Containers as a Service Market Insights, 2032

The global containers as a service market was valued at $2.2 billion in 2022, and is projected to reach $20.7 billion by 2032, growing at a CAGR of 25.3% from 2023 to 2032.

Containers as a service (CaaS) is a service that allows software developers and IT departments to upload, organize, execute, grow, and manage containers using container-based virtualization. A container is a software package that includes all of the required components, including runtime, code, configuration, and system libraries, and may operate on any host system. CaaS allows software teams to launch and expand containerized apps to high-availability cloud infrastructures quickly.

The rising knowledge of the benefits of cost-effectiveness and better productivity, as well as the increasing acceptance of containers as a service to enable both IT divisions and developers to construct are accelerating market growth. In addition, increase in demand for flexible and dependable container service solutions is the major driving factor for the market. Containers as a service platforms enable companies to deploy and manage containerized applications across different infrastructure environments. Such as public cloud, private cloud, and hybrid environment, CaaS enables organizations to choose the infrastructure that best suits their needs. This flexibility not only allows organizations to leverage existing infrastructure investments, but also provides the flexibility to seamlessly migrate applications between environments, facilitating efficient workload balancing and resource optimization However, the heavy increase in container sprawl is a major factor hampering the growth of the containers as a service market.

Container sprawl can result in unexpected cost overruns. Each container consumes resources, and the uncontrolled proliferation of containers can lead to excessive resource usage, leading to higher infrastructure costs. Contrarily, increase in adoption of containers as a service in small and medium-scale enterprises presents a significant opportunity for the containers as a service industry. CaaS platforms offer cost-effective solutions for SMEs. They allow organizations to leverage containerization technology without the need for significant upfront investments in infrastructure or expertise. With CaaS, SMEs can access the benefits of containerization, such as resource efficiency and scalability, while paying for only the resources they consume. This cost-effective model enables SMEs to optimize their IT budgets and allocate resources more efficiently.

The report focuses on growth prospects, restraints, and trends of the containers as a service market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the containers as a service market.

Segment Review

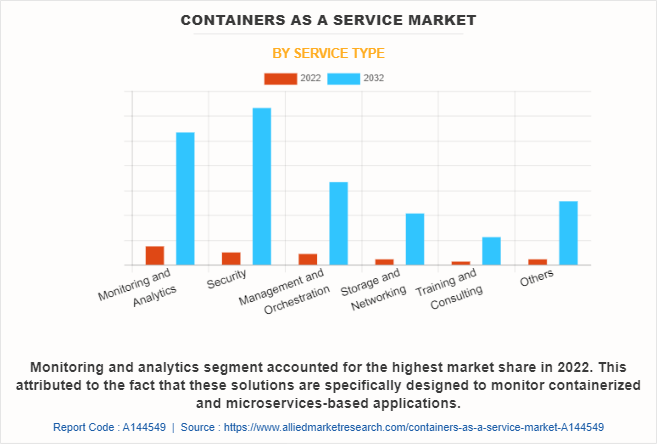

The containers as a service market is segmented on the basis of service type, deployment model, enterprise size, industry vertical and region. On the basis of service type, it is categorized into monitoring and analytics, security, management and orchestration, storage and networking, training and consulting, and others. By deployment model, it is divided into public cloud, private cloud, and hybrid cloud. By enterprise size, it is bifurcated into large enterprises, and small and medium-sized enterprises. On the basis of industry vertical, it is classified into BFSI, manufacturing, IT and telecom, retail and consumer goods, media, entertainment and gaming, healthcare, government and public sector, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of service type, the monitoring and analytics segment attained the highest containers as a service market size in 2022. This is attributed to the fact that these solutions are specifically designed to monitor containerized and microservices-based applications. They provide granular visibility into container performance, application dependencies, and service-to-service communication within the containerized environment.

On the basis of region, North America held the highest containers as a service market share in 2022. This is because the increasing adoption of hybrid and multi-cloud strategies by organizations to meet diverse application and infrastructure needs is increasing the trend of adoption and utilization of containers as a service technology.

