Coupled Inductor Market Research, 2032

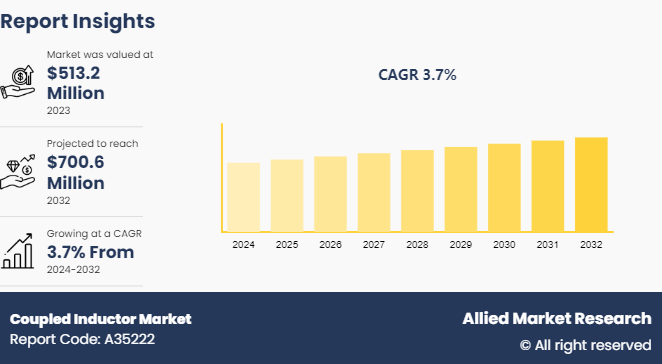

The Global Coupled Inductor Market was valued at $513.2 million in 2023, and is projected to reach $700.6 million by 2032, growing at a CAGR of 3.7% from 2024 to 2032.

Market Introduction and Definition

A coupled inductor is a device that has two or more windings on the same core and transfers energy from one to the other. They are utilized in numerous electrical applications, such as power conversion circuits, radio broadcasts, and long-distance power distribution. Further, coupled inductors are primarily used for energy storage, noise filtering, and signal coupling. In power electronics, coupled inductors enhance the efficiency of DC-DC converters by providing better energy transfer and reducing the overall size of the circuit. They are integral in applications ranging from consumer electronics and automotive systems to telecommunications and industrial equipment. The performance of coupled inductors is often determined by factors such as inductance value, coupling coefficient, core material, and current handling capabilities.

Key Takeaways

- By type, the multilayer coupled inductor segment dominated the coupled inductor industry size in terms of revenue in 2023 and is anticipated to grow at a high CAGR during the forecast period.

- By application, the converter segment dominated the coupled inductor market size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

- By end user, the market is dominated by the consumer electronics segment in the year 2023, and is expected to dominate the coupled inductor market forecast4ed period.

- Region-wise, Asia-Pacific generated the largest revenue in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

- On May 12, 2023: The German Federal Ministry for Economic Affairs and Energy (BMWi) allocated €50 million in funding for a collaborative research initiative focusing on high-efficiency coupled inductors for wireless power transfer. This funding will be utilized to develop innovative inductor designs with improved power density and thermal management, aiming to achieve faster and safer wireless charging for electric vehicles and various consumer electronics devices.

- On May 26, 2023: The Japanese Ministry of Economy, Trade, and Industry (METI) launched a national program to accelerate the adoption of wireless power transfer technology in healthcare and industrial automation. The program aims to establish technical standards and safety guidelines for wireless charging, while also supporting research and development of coupled inductors with higher efficiency and smaller form factors to enable seamless integration into medical devices and industrial robots.

- On June 8, 2023: The AirFuel Alliance, a global consortium of companies developing wireless power standards, announced a new certification program for coupled inductors used in resonant wireless charging systems. This program aims to ensure the interoperability and safety of wireless charging products across different brands and devices, fostering consumer confidence and driving market adoption.

- On June 20, 2023: The Electronics and Telecommunications Research Institute (ETRI) unveiled a new coupled inductor design that achieves a record-high power transfer efficiency of 95%. This breakthrough could significantly improve the performance and charging speed of wireless power transfer systems, paving the way for wider adoption in consumer electronics and electric vehicles.

Key Market Dynamics

The coupled inductor market is experiencing significant growth driven by the increasing demand for high-efficiency power management solutions in consumer electronics and industrial applications. Moreover, the rise in adoption of electric vehicles (EVs) necessitates advanced power converters, which, in turn, boosts the demand for coupled inductors. The expansion of renewable energy systems, such as solar and wind power, also contributes to market growth due to the need for efficient energy conversion and storage solutions. Additionally, technological advancements in 5G networks and the proliferation of Internet of Things (IoT) devices further propel the market, as these technologies require robust and efficient power management components.

