Crop Reinsurance Market Research, 2032

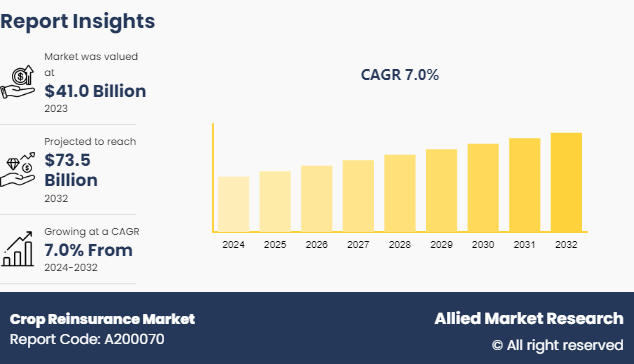

The global crop reinsurance market was valued at $41.0 billion in 2023 and is projected to reach $73.5 billion by 2032, growing at a CAGR of 7% from 2024 to 2032. Crop reinsurance is a financial arrangement where insurance companies transfer part of their risk associated with crop insurance policies to reinsurers, helping manage losses from adverse weather, pests, and other agricultural risks. This enables primary insurers to stabilize their financial performance and extend more coverage to farmers.

Market Introduction and Definition:

Crop reinsurance is a type of insurance purchased by insurance companies to manage their risk exposure in the agricultural sector. It involves transferring part of the risk associated with crop insurance policies to another insurance entity, known as the reinsurer. This helps the primary insurer stabilize its financial position by mitigating the impact of large losses resulting from widespread crop failures due to natural disasters, adverse weather conditions, or other catastrophic events. The rise in natural disasters is expected to boost growth in the crop reinsurance market. The industry assists farmers or agricultural organizations when their crops are negatively impacted or destroyed by natural catastrophes, acting as a financial buffer for crop insurers against losses arising from such incidents. The efficiency and yield of crop and livestock production within a given region or period is referred to as agricultural productivity. By reducing the financial risks connected to crop losses, crop reinsurance market share is essential to increasing agricultural output and stabilizing the farming industry. By assigning some risks to specific parties, this crop reinsurance industry shields farmers against anticipated crop yields and provides them with compensation.

Key Takeaways :

The global crop reinsurance market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the crop reinsurance market forecast and crop reinsurance market analysis 2023-2032.

More than 1, 500 product literature, industry releases, annual reports, and other such documents of major crop reinsurance industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics:

The crop reinsurance market for agriculture insurance and reinsurance is driven by several important factors that support its expansion. The occurrence and intensity of natural disasters and extreme weather events, such as heatwaves, floods, and droughts, which pose serious dangers to agricultural productivity, are among the main causes. These incidents serve as a reminder of the value of risk management techniques and the necessity of having extensive insurance coverage to safeguard the assets and means of subsistence of farmers of the crop reinsurance market.

The crop insurance and reinsurance market is mostly driven by government policies and initiatives. Subsidies, premium support, and other incentives have been put in place by numerous governments worldwide to entice farmers to use insurance solutions. These regulations support the agricultural sector's overall resilience and sustainability in addition to raising the insurance penetration rate. Furthermore, more precise risk assessment and pricing in the insurance sector have been made possible by technology developments in fields like remote sensing, data analytics, and precision farming.

With the use of these technologies, insurers and reinsurers may create solutions that are specifically suited to certain agricultural risks, making their offerings more appealing and relevant. The crop reinsurance market for agriculture insurance and reinsurance is expanding significantly, but several obstacles could prevent it from reaching its full potential. One of the main obstacles is that farmers, especially those in developing countries, do not fully comprehend the significance and advantages of crop insurance. Farmers may be deterred from using these solutions by a lack of funding and the belief that insurance is an extra cost. Another issue in some areas is the lack of data availability and inadequate infrastructure. Reliable data sources, such as weather patterns, soil conditions, and crop yield histories, are essential for accurate risk assessment and pricing. Developing comprehensive and customized products may be challenging for insurers and reinsurers in areas with limited data collecting and processing capabilities.