The report analyzes the profiles of key players operating in the containers as a service market such as Google LLC, Amazon Web Services, Inc., Cisco Systems, Inc., IBM, Microsoft, Huawei Technologies Co., Ltd., VMware, Inc., Docker Inc., Oracle, and Hewlett Packard Enterprise Development LP. These players have adopted various strategies to increase their market penetration and strengthen their position in the containers as a service market.

Market Landscape and Trends

The market has a promising growth potential, mainly due to the surge in the adoption of containers as a service to assist IT departments and developers in creating, managing, and running containerized applications. Moreover, with the growing awareness of the benefits of cost-effectiveness and increased productivity, the rise in the need for services from businesses to reduce shipping times as a result of hosted applications facilitates the overall market's exponential growth.

Furthermore, the CaaS model is expected to provide new business opportunities for small and medium-sized enterprises (SMEs) since it enables business organizations to endure a greater degree of agility, which is the ability to create a new production workload as quickly as possible. In addition, the technique is quite easy to manage, as these are lightweight, enabling rapid delivery and deployment of new application containers. This is further expected to augment market growth. Therefore, the containers as a service industry is constantly evolving, with new trends emerging as technology advances.

Top Impacting Factors

Increase in Demand for Flexible and Dependable Container Service Solutions

Containers as a service platforms enable companies to deploy and manage containerized applications across different infrastructure environments. Such as public cloud, private cloud, and hybrid environment, CaaS enables organizations to choose the infrastructure that best suits their needs. This flexibility not only allows organizations to leverage existing infrastructure investments, but also provides the flexibility to seamlessly migrate applications between environments, facilitating efficient workload balancing and resource optimization.

Furthermore, with the help of CaaS platform, companies can scale containerized applications up or down as needed. This scalability ensures that applications can handle changing workloads and sudden traffic spikes without impacting performance or incurring additional infrastructure costs. In addition, CaaS platforms offer a reliable solution for running containerized applications. They provide robust orchestration and management capabilities ensuring that containers are properly deployed, monitored, and maintained. Moreover, CaaS platforms often incorporate features such as load balancing, fault tolerance, and automatic scaling that improve application reliability and availability. Therefore, these trends are driving the containers as a service market growth.

Growth in the Use of Microservices

The growth in the use of microservices is indeed a significant driver for the containers as a service market. Microservices architecture is an approach where applications are built as a collection of small, loosely coupled, and independently deployable services. Moreover, microservices promote modularity and allow applications to be broken down into smaller, manageable components. Each microservice can be fixed in a container, allowing it to scale independently as needed. In addition, a CaaS platform provides the necessary infrastructure and tools to manage the deployment, scaling, and orchestration of these containerized microservices.

Containers are lightweight and consume less resources than traditional virtual machines. This resource efficiency enables organizations to maximize the utilization of their infrastructure, resulting in cost savings. A CaaS platform provides container orchestration and management capabilities, optimizes resource allocation, and reduces infrastructure costs associated with running microservices-based applications. Furthermore, in September 2020, CloudPassage, announced that it has migrated the fully-containerized microservices architecture of its Halo cloud security and compliance platform to the fully-managed Kubernetes service, Amazon Elastic Kubernetes Service (Amazon EKS). This allowed Halo to take advantage of the enhanced services from Amazon Web Services (AWS) for networking, user identity, and automatically scaling up and down on-demand.

Cost-effectiveness and Increased Productivity

CaaS platforms use containerization technology that enables efficient use of computing resources. Containers are lightweight and share a host operating system, reducing the overhead associated with running multiple instances of an application. This efficient use of resources allows organizations to maximize infrastructure investments, reduce hardware costs, and improve overall cost efficiency.

Moreover, containers as a service streamlines the application deployment process. Containers encapsulate all the dependencies and configurations required for an application to run, making the deployment process consistent and repeatable. This eliminates the time-consuming tasks associated with configuring and managing the underlying infrastructure, allowing developers to focus more on writing code and accelerating the time to market for new applications or updates.

