers nearly 20 countries. The segment analysis of each country in terms of value and volume during the forecast period 2022-2032 is covered in the construction materials market report.

Market Dynamics

Rapid urbanization leads to increased demand for housing, both residential and commercial. This requires the construction of apartment buildings, condominiums, townhouses, and other housing structures. Also, urbanization leads to the establishment of more businesses, offices, retail spaces, and entertainment facilities, necessitating the construction of commercial buildings. In addition, as urban populations grow, there is a need for schools, healthcare facilities, government offices, and recreational centers, leading to increased construction of public and civic buildings. In addition, aging urban infrastructure requires repairs, upgrades, and replacements, leading to ongoing construction projects and material utilization.

Urbanization encourages the adoption of modern construction techniques and innovative materials to meet the demands of growing populations sustainably. Besides, urban areas are adopting smart city technologies, which can involve the construction of advanced infrastructure requiring specialized materials. Besides, with increasing urban populations, there is a need for environmentally friendly construction materials and sustainable building practices to reduce the impact on resources. All these factors are expected to drive the demand for the construction material market during the forecast period.

However, the construction sector is highly sensitive to economic cycles, with demand for construction projects often rising and falling owing to broader economic conditions. During periods of economic expansion, construction activities generally increase, leading to higher demand for construction materials. Conversely, during economic downturns or recessions, construction projects may be delayed or canceled, resulting in reduced demand for these materials. All these factors hamper the construction material market growth.

Prefabrication and modular construction involve the off-site assembly of building components or entire structures in controlled environments before they are transported to the construction site. This approach offers several advantages, including faster construction times, reduced labor costs, and improved quality control.

As prefabrication and modular construction methods gain popularity, there is an increasing demand for specialized construction materials that cater to these innovative techniques. These materials often need to meet specific performance criteria to ensure they are suitable for off-site manufacturing and subsequent assembly. For example, materials that offer lightweight properties, ease of transport, and compatibility with modular systems are in high demand. All these factors are anticipated to offer new growth opportunities for the global construction materials market during the forecast period.

Segment Overview

The construction materials market is segmented on the basis of material type, end use, and region. By material type, the market is categorized into aggregates, cement, bricks and blocks, metals, and others. By end use, the construction materials market is classified into residential, commercial, and industrial. By region, the construction materials market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

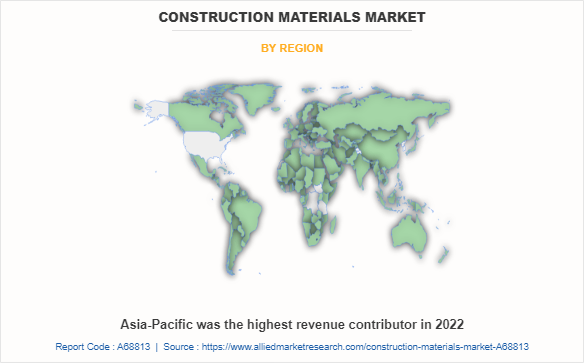

Construction Materials Market By Region

Asia-Pacific was the highest revenue contributor in 2022. Asia-Pacific is witnessing significant urbanization, leading to the construction of residential complexes, commercial spaces, and infrastructure in order to accommodate the rising urban population. Besides, urbanization propels the need for new infrastructure, including housing, transportation, utilities, and social services, leading to increased construction and development activities. Besides, the region has one of the highest rates of urbanization in the world. Many countries are witnessing a shift from rural to urban living as people seek better economic opportunities and improved living standards in cities.