The market for reinsurance and insurance for crop reinsurance market trends in agriculture offers many crop reinsurance market opportunity for expansion and creativity. The creation of novel insurance products suited to agricultural hazards and local conditions represents one of the biggest prospects. Insurers and reinsurers can design specialized solutions that cater to the requirements of farmers and agribusinesses by utilizing cutting-edge technology like machine learning, data analytics, and remote sensing. Insurance companies stand to gain from the growing use of climate-smart and sustainable agricultural methods. There is a rising need for insurance solutions that encourage and support farmers' transition to more resilient and ecologically friendly farming techniques. Products that support sustainable agriculture can be created by insurers, helping to reduce risk and conserve the environment.

Reinsurance Market Outlook:

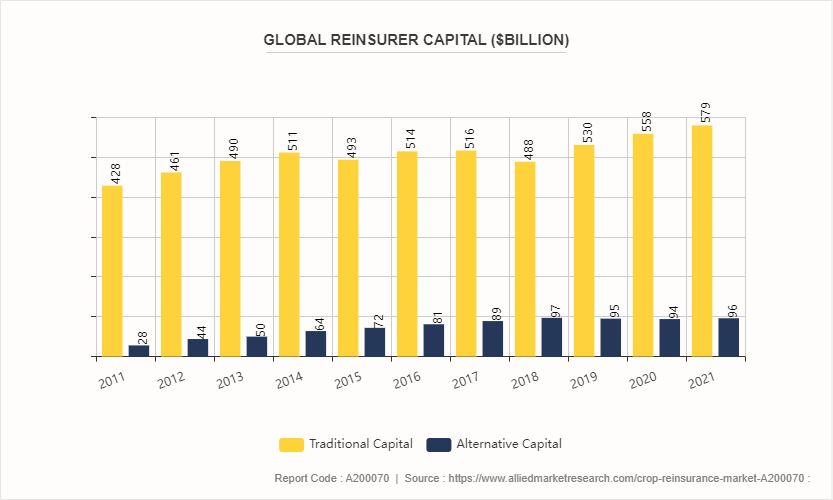

Aon estimates that global reinsurer capital totaled during market forecast $675 billion at December 31, 2021, an increase of $25 billion relative to the end of 2020, driven principally by retained earnings. This calculation is a broad measure of the capital available for insurers to trade risk.

Most reinsurers reported profitable results for 2021, despite above-average natural catastrophe losses and ongoing impacts from the pandemic (mainly relating to excess mortality). In contrast to 2021, issuances of new equity were modest and there were not any noteworthy start-ups leading up to January renewals. Nevertheless, retained earnings were sufficient to boost traditional equity of market size by $23 billion to $579 billion. 2021 was a record issuance year for the catastrophe bond market, driven by investors’ market share flight to relative safety and significant bond maturities. A steady influx of new capital in 2021 kept catastrophe bonds largely insulated from the rate hardening experienced in other parts of the reinsurance market and helped drive positive issuance momentum into 2022. Issuance pipelines continued to expand early in 2022 ascedents looked to capitalize on favorable pricing and terms. Recently though, the geopolitical turmoil and currency volatility have reduced the ILS investors’ investable cash (currency hedging, redemptions, and a need for increased liquidity have all been cited) leading to a reversal of the tightening trend, with most transactions now pricing around their wide end of spread guidance. Coupled with a robust pipeline, this has also led to increased investor selectivity in risk selection and a push for improved structural terms. We would expect the current market uncertainty to be relatively short-lived, as the shift was not driven by losses but rather by external forces. We believe that new entrants and fresh capital will continue to return to the space once the broader capital market volatility recedes.

Market Segmentation:

The crop reinsurance market is segmented into product, distribution channel, and region. On the basis of the product, the market is divided into multi-peril crop insurance, crop-hail insurance, livestock insurance, green house insurance, and others. On the basis of distribution channel, the market is segregated into banks, insurance companies, brokers/agents, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook:

The crop reinsurance market is segmented based on regions into North America, Asia-Pacific, and LAMEA. The Asia-Pacific crop reinsurance market is expected to hold a significant revenue share and grow rapidly in the coming years due to the region's diverse agro-climatic zones, which provide substantial agricultural advantages. The Asia-Pacific region crop reinsurance market outlook is expected to have significant growth due to the vast spread of agricultural land, resources available in this region, and government support in funding reinsurers in countries such as India. Effective and cutting-edge weather and space monitoring technology support the expansion of North America's agricultural reinsurance business. Various public policy instruments are employed across the U.S., including targeted legislation, ministerial decrees, and public money intended to encourage the adoption of certain coverage or offer ex-post solutions, particularly during catastrophic weather occurrences.

