Cross-border Payments Market Research, 2032

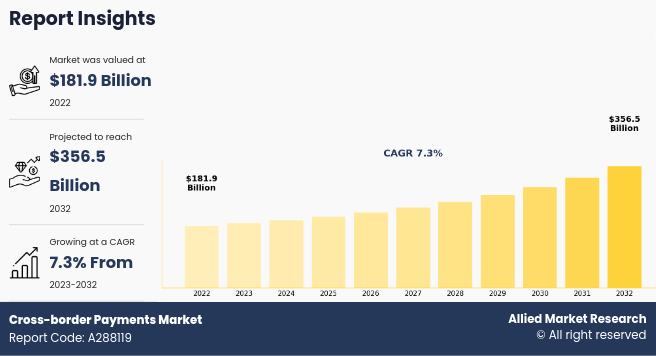

The global cross-border payments market was valued at $181.9 billion in 2022, and is projected to reach $356.5 billion by 2032, growing at a CAGR of 7.3% from 2023 to 2032.

Cross-border payments market refers to financial transaction that occur between parties located in different countries. Cross-border payments involve the transfer of funds or assets from one country to another, typically through banks or other financial institutions. Furthermore, the financial services and infrastructure that enable the transmission of money and other transactions across national borders are known to as the cross-border payment market. Money must regularly move between different countries and currencies as a result of firms and individuals participating in international commerce, investment, and remittances in a globalized economy. To facilitate such cross-border payments, a number of platforms and processes are included in the cross-border payment market.

Moreover, cross-border payment are the systems and networks that are used to carry out financial transactions. Financial organizations, banks, and payment service providers that enable the transfer of money between individuals residing in several nations may be involved. In addition, the process of changing one currency into another is common in cross-border payments. Services for exchanging currencies are essential for supplying the conversion rates required for effortless transactions. Furthermore, working abroad allows people to remit money to their native country in the form of earnings. A segment of the cross-border payment sector called remittance services makes it possible for people to send money across borders quickly and easily.

The rise in number of e-commerce transactions is a significant driver of the growth of the cross-border payments market. E-commerce has expanded rapidly throughout the world, allowing companies to contact customers outside of their national borders. The global expansion of online retail platforms has led to an increasing demand for reliable and successful cross-border payment solutions that enable cross-currency transactions. Furthermore, increase in globalization and international trade driven the demand of the cross-border payments market size.

However, currency exchange risks and volatility has hampered the growth of the cross-border payments market as exchange rate fluctuations may result in higher expenses for companies and customers doing cross-border payments. Unpredictable and unexpected fluctuations in currency can lead to unfavorable exchange rates, which raises transaction costs and lowers the total value of cross-border payments market share. Moreover, complex regulatory environment are major factors that hamper the cross-border payments market growth. On the contrary, rise in demand for remittance service is an opportunity for cross-border payments market. Remittances move between different countries and currency pairs via a variety of corridors. The cross-border payments industry has the chance to provide customized solutions, such as effective currency exchange, affordable transaction fees, and faster settlement times, that address the unique requirements of various remittance corridors.

The report focuses on growth prospects, restraints, and trends of the cross-border payments market. The study provides Porters five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the cross-border payments market outlook.