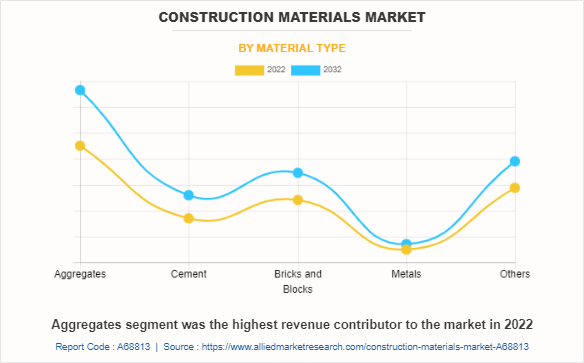

Construction Materials Market By Material Type

Aggregates segment was the highest revenue contributor to the market in 2022. Aggregates are granular materials used in construction as a key component of concrete, asphalt, and other building applications. They provide bulk and stability to the final construction product while contributing to the structural strength, durability, and overall performance of the material. Aggregates can be natural or manufactured and come in various sizes and types to suit different construction needs.

While the demand for aggregates is significant, there are also challenges such as environmental concerns related to quarrying and transportation, supply chain disruptions, and the need to balance resource extraction with sustainability goals. To address these challenges, the industry is exploring innovations such as alternative materials, improved extraction methods, and sustainable transportation practices.

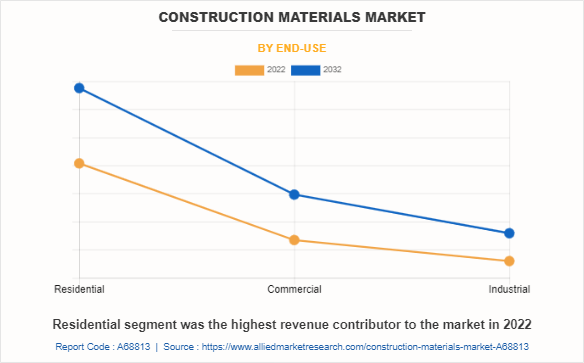

Construction Materials Market By End Use

Residential segment was the highest revenue contributor to the market in 2022. Many regions are facing housing shortages, leading to increased construction activity to address the demand for affordable housing and rental properties. Developing countries are experiencing rapid urbanization, leading to increased demand for residential construction materials to accommodate urban growth.

Further, government programs promoting affordable housing, green building, and energy efficiency can stimulate demand for specific construction materials. Real estate investors and developers contribute to the demand for construction materials as they seek to capitalize on housing market opportunities. Consequently, the above-mentioned factors are anticipated to drive segment growth during the forecast period.

Competitive Analysis

Key players in the construction materials industry include Ambuja Cements Ltd; ArcelorMittal; Grasim Industries Limited; LIXIL Corporation; Sika AG; CRH; Knauf Digital GmbH; CEMEX, S.A.B. de C.V.; Holcim; and Boral. Nowadays, the key manufacturers operating in the construction materials market have adopted strategies such as product innovation, joint venture, expansion, partnership, agreement, investment, and collaboration to increase their market share.

Key Developments

In July 2024, Ambuja Cements Limited and ACC Limited, part of the Adani Group, reaffirmed their leadership in sustainability, showcasing their dedication to environmental responsibility and innovation. These companies are at the forefront of green construction, offering innovative solutions that reduce carbon emissions as well as enhance product quality. Their product portfolio includes Ambuja Cement, Ambuja Plus, Ambuja Kawach, Ambuja Compocem, ACC F2R, ACC Suraksha, ACC Concrete Plus, ACC Gold, and ACC HPC, all of which are GRIHA-certified, contributing to sustainable building practices. With over 85% of their products being blended cement, these companies have significantly reduced their carbon footprint as compared to traditional Portland cement, conserving natural resources. ACC's ECOMaxX, a Green Pro-certified concrete, allows customers to select a concrete mix based on their desired CO2 reduction levels and sustainability goals. By expanding their networks and promoting sustainable products, the companies are encouraging Individual Home Builders (IHBs) and professionals to adopt green construction practices. Initiatives like 'Sapno Ka Ghar,' which leverages their Certified Technology, offer guidance to registered contractors and engineers, ensuring high-quality and sustainable construction. These programs also incentivize contractors and dealers to embrace sustainable practices, driving the growth and success of eco-friendly building solutions.

