Cryptocurrency Market Research, 2033

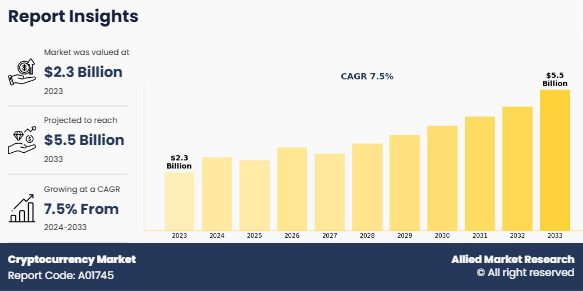

The global cryptocurrency market was valued at $2.3 billion in 2023, and is projected to reach $5.5 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033. Increase in participation of institutional investors and rise developments in blockchain technology are expected to drive the growth of market. Additionally, the growing acceptance of cryptocurrencies as a legitimate payment method by major businesses is boosting market adoption. Moreover, advancements in regulatory frameworks are enhancing investor confidence, further fueling growth.

The cryptocurrency market includes a digital ecosystem where various decentralized digital currencies, often utilizing blockchain technology, are traded and exchanged. These digital assets serve as mediums of exchange, units of account, and stores of value, independent of traditional financial institutions. Participants in the market include individual investors, institutions, miners, and developers, engaging in activities such as buying, selling, and holding cryptocurrencies. Market dynamics are influenced by factors such as regulatory developments, technological advancements, market sentiment, and macroeconomic conditions, shaping the volatility and growth of this evolving financial landscape.

Increase in need for operational efficiency and transparency in financial payment systems, rise in demand for remittances in developing countries, increase in data security, and increase in cryptocurrency market capitalization of cryptocurrency are the major factors that drive the growth of themarket. Moreover, high implementation cost and lack of awareness of cryptocurrency among the people in developing nations hamper the cryptocurrency market growth. Furthermore, increase in demand for cryptocurrency among banks, and financial institutions and untapped potential on emerging economies are expected to provide lucrative opportunity for the market expansion during the cryptocurrency market forecast period.

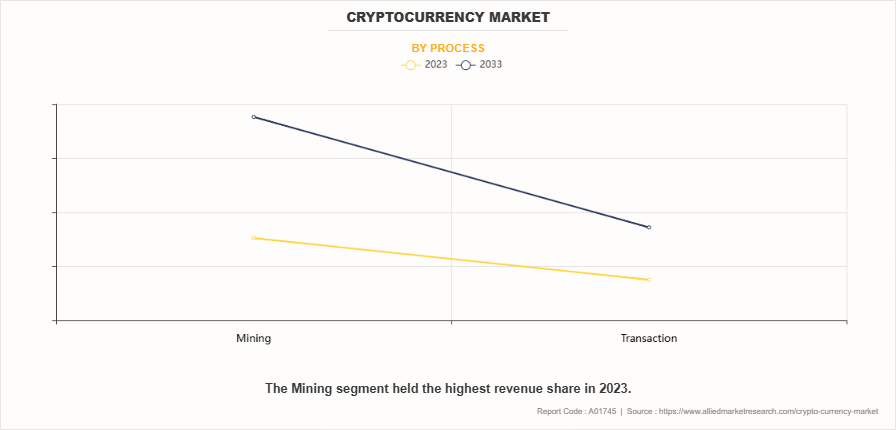

On the basis of process, the mining segment is dominated the cryptocurrency market size in 2023, owing to rise in need for upgrading the performance of the software and to enhance the efficiency of financial payment tools. However, the software segment is expected to grow at the highest growth during the forecast period, as it facilitates managing the massive volume of data being generated for meaningful insights and better-informed decisions.

By region, the market was dominated by North America in 2023 and is expected to retain its position during the forecast period. Owing to increase in number of Bitcoin exchange across U.S., which bring a certain healthy competition and maturity to the cryptocurrency market. Banks are hiring blockchain experts as the government pushes the use of the technology behind bitcoin to increase transparency and combat fraud in its financial sector. These factors drive growth of the cryptocurrency market in North America.

The report focuses on the growth prospects, restraints, and trends of the global cryptocurrency market analysis. The study provides Porters five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the market.

Key Findings of the Study

By process, the mining segment accounted for the highest market portion in 2023.

By end user, the individuals/personal segment accounted for the highest cryptocurrency market portion in 2023.

By end user industry, the trading segment accounted for the highest cryptocurrency market portion in 2023.

By type, the Bitcoin (BTC) segment accounted for the highest cryptocurrency market share in 2023.

By region, North America generated the highest revenue in 2023.