In addition, CaaS platforms simplify the management and operations of containerized applications. They provide centralized management interfaces, command-line tools, and automation capabilities for deploying, monitoring, and scaling containers. This simplification reduces the complexity of infrastructure management, enabling IT teams to focus on higher-value tasks and increasing overall productivity.

Heavy Increase in Container Sprawl

Container sprawl is a term used to characterize the execution of numerous unmanageable applications through containers and the resultant high resource usage. As more containers are deployed without proper monitoring and management, container proliferation can lead to resource overutilization. If not managed well, organizations may face challenges in optimizing resource allocation, resulting in wasted computing resources and higher infrastructure costs. Moreover, container proliferation can make it difficult to track, monitor, and update containers, leading to difficulties in troubleshooting, ensuring compliance, and maintaining overall system stability.

In addition, container sprawl can result in unexpected cost overruns. Each container consumes resources, and the uncontrolled proliferation of containers can lead to excessive resource usage, leading to higher infrastructure costs. Organizations may need to invest in additional hardware or cloud resources to accommodate the growing number of containers, potentially straining their IT budgets. Furthermore, the proliferation of hundreds of unmonitored containers may emerge from an unrestrained interest in containerizing applications. The heavy increase in container sprawl may restrict the growth of containers as a service market.

Lack of Enterprise DevOps Culture

A DevOps culture emphasizes automation and continuous delivery practices for faster and more reliable software delivery. However, the lack of a DevOps culture hinders the adoption of these practices, which are critical to realizing the full potential of a CaaS platform. Automation and continuous delivery enable efficient deployment, scaling, and management of containerized applications, but without a DevOps culture, it can be difficult for organizations to effectively embrace these practices.

In addition, CaaS platforms are built on containerization technologies such as Docker and Kubernetes, as well as infrastructure-as-code and automation practices. A lack of a company-wide DevOps culture often leads to skills and knowledge gaps within the company. Without a culture that encourages learning, skill development, and knowledge sharing, organizations may lack the expertise to effectively manage and operate a CaaS platform. This gap can hinder the growth and adoption of CaaS solutions.

Increasing Adoption of Containers as a Service in Small and Medium-scale Enterprises

CaaS platforms offer cost-effective solutions for SMEs. They allow organizations to leverage containerization technology without the need for significant upfront investments in infrastructure or expertise. With CaaS, SMEs can access the benefits of containerization, such as resource efficiency and scalability, while paying for only the resources they consume. This cost-effective model enables SMEs to optimize their IT budgets and allocate resources more efficiently.

In addition, these platforms simplify the deployment and management of containerized applications, making them more accessible to SMEs. These platforms provide user-friendly interfaces, automated workflows, and pre-configured environments, reducing the complexity associated with managing containers. SMEs with limited IT resources can quickly adopt CaaS without extensive training or expertise, enabling them to focus more on application development rather than infrastructure management.

For instance, in June 2022, Oracle partnered with Kyndryl, a provider of IT infrastructure services. The partnership helped customers in accelerating their cloud journey by providing managed cloud solutions to enterprises globally. With the help of Oracle Cloud Infrastructure and Kyndryl's experience, these organizations took advantages of the newest technical advancements to achieve their desired business goals.

Regional Insights

North America holds the largest share of the containers as a service market due to the region's strong technological infrastructure and the early adoption of cloud and container technologies. The presence of key players such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, which offer CaaS platforms, is driving growth in the U.S. Enterprises in this region are leveraging CaaS to improve agility, reduce infrastructure costs, and streamline application development. The rising demand for microservices architecture and DevOps practices further boosts CaaS adoption.

In Europe, the market is growing rapidly, with countries like the UK, Germany, and France leading the way in adopting container technologies. The region's increasing focus on cloud adoption and digital transformation initiatives across various industries, including banking, retail, and manufacturing, is driving the demand for CaaS platforms. Moreover, the growing emphasis on data privacy and regulatory compliance, such as the GDPR, is prompting European companies to adopt secure and scalable CaaS solutions to manage applications in hybrid cloud environments.