In February 2023, Holcim, a global leader in building materials, acquired FDT Flachdach Technologie (FDT), a prominent manufacturer of thermoplastic roofing systems. FDT specializes in producing durable and energy-efficient thermoplastic roofs, which are widely used in various construction applications. With this acquisition, Holcim strengthened its presence in the Europe market and expanded its solutions and products business, particularly in the roofing sector. By integrating FDT's expertise and product offerings, Holcim aimed to become a global leader in roofing systems, enhancing its portfolio with innovative and sustainable roofing solutions. This move aligns with Holcim's broader strategy to provide comprehensive solutions for building construction while focusing on sustainability and energy efficiency. The acquisition not only allowed Holcim to diversify its product range but also provided access to new markets and technologies, supporting the company's long-term growth objectives.

In October 2022, Holcim acquired Wiltshire Heavy Building Materials (Wiltshire), one of the leading building solutions and material circularity companies in the UK. This development will help to advance the global goal of recycling 10 million tons of construction & demolition waste by 2025.

In July 2022, Grasim Industries, an Aditya Birla Group company, approved a foray into B2B e-commerce in the building materials segment with an investment of $241.4 million over the next five years. This investment will add a new high-growth engine with clear adjacencies within Grasim's standalone businesses and its subsidiaries and associate companies. The company will spend $1,206.7 million on a new paint business and will launch its products by early 2024.

Key Regulations:

Some key regulations and standards that impact the construction materials market include:

- LEED (Leadership in Energy and Environmental Design): LEED is a widely recognized green building certification system that encourages the use of sustainable construction materials and practices. It sets criteria for energy efficiency, water efficiency, materials selection, indoor environmental quality, and more.

- EU Construction Products Regulation (CPR): Applicable within the European Union, CPR mandates that construction products meet specific performance standards and have a CE marking to indicate compliance. This regulation covers aspects such as fire safety, structural integrity, and environmental impact.

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): This European regulation aims to ensure the safe use of chemicals in products, including construction materials. It requires the registration and evaluation of chemical substances used in products to protect human health and the environment.

- Building Codes and Standards: Many countries have building codes that specify the minimum requirements for construction materials to ensure safety, structural integrity, and fire resistance. These codes may include specifications for materials such as concrete, steel, and wood.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the construction materials market analysis from 2022 to 2032 to identify the prevailing construction materials market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the construction materials market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global construction materials market trends, key players, market segments, application areas, and market growth strategies.

Construction Materials Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1732.3 billion |

| Growth Rate | CAGR of 3.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 299 |

| By Material Type |

|

| By End-use |

|

| By Region |

|

| Key Market Players | Holcim, CEMEX, S.A.B. de C.V., Sika AG, Ambuja Cements Ltd, ArcelorMittal, CRH, Grasim Industries Limited, LIXIL Corporation, Boral, Knauf Digital GmbH |

Analyst Review

According to the opinions of various CXOs of leading companies, the construction materials market is expected to witness increased demand during the forecast period due to population growth, urbanization, infrastructure development, and economic expansion. As the population continues to increase worldwide, more people are moving to urban areas, leading to the construction of residential and commercial buildings to cope with this trend. Also, infrastructure projects such as highways, airports, rail, and water supply schemes are also being invested by governments and privately owned companies. These projects require vast amounts of construction materials. In addition, growing economies often result in increased construction activity as businesses expand, leading to the construction of new factories, offices, and retail spaces.

The Construction Materials Market was valued at $1.2 trillion in 2022, and is projected to reach $1.7 trillion by 2032, growing at a CAGR of 3.8% from 2023 to 2032.

Infrastructure development is a major driving force behind the demand for construction materials.

Residential is the major end-user of Construction Materials Market.

Asia-Pacific is the largest regional market for Construction Materials.

The top companies to hold the market share in Construction Materials include Ambuja Cements Ltd; ArcelorMittal; Grasim Industries Limited; LIXIL Corporation; Sika AG; CRH; Knauf Digital GmbH; CEMEX, S.A.B. de C.V.; Holcim; and Boral.

Loading Table Of Content...

Loading Research Methodology...