The global cosmetic implants market was valued at $9,240.80 million in 2020, and is projected to reach $20,541.20 million by 2030, growing at a CAGR of 8.2% from 2021 to 2030. Cosmetic implant is used to enhance aesthetics and rectify abnormalities of an individual caused by accidents, trauma, and congenital disorders. Cosmetic implants enabled people to conveniently replace dysfunctional body parts. It is easier for patients to regain or improve aesthetics after any incident. Cosmetic implants include facial augmentation, soft tissue or injection implants, hair grafts or implants, chest augmentation, penile implant, buttock augmentation, and calf augmentation. Various cosmetic implants are made up of silicone, expanded polytetrafluoroethylene (Gore-Tex), hydroxyapatite, and porous polyethylene (Medpor).

Growth of global cosmetic implants market size is majorly driven by increase in prevalence of congenital facial deformities, including cleft lip and cleft palate. For instance, as per the Centers for Disease Control and Prevention (CDC), in 2020, about 1 in every 1,600 babies is born with cleft lip with cleft palate in the U.S.. Increase in sedentary lifestyle, including smoking, diabetes, and specific medication therapies of mother increase the risk of babies suffering from cleft lip and cleft palate. This surge the demand for cosmetic implant, which, in turn, drives the cosmetic implants market growth.

In addition, technological advancements in cosmetic implants contribute in growth of cosmetic implants market. Increase in number of product approvals by the U.S Food and Drug Administration (FDA) for cosmetic implant products drive the growth of the cosmetic implants industry. For instance, Galderma, the world's largest independent global dermatology company, in May 2020, received the U.S. Food and Drug Administration (FDA) approval for its Restylane Kysse, which is a new hyaluronic acid (HA) filler specifically designed and indicated to add fullness to the lips. It is also used for lip augmentation and correction of upper perioral rhytids (wrinkles around upper lips) in adults aged 21 and above. Furthermore, increase in demand for surgical cosmetic implants to improve facial appearance and beauty boosts the growth of cosmetic implants industry. According to the International Society of Aesthetic Plastic Surgery (ISAPS) survey, in 2020, around 10,129,528 cosmetic surgical procedures were performed across the globe.

In addition, increase in R&D activities in surgical imaging systems boost the growth of cosmetic implants market. Surgical imaging tools help patients to improve comfort and enhance results of surgical operations. For instance, in August 2020, Dentsply Sirona, a global leader in dental implants and prosthetics, announced the launch of Axeos 3D/2D imaging system, which improves clinical confidence of patient, provides exceptional patient experience, and the opportunity for procedural expansion. Moreover, advancements in cosmetic implants and new product launches in the global market are anticipated to contribute toward the growth of the market. For instance, in January 2021, Mentor Worldwide LLC, a subsidiary of Johnson & Johnson, a global leader in developing and manufacturing of breast aesthetics, received the U.S. Food and Drug Administration (FDA) approval for MENTOR MemoryGel BOOST breast implant for breast augmentation in women aged 22 years and above, undergoing breast reconstruction. However, high cost of cosmetic implants procedure and risk of product malfunction impede the growth of this market.

Cosmetic Implants Market Segmentation

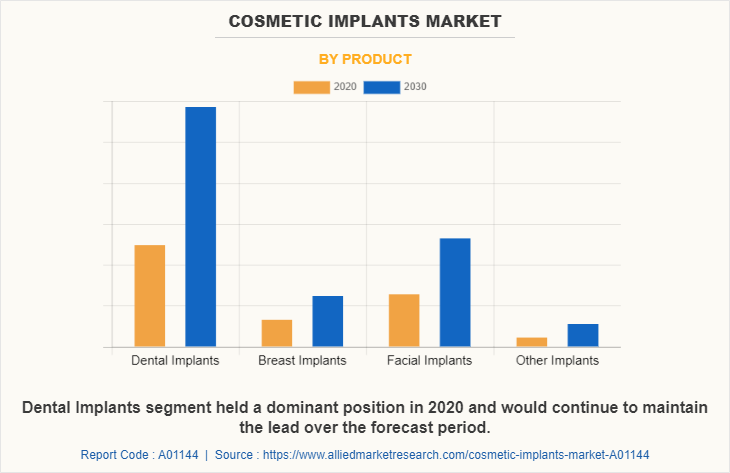

The cosmetic implants market size is segmented on the basis of product, raw material, and region. Depending on product, it is categorized into dental implants, breast implants, facial implants, and others. The dental implant segment is divided into root form dental implants and plate form dental implants. The breast implant segment is bifurcated into saline-filled and silicone gel-filled. As per the others implant segment, it is fragmented into buttock implants, penile implants, calf implants, pectoral implants, and ear implants.

