Corn Syrup Market Research, 2031

The global corn syrup market size was valued at $9.8 billion in 2021, and is projected to reach $13.5 billion by 2031, growing at a CAGR of 3.2% from 2022 to 2031.

The corn syrup market is segmented into Type, Application and Distribution Channel.

Corn syrup is produced by hydrolyzing the cornstarch either by heating the cornstarch with diluted acid or by adding enzymes to the cornstarch. Corn syrup is extensively used in the production of jams & jellies, baked food, and various other foods such as dairy products, confectioneries, and beverages. The demand for corn syrup is expected to grow significantly in the food & beverages industry, owing to increase in demand for sweeteners in different processed foods. Corn syrup is not crystallized under certain conditions and it has higher solubility. Moreover, it is cheaper than sugar, and it act as a preservative that extends the shelf life of food & beverages. Thus, multiple benefits associated with corn syrup are boosting its adoption in the global food & beverages industry. In addition, rise in demand for processed food across developed and developing nations due to expansion of penetration of quick service restaurants chains & fast food chains as well as rise in consumption of ready-to-drink beverages fuel the growth of the market.

The global corn syrup market growth is further driven by exponential increase in global population, rise in disposable income, rapid urbanization, changes in food habits, and surge in demand for packaged food. According to the United Nations, the global population in 2020 was estimated at 7.7 billion, and is expected to reach at 9.7 billion by 2050. The rising population is expected to create a huge pressure on the supply of food & beverages globally, and hence the demand for the corn syrup is anticipated to increase for the production of various food & beverages items. Moreover, surge in adoption of corn syrup solids in the manufacturing of powdered drink mixes is boosting the growth of the market significantly. In addition, rise in adoption of corn syrup solids and high fructose corn syrup (HFCS) in the pharmaceuticals industry for producing various drugs is significantly driving the market growth. However, increase in prevalence of diabetes and other diseases due to growing consumption of sweeteners and rise in health consciousness among consumers adversely impact the growth of the global corn syrup market.

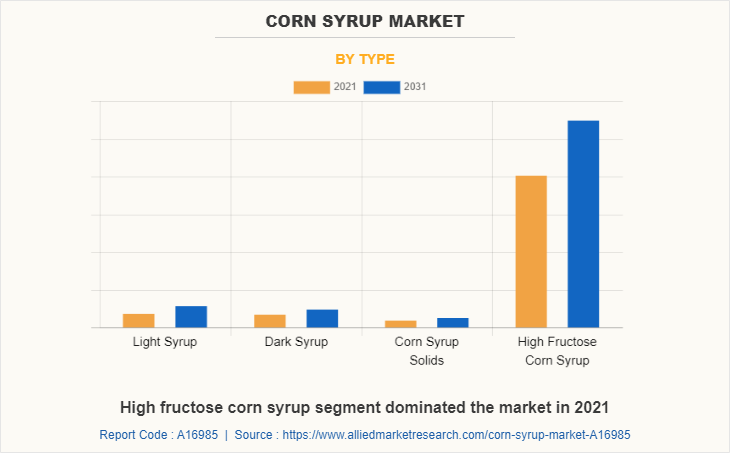

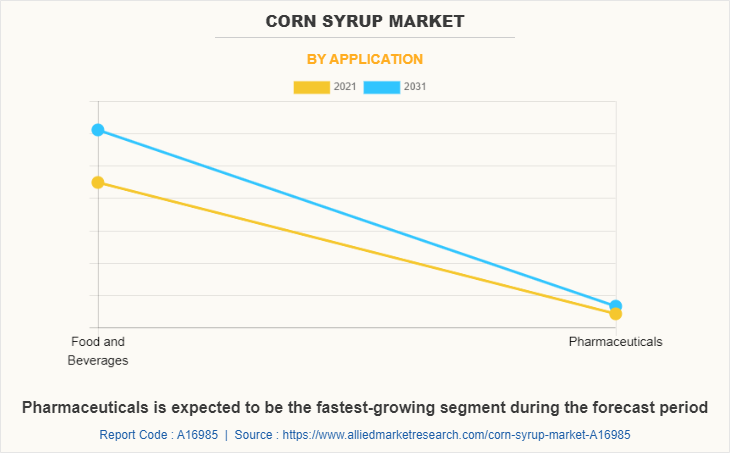

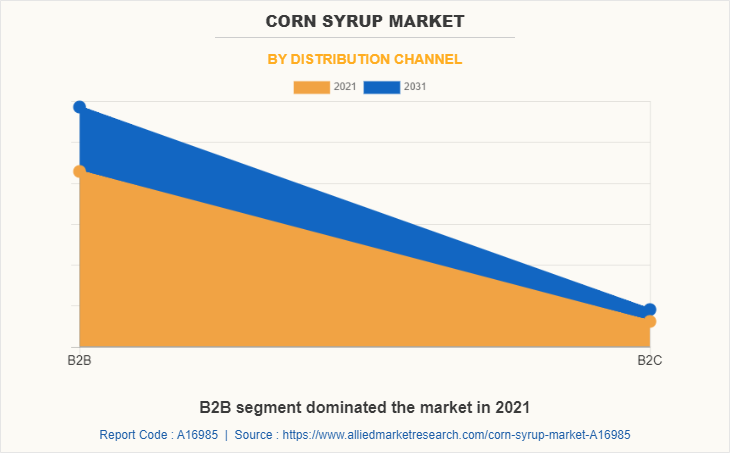

The corn syrup market is segmented into type, application, distribution channel, and region. On the basis of type, the market is segregated into light syrup, dark syrup, corn syrup solids, and HFCS. Depending on application, it is categorized into food & beverages and pharmaceuticals. By distribution channel, it is divided into B2B and B2C. Region wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, Saudi Arabia, and rest of LAMEA).

