Cranes Market Overview

The Global Cranes Market size was valued at $35 billion in 2020, and is projected to reach $52.7 billion by 2032, growing at a CAGR of 3.2% from 2023 to 2032. Leading players in the cranes industry are pursuing acquisition strategies to expand their market share, driving consolidation across the global market. Additionally, the integration of automation technologies has enhanced crane efficiency, enabling features such as remote operation and predictive maintenance, which improve performance and reduce downtime.

Market Dynamics & Insights

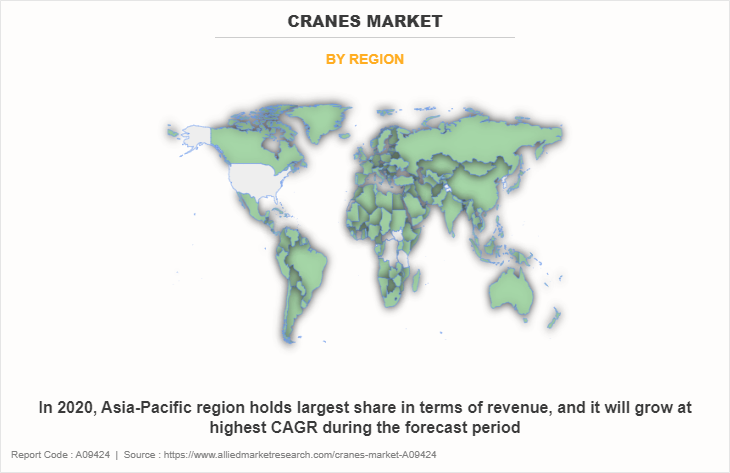

- The cranes industry in Asia-Pacific held a significant share of over 50.2% in 2020.

- The cranes industry in U.S. is expected to grow significantly at a CAGR of 2.7% from 2023 to 2032.

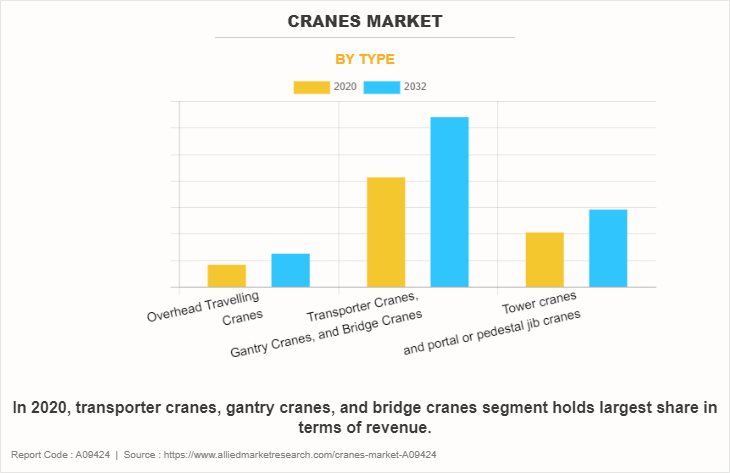

- By type, transporter cranes, gantry cranes, and bridge cranes is one of the dominating segments in the market and accounted for the revenue share of over 58.7% in 2020.

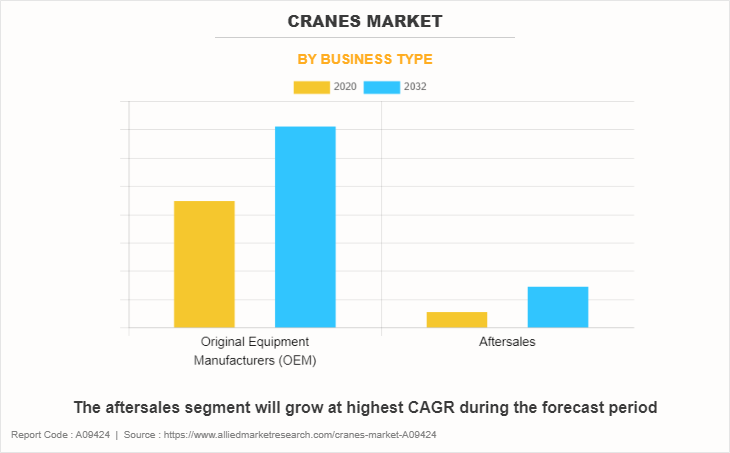

- By business type, aftersales segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $35 Billion

