Crushing, Screening, And Mineral Processing Equipment Market Research: 2032

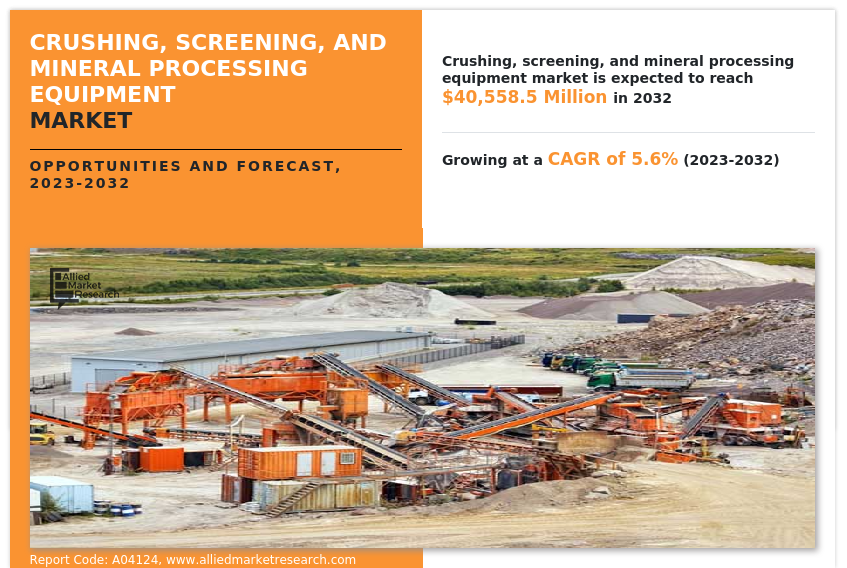

The Global Crushing, Screening, and Mineral Processing Equipment Market Size was valued at $20614.1 million in 2020, and is projected to reach $40558.5 million by 2032, growing at a CAGR of 5.6% from 2023 to 2032. The crushing equipment is designed to reduce the size of large rocks, ores, and other solid materials into smaller, more manageable pieces. Furthermore, screening equipment is used to separate materials into different sizes or grades based on their particle size or shape. It is commonly employed after crushing to classify and separate the processed materials.

Mineral processing equipment encompasses a wide range of machinery and tools used to process minerals and ores into valuable products. It involves various physical and chemical processes to separate and concentrate valuable minerals from ore materials. This equipment is used in industries such as mining, metallurgy, and mineral extraction.

Market Dynamics

There is a rise in global demand for mining activities due to the rapid increase in population and the expanding economies. Development in the transportation and conveyance industry, particularly in Asia-Pacific, has led to an expansion in these operations. For instance, in September the Canadian Trade Commissioner Service estimated that China spends about $200 billion yearly on supplies and services for mines. The requirement for machinery to collect, refine, and transport minerals grows as mining operations increase. Crushers, screens, and machinery for processing minerals are included in this.

These devices are necessary for miners to effectively dissect and sort raw minerals. In addition, the automotive industry has moved more and more toward electric vehicles and away from gasoline and diesel-powered ones. Numerous material processing techniques are needed to extract lithium for the fiercely competitive automotive industry as lithium-ion batteries are the main source of energy for a battery-powered vehicle. Furthermore, in July 2023, Panasonic Holdings invested $4 billion in Kansas to construct a second electric vehicle battery manufacturing facility in the U.S. This factory is expected to produce high-capacity batteries for Tesla and other electric vehicle manufacturers. As a result, it is projected that an increase in mining activities is expected to boost demand for crushing, screening, and mineral processing equipment industry.

Moreover, global adoption of crushing, screening, and mineral processing equipment is anticipated to rise with the growth in engineering, procurement, and construction (EPC) projects in the infrastructure sector, followed by real estate, and various urban infra projects. The pattern demonstrates that the expansion of crushing and screening equipment is directly correlated with the expansion of the construction industry. Construction of infrastructure, which includes building roads, bridges, airports, power plants, and highways—most notably highway and road projects—drives the market for crushing and screening equipment. For instance, in July 2023, the Indian government designated approximately $1.4 trillion of investment in infrastructure through 2025, significantly boosting infrastructure.

