Cross Laminated Timber Market Research, 2032

The Cross Laminated Timber Market size was valued for $1,575.50 million in 2020 and is estimated to reach $3,735.90 million by 2032, exhibiting a CAGR of 8.4% from 2023 to 2032. Furthermore, in terms of volume, the global cross laminated timber market was valued at 75.03 million cubic feet in 2020, and is projected to reach 160.67 million cubic feet by 2032, registering a CAGR of 7.5% from 2023 to 2032. Cross laminated timber is a type of engineered wood construction material manufactured by stacking and gluing two or more layers of solid wood perpendicular to the lower layer. This gives the cross-laminated timber high strength in all four directions. CLT is primarily made of softwood such as spruce, pine, and fir.

Cross Laminated Timber Market Dynamics

The cross laminated timber market is primarily driven by various factors such as the growing demand for premium and affordable residential and non-residential buildings to accommodate the increasing population worldwide. Simultaneously, the rising pollution is driving demand for sustainable construction materials including cross-laminated timber.

Cross laminated Timber is an environment-friendly construction material, which is typically made from wood sourced from sustainably harvested forests. The use of CLT helps reduce carbon emissions from the overall construction process and promotes the use of renewable resources. CLT has comparable strength to steel or concrete, thus providing excellent load-bearing capacity and dimensional stability. In addition, properties such as fire resistance, and higher thermal insulation than steel and concrete make CLT a suitable choice for residential and commercial buildings.

For instance, in 2020, the production of CLT in Italy, the Czech Republic, and the DACH region which includes Germany, Austria, and Switzerland, increased, and crossed the sales volume of 1 million m³ for the first time. In addition, in 2021, major CLT producers such as HBS Berga, KLH, the Pfeifer Group, and Schwarzwald Holzbausysteme, expanded their production capabilities in Europe to meet the increasing demand for CLT. Such an increase in the production of CLT driven by rising demand for CLT from the rising construction sector in the region is fostering the growth of the market. Additionally, cross-laminated timber is widely used in the construction of prefabricated housing across the world. The concept of prefabricated housing was first unveiled at the end of World War 2, and it has since been evolving with respect to technology, design flexibility, and durability. It involves the construction of houses using cross-laminated timbers as well as other materials at offsite manufacturing facilities, which are then shipped to and assembled at the predefined location, resulting in quick and inexpensive construction.

In addition, stringent environmental regulations, resulting from concerns over increasing pollution, and labor shortages due to the aging population are playing a crucial role in the growth of the prefabrication housing industry which is driving the growth of the cross laminated timber market. Prefabricated houses are provided with enhanced efficiency, resilience, and versatility, thus meeting the long-term demand and construction requirements of high-performance houses. Countries such as Japan, China, the U.S., Sweden, and various others are leading the cross-laminated timber prefabricated houses industry. For instance, in 2021, Green Canopy Homes, a U.S.-based CLT modular home manufacturer merged with NODE a construction technology company to form Green Canopy NODE. The new company is involved in conventional construction as well as sales of prefabricated Integrated Building Kits and Utility Kits. In March 2023, the same company unveiled a prototype made of CLT which has two stories, 1,200 sq. ft. of floor space, two bedrooms, 1.5 bathrooms, and a rooftop deck.

In addition, in 2021, Forterra, a major wood-based construction material manufacturer unveiled its Forest to Home initiative, where it acquires sustainably harvested local timber, processes it to cross-laminated timber, and then uses it for modular homes. Moreover, in October 2021, Countryside, a UK-based closed panel home manufacturer delivered its 5,000th closed panel home to Ribblesdale Place in Accrington, Lancashire. Such developments in the CLT-based prefabricated homes is positively affecting the cross laminated timber market overview.

However, the high initial cost of the cross-laminated timber (CLT) is a major restraint for the market growth. For example, according to a study published in the Forest Products Journal (2020), Volume 70, Issue 4, a mass timber building has 26% higher front-end costs than its concrete alternative.

