Cord Blood Banking Services Market Size, Share & Trends

The global cord blood banking services market size was valued at $1.3 billion in 2020, and is projected to reach $4.5 billion by 2030, growing at a CAGR of 13.3% from 2021 to 2030. Cord blood contains a rich source of stem cells, which can treat more than 80 genetic diseases. Cord blood stem cells can treat chronic diseases such as cancer, diabetes, blood diseases, and immune diseases. Although, only a small amount of cord blood can be collected from a single umbilical cord, it contains large number of stem cells and is the only type of stem cell stored for future use. These cells are collected from hospitals & nursing homes and stored in cord blood banks for future use and can be stored for an average of 20-25 years. Government authorities have supported research and clinical trials of cord blood stem cells, thus increasing the interest of healthcare companies to invest in research and commercialization of cord blood stem cell therapies. The cord blood banking services market forecast from 2020 to 2030.

Market for cord blood banking services has increased since the last 20 years. At present, the market competition has increased while the companies are trying to increase the awareness related to the benefits of cord blood storage. Moreover, Cord Blood Registry and The Institute for Transfusion Medicine collaborated to launch a multi-year initiative to increase awareness about cord blood cells. With the help of campaigns, expectant parents are educated and guided about options available for cord blood banking related to the different financial schemes for storage and donation, which is expected to boost the cord blood banking services market growth.

Major players such as Covis Group S.a.r.l, Americold Registry LLC and others have adopted the product acquisition to improve their product portfolio to maintain competition in the market. For instance, in November 2020, Covis completed the acquisition of Amag Pharmaceuticals, Inc. and this acquisition aims to improve the therapeutic portfolio and enhance the capabilities & offerings. Such instances are expected to provide lucrative cord blood banking services market opportunity.

The COVID-19 pandemic forced many companies in the global cord blood banking services market size to halt business operations for a short term to comply with new government regulations to curb the spread of the disease. This halt in operations directly impacted revenue flow of the global cord blood banking services market. In addition, there is a halt in manufacturing of industrial products, owing to lack of raw materials and manpower during the lockdown period. Further, no new consignments are received by companies that operate in this sector. Hence, halt in industrial activities and lockdowns for several months have affected the global cord blood banking services industry due to which the market witnessed a slow recovery during the forecast period.

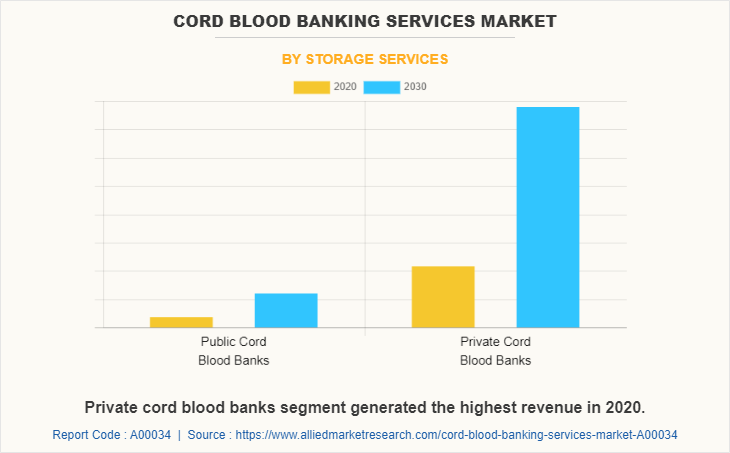

The cord blood banking services market size is segmented into storage services, component, application, and region. By storage services, it is classified into public cord blood banks and private cord blood banks. Private cord blood banks segment having the highest cord blood banking services market share.