The market for mobile crushing and screening equipment has expanded steadily in tandem with rise in demand for infrastructure improvements in the residential, commercial, and industrial sectors. In addition, the U.S. government provided funding for nine projects around the country in January 2023 totaling about $1.2 billion through the newly established National Infrastructure Project Assistance (Mega) discretionary grant program. Construction equipment demand has increased in emerging economies due to infrastructure development, which has had a favorable impact on the crushing, screening, and mineral processing equipment industry. Demand for building supplies including sand, gravel, and crushed stone has grown rapidly due to an increase in construction activity. Such instances boost the crushing, screening, and mineral processing equipment industry.

Furthermore, advanced automation and control systems enable operators to monitor and control equipment remotely, optimizing processes and reducing the risk of human error. This leads to increased productivity, reduced downtime, and lower operating costs. In order to create their mark on the global market, major players are concentrating on releasing technologically advanced products. For instance, in May 2022, Terex India officially unveiled 8 brand-new products from six of its brands, including Franna, Powerscreen, Finlay, MPS, TWS, and EvoQuip. Pick-and-carry mobile cranes, mobile crushing and screening equipment, tracked mobile screening equipment, cone crushers, high-capacity vertical shaft impactors, and wheeled radial conveyors are a few of its more recent products. In addition, this innovative technology frequently includes elements that minimize environmental impact. This includes improved waste management, lower energy use, and lower emissions. Environment-friendly equipment is in high demand in a world that is becoming increasingly concerned with sustainability. Thus, advancements in technology positively influence crushing, screening, and mineral processing equipment market growth.

The crushing, screening, and mineral processing equipment market has witnessed various obstructions in its regular operations due to COVID-19 pandemic and inflation. lockdowns and travel restrictions imposed to curb the spread of the virus led to supply chain disruptions. Manufacturers faced difficulties in sourcing raw materials, components, and parts needed for producing screening & crushing equipment. Delays in shipments and logistical bottlenecks affected the timely delivery of equipment, contributing to project delays and reduced operational efficiency.

However, the COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rise in global inflation, is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war, and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for machineries and equipment. In addition to this, the cost of mining equipment has also increased substantially, and many countries; especially, the countries in Europe, Latin America, and developing economies in Asia-Pacific are experiencing severe negative impacts in industrial production, including the production of various machineries. However, India and China are performing relatively well.

Segmental Overview

The crushing, screening, and mineral processing equipment market is segmented on the basis of type, application, mobility, sales type, and region. On the basis of type, the market is segmented into crushing, screens, and other processing equipment. On the basis of application, it is categorized into construction, mining, recycling, and others. On the basis of mobility, the market is categorized into stationary, mobile-wheeled, and mobile–tracked. On the basis of sales type, the market is bifurcated into new equipment sales, and aftermarket sales.

On the basis of region, it is analyzed across North America (the U.S. and Canada), Europe (France, Germany, Italy, Spain, the UK, Russia, Sweden, Norway, Finland, Poland, Ukraine, and rest of Europe), Asia (China, Japan, India, South Korea, Thailand, Malaysia, Indonesia, Cambodia, Philippines, Myanmar, Afghanistan and the rest of Asia), Oceania (Australia, New Zealand, and rest of Pacific), Latin America (Brazil, Argentina, Mexico, Chile, and rest of Latin America), Middle East (Saudi Arabia, UAE, Iraq, Iran, Syria, Yemen, Lebanon and rest of Middle East), and Africa(Ethiopia, Zimbabwe, South Africa, Egypt, Kenya, Ghana, Nigeria, and rest of Africa).

By Type:

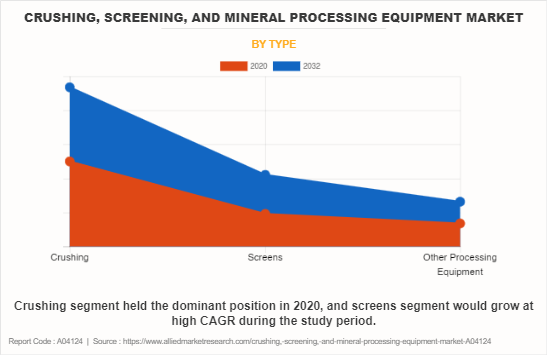

The crushing, screening, and mineral processing equipment market is categorized into crushing, screens, and other processing equipment. In 2020, the crushing segment dominated the crushing, screening, and mineral processing equipment market share, in terms of revenue. However, the screens segment is expected to grow with a higher CAGR during the forecast period. Moreover, crushers are designed to reduce the size of raw materials, making them suitable for further processing. This size reduction is a fundamental step in mineral processing. In addition, screens are available in various sizes and configurations, making them adaptable to different processing requirements. This scalability allows for flexibility in handling different types of materials and production volumes.

