Core Banking Software Market Research, 2032

The global core banking software market was valued at $10.2 billion in 2022, and is projected to reach $49.7 billion by 2032, growing at a CAGR of 17.6% from 2023 to 2032.

Core banking is a back-end system that connects multiple branches of the same bank together to deliver operations such as loan management, withdrawals, deposits, and payments in real time. Core banking software is software that banks use to manage their most critical processes, such as customer accounts, transactions, and risk management. It is the central nervous system of a bank, and it is essential for providing a seamless customer experience (CX) and maintaining compliance with regulations.

The increase in customer satisfaction is a major driver of the core banking software market. Core banking software has been associated with a better user experience. Customers like the flexibility of being able to conduct financial transactions from different places as needed. They can also use the software to perform basic operations such as money transfers on their own. Thus, these services provided by banks satisfy customers, which drives the growth of the core banking software market.

Furthermore, the introduction of automation in banking has made data access and management extremely simple. Banks can now swiftly obtain all relevant data due to the centralized database. This provides banks with fast access to analytics and, hence, drives the core banking software market growth. In addition, rise in adoption of cloud-based platforms accelerated the growth of the core banking software market. However, several banks and financial institutions might be unaware of core banking technologies, which may hinder industry expansion.

Furthermore, privacy concerns associated with banking systems are expected to hamper core banking software market growth over the forecast period. On the contrary, the integration of artificial intelligence (AI) in banking systems is expected to provide lucrative growth opportunities for the core banking software market. The integration of AI into the banking system helps in the advancement of visualization skills and contributes to increased connectivity and advanced security procedures in banks and financial organizations.

The report focuses on growth prospects, restraints, and trends of the core banking software market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the core banking software market outlook.

Segment Review

The core banking software market is segmented into component, deployment model, end user, and region. By component, the market is differentiated into solution and service. Depending on deployment model, the market is segmented into on-premise and cloud. By end user, the market is divided into banks, financial institutions, and others. Region-wise, the core banking software market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

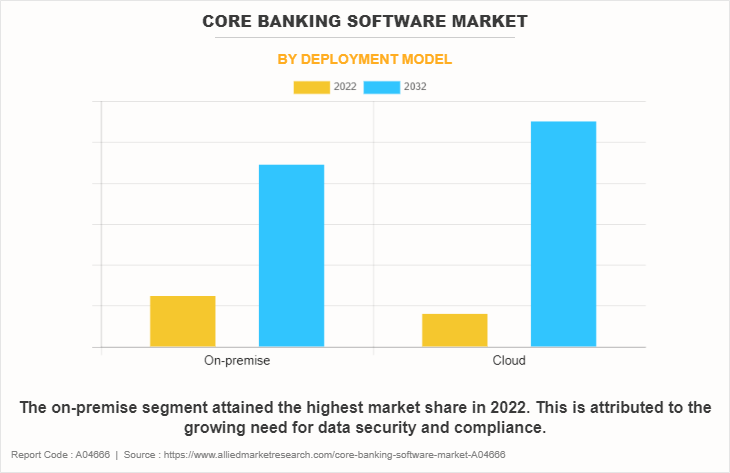

By deployment model, the on-premise segment acquired a major core banking software market share in 2022. This is attributed to the growing need for data security and compliance. Many financial institutions prefer on-premise deployment as they are hosted on a bank’s own in-house servers and can be integrated seamlessly with existing IT infrastructure. However, the cloud segment is attributed to be the fastest-growing segment during the forecast period, owing to the increase in demand for cloud-based banking systems. A cloud-based core banking system is hosted entirely in the cloud, eliminating the need for on-premise infrastructure, and reducing hardware and maintenance costs for banks and financial institutions.