Moreover, technological development is a primary cross laminated timber market opportunity for the key market players. The introduction of automation in the cross-laminated timber is expected to play a crucial role in the market growth. For instance, February 2022, Stora Enso OYJ, invested more than $10 million in the development of its automated CLT (cross-laminated timber) coating line at the YBBS sawmill in Austria. This facility is anticipated to be completed in the third quarter of 2023 and will offer pre-applied CLT coatings on the CLT walls and floors. This will allow the company to solve the issue of labor shortage and will also help the company to increase and optimize the production in a given time frame.

The cross laminated timber market witnesses various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced construction activities, eventually leading to reduced demand for cross-laminated timber from various sectors such as construction and industrial. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of wood used for manufacturing cross-laminated timber. In addition, the cost of oil & gas has also increased substantially, and many countries; especially, the countries in Europe, Latin America, North America, and Sub-Saharan Africa experience severe negative impacts in industrial production, including the production of cross-laminated timber.

Moreover, the cost of construction has risen substantially, discouraging builders from initiating new projects, which is also expected to negatively affect the cross laminated timber market growth. However, India and China are performing relatively well. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised, which is expected to end the war between them and reduce the global inflation.

Cross Laminated Timber Market Segmental Overview

The cross laminated timber market is segmented on the basis of layer type, structure type, application, and region. By layer type, the market is divided into 3-Ply, 5-Ply, and 7-Ply. Depending upon the structure type, the market is categorized into wall, roof and floor, and others. On the basis of application, it is divided into residential and non-residential. Region-wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

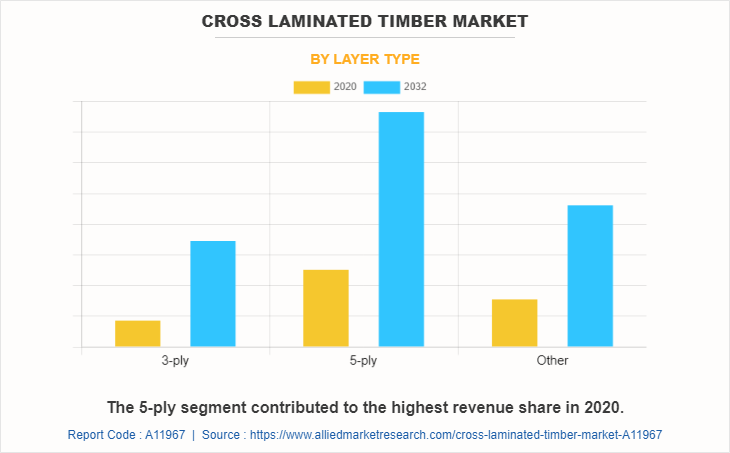

By Layer Type:

The cross laminated timber market is divided into 3-Ply, 5-Ply, and 7-Ply. In 2022, the 5-ply cross laminated timber segment dominated the cross laminated timber market share, in terms of revenue, the same segment is expected to dominate the cross laminated timber market forecast by growing with a higher CAGR. The 5-ply CLT is among the most cost-effective CLT and offers a perfect balance in terms of their cost as well as strength. It comprises a number of layers, making them lighter and easy to handle during construction. Moreover, it can support larger spans and heavier loads, as compared to 3-ply CLT. It exhibits improved resistance to horizontal forces, such as wind loads. This makes them suitable for structures in regions with higher wind loads or seismic activity.

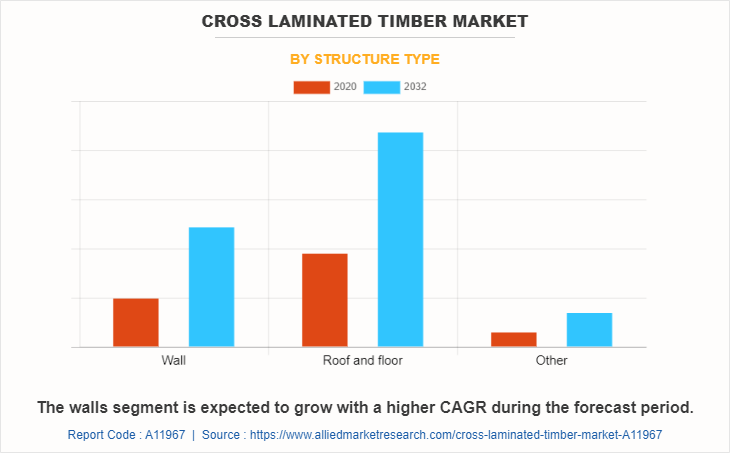

By Structure Type:

