Contactless Payment Market Research, 2032

The global contactless payment market was valued at $2.4 trillion in 2022, and is projected to reach $12.5 trillion by 2032, growing at a CAGR of 18.3% from 2023 to 2032.

Contactless payment is a secure method for consumers to purchase products or services, with the use of devices such as smart cards, wearables, key fobs, smartphones, and others. Primarily, contactless payment uses radio-frequency Identification (RFID) and near field communication (NFC) technologies to facilitate contactless transactions in the market. In addition, the embedded chip & antenna placed in transaction devices enable consumers to wave or tap their smart cards, key fob, or handheld device over a reader at the point of sale (POS) terminal.

An increase in the potential of cashless payments across the globe and a rise in demand for wearable devices along with contactless payments for secure and safer payment transactions are driving the growth of the contactless payment market. Furthermore, the rise in the adoption of mobile and contactless payments by merchants and businesses is driving the contactless payment market growth. More retailers, restaurants, service providers, and other businesses are accepting and offering mobile and contactless payments, to attract and retain customers, increase sales, and reduce costs. In addition, with contactless payment trends, NFC card adoption has increased, with an increasing number of merchants accepting NFC-enabled cards. This, in turn, attracts all types of companies to offer their goods and services via contactless NFC card payments, thus driving the growth of the market.

However, the rise in data privacy and security issues while conducting payments hampers the growth of the market. On the contrary, the integration of IoT in contactless payment technology and untapped potential of emerging economies are expected to provide lucrative growth opportunities to the contactless payment market in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the contactless payment market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the contactless payment market outlook.

Segment Review

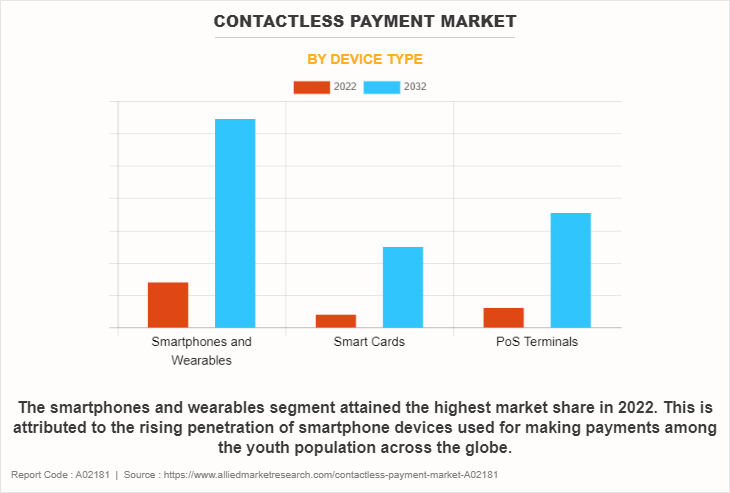

The contactless payment market is segmented on the basis of device type, application, and region. By device type, the market is divided into smartphones and wearables, smart cards, and point-of-sale (POS) terminals. By application, it is segmented into food and groceries, pharmacy and drug stores, restaurants and bars, consumer electronics, media and entertainment, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By device type, the smartphones and wearable segment acquired a major contactless payment market share in 2022. This is attributed to the rising penetration of smartphone devices used for making payments among the youth population across the globe. The use of digital wallets for making contactless payments through smartphones has increased the usage of smartphones in everyday tasks and activities. Furthermore, innovations in wearables, such as payment watches for making contactless payments, are expected to propel the segment's growth. However, the smart cards segment is expected to grow at the fastest CAGR during the forecast period. This is attributed to the growing adoption of contactless cards, such as credit and debit cards for making payments in sectors such as BSFI, retail, transportation, and hospitality.

By region, the contactless payment market was dominated by Europe in 2022, due to increased adoption of technologies, which has changed consumer behavior toward booking taxies, lodging, entertainment, and others. In addition, the launch of easy-to-use and new contactless applications, such as Samsung Pay, Apple Pay, and Google Wallet, has accelerated the usage of contactless payment by customers primarily in the retail and hospitality industries. These major factors influence the growth of the contactless payment market in Europe. However, Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. This is attributed to the fact that as several consumers are adopting contactless payment for day-to-day transactions, increased government support toward investment in technologies are becoming a major growth factor in the region.