- 2032 Projected Market Size: $52.7 Billion

- CAGR (2022-2032): 3.2%

- Asia Pacific: Largest market in 2020

- Asia Pacific: Fastest growing market

What is meant by Cranes

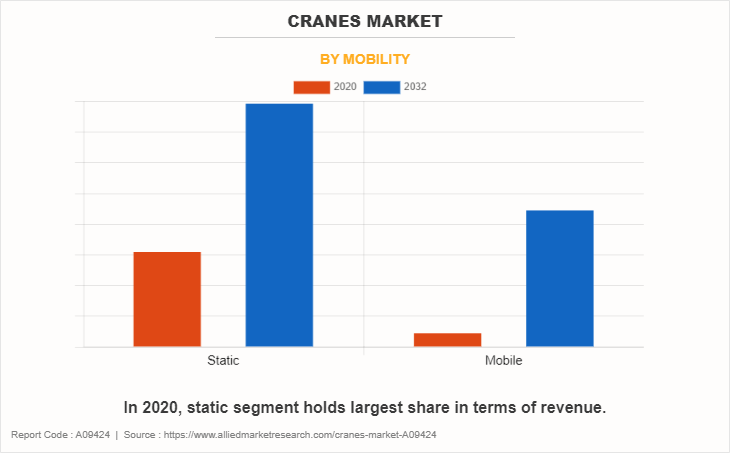

A Crane is utilized for lifting heavy materials and transporting them to another place with the help of hoisting mechanism. Cranes are majorly used in various sectors such as construction, manufacturing, and shipbuilding industries for safe and efficient material handling applications. Depending on their mobility characteristics, they are classified into two types, static and mobile cranes. On the basis of their type, they are available as tower cranes, overhead travelling cranes, girder cranes, bridge cranes, and others.

Rise in focus toward public and private partnerships (PPPs) can help in overcoming the gap between infrastructural investment, which is expected to drive the cranes market growth. PPPs have been implemented in various countries, such as South Korea and India, which acts as a key driving force of the global market. In addition, the surge in investments through private channels assists in boosting the infrastructure industry, thereby augmenting the growth of the market. Furthermore, increase in focus on service and aftermarket industry is expected to fuel the growth of the market. The major players such as Liebherr and Manitowoc are focusing on development of repair, real-time diagnostics, training, and other programs to enhance their crane service capabilities and assist customers to attain maximum productivity from their products, which contribute toward the growth of the market.

However, unavailability of skilled labor in the manufacturing industry is one of the restraining factors of the of the market. This is attributed to the fact that overhead cranes have complicated configurations, and achieving desirable results requires extensive training of the operator. In addition, fluctuations in raw material prices hinder the growth of the market. Furthermore, the outbreak of the COVID-19 pandemic has halted the production and sales of cranes, owing to the prolonged lockdown in major global countries, such as the U.S., Italy, and the UK. This has hampered the growth of the cranes market significantly within the past few months.

On the contrary, various companies are investing in domestic manufacturing in many developing countries such as India and Sri Lanka, which is expected to provide lucrative opportunities to small and new crane manufacturers to expand their business capabilities during the forecast period.

The transporter cranes, gantry cranes, and bridge cranes segment was the highest revenue contributor to the market in 2020, and it will grow with a CAGR of 3.5%. Overhead crane or industrial crane is majorly utilized for material handling applications in industrial spaces. It consists of a hoist and a trolley attached to a support structure, which is called a girder. The girder allows the trolley and the hoist to travel from side to side along the length of the crane. Gantry cranes and bridge cranes are majorly utilized in industrial sites such as automobile assembly, steel manufacturing, ports, and shipbuilding. On the contrary, transporter cranes are called as mobile cranes or truck cranes, and are majorly used in construction, utilities, and other applications.

The static segment was the highest revenue contributor to the market in 2020 with a CAGR of 3.1%. The mobile segment is estimated to grow at a significant CAGR of 3.4% during the forecast period. Static types of cranes include overhead travelling cranes, tower cranes, bridge cranes, girder cranes, and portal or pedestal jib cranes. These types of cranes cannot be transported without dismantling. Mobile cranes consist of truck cranes, rough terrain cranes, crawler cranes, and all terrain cranes. Mobile cranes are equipped with hydraulic telescopic arm or lattice booms for lifting and transporting medium to heavy weight loads.

Cranes Market Segment Overview

The original equipment manufacturers (oem) segment was the highest revenue contributor to the market in 2020, with a CAGR of 3.1%. The aftersales segment will grow at a significant CAGR of 3.6% during the forecast period. OEM companies mostly manufacture and develop various parts and accessories of an equipment that are marketed under other brand names. However, major OEMs may utilize engines and other equipment parts provided by other specialized manufacturing companies.Aftersales services include repairing, maintenance, and replacement of parts & accessories. The aftersales cranes market is not only majorly operated by the equipment providers but may also include local workshops. The aftersales support improves the overall lifecycle of the equipment and assists in proper functioning of the mobile cranes for a prolonged time.

Asia-Pacific was the highest revenue contributor in 2020, and is estimated to grow with a CAGR of 3.6%. Asia-Pacific includes China, India, Japan, Australia, and rest of Asia-Pacific. China garner the maximum share within the cranes market in the region, owing to the highly developed manufacturing infrastructure and the focus toward technological advancements in the crane product portfolio.

The global cranes market is segmented on the basis of type, mobility, business type, and region. On the basis of type, the market is segregated into overhead travelling cranes; transporter cranes, gantry cranes, & bridge cranes; tower cranes; and portal or pedestal jib cranes. By business type, the market is divided into original equipment manufacturer (OEM) and aftersales. Depending on mobility, the market is classified into static and mobile.

