Converting Paper Market Research, 2033

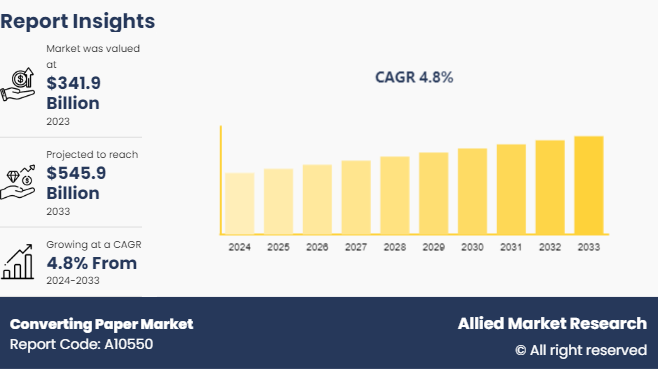

The global converting paper market was valued at $341.9 billion in 2023, and is projected to reach $545.9 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Introduction and Definition

Converting paper refers to the process of transforming large rolls or sheets of raw paper material into specific finished products or forms, such as envelopes, bags, labels, boxes, or printed sheets. This involves various operations like cutting, folding, laminating, printing, coating, and binding, depending on the desired end product. The process is a critical step in the paper manufacturing industry, as it tailors paper materials to meet specific consumer or industrial needs. Converting paper is essential in packaging, publishing, and numerous other sectors that rely on customized paper products. It often requires specialized machinery and expertise to ensure precision and efficiency in producing high-quality items from bulk paper stock.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global converting paper such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,300 converting paper-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global converting paper market.

Key Market Dynamics

One of the primary drivers of the converting paper market is technological advancement. Innovations in machinery and automation have significantly increased production efficiency, allowing manufacturers to meet the rise in demand while reducing costs. For example, the introduction of advanced cutting and folding machines has enabled more precise and faster production processes. In addition, digital printing technology has revolutionized the industry by allowing for high-quality, customized printing on paper products, catering to specific consumer needs and preferences.

Moreover, the integration of Industry 4.0 technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), into paper converting processes has further enhanced productivity. IoT-enabled machines can monitor and optimize production in real-time, reducing waste and minimizing downtime. AI, on the other hand, can be used for predictive maintenance, ensuring that machines operate at peak efficiency. These technological advancements drive growth in the converting paper market and contribute to the overall competitiveness of the industry on a global scale.

Furthermore, environmental sustainability is another critical driver of the converting paper market. With increasing awareness of environmental issues, both consumers and governments are pushing for more sustainable practices within the industry. The shift away from plastic packaging towards paper-based alternatives is a significant trend driving demand for converted paper products. This shift is supported by government regulations aimed at reducing plastic waste and promoting the use of renewable and biodegradable materials. For instance, the Indian government has implemented several policies to encourage sustainable practices in the paper industry. The "National Action Plan on Climate Change" emphasizes the importance of reducing greenhouse gas emissions and promoting the use of renewable resources. In response, many paper converting companies in India have adopted eco-friendly practices, such as using recycled paper and reducing energy consumption in production processes. Furthermore, the government’s push for afforestation and sustainable forest management ensures a steady supply of raw materials for the paper industry, supporting the growth of the converting paper market.

However, one of the most significant restraints on the converting paper market is the rising cost of raw materials, particularly wood pulp. The cost of wood pulp, which constitutes a large portion of the production cost for paper products, has been volatile in recent years due to factors like deforestation, climate change, and increased global demand. According to the Indian Ministry of Commerce & Industry, the price of wood pulp has seen a significant increase of over 20% in the last five years, impacting the cost structure of paper converting companies. This increase in costs is often passed on to consumers, leading to higher prices for end products, which can reduce demand.

On the contrary, The rapid growth of e-commerce is another key opportunity for the converting paper market, particularly in the area of packaging. With the exponential rise in online shopping, there is an increasing demand for packaging solutions that are not only functional but also enhance the consumer experience. This includes innovations in protective packaging, branded packaging, and solutions that address sustainability concerns.