The key players operating in the contactless payment market include Visa Inc., American Express Company, PayPal, Inc., Apple Inc., Mastercard, Amazon.com, Inc., Square, Inc., Ingenico, VeriFone, Inc., and Thales. These players have adopted various strategies to increase their market penetration and strengthen their position in the contactless payment industry.

Market Landscape and Trends

Wearable devices are proven to be up to 10 times faster than traditional payment methods due to the removal of verifying a user’s identity with a PIN or signature during the transaction process. Through near-field communication (NFC) technology, wearable payments link a user’s smart device to a credit, debit, or prepaid card, eliminating the need to touch public surfaces and point of sale (POS) terminals. NFC technology only activates when there is a minimal distance between a smart device and a payment terminal, ensuring that consumers only pay for their purchases. Thus, this factor is expected to provide lucrative growth opportunities for the contactless payment industry in the upcoming years.

Furthermore, in February 2022, Apple introduced Tap to Pay on iPhone. The new capability empowers millions of merchants across the U.S., from small businesses to large retailers, to use their iPhone to accept Apple Pay, contactless credit and debit cards seamlessly and securely, and other digital wallets through a simple tap to their iPhone with no additional hardware or payment terminal needed.

The COVID-19 pandemic accelerated the adoption of contactless payment and has resulted in greater investments in the contactless payment industry, with a focus on digital transformation. With social distancing measures, contactless payment methods faced higher acceptance among merchants and consumers. The fear of virus transmission through cash or card handling led to a surge in demand for the contactless payment industry. Many governments and businesses encouraged the use of contactless payment to reduce the spread of the virus. Thus, these factors drive the growth of the contactless payment market size during the pandemic.

Top Impacting Factors

Surge in Demand for Mobile & Wearable Payment Devices

An increase in the potential of cashless payments across the globe and a rise in demand for wearable devices along with contactless payment for secure and safer payment transactions are driving the growth of the contactless payment market. Moreover, during the COVID-19 pandemic, the payments industry saw rapid adoption of contactless payment in India. According to a global consumer survey, 79% of participants prefer to use contactless payment methods due to safety and sanitary reasons. Furthermore, key players in the market adopted various strategies such as partnership and product launch during the pandemic to improve their product portfolio and provide contactless payment methods to stay protected from the spread of virus.

For instance, in September 2020, keeping pandemic and social distancing as the focus, watch maker Titan launched five new models in India in partnership with State Bank of India. These are not smartwatches but still come with a ‘smart' feature – contactless payment. All users need to do is to tap the Titan watch to the contactless payment POS machines so the transaction take place.

Rise in Adoption of Contactless Payment among Merchants

The rise in the adoption of mobile and contactless payment by merchants and businesses is driving the contactless payment market growth. More retailers, restaurants, service providers, and other businesses are accepting and offering mobile and contactless payment, to attract and retain customers, increase sales, and reduce costs. Moreover, they are investing in new and improved payment systems, terminals, and software, to enable and integrate mobile and contactless payment with their operations, marketing, and customer service.

In addition, as contactless payments are executed through smartphones, which use Near-Field-Communication (NFC) technology, consumers are increasingly using mobile payment systems. In addition, customers swipe their smartphone over a card reader to make a purchase without using credit and debit cards or counting out cash. Therefore, merchants & retailers are largely adopting contactless payment technology in their businesses, with consumers using contactless payment for day-to-day transactions. Thus, adoption & implementation of contactless payment technology among merchants is one of the major factors that propels the market growth.

Adoption of NFC card Payments

The COVID-19 pandemic catalyzed the accelerated adoption of contactless payment. NFC-enabled cards played a crucial role in promoting touchless transactions, reducing the need for physical contact, and minimizing the spread of virus. With contactless payment trends, NFC cards adoption has increased, with an increasing number of merchants accepting NFC-enabled cards. From local businesses to global retailers, one confidently tap their card at an expanding range of locations, including grocery stores, restaurants, and even vending machines. The widespread availability of NFC-enabled cards from various issuers further enhances their convenience and usability promoting the contactless payment market growth.