The global cranes market share is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific is expected to hold the largest market share throughout the study period; however, LAMEA is expected to grow at the fastest rate.

Cranes Market Competition Analysis

The key market players profiled in the report include Cargotec Corporation, Kito Corporation, Konecranes Plc, Liebherr-International AG, Manitowoc Company, Inc., SANY Heavy Industry Co. Ltd., Tadano Ltd., Terex Corporation, Xuzhou Construction Machinery Group Co., Ltd., and Zoomlion Heavy Industry Science and Technology Co., Ltd.

Many competitors in the cranes market have adopted acquisition as their key developmental strategy to strengthen their foothold and upgrade their product technologies. For instance, Cargotec, through its business division Hiab, announced the acquisition of Effer loader cranes business from the CTE Group. The acquisition of Effer complements the loader cranes portfolio and expands its range of heavy cranes, such as the more than 100 ton segment. In addition, Konecranes launched two new series of cranes, such as the S-series and M-series. This cranes provide real-time data and insights through the Konecranes consumer portal, which increases the usage visibility and assists in anticipating maintenance requirements. Furthermore, Manitowoc opened a new facility in the Philippines, which consists of a warehouse and a workshop which extends over 2,900 m2 area. The new facility enhances the foothold of the company in the Philippines.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging global cranes market trends and dynamics.

- In-depth cranes market analysis is conducted by constructing market estimations for the key market segments between 2020 and 2032.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive cranes market opportunity analysis of all the countries is also provided in the report.

- The global cranes market forecast analysis from 2023 to 2032 is included in the report.

- Key players within the market are profiled in this report and their strategies are analyzed thoroughly, which helps to understand the competitive outlook of the cranes industry.

Cranes Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 52.7 billion |

| Growth Rate | CAGR of 3.2% |

| Forecast period | 2020 - 2032 |

| Report Pages | 231 |

| By Type |

|

| By Mobility |

|

| By Business Type |

|

| By Region |

|

| Key Market Players | Terex Corporation, LIEBHERR-INTERNATIONAL AG, Tadano Ltd., Zoomlion Heavy Industry Science and Technology Co., Ltd., XUZHOU CONSTRUCTION MACHINERY GROUP CO., LTD., Kito Corporation, Manitowoc Company, Inc., KONECRANES PLC., SANY HEAVY INDUSTRY CO. LTD., Cargotec Corporation |

Analyst Review

China is the largest shareholder of the cranes industry, owing to the presence of large manufacturing infrastructure and a strong foothold in the construction industry. According to the Oxford Economics, around two-thirds of construction industry growth will be accounted by the U.S., China, India, and Indonesia. China has various technological development programs to boost the sales of domestically produced cranes globally through the one belt, one road initiative, and Made in China 2025. China has largely recovered from the COVID-19 pandemic and the resulted lockdowns. However, the major players such as Konecranes Plc based in Finland, Columbus McKinnon Corporation based in the U.S., and Kito Cranes headquartered in Japan have a strong presence in the cranes market.

Moreover, the market is expected to witness growth during the forecast period, due to the upsurge in product developments in compact sized crane technology. In addition, the developments in electrically operated and robotic cranes are anticipated to boost the demand for cranes in the global market.

Many competitors in the cranes market have adopted acquisition as their key developmental strategy to expand their geographical foothold and upgrade their product technologies. For instance, in July 2022, Scandinavia based Nordic Crane acquired 70% of Danish crane company Kran-Kompagniet. Nordic Crane will act as supplier of all types of lifts in Norway, Sweden, and Denmark.

In addition, in June 2022, International tower crane specialist France-based UPERIO Group has acquired U.S. based Compass Equipment Holdings. The aim of the acquisition is expansion of equipment segments sales, rental, and service in U.S. Furthermore, in June 2022, UPERIO Group acquired LaurentKeller, a crane company based in France. This acquisition aimed to strengthen the foothold of the company in France.

The global cranes market was valued at $35,035.3 million in 2020

Overhead Travelling Cranes Transporter Cranes, Gantry Cranes, and Bridge Cranes, Tower cranes and portal or pedestal jib cranes

Asia-Pacific is the largest regional market for Cranes

It is projected to reach $52,675.5 million by 2032

Key companies profiled in the report include Cargotec Corporation, Kito Corporation, Konecranes Plc, Liebherr-International AG, Manitowoc Company, Inc., SANY Heavy Industry Co. Ltd., Tadano Ltd., Terex Corporation, Xuzhou Construction Machinery Group Co., Ltd., and Zoomlion Heavy Industry Science and Technology Co., Ltd.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically covers company overview, geographical presence, and market dominance (in terms of revenue and volume sales).

Based on the business type, in 2020, the original equipment manufacturers (OEM) segment generated the highest revenue, of the market.

The base year considered in the global cranes market is 2022.

Loading Table Of Content...

Loading Research Methodology...