Furthermore, the trend towards miniaturization in electronic devices increases the need for compact and efficient inductors. The multilayer segment, in particular, is gaining traction due to its superior performance in high-density power applications. However, the market faces challenges such as fluctuating raw material prices and the complexity of manufacturing high-precision inductors, which can restrain growth. Nonetheless, the increasing focus on developing smart grids and advancements in semiconductor technology present significant opportunities for market expansion. The Asia-Pacific region dominates the market, fueled by its strong electronics manufacturing base and rapid technological advancements, particularly in countries like China, Japan, and South Korea.

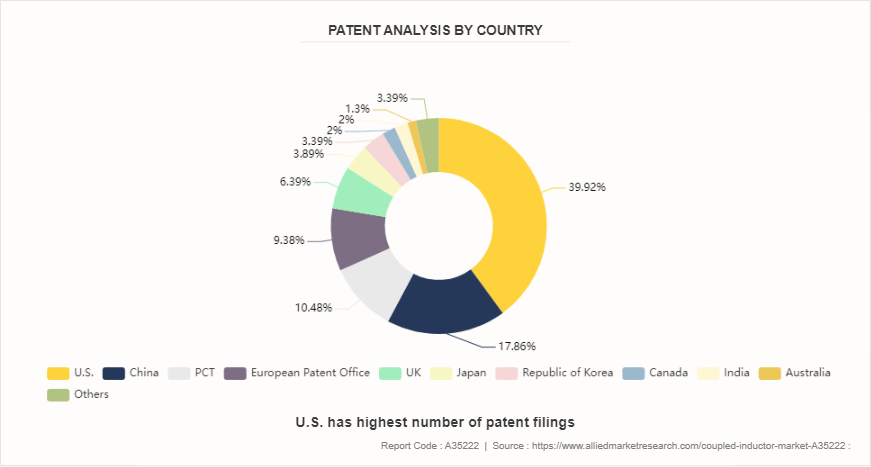

Patent Analysis of the Global Coupled Inductor Market

The global coupled inductor sector analysis is segmented according to the patents filed in China, the U.S., the Republic of Korea, Japan, PCT, the European Patent Office, Germany, the UK, India, and Canada. China has the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed/accepted by registration authorities in many of the developing regions/countries. Therefore, this region has a maximum number of patent filings. This applicant was followed by the coupled inductor for US Market., which registered over 1821 during the period of 2015 to 2024.

Market Segmentation

The coupled inductor market report is segmented into type, application, and region. On the basis of type, the market is divided into multilayer coupled inductors, monolithic coupled inductors, and discrete coupled inductors. By application, the coupled inductor market insights are analyzed across converters, transformers, regulators, and others. By end user, the market is segmented into consumer electronics, telecommunication, automotive, Industrial, and others. Region-wise, the coupled inductor market data is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Regional/Country Market Outlook

By region, Asia-Pacific generated the largest revenue in the coupled inductor market in 2023, primarily due to its role as the manufacturing hub for electronic devices. Countries like China, South Korea, Japan, and Taiwan are home to leading semiconductor and electronics manufacturers who drive the production and consumption of coupled inductor memory. The region's advanced manufacturing infrastructure, coupled with significant investments in research and development, has enabled the mass production of high-quality coupled inductor at competitive prices. Furthermore, the growth of the consumer electronics market in Asia-Pacific, fueled by rising disposable incomes and increasing digitalization, has led to substantial demand for coupled inductor in smartphones, laptops, and other devices. The presence of key players and favorable government policies supporting technological advancements and industrial growth also contribute to Asia-Pacific's leadership in the coupled inductor market.

Competitive Landscape

The coupled inductor market share by companies is analyzed across Samsung Electronics, Kioxia (formerly Toshiba Memory), Western Digital, Micron Technology, SK Hynix, Intel Corporation, Yangtze Memory Technologies Co. (YMTC), Solidigm (formerly Intel's NAND business), Phison Electronics, and Silicon Motion. Other top coupled inductor company list includes Marvell., Realtek, and others.

