Credit Bureaus Market Research, 2032

The global credit bureaus market was valued at $124.4 billion in 2023, and is projected to reach $385.6 billion by 2032, growing at a CAGR of 13.4% from 2024 to 2032. The credit bureaus market is experiencing growth due to the surge in customers credit demand, expansion of financial inclusion, and regulatory requirements.

Market Introduction and Definition

Credit bureaus are organizations that collect and maintain consumer credit information. Its primary function is to compile credit reports that detail individuals' borrowing and repayment histories, which lenders use to evaluate creditworthiness. It gathers data from various sources, such as banks, credit card companies, and other financial institutions. This data includes payment histories, outstanding debts, and public records linked to bankruptcies or liens.

In addition, there are three major credit bureaus in the U.S such as Equifax, Experian, and TransUnion. These agencies provide credit reports to lenders, employers, and consumers themselves, aiding in the decision-making processes for loans, credit cards, and other financial services. They use this information to generate credit scores, numerical representations of a consumer's credit risk.

Furthermore, credit bureaus play a key role in the financial ecosystem by promoting transparency and trust between borrowers and lenders. They help to reduce the risk of lending, allowing for more informed credit decisions. Consumers benefit by having their credit behavior accurately tracked and reported, which can lead to better borrowing terms when they demonstrate responsible financial management.

Key Takeaways

The credit bureaus market size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major credit bureaus industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global credit bureaus market share and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The surge in consumer credit demand is a significant driving force behind the growth of the credit bureaus industry. As individuals increasingly seek financing options such as mortgages, auto loans, personal loans, and credit cards, the necessity for detailed and accurate credit reporting becomes more pronounced. With the growing number of credit applications, lenders require reliable data to assess the creditworthiness of potential borrowers. In addition, the comprehensive credit reporting services provided by credit bureaus play a significant role in process by offering a detailed view of an individual's credit history, including payment records, outstanding debts, and overall credit behavior, thereby drives the credit bureaus market growth. However, data privacy concerns significantly impact the credit bureaus market by presenting substantial challenges. As regulatory frameworks such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) become more stringent, credit bureaus must navigate complex requirements for data handling and protection.

Furthermore, expansion into emerging markets presents a significant opportunity for credit bureaus as developing countries enhance their financial inclusion efforts and consumer credit activities. Moreover, the many emerging economies are experiencing rapid economic growth, increased urbanization, and a rising middle class, which is fueling demand for financial products such as loans, credit cards, and mortgages, which future drive the credit bureaus sector growth.

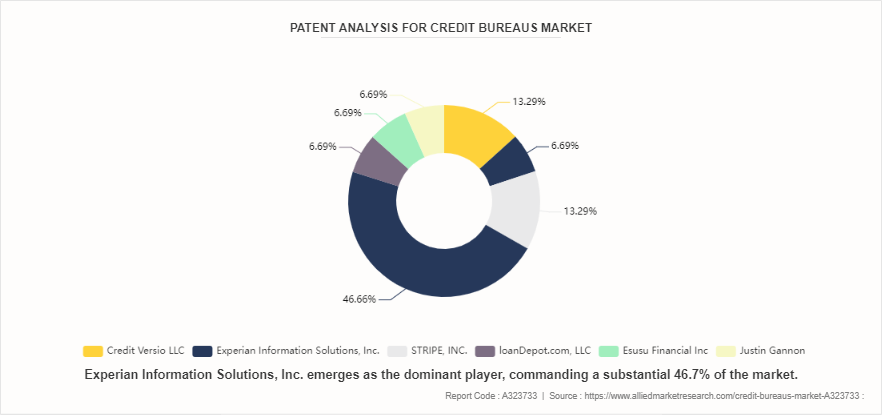

Patent Analysis for Credit Bureaus Market

According to World Intellectual Property Organization (WIPO) , the credit bureaus market demonstrates a diverse landscape with varied market share distribution. Experian Information Solutions, Inc. emerges as the dominant player, commanding a substantial 46.7% of the market. This significant share underscores Experian's extensive influence and leading position in the credit information and reporting sector. In addition, the Credit Versio LLC and Stripe, Inc. both hold 13.3% of the market each. These entities highlight their growing impact within the industry, reflecting their innovative approaches and solutions in credit management and financial services. Furthermore, loanDepot.com, LLC, Esusu Financial Inc, and Justin Gannon each contributed 6.7% to the market. These credit bureauscompanies bring specialized services and unique value propositions to the credit bureau ecosystem, indicating a broader spectrum of solutions available to consumers and businesses alike.

