The global courier services market was valued at $381 billion in 2021, and is projected to reach $658.3 billion by 2031, growing at a CAGR of 5.7% from 2022 to 2031.

Courier service is a facility or service for fast & door to door pickup and delivery of goods or documents from one place to another. A company that provides such a service is referred as courier company. A courier company charges a rate for the package based upon the weight of the package and urgency of delivery of the package. In addition, courier services are recognized for their security, speed, swift delivery, and tracking features. Moreover, prominent courier service companies comprise DHL, Firstflight, United Parcel Services, Bluedart, and others.

The growth of the global courier services market has propelled due to development of e-commerce industry and increase in demand for fast delivery of packages. However, poor infrastructure and higher logistics costs is the factor hampering the growth of the market. Furthermore, technological advancements are expected to offer growth opportunities during the forecast period.

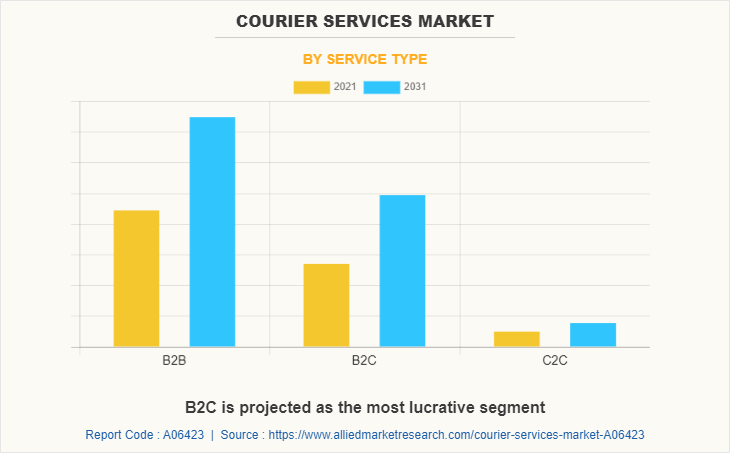

The advent of online B2B e-commerce platform is one of the primary factors driving the growth of the courier services market in the B2B segment. In addition, rise in trade of products and goods between different organizations is anticipated to fuel the growth of the market in B2B. Moreover, surge in demand for same-day delivery services from business customers further propels the demand for B2B courier services. Furthermore, small businesses are increasingly looking for faster courier delivery service, which is further expected to fuel the segmental growth.

The surge in inclination of consumers toward purchasing products using e-commerce platforms is the primary factor driving the growth of the courier services market in the B2C segment. For instance, leading online e-commerce platforms, such as Amazon, Inc., Flipkart, and others are offering one-day courier delivery option to their customers to attract more customers and provide them with a faster buying experience. In addition, the ongoing substitution of stationary retail sales by online sales through e-commerce platforms has led to a significant increase in B2C courier deliveries, which fuels the market growth. Moreover, rise in shipments coupled with consumer demand for faster delivery service further propels the growth of B2C courier services.