Segment Review

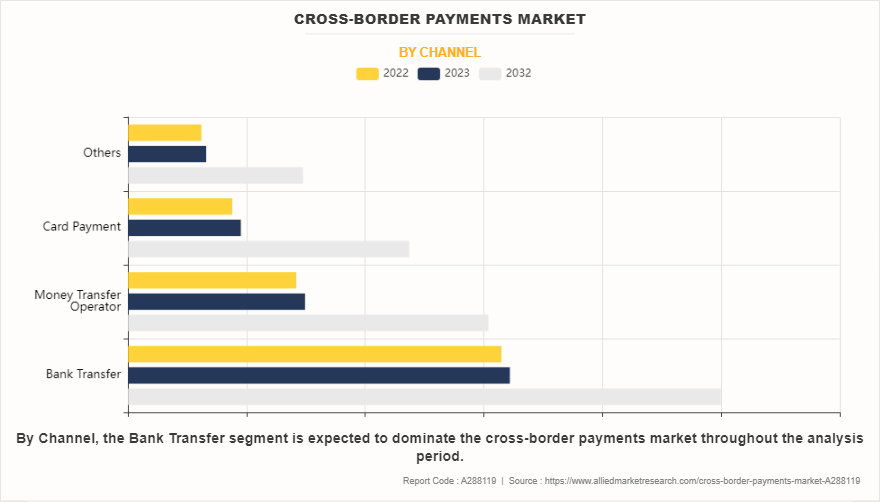

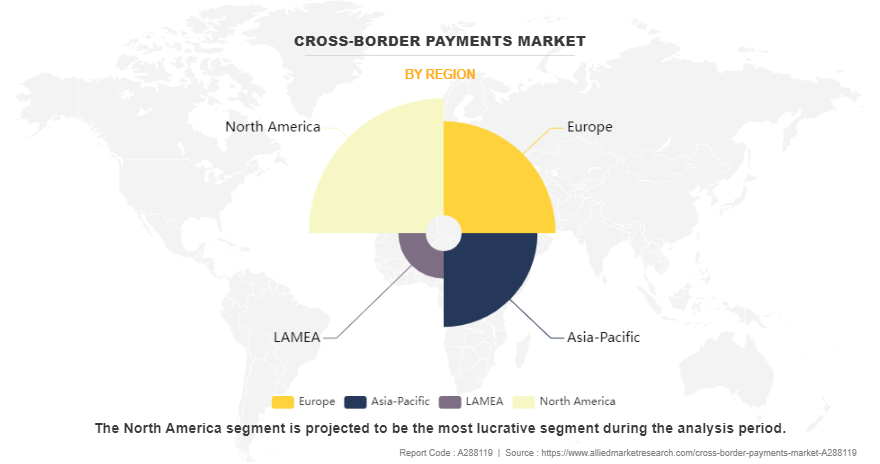

The cross-border payments market is segmented on the basis of channel, transaction enterprise size, end-user, and region. On the basis of channel, the market is segmented into bank transfer, money transfer operator, card payment, and others, by transaction type, it is bifurcated into business to business (B2B), customer to business (C2B), business to customer (B2C), and customer to customer (C2C) on the basis enterprise size it is segmented into large enterprise size, and small and medium-sized enterprises, by end user, it is bifurcated into individuals, and business, and On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of channel, the bank transfer segment attained the highest market share in 2022 in the cross-border payments market. This can be attributed to the fact that banks are well-equipped to handle cross-border payments market owing to their extensive international networks and infrastructure. The secure transfer of money between banks all over the world is made possible by their correspondent banking connections and memberships in international financial networks like society for worldwide interbank financial telecommunication (SWIFT). Meanwhile, the card payment segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that card payments, especially credit and debit cards, offer a high level of convenience for consumers. They are widely accepted globally, allowing users to make cross-border payments without the need for physical currency exchange. This accessibility contributes to the popularity of card payments for international purchases.

On the basis of region, North America attained the highest market share in 2022 and emerged as the leading region in the cross-border payments market. This is attributed to the fact that the North America's two largest nations, the U.S. and Canada, have robust banking systems and are economic superpowers. Most international cross-border payment activities are attracting such nations due to their strong and sophisticated financial infrastructure, which makes cross-border payments faster. On the other hand, the Asia-Pacific region is projected to be the fastest-growing region for the cross-border payments market during the forecast period. This growth is attributed to the fact that the Asia-Pacific is become a hub of innovation in fintech. In order to deliver faster and more affordable services, a number of startups and tech companies in the area are creating cutting-edge cross-border payment solutions by utilizing technologies like blockchain, artificial intelligence, and mobile applications.

The report analyses the profiles of key players operating in the cross-border payments market such as Adyen, American Express, FIS, Payoneer Inc., PayPal Holdings, Inc., Square, Inc, Stripe, Inc., TransferMate, VISA INC., Western Union Holdings, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the cross-border payments market.