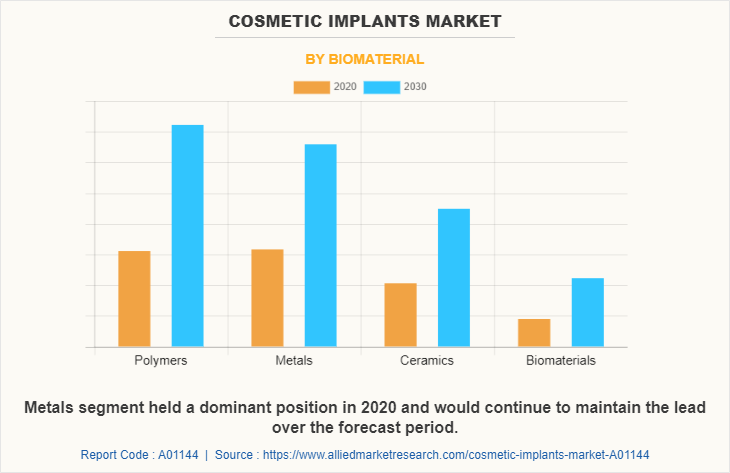

According to raw material, it is segregated into polymers, metals, ceramics, and biomaterials.

Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Arabia, South Africa, and LAMEA).

Depending on product, the dental implants segment dominated the cosmetic implants market share in 2020, and this trend is expected to continue during the forecast period, owing to rise in prevalence of dental deformities and increase in number of dental procedures. However, the facial implants segment is expected to witness considerable growth during cosmetic implants market forecast period, due to increase in number of congenital facial deformities and surge in demand for aesthetic products.

According to raw material, the metal segment was the major contributor in 2020 and is expected to maintain its lead during the forecast period, owing to rise in number of facial cosmetic surgeries. However, the biomaterials segment is expected to witness considerable growth during the forecast period, due to increase in number of dental clinics and dental surgeries.

Region wise, North America dominated the cosmetic implants market in 2020, and is expected to be dominant during the forecaste period, owing to the rise in number of road accidents, increase in presence of key players for development of cosmetic implants, and surge in well-established infrastructure. However, Asia-Pacific is expected to register the highest CAGR of 9.6% from 2021 to 2030, owing to increase in number of dental hospitals, rise in prevalence of congenital deformities, and surge in population base.

The key players operating in the global cosmetic implants market include 3M Company, AbbVie Inc., Danaher Corporation, Dentsply Sirona Inc., GC Aesthetics plc., Institut Straumann AG, Johnson & Johnson, Polytech Health & Aesthetics GmbH, Sientra Inc., and Zimmer Holdings Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cosmetic implants market analysis from 2020 to 2030 to identify the prevailing cosmetic implants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cosmetic implants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cosmetic implants market trends, key players, market segments, application areas, and market growth strategies.

Cosmetic Implants Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Biomaterial |

|

| By Region |

|

| Key Market Players | Zimmer Holdings Inc, Dentsply Sirona Inc., AbbVie, Inc, Institut Straumann AG., GC Aesthetics PLC., POLYTECH Health and Aesthetics GmbH, Danaher Corporation, Sientra Inc, 3M |

Analyst Review

The cosmetic implant is used to correct abnormalities and enhance aesthetic appearance of an individual. Depending on product , market is classified into dental implants, breast implants, and facial implants. The dental implants dominates the market, owing to increase in prevalence of dental deformities and rise in number of dental clinics.

Factors such as increase in prevalence of congenital deformities, rise in number of cosmetic surgeries, and rise in geriatric population drive the growth of market. In addition, advancement in cosmetic implants technologies drive the growth of the cosmetic implants market.

North America is expected to witness the highest growth, in terms of revenue, owing to rise in prevalence of dental deformities, surge in presence of key players for R&D in cosmetic implants technology, and increase in number of dental hospitals. However, high cost of treatments and potential risk of implant malfunction are expected to hamper the market growth during the cosmetic implants market forecast period.

The total market value of cosmetic implants market is $9,240.8 million in 2020.

The forecast period in the report is from 2021 to 2030

The market value of cosmetic implants Market in 2021 was $10,134.4 million

The base year for the report is 2020.

Yes, cosmetic implants companies are profiled in the report

The top companies that hold the market share in cosmetic implants market are 3M Company, AbbVie Inc., Danaher Corporation, Dentsply Sirona Inc., GC Aesthetics plc., Institut Straumann AG, Johnson & Johnson, Polytech Health & Aesthetics GmbH, Sientra Inc., and Zimmer Holdings Inc.

The key trends in the cosmetic implants market are increase in prevalence of congenital facial deformities, including cleft lip and cleft palate.

Loading Table Of Content...