Globally, the e-commerce market has been expanding at a remarkable pace. For instance, according to a report published by the Indian Ministry of Commerce & Industry in 2023, the e-commerce sector has witnessed an annual growth rate of over 20% from 2019-2022. This boom in e-commerce has driven significant demand for packaging materials, particularly those that are sustainable and can be customized to meet specific brand requirements. The demand for packaging that protects products during transit, reduces waste, and enhances brand visibility is creating new opportunities for paper converters to develop specialized products.

Parent Market Overview

Parent Market Name | Global Pulp and Paper Market |

Market Value in 2023 | $357.2 billion |

Drivers | Increasing Paper Recycling Activities and escalating demand from various end-use industries |

Restraints | Increasing Deforestation and Water Crisis |

Market Segmentation

The converting paper market is segmented on the basis by pulp type, application, and region. By pulp type, the market is classified into chemical pulp, mechanical pulp, recycled pulp, and others. Based on application, the market is segmented into packaging, printing and publishing, tissues and hygiene products, labels and stickers, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The converting paper market in the Asia-Pacific region is experiencing significant growth, driven by several key factors, including rapid urbanization, expansion of the e-commerce sector, and increase in demand for sustainable packaging solutions. Urbanization and rise in consumer incomes in countries like China, India, and Southeast Asian nations have led to higher consumption of packaged goods, thereby boosting demand for paper-based packaging materials. According to the United Nations, the urban population in Asia-Pacific is projected to increase by 1.2 billion by 2050, further amplifying the need for converting paper in packaging applications, such as corrugated boxes, cartons, and paper bags.

Government policies supporting sustainable practices and the reduction of plastic use are also major drivers of the converting paper market in APAC. For instance, India's ban on single-use plastics, implemented in July 2022, has significantly increased the demand for paper-based alternatives, such as paper bags and biodegradable packaging. According to the Ministry of Environment, Forest and Climate Change, this policy has led to a 20% annual increase in the production of paper packaging materials. In addition, China's "National Sword" policy, which restricts the import of low-quality waste paper, has spurred domestic production of high-quality recycled paper, further driving the market. These government initiatives, combined with the region's growing industrial base, are creating a robust demand for converting paper products, positioning APAC as a key growth market in the global paper converting industry.

Competitive Landscape

The major players operating in the converting paper include International Paper Company, Georgia Pacific LLC, Finch Paper LLC, Burgo Group, Biyani Paper Converters (P) Ltd., Oren International, Nippon Paper Group, Impress Paper Converters, American Paper Converting, and CPP Inc.

Industry Trends

- According to the Indian government's Ministry of Commerce & Industry, the paper and paper products sector, including converting operations, has been steadily growing, with an annual growth rate of 5-7% in recent years. The industry is expected to reach a market size of approximately $25 billion by 2025. The government has also been promoting initiatives such as "Make in India, " which encourages domestic production and innovation in paper and packaging, further boosting the converting paper industry.

- The paper converting industry has seen significant shifts driven by sustainability concerns, technological advancements, and changing consumer preferences. A notable trend is increasing demand for eco-friendly and recyclable paper products, propelled by global movements toward reducing plastic usage and waste. This has led to innovations in biodegradable packaging, recycled paper products, and minimalistic designs that use less material.

- In addition, advancements in digital printing and automation have enhanced the efficiency and customization capabilities of paper converters, allowing for faster production and more personalized products. These trends reflect a broader shift in the industry towards more sustainable and technologically integrated operations, aligning with global environmental goals.

Key Sources Referred

- The World Paper Council

- American Paper Association

- Arab Federation of Paper

- National Promotion and Facilitation Agency

- U.S. Development Authority

- United States Environmental Protection Agency

- Invest In India

- Press Information Bureau

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the converting paper market analysis from 2024 to 2033 to identify the prevailing converting paper market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the converting paper market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global converting paper market trends, key players, market segments, application areas, and market growth strategies.

Converting Paper Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 545.9 Billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 410 |

| By Pulp Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | CPP Inc, Burgo Group, Georgia Pacific LLC, Nippon Paper Group, American Paper Converting, International Paper Company, Oren International, Biyani Paper Converters (P) Ltd., Finch Paper LLC, Impress Paper Converters |

Loading Table Of Content...