Consumer Electronics Batteries Market Research, 2032

The Global Consumer Electronics Batteries Market was valued at $13.9 billion in 2022, and is projected to reach $61.3 billion by 2032, growing at a CAGR of 16.2% from 2023 to 2032.

Consumer electronic batteries quietly serve as the backbone of the modern world. These compact, portable energy storage technologies have revolutionized the lifestyle. They provide ease and adaptability that are taken for granted by allowing the maintenance of the seamless operation of cellphones, computers, tablets, and many other technological devices. The history of batteries used in consumer electronics is intricately entwined with the history of battery technology as a whole. The first real battery, known as the Voltaic Pile, was developed by Italian scientist Alessandro Volta in the latter half of the 18th century. A constant flow of energy was produced by this early battery, which was made of alternating layers of zinc and copper separated by saltwater-soaked cardboard. Volta's discovery paved the way for later advancements in battery technology even though they are far different from the batteries we use today.

The consumer electronics batteries market forecast is segmented into Type and Application.

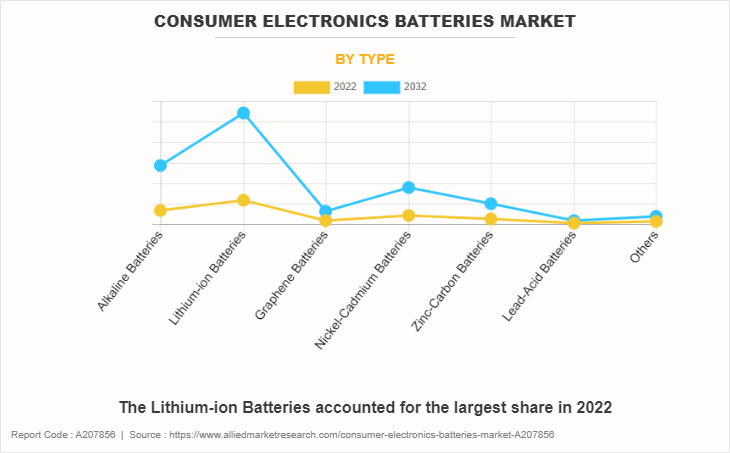

On the basis of type, the consumer electronics batteries industry is classified into alkaline batteries, lithium-ion batteries, graphene batteries, nickel-cadmium batteries, zinc-carbon batteries, lead-acid batteries, and others.

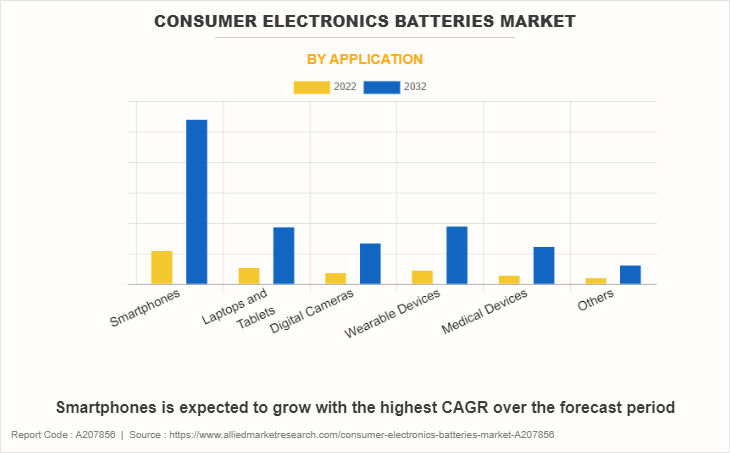

By application, the consumer electronics batteries industry is categorized into smartphones, laptops & tablets, digital cameras, wearable devices, medical devices, and others.

Region wise, the consumer electronics batteries market share are analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

Batteries for consumer electronics are made up of a number of essential parts that work together to store and discharge electrical energy. To appreciate the inner workings of various power sources, it is essential to comprehend these elements and how they interact. The cathode, which is frequently comprised of metal oxide, serves as the battery's positive electrode. Lithium cobalt oxide (LiCoO2) is a typical cathode material in lithium-ion (Li-ion) batteries. The electrochemical processes take place at the cathode during both charging and discharging. On the other hand, the anode, which is located at the other end of the battery, serves as the negative electrode. The anode is frequently made of graphite in batteries for consumer electronics, particularly Li-ion batteries.