Integration of IoT in Contactless Payment Technology

Contactless transaction is considered as a key factor that significantly contributes toward the growth of the contactless payment market. For instance, Apple Pay and Android Pay enable new technologies such as NFC and contactless payment with QR codes and pre-staged mobile transactions, which are gaining increased traction in the market. Moreover, advancement in technology through integration of Internet of Things (IoT) with contactless payment has led to the development of innovative devices to customers.

For instance, in July 2021, Mastercard and Verizon formed a partnership focused on 5G contactless payment for consumers as well as small- and medium-sized businesses. The collaboration aimed to enable businesses to use emerging payment technologies to turn smartphones into cash registers, to turn wearables such as watches as payment devices, and to facilitate touchless retail similar to Amazon Go stores. Therefore, these factors are expected to remain major trends in the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the contactless payment market analysis from 2022 to 2032 to identify the prevailing contactless payment market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the contactless payment market segmentation assists to determine the prevailing contactless payment market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as contactless payment market trends, key players, market segments, application areas, and market growth strategies.

Contactless Payment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.5 trillion |

| Growth Rate | CAGR of 18.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 315 |

| By Device Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | American Express Company, Apple Inc., VeriFone, Inc., Ingenico, Square, Inc., Mastercard, Amazon.com, Inc., Thales, PayPal, Inc., Visa Inc. |

Analyst Review

The exponential growth in contactless payment is attributed to the development of businesses and a greater adoption rate of contactless payment in areas such as North America, emerging economies of Asia-Pacific, and Latin America. Even early adopters such as Australia, Canada, and the UK are also picking up the pace to support the overall growth. Quick bank approvals and the widespread existence of 5G internet are the specific reasons that help these regions register such phenomenal growth.

Contactless payments have become a transformational force in the retail business, revolutionizing the way transactions are handled. This mode of payment has numerous benefits for small retailers, ranging from improved customer experiences and lower costs to increased security and market reach. Accepting contactless payment helps retailers speed up their transaction processes and develop a more resilient and future-ready business. Furthermore, in India, to educate and encourage consumers to upgrade their card payment experience, an upgrade that spurs innovations in the timeliness, convenience, safety, and security of contactless payment, RuPay launched a strategic campaign to promote contactless payment.

The COVID-19 pandemic accelerated the shift to mobile and contactless payment, as people avoided physical contact and sought safer and more hygienic ways to pay. The pandemic increased the demand for online shopping, delivery, and digital services, which require mobile and contactless payment. Thus, these factors boosted the adoption of contactless payment during the pandemic.

The key players in the contactless payment market are Visa Inc., American Express Company, PayPal, Inc., Apple Inc., Mastercard, Amazon.com, Inc., Square, Inc., Ingenico, VeriFone, Inc., and Thales. Major players that operate in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for contactless payment across the globe, major players have collaborated with their product portfolio to provide differentiated and innovative products.

The global contactless payment market was valued at $2.4 trillion in 2022, is projected to hit $12.5 trillion by 2032, growing at a CAGR of 18.3% from 2023 to 2032.

At a CAGR of 18.3%, the Contactless Payment Market will expand from 2023 - 2032.

By the end of 2032, the market value of the Contactless Payment Market will be $12,476.6 billion.

Surge in demand for mobile & wearable payment devices, rise in adoption of contactless payments among merchants, and adoption of NFC card payments drive the contactless payment market growth.

The contactless payment market is segmented on the basis of device type, application, and region. By device type, the market is divided into smartphones and wearables, smart cards, and point-of-sale (POS) terminals. By application, it is segmented into food and groceries, pharmacy and drug stores, restaurants and bars, consumer electronics, media and entertainment, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the contactless payment market include Visa Inc., American Express Company, PayPal, Inc., Apple Inc., Mastercard, Amazon.com, Inc., Square, Inc., Ingenico, VeriFone, Inc., and Thales.

Loading Table Of Content...

Loading Research Methodology...