Key Market Segments

The cryptocurrency market is segmented on the basis of process, type, end user, end user industry, and region. By end user, it is fragmented into individuals/personal, organizations. By process, it is bifurcated into mining and transaction. By type, it is segmented into bitcoin (BTC), Ethereum (ETH), tether (USDT), binance coin (BNB), Cardano (ADA), ripple (XRP), and others. By end user industry, it is classified into individuals and organizations. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competition Analysis:

Competitive analysis and profiles of the major players in the cryptocurrency market are Binance, Coinbase, Inc., Tether Operations Limited, Stiftung Ethereum, Grayscale Investments, LLC, Bitcoin Foundation, Ripple Labs, Inc., MicroStrategy Incorporated, Bitmain Technologies Holding Company, and Payward, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the cryptocurrency market.

Recent Developments in the cryptocurrency Industry:

In May 2024, MoonPay partnered with PayPal to introduce a crypto purchasing option for cryptocurrency app users in the U.S. This service enables users to use PayPal for transactions via wallet transfers, bank transfers, and debit cards. The integration promises to enhance the accessibility and convenience of buying and trading cryptocurrencies by bridging the gap between traditional financial services and the crypto market.

In September 11, 2023, PayPal unveiled on- and off-ramps for web3 payments, providing users in the U.S. with a seamless method to convert their cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), into U.S. Dollars directly within their PayPal wallets.

Top impacting factors

Rise in need for transparency in the payment system

The cryptocurrency market is expected to witness promising growth in the coming years, owing to improved data transparency and independency across payments in banks, financial services, insurance, and various other business sectors. The use of crypto currency across banking industries provides various benefits such as sending and receiving payment transparently and storing customers detail information securely for next purpose. For instance, in October 2024, Coinbase filed two Freedom of Information Act (FOIA) requests, demanding transparency from the U.S. regulators regarding their crackdown on the cryptocurrency industry, particularly concerning deposit limitations imposed on banks. The exchange seeks clarity on the Federal Deposit Insurance Corporationas (FDIC) stance on digital assets and its handling of past information requests, signalling a growing tension between the burgeoning crypto industry and regulatory bodies. Furthermore, innovative blockchain distributed technology protocols are expected to replace the need for certain organizational solutions and allow diverse players to share payment transparently across Coinbase. Such systems bring transparency to supply chains, helping in elimination of environmental crimes and others. This boosts the adoption of cryptocurrency in the future.

Untapped Potential on emerging economies

Emerging economies present significant untapped potential for the cryptocurrency market. With rapid digitalization and limited access to traditional banking systems, these regions provide fertile ground for crypto adoption. Many consumers in emerging markets lack access to financial services, which is creating a demand for decentralized solutions such as cryptocurrencies. In addition, blockchain technology offers a way to bypass inefficient banking infrastructures, enabling secure, low-cost transactions across borders. Moreover, governments in some emerging economies have begun to explore crypto-friendly regulations, recognizing the potential to boost financial inclusion and stimulate economic growth. These markets often face currency instability and inflation, making cryptocurrencies an attractive alternative for wealth preservation. Furthermore, growth of mobile internet usage accelerates crypto adoption, as smartphones serve as gateways to digital wallets and exchanges. Investors and blockchain companies are prioritising developing regions such as Asia-Pacific to capture early market share. In addition, by tailoring solutions to local needs, such as microtransactions and remittances, cryptocurrency businesses can drive adoption and build trust within these economies. Moreover, there is considerable potential for growth, both in terms of increasing consumer adoption and in developing smart contracts financial systems that integrate with local economies.

Key benefits for stakeholders

This report provides a quantitative analysis of the market segments, cryptocurrency market trends, estimations, and dynamics of the market forecast from 2023 to 2033 to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities of cryptocurrency market outlook.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists in determining the prevailing cryptocurrency market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Cryptocurrency Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 200 |

| By Process |

|

| By End Use Industry |

|

| By End User |

|

| By Type |

|

| By Region |

|

| Key Market Players | Ripple Labs, Inc., Tether Operations Limited, Stiftung Ethereum, Coinbase, Inc., Grayscale Investments, LLC, Bitmain Technologies Holding Company, MicroStrategy Incorporated, Payward, Inc., Bitcoin Foundation, Binance |

The Cryptocurrency Market is estimated to grow at a CAGR of 7.5% from 2024 to 2033.

The Cryptocurrency Market is projected to reach $5.5 billion by 2033.

The Cryptocurrency Market is expected to witness notable growth due to the increased need for operational efficiency and transparency in financial payment systems, the rise in demand for remittances in developing countries, the increase in data security, and the increase in cryptocurrency's market capitalization.

The report profiles key players including Binance, Coinbase, Inc., Tether Operations Limited, Stiftung Ethereum, Grayscale Investments, LLC, Bitcoin Foundation, Ripple Labs, Inc., MicroStrategy Incorporated, Bitmain Technologies Holding Company, and Payward, Inc.

The key growth strategies of Cryptocurrency Market players include expanding their product portfolios, mergers and acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...