Depending on type, the HFCS segment accounted for 82.2% of the corn syrup market share in 2021. This growth is attributable to huge demand for HFCS among the food & beverages and the pharmaceutical industries for the production of numerous products. However, the light corn syrup segment is expected to register the highest CAGR of 4.2% during the forecast period.

As per the global corn syrup market forecast, on the basis of application, the pharmaceuticals segment is expected to witness the highest CAGR during the forecast period, owing to surge in adoption of HFCS and corn syrup solids in the production of various tablet and capsule forms of medications. This is attributed to the fact that corn syrup allows the drugs to breakdown into smaller fragments and helps in absorption. Thus, rapid development of the pharmaceutical industry due alarming rise in prevalence of diseases is expected to drive the growth of this segment.

By distribution channel, the B2C is expected to dominate the market, due to rise in penetration of the online grocery delivery platforms across the globe. In addition, the manufacturers of corn syrup are emphasizing on their marketing strategies to stimulate a number of people for buying corn syrups. The various B2C channels such as supermarkets, hypermarkets, convenience stores, and other retail stores provides a huge customer base that may help the corn syrup manufacturers to tap into the households and allow them to generate huge revenues apart from the B2B channels.

Region wise, North America dominated the global market in 2021 with highest revenue share, owing to the fact that the U.S. is the highest producer and consumer of corn syrup. This is attributed to huge demand for processed food, confectioneries, baked food, and ready-to-drink beverages in the U.S. Moreover, abundant availability of corn as raw material for corn syrup production is major benefit for regional manufacturers of corn syrup.

The key players operating in the global corn syrup industry are constantly engaged in strategic developments such as partnerships, joint ventures, acquisition, and mergers to exploit the prevailing corn syrup market opportunities. Business expansion has emerged as a key strategy among the market players to strengthen their position and achieve growth in the long term. The major players operating in the market include Archer Daniels Midland Company, Cargill, Incorporated, Associated British Foods Plc., COFCO Corporation, Global Sweeteners Holdings Ltd., Ingredion Incorporated, Kent Corporation, Luzhou Bio-chem Technology Limited, Roquette Freres, and Tate and Lyle PLC.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the corn syrup market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the corn syrup market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global corn syrup market trends, key players, market segments, application areas, and market growth strategies.

Corn Syrup Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Grain Processing Corporation, Roquette America, Inc., Cargill, Incorporated, Archer Daniels Midland Company, ingredion, Karo Syrups, Global Sweetners Holdings Ltd., Tate & Lyle Ingredients Americas, Inc., COFCO Rongshi Bio-technology Co. Ltd., Xiwang Sugar Holdings Company limited |

Analyst Review

As per the insights of CXOs, the demand for baking products is rising significantly in emerging markets. According to Del Monte—a leading food processing and distribution company in North America—its new product launches are gaining rapid traction among household bakers. The e-commerce sites like Snapdeal, Wal Mart, Amazon, and Flipkart is witnessing a surge in demand for bakeware. Puratos, a Belgium-based confectioner, bakery, and chocolate producer, opened a school for helping those who want to learn about baking. The changing consumer preferences toward baked foods are reflecting a surge in demand for bakery products in developing markets. There is a gap in the availability of experienced and skilled craftsmen in the patisserie and bakery industry in India. Hence, Puratos established experience centers to offer assistance to the small and medium bakers to perfect the art of bakery. These initiatives taken up by major food manufacturers are expected to positively impact the demand for corn syrup, as corn syrup and corn syrup-based sauces are extensively used in the production of bakery products.

The CXOs further added that major players in the corn syrup market are adopting business expansion as a key strategy for their long-term growth. The key players such as Archer Daniels Midland Company, Cargill, Incorporated, and Tate & Lyle Plc are heavily investing in setting up new manufacturing facilities at various locations to meet the growing demand of corn syrup due to rise in need for food & beverages. For instance, in October 2021, Tate & Lyle Plc. opened a new state-of-the-art food & beverage Technical Application Centre in Dubai to promote R&D activities and to help improve the quality of its products.

The global corn syrup market size was valued at $9.8 billion in 2021, and is projected to reach $13.5 billion by 2031

The global Corn Syrup market is projected to grow at a compound annual growth rate of 3.2% from 2022 to 2031 $13.5 billion by 2031

COFCO Rongshi Bio-technology Co. Ltd., Grain Processing Corporation, Archer Daniels Midland Company, Karo Syrups, Xiwang Sugar Holdings Company limited, ingredion, Global Sweetners Holdings Ltd., Roquette America, Inc., Tate & Lyle Ingredients Americas, Inc., Cargill, Incorporated

Region wise, North America dominated the global market in 2021

Exponential increase in the global population, rapid urbanization, changes in food habits, and surge in demand for packaged food drive the growth of the global corn syrup market.

Loading Table Of Content...