By Application:

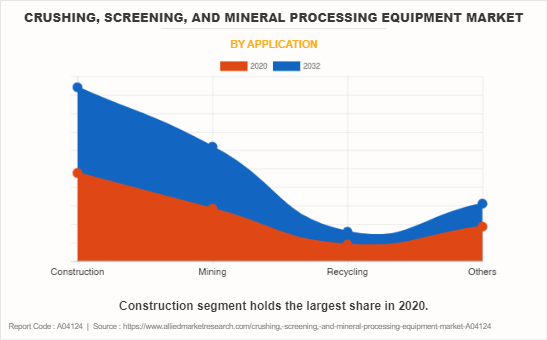

The crushing, screening, and mineral processing equipment market is divided into construction, mining, recycling, and others. In 2020, construction dominated the crushing, screening, and mineral processing equipment market, in terms of revenue, and mining is expected to witness growth at a higher CAGR during the forecast period. The construction industry benefits significantly from the use of crushing, screening, and mineral processing equipment. These machines play a crucial role in various construction applications, providing several advantages that contribute to the overall efficiency and quality of construction projects. Furthermore, efficient crushing and screening processes, along with advanced mineral processing techniques, can lead to higher recovery rates of valuable minerals from ore deposits, maximizing the economic benefits of mining operations.

By Mobility:

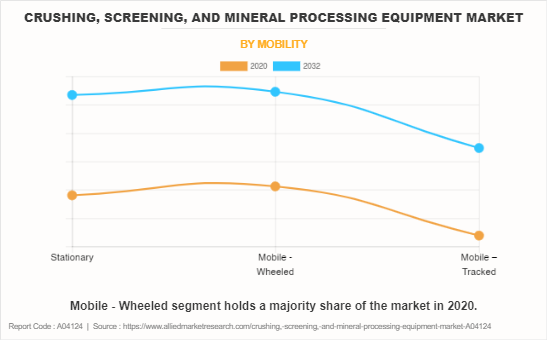

The crushing, screening, and mineral processing equipment market is divided between stationary, mobile-wheeled, mobile – tracked. The mobile-wheeled segment accounted for a higher market share in 2020 and the mobile-tracked segment is anticipated to register a higher growth rate throughout the forecast period. The mobile-wheeled equipment is designed for easy transport between different job sites. Its wheeled chassis allows it to be towed by a truck or moved under its own power. Moreover, mobile-tracked provides stability which is crucial for safe and effective operation in challenging environments, such as mining sites and construction sites with uneven ground.

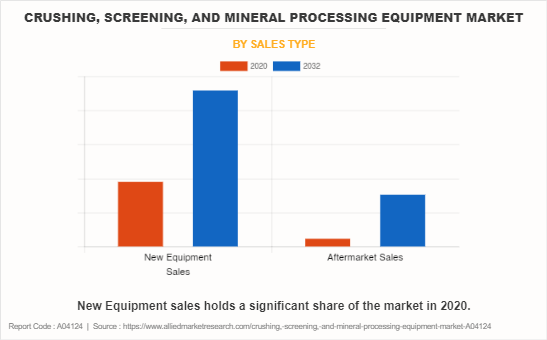

By Sales Type:

The crushing, screening, and mineral processing equipment market is divided into new equipment sales, and aftermarket sales. In 2020, new equipment sales dominated the crushing, screening, and mineral processing equipment market, in terms of revenue, and aftermarket sales is expected to witness growth at a higher CAGR during the forecast period. New equipment incorporates the latest technological advancements, ensuring improved efficiency, performance, and safety features. Customers benefit from state-of-the-art solutions that meet current industry standards.