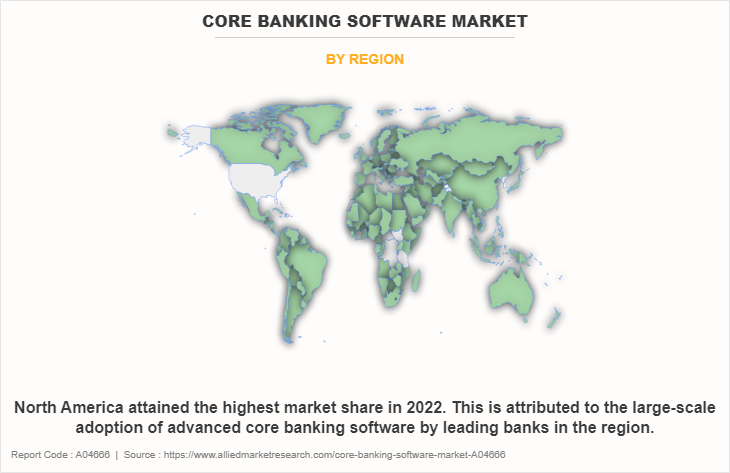

Region-wise, North America dominated the core banking software market in 2022, owing to increase in adoption of digital banking services. Furthermore, key players such as FIS and Fiserv, Inc. are expected to boost the market growth for banking solutions in the U.S. and Canada, as they are focused on launching advanced banking solutions to improve their product portfolio. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the rising adoption of web-based and mobile applications in the banking sector. Furthermore, banks in Asia-Pacific are investing in modernizing their systems to provide better customer experiences, seamless transactions, and real-time data access.

The key players operating in the core banking software market include Capgemini, Finastra, FIS, Fiserv, Inc., HCL Technologies Limited, Infosys Limited, Jack Henry & Associates, Inc., Oracle, Temenos, and Unisys. These players have adopted various strategies to increase their market penetration and strengthen their position in the core banking software industry.

Market Landscape and Trends

The future of banking technology is driven by consumers, especially Gen Z's, who see technology as something that enhances their lives. A common trend in banking technology is using an application programming interface (API) to make proprietary data available to anyone who has the consumer’s permission to access it. In addition, in 2020, an Insider Intelligence survey of banking executives found that 66% believe new technologies such as blockchain, artificial intelligence (AI), and the Internet of Things (IoT) will have the greatest impact on banking by 2025. According to Insider Intelligence, banks are exploring blockchain technology in hopes of streamlining processes and cutting costs.

Furthermore, core banking software providers are integrating artificial intelligence (AI) technologies into their offerings to improve their product portfolio. For instance, in January 2022, Swiss banking software company Temenos launched a buy now, pay later (BNPL) banking service on the Temenos Banking Cloud. Temenos BNPL, which claims to be the first AI-driven BNPL banking service, is a “fully flexible, pay-as-you-go solution” that enables banks to introduce BNPL at scale, without the need for new IT infrastructure. Thus, the strategy adopted by Temenos contributes to the growth of core banking software market.

COVID-19 has accelerated the adoption of digital banking systems and resulted in greater investments in core banking software, with a focus on digital transformation, cybersecurity, and cloud-based technology. The pandemic worked as a catalyst for banking industry innovation and modernization. With lockdowns and social distancing measures, people turned to online banking more than before. Increase in demand for digital banking services forced banks to improve their core banking software to fulfill their customers’ growing expectations. Thus, these factors positively impacted the core banking software market size.

Top Impacting Factors

Rise in Adoption of Cloud-based Solutions

One of the major drivers of the core banking software market is the rise in adoption of cloud-based banking platforms, provided by software providers such as Finastra, FIS, and Temenos AG. Banks can monitor payments, transactions, and other banking activities using cloud-based platforms. In addition, key players are focusing on launching new products and acquiring startups to gain a competitive edge in the market.

For instance, in January 2023, Kenya fintech startup, Kwara acquired IRNET Coop Kenya, a software company that is a subsidiary of the Kenya Union of Savings and Credit Cooperatives (KUSCC). The acquisition of IRNET and the KUSCCO-Kwara partnership delivers to its thousands of SACCO members a tested and proven, secure, and efficient cloud-based core banking platform as well as modern mobile banking channels. Moreover, Finacle core banking, a solution from Infosys helps banks and financial institutions modernize their cloud-based banking services. It offers a comprehensive suite of capabilities, including flexible product factories, extensive parameterization, product bundling, and reusable business components, to power banks' digital transformation. As a result, these factors collectively contribute to the growth of core banking software market.

Improved Customer Relationship

The core banking system has enabled banks to receive immediate notification of any client query and to resolve it with greater efficiency. This increased their retention rate as well as increases customer satisfaction by providing immediate solutions to their problems, which drives the growth of the core banking software market.

In addition, with a core banking solution, an omnichannel banking experience allows customers to access and manage their accounts from any location through mobile and online banking and interconnected branches. The transactions are easier and more transparent, creating a more enhanced customer experience. Due to improved customer satisfaction levels, banks have reported increase in both, customer loyalty and new clients, which foster the growth of the core banking software market.

Lower Operational Costs

The deployment of core banking software has significantly lowered the banks' operational and support costs. In addition, most operations such as ATMs, online and mobile banking, and payment gateways do not require manual processing, which lowers the operational cost. Visitors to the bank branches have significantly reduced, enabling banks to cut down on infrastructural and support expenses. Furthermore, the automation of services has enabled the banks to serve their customers better and have a positive relationship with them. Therefore, this factor drives the growth of the core banking software market.