Asia-Pacific is the fastest-growing region in the CaaS market, driven by the rapid digitalization of enterprises and increasing investments in cloud infrastructure. Countries like China, Japan, and India are leading in CaaS adoption, particularly in sectors like e-commerce, telecommunications, and banking. China’s tech giants, such as Alibaba Cloud and Tencent Cloud, are heavily investing in container technologies to support large-scale application deployment and management. The growing use of CaaS to enable faster time-to-market for applications and enhance scalability is a key driver in this region.

Key Industry Developments

In July 2023, Amazon Web Services (AWS) announced the expansion of its AWS Fargate service, a CaaS solution that allows users to run containers without managing servers. The new features included improved scaling capabilities and enhanced security features, making it easier for enterprises to manage containerized applications at scale.

In August 2023, Google Cloud introduced an update to its Google Kubernetes Engine (GKE), enhancing the platform’s security and compliance capabilities to meet growing regulatory demands, particularly in Europe. This update allows enterprises to automate compliance checks and secure containerized workloads in regulated industries such as healthcare and finance.

In September 2023, Microsoft Azure launched Azure Kubernetes Service (AKS) in several new regions, including Southeast Asia and South America, reflecting the global demand for container management solutions. The expansion aims to help businesses in emerging markets leverage container technologies to accelerate digital transformation and adopt cloud-native architectures.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the containers as a service market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of containers as a service market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the containers as a service market segmentation assists in determining the prevailing containers as a service market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global containers as a service market trends, key players, market segments, application areas, and market growth strategies.

Containers as a Service Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 20.7 billion |

| Growth Rate | CAGR of 25.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 314 |

| By Deployment Model |

|

| By Service Type |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Hewlett Packard Enterprise Development LP, Docker Inc., Huawei Technologies Co., Ltd., Cisco Systems, Inc., Microsoft Corporation, VMware, Inc., Google LLC, Amazon Web Services, Inc., Oracle, IBM |

Analyst Review

As per the insights of the top-level CXOs, containers as a service is a developing technology in which retailers offer a complete framework to the users for developing and managing containers and applications. Containers as a Service is mainly designed for IT developers to run and manage applications. The client can scale, oversee, transfer, sort out the web-based or API calls interface by making the usage of containers as a service. Increasing acceptance of containers as a service to aid IT departments & developers in designing, administering, and executing containerized applications is the primary factor contributing to the market's promising growth potential. In addition, the rising demand for services from businesses to minimize shipping times due to hosted applications enables the entire market's exponential expansion due to a greater understanding of the advantages of cost-effectiveness and enhanced productivity.

The CXOs further added that market players are adopting strategies like agreement for enhancing their services in the market and improving customer satisfaction. For instance, in March 2023, Hewlett Packard Enterprise signed an agreement to acquire OpsRamp, an IT operations management company focused on monitoring, observing, automating, and managing IT infrastructure, workloads, cloud resources, and applications for multi-and hybrid cloud. Following the acquisition, OpsRamp's hybrid digital operations management solution will be integrated with HPE GreenLake Edge to the cloud platform, and support it with HPE services. This will minimize the complexity of multi-cloud and multi-vendor IT environment management operations. Therefore, such strategies are expected to boost the growth of the containers as a service market in the upcoming years.

Moreover, some of the key players profiled in the report are Google LLC, Amazon Web Services, Inc., Cisco Systems, Inc., IBM, Microsoft, Huawei Technologies Co., Ltd., VMware, Inc., Docker Inc., Oracle, and Hewlett Packard Enterprise Development LP. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The container as a service market is estimated to grow at a CAGR of 25.3% from 2023 to 2032.

The container as a service market is projected to reach $20.70 billion by 2032.

Increase in demand for flexible and dependable container service solutions, growth in the use of microservices and cost-effectiveness and increased productivity majorly contribute toward the growth of the market.

The key players profiled in the report include container as a service market analysis includes top companies operating in the market such as Google LLC, Amazon Web Services, Inc., Cisco Systems, Inc., IBM, Microsoft, Huawei Technologies Co., Ltd., VMware, Inc., Docker Inc., Oracle, and Hewlett Packard Enterprise Development LP.

The key growth strategies of container as a service players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...