The cross laminated timber market is divided into wall, rood and floor, and others. In 2022, the roof and floor segment dominated the cross laminated timber market, in terms of revenue, and the walls segment is expected to witness growth at a higher CAGR during the forecast period. CLT panels provide excellent structural performance for roofs and floors. The cross-laminated configuration of solid wood layers creates a strong and rigid material capable of supporting heavy loads and spanning large distances. Moreover, the wall segment includes the use of cross-laminated timber panels for the construction of walls in buildings. Such factors are driving the growth of others segment.

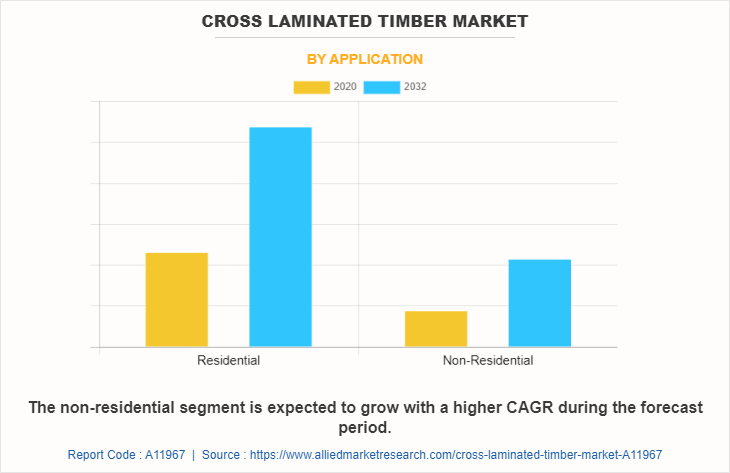

By Application:

The cross laminated timber market is divided into residential and non-residential. The residential segment accounted for the highest market share in 2022. The residential construction segment has witnessed substantial growth due to an increase in population, eventually leading to an increased number of households in countries such as the U.S., Japan, and others. However, the non-residential segment is anticipated to register a higher growth rate during the forecast period, owing to a rise in industrialization, especially in the developing nations.

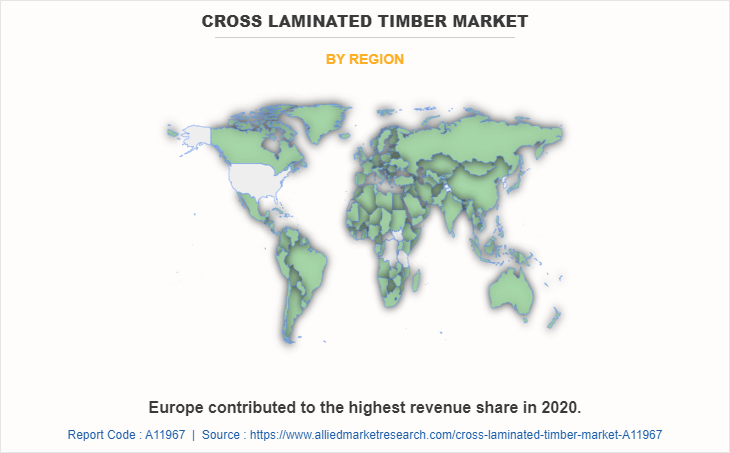

By Region:

Europe accounted for the highest market share in 2022 and North America is expected to grow with a highest CAGR during the forecast period. Europe has been in the forefront of the cross laminated timber market as it is the largest producer of CLT and is also a major consumer. Moreover, Asia-Pacific is a highly developing region with the fastest growing population. According to the United Nations, nearly two-thirds of the world population resides in Asia-Pacific, with China and India alone accounting for one-third of the global population. In addition, the rate of urbanization in Asia-Pacific is also high. Thus, owing to high population growth and urbanization in the region, demand for construction is high, thereby, positively affecting the cross laminated timber market.