The anode is where lithium ions are either held (when charging) or discharged (during discharging) during charging and discharging cycles. An essential element that helps ions move between the cathode and anode is electrolyte. The electrolyte in Li-ion batteries usually consists of a lithium salt dissolved in a solvent. The passage of electric current is made possible by this solution by allowing lithium ions to travel back and forth between the cathode and anode. A separator is utilized to stop a short circuit between the cathode and anode. These two electrodes are physically separated by the separator, which is a porous membrane that permits ion movement. This crucial element improves the battery's overall performance and safety. Electrochemical processes are important to how a consumer electronics battery function overall. Lithium ions are removed from the cathode and intercalated into the anode during charging, storing energy within the battery. These stored lithium ions are released from the anode during discharge, move through the electrolyte, and then are reabsorbed by the cathode, producing an electrical current.

The environmental effects of the batteries used in consumer electronics have increased along with their use in daily life. Concerns concerning the proper disposal of these chemically active materials have been highlighted by the growing usage of disposable batteries such as alkaline and zinc-carbon batteries. Once exhausted, primary batteries are frequently disposed of in landfills. These batteries contain chemicals that, over time, leak into the environment and endanger both human health and ecosystems. Primary battery recycling activities have expanded as a result of this environmental concern, especially for those that contain hazardous components such as cadmium.

An ecologically beneficial substitute are rechargeable batteries, such NiMH and Li-ion batteries. Since they are recharged and used repeatedly, fewer batteries are disposed of in landfills. Environmental concerns, however, also apply to the mining and processing of raw minerals such as nickel, cobalt, and lithium for these batteries. Manufacturers are focusing on enhancing battery recycling procedures and creating substitute materials that are less harmful to the environment in an effort to allay these worries. The objective is to develop batteries that are not only effective but also long-lasting, hence minimizing their total environmental impact.

Throughout the beginning, batteries for consumer electronics have advanced significantly. They have completely changed the way we live by making many gadgets portable and effective. If we continue to rely on batteries for the contemporary way of life, it is crucial to understand their components, operating principles, lithium ion battery failures in consumer electronics environmental effect, and future possibilities. As technology develops, batteries will continue to change, influencing consumer devices' future as well as the overall energy environment.

The consumer electronics batteries market is segmented on the basis of type, application, and region. On the basis of type, the market is classified into alkaline batteries, lithium-ion batteries, graphene batteries, nickel-cadmium batteries, zinc-carbon batteries, lead-acid batteries, and others. By application, the market is categorized into smartphones, laptops & tablets, digital cameras, wearable devices, medical devices, and others.

Region wise, the consumer electronics batteries market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

Covid Impact Analysis

The COVID-19 pandemic caused a huge upheaval in the consumer electronics batteries market size. There has been a growth in demand for consumer gadgets, such as laptops, tablets, smartphones, and gaming consoles, as a result of widespread remote working and more time spent at home. This increase in demand puts pressure on the supply system, causing sporadic shortages and delays. The pandemic also interfered with transportation and industrial processes, which affected total production capabilities and caused changes in the pricing of raw materials. Despite these difficulties, the market for consumer electronics batteries showed resiliency as producers adjusted to the new normal by placing an emphasis on innovation, sustainability, and satisfying the changing demands of customers who rely on devices for work, education, and leisure.

Competitive Analysis

Competitive analysis and profiles of the major global consumer electronics batteries market players that have been provided in the report include Samsung SDI Co., Ltd., LG Chem, Panasonic Corporation, Toshiba Corporation, Duracell, Sony Corporation, Apple, Inc., Hitachi, Ltd., Johnson Controls International Plc, and Energizer.

Top Impacting Factors

One of the significant factors that impact growth of the consumer electronics batteries market includes rise in adoption of EVs. Moreover, technological advancements is expected to drive the market growth. However, limited energy density and environmental concerns might hamper growth of the market. On the contrary, miniaturization and form-factor innovation offer potential growth opportunities for the consumer electronics batteries market.