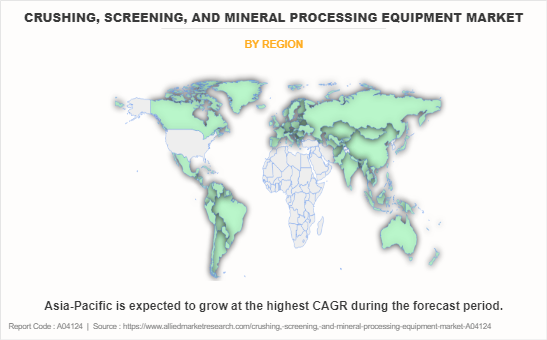

By Region:

Asia-Pacific accounted for the highest market share in 2020 and is expected to grow with a higher CAGR throughout the projected period. Many countries in Asia, particularly China and India, have been experiencing rapid economic growth and urbanization. This has led to increased demand for infrastructure development, including roads, bridges, buildings, and transportation systems, thereby positively influencing the crushing, screening, and mineral processing equipment market growth.

Competition Analysis

Competitive analysis and profiles of the major players in the industry are provided in the crushing, screening, and mineral processing equipment market forecast report. Major companies in the report includes Eagle Crusher Company, Inc., FLSmidth & Co. A/S, Kleemann GmbH, McCloskey International Ltd., Metso Outotec Corporation, Rubble Master Hmh GmbH, Sandvik AB, Screen Machines Industries, LLC, Terex Corporation and ThyssenKrupp AG.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the crushing, screening, and mineral processing equipment market analysis from 2020 to 2032 to identify the prevailing crushing, screening, and mineral processing equipment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the crushing, screening, and mineral processing equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global crushing, screening, and mineral processing equipment market trends, key players, market segments, application areas, and market growth strategies.

Crushing, Screening, and Mineral Processing Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 40558.5 million |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2020 - 2032 |

| Report Pages | 1112 |

| By Application |

|

| By Mobility |

|

| By Type |

|

| By Sales type |

|

| By Region |

|

| Key Market Players | ThyssenKrupp AG, Terex Corporation, Screen Machines Industries, LLC, FLSmidth & Co. A/S, Rubble Master Hmh GmbH, McCloskey International Ltd., Metso Outotec Corporation, Sandvik AB, Deere & Company (Kleemann GmbH), Eagle Crusher Company, Inc. |

Analyst Review

Crushing, screening, and mineral processing equipment are machinery and equipment used in various stages of the mining and mineral processing processes to break down, separate, and process minerals and other materials.

The crushing, screening, and mineral processing equipment market has witnessed notable growth in the past few years. Rapid urbanization in developing countries such as India, China, and Indonesia results in an increase in demand for crushers & screening equipment. The major application for crushers & screeners is construction & plant modification. Jaw crushers are generally used as primary crushers in a crushing circuit. Leading companies, such as Terex Corporation, and Sandvik AB have witnessed significant market growth in the past few years.

Moreover, there is also a positive trend in the purchase of equipment with more small players entering the fragmented aggregate industry. The market is robust and is expected to grow in the next couple of years. The latest technology offerings, combined with total solution providers facilitate the progressive growth of key manufacturers. Product customization is one of the key drivers in product development strategy in the crushing, screening, and mineral processing equipment industry. Major players in the market focus on the development and launch of high-quality products, based on the needs and preferences of consumers and to keep up with recent technological advancements, which can increase production capacity and be cost-efficient.

The crushing, screening, and mineral processing equipment market size was valued at $20,614.1 million in 2020.

Based on the type, crushing holds the maximum market share of the crushing, screening, and mineral processing equipment market in 2020.

The crushing, screening, and mineral processing equipment market is projected to reach $ 40,558.5 million by 2032.

The increase in demand from the construction industry and the rise in mining activities are the key trends in the crushing, screening, and mineral processing equipment market.

The product launches and expansions are key growth strategies of the crushing, screening, and mineral processing equipment Industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The inadequate industry infrastructure is the effecting factor for the crushing, screening, and mineral processing equipment market.

The latest version of the global crushing, screening, and mineral processing equipment market report can be obtained on demand from the website.

Loading Table Of Content...

Loading Research Methodology...