Competitive Analysis

Recent product launch in the cross-border payments market

In September 2023, YES bank launched cross-border payments solution. YES Bank and BriskPe have partnered to launch BriskPe A2A, a range of solutions for importers and exporters. Customers of BriskPe will be able to accept payments in more than 180 countries and over 36 foreign currencies owing to this platform. Within one business day, the money can be transferred into Indian Rupees and deposited straight into the recipients' regional bank accounts in India, according to the lender. Fast cross-border payments will be made possible by this partnership, which will primarily help Micro, Small, and Medium-Sized Enterprises (MSMEs) in the manufacturing and services industries.

In July 2023, Jeeves a financial operating system lunched global cross border payments and prepaid local cards, and expanding its corporate offering in three continents. Furthermore, corporate credit cards as its initial product and has seen surging demand for its cross-border payments product, especially throughout Latin America. Moreover, customers using Jeeves will be able to transfer money into and out of Brazil, Colombia, and Mexico in less than 24 hours, which is a significant improvement over the previous procedure that might take up to seven days. With the use of multinational invoice scanning technology, customers may now seamlessly pay suppliers and vendors in more than 150 countries using their local currency.

Top impacting Factors

Rise in number of e-commerce transaction

E-commerce platforms enable merchants to sell products and services globally, leading to a surge in cross-border trade. To complete such transactions, businesses and consumers require cross-border payment mechanisms that can seamlessly handle international transactions. Furthermore, customers from different regions have varied payment preferences, cross-border payment solutions must accommodate a wide range of payment methods to cater to the diverse needs of global consumers. This includes credit/debit cards, digital wallets, and other local payment methods, requiring a sophisticated and adaptable cross-border payment infrastructure.

In addition, the emergence of online marketplaces that connect buyers and sellers globally has contributed significantly to the growth of cross-border e-commerce. Such marketplaces often involve transactions between parties located in different countries, necessitating efficient cross-border payment systems. Moreover, fintech companies are playing a crucial role in transforming cross-border payments market within the e-commerce space. They offer innovative solutions such as real-time currency conversion, secure payment gateways, and simplified checkout processes, enhancing the overall user experience for international shoppers. Therefore, rise in number of e-commerce transaction has driven the demand for cross-border payments market.

Advancements in technology and fintech innovation

Cross-border payment processing is now faster and more effective owing to technological improvements. Businesses and people can obtain payments internationally more quickly due to real-time payment systems and quicker settlement options, which shorten transaction delays. Furthermore, blockchain and distribution ledger technology (DLT) have the potential to revolutionize cross-border payments market by offering transparent, secure, and decentralized systems. These technologies can streamline processes, reduce fraud, and enhance the traceability of transactions.

Moreover, the rise of digital wallets and mobile payment solutions offers users a convenient and accessible way to make cross-border payments market forecast. Mobile applications provide a user-friendly interface for initiating and managing international payments. In addition, various financial systems can communicate with one other more easily owing to open banking efforts and Application Programming Interfaces (APIs). This encourages innovation and competition by enabling easy integration of cross-border payment services into numerous platforms. Therefore, advancements in technology and fintech innovation is driving the demand of the cross-border payments market.

Currency exchange risks and volatility

Currency fluctuations can cause unpredictable changes in exchange rates, raising the price of cross-border payments for both consumers and enterprises. Unfavorable exchange rates may result in higher costs, which would reduce the total value of cross-border payments. Furthermore, there is uncertainty about the ultimate value of cross-border payments due to exchange rate volatility. Properly forecasting the financial results of cross-border payments can be a challenge for businesses, which impact financial planning and budgeting.

Moreover, small and medium-sized “enterprise (SMEs) may be particularly impacted since they may lack the resources to address currency risks. SMEs may be discouraged from participating in cross-border trade and transactions due to the perceived complexity and risk involved in currency exchange. In addition, adverse currency swings have the potential to reduce profits for companies with limited margins of profit. Cross-border business transactions may become less attractive to companies due to the requirement of covering higher costs resulting from unfavorable exchange rates. Therefore, currency exchange risk and volatility is hampering the growth of the cross-border payments market opportunity.

Rise in demand for remittance services

The worldwide migrant population has increased dramatically as a result of people moving abroad in search of career opportunities and higher wages. Cross-border remittance services are in high demand since these people frequently send money back to their native nations. Furthermore, the economies of the nations where migrant workers are employed as well as their own countries benefit greatly from their presence. Remittances are a means for receivers to maintain their financial stability by helping with household income, healthcare, education, and other necessities.