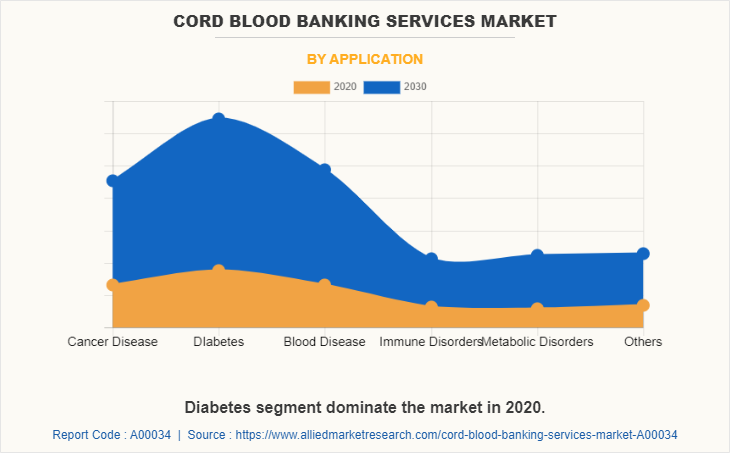

By component, the market is segmented into cord blood and cord tissue. Cord tissue segment generated the highest revenue in 2020. By application, diabetes segment have the highest cord blood banking services market share.

On the basis of region, the cord blood banking services market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America is expected to have the highest cord blood banking services market share, followed by Europe. LAMEA is predicted to grow faster than Asia-Pacific with a CAGR of 13.5% during the forecast period.

Competition Analysis

The key players that operate in this market include Americord Registry LLC, China Cord Blood Corporation, Covis Group, Cordlife Group Limited, Cryo-Cell International, Inc., Cord for Life, National Cord Blood Program, Cordvida, Perkinelmer Inc., and Lifecell international Pvt. Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cord blood banking services market analysis from 2020 to 2030 to identify the cord blood banking services industry opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cord blood banking services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the cord blood banking services industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cord blood banking services market trends, key players, market segments, application areas, and market growth strategies.

Cord Blood Banking Services Market Report Highlights

| Aspects | Details |

| By STORAGE SERVICES |

|

| By COMPONENT |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Cryoholdco DE LatinoAMerica, Americord Registry LLC, Cord Blood America, Lifeforce Cryobank Science Inc, Cryo-cell International, AMAG Pharmaceuticals, Inc., Cordlife Group LImited, Esperite N.V., China Cord Blood Corporation, cordvida |

Analyst Review

This section provides various opinions of the top-level CXOs in the cord blood banking services sector. In accordance to several interviews conducted, the cord blood banking services is expected to witness a significant growth in the market.

The cord blood banking services have gained attraction, as cord blood is a more reliable source of stem cells as compared to other stem cells sources such as bone marrow stem cells. The market for cord blood in therapeutics is expected to grow in future. R&D activities on cord blood stem cells present new opportunities for pharmaceutical companies to introduce drug and therapies on chronic diseases, such as immune and blood-related diseases, which had no conventional treatment earlier. Umbilical cord blood is one of the rich sources of stem cell compared to other available options. Advancement in technology in regard to collection and storage of cord blood increases its importance in practical application.

On the basis of storage devices, private cord blood banks segment have a dominant share, in terms of revenue, in 2020, a paradigm shift is expected to be observed from private to public as the applications and therapeutics get more utility from public banks. In addition, the storage of cord blood is free in public cord blood banks. Furthermore, the rise in awareness about the benefits of using public cord blood bank for storage purposes is expected to fuel the market growth.

Rising birth globally, and increase in penetration of cord blood banking services in maternity hospitals, are the key trends in the global cord blood banking services market.

Cord blood banking services are used to treat diseases such as cancer diseases, diabetes, blood disease, immune disorders, and metabolic disorders.

North America region dominate the market.

The global cord blood banking services market was valued at $1,258.2million in 2020 and is projected to reach $4,495.8 million by 2030, growing at a CAGR of 13.3% from 2020 to 2030.

Americord Registry LLC, COVIS Group, and Cordvida are the top compnaies in the cord blood banking services market.

Loading Table Of Content...