Market Segmentation

The credit bureaus market outlook is segmented into product/service, report type, end user, and region. On the basis of product/service, the market is divided into credit score, credit reports and credit check services. As per report type, the market is segregated into corporate report and individual report. On the basis of end user, the market is classified into commercial and consumer. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The credit bureaus market exhibits diverse regional dynamics driven by varying economic conditions, regulatory environments, and technological advancements. North America remains a significant player owing to its mature financial sector and high adoption of advanced credit scoring technologies.

In addition, Europe shows robust growth, with increasing regulatory emphasis on data protection and credit transparency, which boosts the demand for credit bureau services, and drives credit bureaus market forecast. Furthermore, Asia-Pacific, rapid economic development, expanding middle-class populations, and growing financial inclusion are offering lucartive opportunities to the credit bureaus providers expansion, though challenges such as regulatory fragmentation and data privacy concerns persist.

Industry Trends

In October 2022, Federal Housing Finance Agency (FHFA) announced that the Enterprises would allow lenders to use either tri-merge credit reporting, which includes credit reports from all three nationwide consumer reporting agencies, or bi-merge credit reporting, which includes credit reports from two of these agencies. The FHFA anticipates that this update will foster credit bureaus market competition while ensuring robust risk management.

In October 2022, Federal Housing Finance Agency (FHFA) announced the validation and approval of two new credit score models, FICO 10T and VantageScore 4.0, for use by Enterprises. In addition, the implemented, lenders will be required to provide both FICO 10T and VantageScore 4.0 credit scores, when available, with each single-family loan sold to Enterprises. This announcement followed an extensive review process of Enterprises' credit score requirements, as mandated by statute and regulation. During this period, the Enterprises conducted rigorous testing of the submitted models. Both newly approved models surpassed the required thresholds for accuracy, reliability, and integrity.

Competitive Landscape

The credit bureaus market players include Fidelity Information Services, Intuit Inc., S&P Global Inc., Experian Credit Information Company of India Private Limited, CRIF High Mark Credit Information Services Pvt. Ltd, Equifax Inc., TransUnion LLC, and LexisNexis Risk Solutions. Other credit bureaus makret players include FICO, TransUnion CIBIL Limited and Creditinfo Group hf.

Recent Key Strategies and Developments

In March 2022, Equifax acquired Data-Crédito, the largest consumer credit reporting agency in the Dominican Republic. By integrating the power of the Equifax Cloud into credit reporting and scoring in the Dominican Republic, Equifax aims to provide financial institutions with enhanced insights into consumers' financial profiles. This will support the lending process and help responsibly extend new mainstream financial services opportunities to underbanked individuals

In March 2022, the three major nationwide credit reporting agencies (NCRAs) Equifax, Experian and TransUnion announced a major change to the reporting of medical collection debt, aimed at assisting consumers dealing with unexpected medical expenses. This joint initiative will result in the removal of nearly 70% of medical collection debt tradelines from consumer credit reports, following extensive industry research.

Key Sources Referred

Consumer Financial Protection Bureau

Financial Conduct Authority

European Banking Authority

Reserve Bank of India (RBI)

Federal Financial Supervisory Authority

Federal Housing Finance Agency

World Intellectual Property Organization (WIPO)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the credit bureaus market analysis from 2024 to 2032 to identify the prevailing credit bureaus market opportunity.

The edit bureausmarket research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the credit bureaus market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global credit bureaus market trends, key players, market segments, application areas, and credit bureaus platform growth strategies.

Credit Bureaus Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 385.6 Billion |

| Growth Rate | CAGR of 13.4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Product/Service |

|

| By Report Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Equifax Inc., Fidelity Information Services, Intuit Inc., Experian Credit Information Company of India Private Limited, LexisNexis Risk Solutions, CRIF High Mark Credit Information Services Pvt. Ltd, Creditinfo Group HF, S&P Global Inc., TransUnion LLC, TransUnion CIBIL Limited, FICO |

The global credit bureaus market size was valued at $124.4 billion in 2023.

By report type, the individual report segment held the largest market share in 2023.

North America is the largest regional market for credit bureaus.

The global credit bureaus market is expected to reach $385.6 billion by 2032.

Fidelity Information Services, Intuit Inc., S&P Global Inc., Experian Credit Information Company of India Private Limited, CRIF High Mark Credit Information Services Pvt. Ltd, Equifax Inc., TransUnion LLC, and LexisNexis Risk Solutions.

Loading Table Of Content...