Historical Data & Information

The global Sensor Patch market is highly competitive, owing to the strong presence of existing vendors. Vendors of Sensor Patch market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Samsung SDI Co., Ltd., LG Chem, Panasonic Corporation, Toshiba Corporation, Duracell, Sony Corporation, Apple, Inc., Hitachi, Ltd., Johnson Controls International Plc, and Energizer are the top companies holding a prime share in the Sensor Patch market. Top market players have adopted various strategies, such as product development, acquisition, innovation, partnership, and others to expand their foothold in the Sensor Patch market.

- In June 2023, Qualcomm collaborated with Sony Corporation, to power the next generation of smartphones. The agreement between the two companies will focus on delivering “unparalleled user experiences” across premium, high-tier, and mid-tier smartphones.

- In May 2023, Energizer Holdings, Inc. raised $43 million on an expansion of its battery production and packaging facilities in the city of Asheboro, North Carolina, U.S.

- In April 2023, Apple, Inc. unveiled a major acceleration of its work to expand recycled materials across its products, including a new 2025 target to use 100 percent recycled cobalt1 in all Apple-designed batteries.

- In July 2022, Duracell launched its new Power Boost Ingredients, aimed at helping people get more out of what matters to them, like spending time outdoors this summer and making memories with friends and family.

- In January 2022, Toshiba Corporation expanded its SCiB product offering with the launch of an innovative 20Ah-HP rechargeable lithium-ion battery cell that delivers high energy and high power at the same time.

- In February 2021, Johnson Controls International plc launched its Lithium-Ion Risk Prevention System. The system is engineered to provide early-warning detection of battery failure in Lithium-Ion Energy Storage Systems (ESS) and other applications using Lithium-Ion batteries such as UPS systems in data centers and manufacturing facilities.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the consumer electronics batteries market analysis from 2022 to 2032 to identify the prevailingcConsumer electronics batteries market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the consumer electronics batteries market overview segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global consumer electronics batteries market trends, key players, market segments, application areas, and consumer electronics batteries market growth strategies.

Consumer Electronics Batteries Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 61.3 billion |

| Growth Rate | CAGR of 16.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 272 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Energizer Holdings, Inc., Apple, Inc., Johnson Controls International plc, Toshiba Corporation, Duracell, Hitachi, Ltd., Samsung SDI Co., Ltd, Sony Corporation, Panasonic Corporation, LG Chem |

Analyst Review

The consumer electronics batteries market is highly competitive owing to the strong presence of existing vendors. Consumer electronics batteries vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals as they have the capacity to cater to the global market requirements. The competitive environment in the market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

Market interest in current technical developments in consumer electronics batteries is high. To enhance the performance, flexibility, and durability of films, producers and researchers look for new techniques. This ongoing innovation is viewed as an indication of potential future growth. The market growth is supplemented by a proactive surge in manufacturing output owing to technological advancements. These factors have allowed emerging markets to evolve as largest markets during the forecast period, both from the demand as well as the supply side. Public & private organizations have substantially invested in R&D activities and fabrication techniques to develop cost-effective consumer electronics batteries.

Asia-Pacific is the major revenue contributor to the global market, followed by North America. The market growth in Asia-Pacific is expected to significantly increase during the forecast period. The Consumer Electronics Batteries market provides numerous growth opportunities to the market players such as Samsung SDI Co., Ltd., LG Chem, Panasonic Corporation, Toshiba Corporation, Duracell, Sony Corporation, Apple, Inc., Hitachi, Ltd., Johnson Controls International Plc, Energizer, and others. These companies are engaged in the process of product innovation, collaboration, and acquisition to expand their services across various regions.

Rise in adoption of EVs and Technological advancements are the trends of Consumer Electronics Batteries Market in the world.

Smartphones is the leading application of Consumer Electronics Batteries Market.

Asia-Pacific is the largest regional market for Consumer Electronics Batteries.

The estimated industry size of the consumer electronics batteries market is $61.31 billion by 2032.

Samsung SDI Co., Ltd., LG Chem, Panasonic Corporation, the top companies include Toshiba Corporation, Duracell, Sony Corporation, Apple, Inc., Hitachi, Ltd., Johnson Controls International Plc, and Energizer

Loading Table Of Content...

Loading Research Methodology...