Integration of Artificial Intelligence in Banking Systems

The banking industry is changing as a result of increase in use of technology, such as artificial intelligence (AI), big data, and cloud. Integrating such technology into the finance industry increases the accessibility of complex data, management of client queries, and development of consumers' visualization abilities. These technologies boost connections and provide sophisticated security measures in financial organizations and banks. Therefore, the integration of AI in banking boost the growth of core banking software market.

In addition, the Al-based core banking system gives legitimate analytics to end users while also assisting with improved client experience, digitization, and data security. Key players in the market adopt various strategies such as product launch and partnerships to create and drive continuous improvement. For instance, in October 2020, Temenos, the banking software company, launched Temenos Transact Data Hub, a real-time data platform that is integrated and embedded within Temenos Transact, the market-leading core banking solution. Temenos Transact Data Hub delivers multiple essential data capabilities that are critical to modern banks, leveraging the power of the data held within the core banking platform. Therefore, these factors are expected to provide lucrative opportunities for the core banking software market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the core banking software market analysis from 2022 to 2032 to identify the prevailing core banking software market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the core banking software market segmentation assists to determine the prevailing core banking software market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as core banking software market trends, key players, market segments, application areas, and market growth strategies.

Core Banking Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 49.7 billion |

| Growth Rate | CAGR of 17.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 245 |

| By Component |

|

| By Deployment Model |

|

| By End User |

|

| By Region |

|

| Key Market Players | Fiserv, Inc., Capgemini SE, Unisys, Jack Henry & Associates, Inc., Oracle Corporation, Infosys Limited, FIS, Finastra, Temenos AG, HCL Technologies Limited |

Analyst Review

Core banking has enabled banks to provide their consumers with a simple and transparent banking experience. These solutions have made the banking system more sophisticated and more user-friendly for customers. It has helped banks significantly decrease their operational costs, as well as assisted them in providing an improved banking experience to their customers by automating various operations.

In addition, maintaining legacy systems causes major expenses. With core banking solutions, banks can move to a shared services platform and combine multiple applications that otherwise would cost huge maintenance expenses to maintain separately. This allows banks to improve backend system efficiency while lowering the cost of maintaining a legacy system. Moreover, key players in the market adopt various strategies to empower clients to deliver innovative digital banking services and exceptional customer experience rapidly and cost-effectively. For instance, in May 2020, Sopra Banking Software (SBS), a global leader in digital banking and financing software, announced the latest version of Sopra Banking Platform in the Netherlands. This next-generation core banking software, providing a broad range of retail banking capabilities including PSD-2 and instant payments, was implemented in close cooperation with Centric, SBS’s long-standing partner in payment transactions for financial institutions.

The COVID-19 outbreak has had a moderate impact on the core banking software market. As a result of the pandemic, many banks and other financial institutions find it challenging to restore changes in the overall loan and credit management scenario. Key market participants focus on releasing advanced software solutions to speed their digital transformation to overcome such hurdles. For instance, in April 2020, Temenos AG introduced its sophisticated SaaS-based eight proposals, utilizing advanced cloud technologies and Explainable Al (XAI) to help various banks respond quickly to the COVID-19 pandemic.

The core banking software market is segmented with the presence of regional vendors such as Capgemini, Finastra, FIS, Fiserv, Inc., HCL Technologies Limited, Infosys Limited, Jack Henry & Associates, Inc., Oracle, Temenos, and Unisys. Major players operating in this market have witnessed significant adoption of strategies such as business expansion and partnership to reduce supply and demand gap. With increase in awareness and demand for core banking software across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The Core Banking Software Market will expand at a CAGR of 17.6% from 2023 to 2032.

By the end of 2032, the market value of Core Banking Software Market will be $49,708.5 million.

Rise in adoption of cloud-based solutions, improved customer relationship, and lower operational costs drives the market growth.

The core banking software market is segmented into component, deployment mode, and end user. By component, the market is differentiated into solution and service. Depending on deployment mode, it is fragmented into on-premise and cloud. By end user, the market is divided into banks, financial institutions, and others.

The key players operating in the core banking software market include Capgemini, Finastra, FIS, Fiserv, Inc., HCL Technologies Limited, Infosys Limited, Jack Henry & Associates, Inc., Oracle, Temenos, and Unisys.

Loading Table Of Content...

Loading Research Methodology...