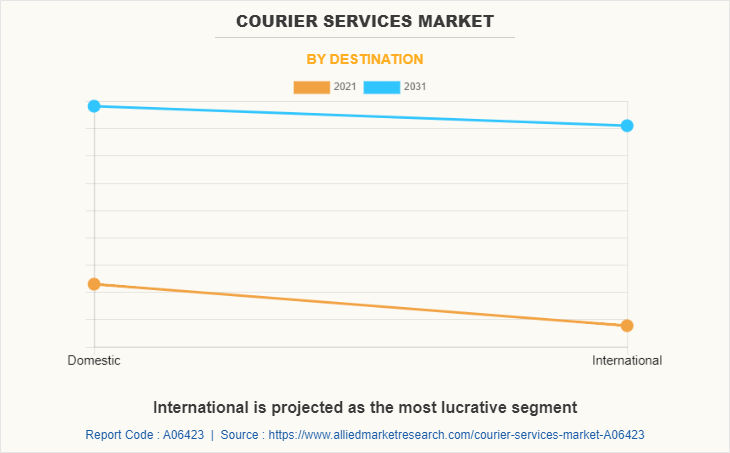

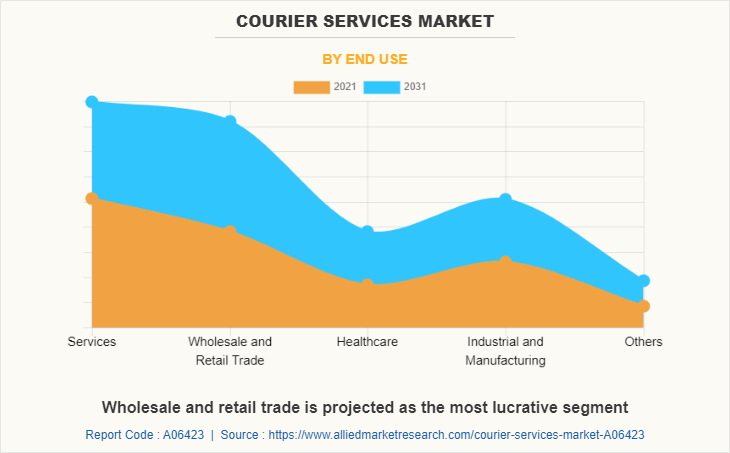

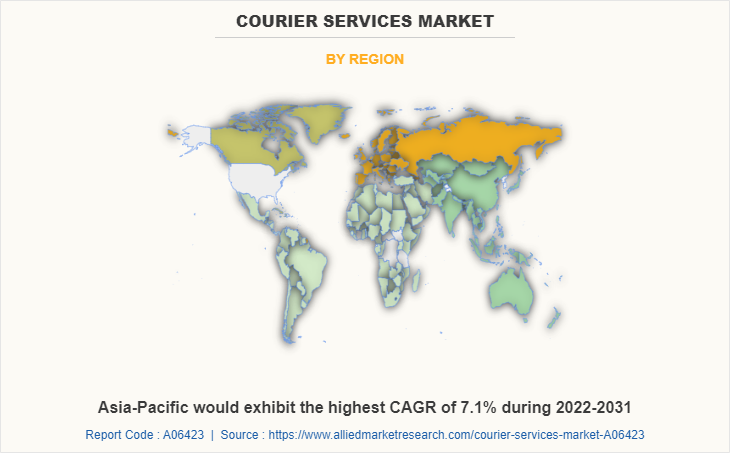

The courier services market is segmented on the basis of service type, destination, end use, and region. By service type, it is classified into B2B, B2C, and C2C. By destination, it is bifurcated into domestic and international. By end use, it is categorized into services, wholesale & retail trade, healthcare, industrial & manufacturing, and others. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the courier services market report comprises DB SCHENKER, Deutsche Post DHL Group, DSV A/S, FedEx, Nippon Express Co., Ltd., PostNL, Qantas Courier Limited, SF Express Co. Ltd., SG Holdings Co., Ltd., Singapore Post Limited, United Parcel Service of America, Inc., and Yamato Transport Company, Ltd.

Development of e-commerce industry

E-commerce refers to buying and selling of goods by utilizing internet. E-commerce is a virtual store where goods & services do not require any physical space and are sold through websites. The e-commerce industry utilizes logistics services to manage and oversee supply chain of e-commerce companies, thus, allowing these companies to focus on marketing and other business operations. Easy accessibility, convenient shopping experiences, and heavy discounts & offers make e-commerce a popular medium for purchase of a wide variety of products. These factors have collectively contributed toward growth of the market for e-commerce services.

In addition, COVID-19 contributed in development of the e-commerce industry across the globe. Several governments imposed lockdown in their regions to restrict spread of the virus. As there was no access to physical marketplace, people started to purchase goods or products online, which, in turn, resulted in development of the e-commerce sector.

Moreover, rise of the e-commerce industry has resulted in increase in the number of parcels being delivered per day as well as the increase in the number of locations where package needs to be delivered. In addition, consumers are also demanding for delivery of their parcels as fast as possible as they place order on e-commerce website. Courier companies have started to use GPS and other technologies to ensure timely delivery of goods or products to customers. Thus, development of e-commerce industry propels growth of the market during the forecast period.

Increase in demand for fast delivery of packages

With the advent in online shopping along with the customer’s inclination toward buying products through an online source, the demand for better and efficient delivery service for the products has increased. With the advent in the COVID-19 pandemic, customer’s preference toward online shipping of daily necessities has increased, which has supplemented the growth of the courier services market. For instance, there has been a spike in the e-grocery orders in China due to consumer’s inclination toward e-commerce companies such as JD.com, Alibaba Group and MTDP to shop virtually for their household needs. This is practiced to avoid face-to-face contact among individuals during the pandemic. In addition, various means to deliver a package such as by drones or by autonomous vehicles have increased due to demand for fast delivery of packages, which further boosts the growth of the courier services industry across the globe.