Recent Key Strategies and Developments

- On February 28, 2024: Samsung Electronics announced the mass production of its 8th-generation V-NAND (Vertical NAND), a significant advancement in coupled inductor technology. This new generation offers a 24% improvement in bit productivity compared to the previous generation, enabling higher storage capacities and faster read/write speeds for a wide range of applications, including data centers, enterprise storage, and consumer electronics. Samsung's V-NAND technology stacks NAND cells vertically, increasing density and performance while reducing power consumption.

- On April 12, 2024: Kioxia, formerly Toshiba Memory, unveiled the world's first 2TB UFS (Universal Flash Storage) 4.0 storage solution for mobile devices. UFS 4.0 doubles the performance of UFS 3.1, the current standard for high-speed mobile storage. This new technology will enable faster app launches, smoother multitasking, and higher-quality video recording on smartphones and other mobile devices, enhancing the overall user experience.

- On May 08, 2024: Western Digital and Micron Technology announced a strategic collaboration to co-develop next-generation coupled inductor technology. This partnership aims to combine the expertise and resources of both companies to accelerate the development of innovative NAND solutions that address the growing demand for data storage in various industries. The collaboration will focus on improving NAND performance, density, and cost-effectiveness, ultimately benefiting consumers with faster and more affordable storage devices.

Key Sources Referred

- Semiconductor Industry Association (SIA)

- SEMI.org

- IEEE Electron Devices Society (EDS)

- U.S. Department of Energy

- Global Semiconductor Alliance (GSA)

- World Economic Forum

- European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

- This coupled inductor industry report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the coupled inductor market analysis from 2024 to 2032 to identify the prevailing coupled inductor market opportunities.The coupled inductor market value is in $ billion.

- The market research is offered along with information related to key coupled inductor growth drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- The important keywords related to market are magnetic coupling, mutual inductance, and flyback converter.

- In-depth analysis of the coupled inductor market segmentation assists to determine the prevailing market opportunities.

- Coupled inductor market size by country in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coupled inductor market trends, key players, market segments, application areas, and market growth strategies.

Coupled Inductor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 700.6 Million |

| Growth Rate | CAGR of 3.7% |

| Forecast period | 2024 - 2032 |

| Report Pages | 270 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Phison Electronics, Intel Corporation, SK Hynix, Western Digital, Samsung Electronics, Micron Technology, Kioxia, Silicon Motion, Yangtze Memory Technologies Co., Solidigm |

The coupled inductor market was valued at $513.2 million in 2023 and is estimated to reach $700.6 million by 2032, exhibiting a CAGR of 3.7% from 2024 to 2032.

By region, Asia-Pacific generated the largest revenue in the coupled inductor market in 2023, due to its robust electronics manufacturing sector and rapid technological advancements. Countries like China, Japan, South Korea, and Taiwan are major hubs for electronics production, contributing significantly to the demand for coupled inductors. The region's strong presence in the automotive industry, particularly in electric vehicles (EVs), also drives the market for coupled inductors, as these comp

The global coupled inductor market is witnessing trends like increased adoption in automotive and industrial applications, driven by the rise in electric vehicles and automation. Demand for compact, energy-efficient power solutions is promoting technological advancements, including 3D packaging and higher frequency inductors, supporting the growth of IoT and renewable energy systems.

By application, the converter segment dominated the coupled inductor market size in terms of revenue in 2023 due to the widespread use of power converters in various electronic devices and systems. Coupled inductors are essential in DC-DC converters, which are critical components in power supply units for consumer electronics, industrial equipment, and automotive applications

The coupled inductor market share by companies is analyzed across Samsung Electronics, Kioxia (formerly Toshiba Memory), Western Digital, Micron Technology, SK Hynix, Intel Corporation, Yangtze Memory Technologies Co. (YMTC), Solidigm (formerly Intel's NAND business), Phison Electronics, and Silicon Motion

Loading Table Of Content...