Industry Trends:

In June 2023, the Department of Agriculture collaborated with private insurers. Federal spending in 2022 amounted crop reinsurance market size $17.3 billion, of which around $12 billion was used to subsidize premiums; the remaining amount was used to pay government costs for policy-related losses as well as the administrative expenses of the insurance companies. From?discovered methods to save federal expenses, such as lowering subsidies for policyholders with the highest incomes. Congress should reevaluate the program to consider these and other issues, as per our recommendation.

Aon, a global re/insurance broker, has partnered with the African Development Bank (AfDB) and Amini, a space technology and artificial intelligence innovator, to increase crop insurance capacity across Africa. the collaboration aims to leverage farm-level data produced by Amini to support the Africa climate risk insurance facility for adaptation, develop innovative de-risking solutions, and build capacity to assess and monitor the changing risk environment across the continent. The data provided will enable farmers to make better-informed decisions, leading to greater resiliency and yield improvements. The collaboration also aims to help Aon clients with extensive supply chains or balance sheet exposure to the agricultural sector manage the multi-faceted impacts of climate risk better.

Competitive Landscape:

The major players operating in the global crop reinsurance market include Sompo International Holdings Ltd., Axa XL, Syngenta, Munich Re, Agroinsurance, Hanover Re, Partner Re, Scor Re, Gramcover, Mapfre Re, Berkshire Hathaway, Everest Re, China Reinsurance, QBE, and Tokio Marine. Other players in the global crop reinsurance market include Swiss Re, Aon, and others.

Recent Key Strategies and Developments:

In September 2021, Drax Group and the National Farmers Union of England and Wales (NFU) partnered to boost the UK crop reinsurance market and support the country's decarbonization goals. The partnership aims to develop a roadmap for boosting perennial energy crop production and identify sustainable uses. The partnership will also support Drax's ambition for British farmers to supply biomass for its bioenergy with carbon capture and storage (BECCS) technology. The partnership follows the UK's announcement of $4 million in funding to increase biomass production for green energy through the Biomass Feedstocks Innovation Programmed.

In March 2021, Corteva Agriscience and AgPlenus partnered to develop novel herbicides to combat global weed resistance. The collaboration will combine Corteva's expertise in crop protection and AgPlenus' predictive biology expertise. The goal is to optimize AgPlenus' chemical families, which have been validated for herbicidal activity and are linked to new modes of action.

Key Sources Referred:

Center for Strategic & International Studies

Aon

MS Amlin AG

Department of Agriculture

United States government

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in crop reinsurance market.

- Assess and rank the top factors that are expected to affect the crop reinsurance market growth of crop reinsurance market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the crop reinsurance market segmentation assists in determining the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Crop Reinsurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 73.5 Billion |

| Growth Rate | CAGR of 7% |

| Forecast period | 2024 - 2032 |

| Report Pages | 455 |

| By Product |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Partner Re, Syngenta, Scor Re, Sompo International Holdings Ltd., Gramcover, Mapfre Re, AXA XL, Hanover Re, Agroinsurance, Munich Re |

$73.53 billion is the estimated industry size of Crop Reinsurance by 2032.

Occurrence and intensity of natural disasters and extreme weather events and intensity of natural disasters and extreme weather events are the upcoming drivers of the Crop Reinsurance Market in the globe.

The vast spread of agricultural land, resources available in this region, and government support in funding the reinsurers in the country are the leading growth factors of the Crop Reinsurance Market.

Asia-Pacific is the fastest-growing market for Crop Reinsurance during the forecast period.

Sompo International Holdings Ltd., Axa XL, Syngenta, Munich Re, Agroinsurance, Hanover Re are some of the top leading companies in the crop reinsurance.

Loading Table Of Content...