Poor infrastructure and higher logistics costs

The availability and quality of infrastructure is one of the key components in determining the courier services environment of a country. It can be observed that in terms of infrastructure, courier services suffer from limited capacity and capability. These include significant inefficiencies in transport, poor condition of storage infrastructure, complex tax structure, low rate of technology adoption, and poor skills of delivery professionals. Poor road transportation infrastructure is one of the key issues affecting the courier services market. Moreover, metropolis traffic congestion is a major issue in population concentrated in urban areas for courier services in the market. In addition, airfreight transport is very important for delivery of items, especially for international parcel deliveries that are time bound, thus lack of adequate airfreight may delay delivery. Moreover, as many countries lack postal codes and rely on local landmarks for addresses, shipping companies often have trouble delivering parcels successfully. Furthermore, factors, such as lack of skilled manpower, poor IT infrastructure, and over-reliance on cash-on-delivery (CoD) payment, also affect the growth of courier services market in several countries across the globe. Therefore, poor infrastructure is anticipated to hinder the growth of the market.

Technological advancements

Surge in technological advancements, such as increase in penetration of Internet of things (IoT), GPS tracking, and others boost the growth of the courier services market. Moreover, some of the courier service providers are increasing their spending and using technologically advanced systems for delivery enhancement. For instance, in November 2019, express courier service provider, Ninja Van, invested in apps and technologies to provide better experiences to customers.

Ninja Van joined forces with ride hailing company, Grab, to provide nationwide delivery service through GrabExpress. Customers can send goods on Grab’s app with real-time tracking. Furthermore, technological advancements, including the utilization of digital technologies with crowdsourced delivery models create a positive outlook for the market. These technologies aid the service providers in increasing their overall operational efficiency and meeting the requirements of the customers effectively. Furthermore, drones have evolved significantly in the past few years and offer a smart mobility alternative for businesses and consumers across the globe. The trend for delivery of packages by means of drones and other autonomous vehicles has increased due to technological advancement along with the demand for faster delivery of packages. Various companies providing drone delivery services have made innovations and developments to deliver packages to longer distances without human involvement, which further boosts the market growth. Thus, rise in technological advancements is expected to offer future growth opportunities for the courier services market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the courier services market analysis from 2021 to 2031 to identify the prevailing courier services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the courier services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global courier services market trends, key players, market segments, application areas, and market growth strategies.

Courier Services Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 658.3 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 286 |

| By Service Type |

|

| By Destination |

|

| By End Use |

|

| By Region |

|

| Key Market Players | SF Express (Group) Co. Ltd., Nippon Express, SG Holdings Co. Ltd, Yamato Holdings Co. Ltd, United Parcel Service Inc., Singapore Post Ltd., Qantas Courier Limited, PostNL NV, FedEx Corporation, DB Schenker, Deutsche Post DHL Group, DSV AS |

Analyst Review

The global courier services market is expected to witness significant growth due to development of e-commerce industry and increase in demand for fast delivery of packages.

Surge in technological advancements, such as increase in penetration of Internet of things (IoT), GPS tracking, and others boost the growth of the courier services market. Moreover, some of the courier service providers are increasing their spending and using technologically advanced systems for delivery enhancement. For instance, in November 2019, express courier service provider, Ninja Van, invested in apps and technologies to offer better experiences to customers.

Increase in cross-border courier delivery services for documents and parcels is one of the key factors driving the growth of the courier services market in the international segment. In addition, development of cross-border trade channels has enhanced the adoption of international trade and B2C shipments, which is further anticipated to boost the growth of the courier services market in the international segment. Moreover, expansion of leading market players in international courier services further fosters the market growth. The key players of the market focus on introducing technologically advanced products to remain competitive in the market.

The global courier services market was valued at $381.0 billion in 2021 and is projected to reach $658.3 billion in 2031, registering a CAGR of 5.7%.

The leading companies in the market include DB SCHENKER, Deutsche Post DHL Group, DSV A/S, FedEx, Nippon Express Co., Ltd., PostNL, Qantas Courier Limited, SF Express Co. Ltd., SG Holdings Co., Ltd., Singapore Post Limited, United Parcel Service of America, Inc., and Yamato Transport Company, Ltd.

The leading application is services.

The largest regional market is Asia-Pacific.

The upcoming trends include greater demand for e-commerce fulfilment and adoption of advanced technologies for improved efficiency.

Loading Table Of Content...