Competition Analysis

Competitive analysis and profiles of the major players in the cross laminated timber market are provided in the report. Major companies in the report include Mayr-Melnhof Holz Holding AG, Mercer International Inc., SmartLam LLC, Stora Enso Oyj, KLH Massivholz GmbH, XLam Pty Ltd., SIPEUROPE s.r.o., Schilliger Holz AG, HESS TIMBER GmbH, and Binderholz GmbH & Co. KG.

Major players adopt development strategies such as product launches, product development, acquisition, and expansion to remain competitive in the market. For instance, in May 2022, Stora Enso acquired 35% shares of France based ACDF Industrie SAS which is involved in manufacturing engineered wood products like CLT, Glulam and LVL (laminated veneer lumber). This move will help Stora Enso to capitalize on the increasing demand for timber in France.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging cross laminated timber market trends and historic data.

- In-depth cross laminated timber market analysis is conducted by constructing market estimations for key market segments between 2020 and 2032.

- Extensive analysis of the cross laminated timber market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The cross laminated timber market revenue and volume forecast analysis from 2023 to 2032 is included in the report.

- The key players within the cross laminated timber market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the cross laminated timber industry.

Cross Laminated Timber Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.7 billion |

| Growth Rate | CAGR of 8.4% |

| Forecast period | 2020 - 2032 |

| Report Pages | 193 |

| By Layer type |

|

| By Structure type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Mercer International Inc., HESS TIMBER GmbH, Mayr-Melnhof Holz Holding AG, Binderholz GmbH & Co. KG, SIPEUROPE s.r.o., SmartLam LLC, Schilliger Holz AG, KLH Massivholz GmbH, Stora Enso Oyj, XLam Pty Ltd. |

Analyst Review

The cross-laminated timber (CLT) market has witnessed significant growth in the past few years, owing to an increase in construction activities involving the use of strong, durable, and sustainable construction materials. As per DI Richard Stralz, Chairman of the Board and CEO of Mayr-Melnhof Holz Holding AG, in the last two decades demand for CLT is driven by efforts to use more climate-friendly, and sustainable resources. In an interview he said, one cubic meter of wood is able to bind one ton of CO2. Moreover, wood including CLT replaces other CO2 intensive, non-renewable materials and thus prevents the emission of greenhouse gases from the construction sector at large.

In addition, Europe is the leader in the construction involving cross-laminated timber and is expected to be a major driver for the market in the coming years as well. On the other hand, a greater potential for growth of the CLT market lies in Asia-Pacific, owing to its high population growth and the targets that the government has put forth to reduce pollution.

The developing nations are still lagging behind the developed nations when it comes to the active adoption of cross laminate timber. This is attributed to the unavailability of enough resources. Furthermore, the lower-income countries are still to be industrialized, and their contribution to global climate change is very less; thus, they have not actively incentivized the use of timber. Similarly, countries experiencing large-scale deforestation are also not inclined toward adopting CLT in construction.

Key factors driving the growth of the cross laminated timber market include the growth of the building construction industry, rise in demand for sustainable construction materials, and various advantages of cross-laminated timber.

The latest version of the global cross laminated timber market report can be obtained on demand from the website.

The global tire recycling market size was valued at $$1,575.50 million in 2020.

The global cross laminated timber market size is estimated to reach $3,735.90 million by 2032, exhibiting a CAGR of 8.4% from 2023 to 2032.

A- The forecast period considered for the global cross laminated timber market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year. In addition, historical period from 2020-2021 is also analysed.

Europe is largest regional market for cross laminated timber market.

Key companies profiled in the tire recycling market report include Mayr-Melnhof Holz Holding AG, Mercer International Inc., SmartLam LLC, Stora Enso Oyj, KLH Massivholz GmbH, XLam Pty Ltd., SIPEUROPE s.r.o., Schilliger Holz AG, HESS TIMBER GmbH, and Binderholz GmbH & Co. KG.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...