Moreover, remittances move through a variety of channels, involving several nations and currency pairs. The market for cross-border payments has the chance to provide customized solutions, such as quick settlement times, inexpensive transaction costs, and effective currency exchange, that address the unique requirements of various remittance corridors. In addition, for cross-border payment providers, the need for remittance services opens up new markets and consumer segments. Businesses that can provide remittance transactions with reasonable prices, transparency, and dependability may be able to draw in more customers. Therefore, rise in demand for remittance services is driving the demand of the cross-border payments market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cross-border payments market analysis from 2022 to 2032 to identify the prevailing cross-border payments market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cross-border payments market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global cross-border payments market trends, key players, market segments, application areas, and market growth strategies.

Cross-border Payments Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 356.5 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 449 |

| By Transaction Type |

|

| By Enterprise Size |

|

| By End User |

|

| By Channel |

|

| By Region |

|

| Key Market Players | Payoneer Inc., FIS, Square, Inc., PayPal Holdings, Inc., Western Union Holdings, Inc., Adyen N.V., TransferMate, Visa Inc., American Express Company, Stripe, Inc. |

Analyst Review

The growing demand for cross-border payment services is mostly driven by the growing interconnection of the world's economies and the expansion of global trade. Furthermore, the emergence of fintech and digital technology advancements have completely changed the cross-border payments market, making transactions easier, faster, and more accessible. Moreover, the demand for fast and safe cross-border payment solutions that facilitate transactions between buyers and sellers in many nations has increased due to the rise of cross-border e-commerce platforms. In addition, the cross-border payments sector is consistently driven by the regular flow of remittances, which occur when people send money abroad to support friends and family. Furthermore, cross-border payments have been made easier by the increasing use of mobile devices and mobile payment systems, giving consumers practical means of sending and receiving money abroad. Moreover, cross-border payment providers now have the chance to meet the demands of businesses and consumers for rapid transaction settlement by providing faster and more responsive services, owing to the worldwide trend toward real-time payments. Furthermore, in order to satisfy the changing needs of both enterprises and consumers, there is a chance to create customer-centric, cost-effective cross-border payment systems that emphasize transparency and affordability. Moreover, since trade finance and cross-border payments frequently go hand in hand, there are chances to combine services and provide companies involved in international commerce with end-to-end solutions.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in August 2022, American Express launched digital, cross-border payment solution for U.S. small businesses. It enables safe domestic and international business-to-business (B2B) payments for American companies. With this innovative digital service, business customers may use a straightforward, mobile-friendly portal to transfer payments funded from their business bank account to their suppliers in over 40 countries, in a variety of currencies. The qualified customers can accrue membership rewards points for their foreign currency transactions. Moreover, in August 2022, American Express launched a cross-border payments platform called Global Pay. It will act as a digital solution that will let U.S. businesses make secure domestic and international B2B payments. With this innovative digital solution, business customers can use an easy-to-use, mobile-friendly portal to transfer payments funded from their business bank account to their suppliers in over 40 countries, in a variety of currencies. These strategies by the market players operating at a global and regional level are expected to help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Adyen, American Express, FIS, Payoneer Inc., PayPal Holdings, Inc., Square, Inc, Stripe, Inc., TransferMate, VISA INC., Western Union Holdings, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in cross-border payments.

The upcoming trends in the cross-border payment market is the increasing integration of blockchain technology. Blockchain, with its decentralized and secure ledger system, is revolutionizing cross-border transactions by reducing processing times, lowering costs, and enhancing transparency. Financial institutions are exploring blockchain-based solutions to streamline cross-border payments, minimizing the need for intermediaries and improving the overall efficiency of the transaction process.

Bank Transfer is the leading application of Cross-border Payments Market in 2022.

North America is the largest regional market for Cross-border Payments in 2022.

$356.47 billion is the estimated industry size of Cross-border Payments in 2032.

Adyen, American Express, FIS, Payoneer Inc., PayPal Holdings, Inc., Square, Inc, Stripe, Inc., TransferMate, VISA INC., Western Union Holdings, Inc. are the top companies to hold the market share in Cross-border Payments.

Loading Table Of Content...

Loading Research Methodology...