Cryptocurrency Hardware Wallet Market Research, 2031

The global cryptocurrency hardware wallet market size was valued at $442.6 million in 2021, and is projected to reach $3.6 billion by 2031, growing at a CAGR of 23.7% from 2022 to 2031.

A hardware wallet is a cryptocurrency wallet that stores the user’s private keys (critical pieces of information used to authorize ongoing transactions on the blockchain network) in a secure hardware device. The main principle behind the hardware wallet is to provide complete isolation between the private keys and easy-to-hack computer or smartphone applications. Moreover, the asset owner, with the help of a protected hardware wallet, can access the private key to buy and sell crypto assets from any place. Most hardware wallets let users manage several accounts; some even permit users to connect to their Facebook or Google accounts. Hardware wallets are often stored in a protected microcontroller and cannot be transferred out of the wallet, making them highly secure.

Increased use of NFC in cryptocurrency wallets and technological advances to enhance the security of cryptocurrency hardware wallets are driving the growth of the market. In addition, the rise in demand for high transparency of distributed ledger technology across the commercial sector helps to propel the growth of the market. However high cost of installing cryptocurrency hardware wallet is a major factor hampering the growth of cryptocurrency hardware wallet market. On the contrary, advances in technology and adoption of AI and machine in the digital currency industry is expected to provide lucrative growth opportunities in the coming years.

Segment Review

The cryptocurrency hardware wallet market is segmented on the basis of hardware component, security methods, and type. By hardware component, it is segmented into ASIC, GPUF, PGA, and others. The ASIC is further segregated into semi-custom ASIC, programmable ASIC, full custom ASIC. By security methods, it is fragmented into PIN, two factor authentication, biometric security, and others. By type, it is segregated into USB connectivity type, Bluetooth connectivity type, NFC connectivity, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

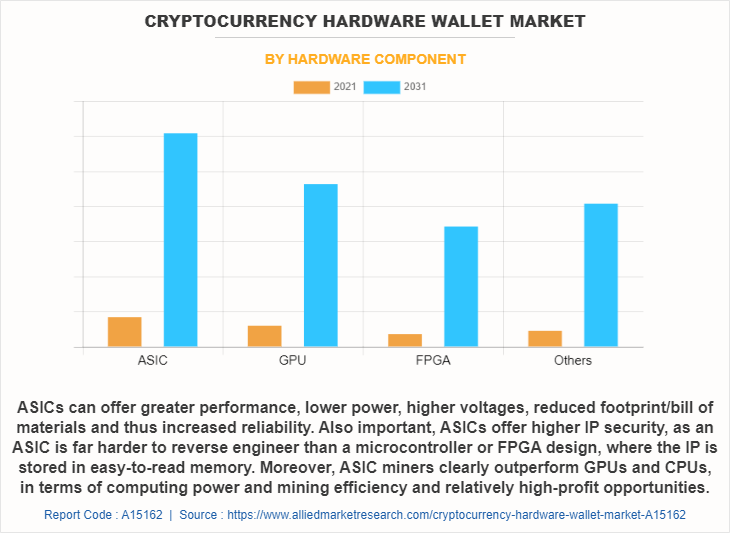

By hardware component, the ASIC segment attained the highest growth in 2021. This is attributed to the fact that ASICs can offer greater performance, lower power, higher voltages, reduced footprint/bill of materials and thus increased reliability. In addition, ASICs offer higher IP security, as an ASIC is far harder to reverse engineer than a microcontroller or FPGA design, where the IP is stored in easy-to-read memory.

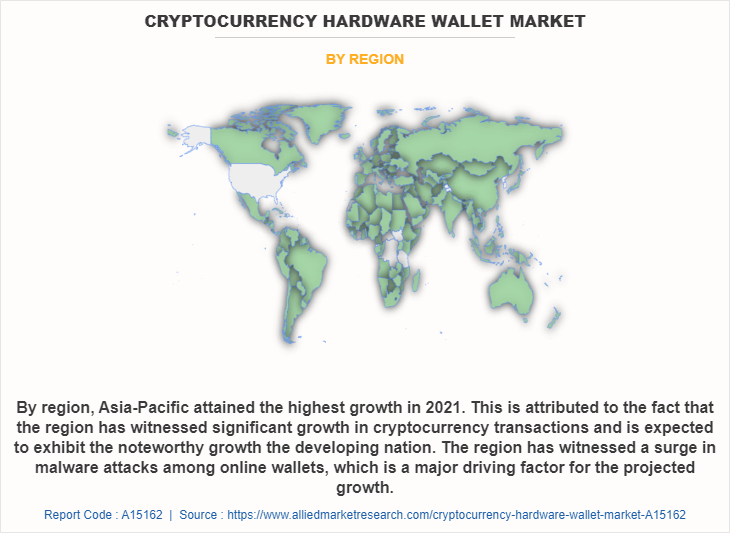

By region, Asia-Pacific attained the highest growth in 2021. This is attributed to the fact that the region has witnessed significant growth in cryptocurrency transactions and is expected to exhibit the noteworthy growth the developing nation. The region has witnessed a surge in malware attacks among online wallets, which is a major driving factor for the projected growth.

The report focuses on growth prospects, restraints, and trends of the cryptocurrency hardware wallet market industry. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the cryptocurrency hardware industry.

The report profiles of key players operating in the cryptocurrency hardware wallet market analysis such as BC VAULT, BitLox, CoolWallet, Cryptomeister, CryoBit LLC , Etherbit Private Limited, Keystone, Ledger SAS, OpenDime, SafePal, SatoshiLabss.R.O., SecuX Technology Inc., ShapeShift, Shift Crypto AG, Sugi, OPOLO SARL, and ELLIPAL LTD. These players have adopted various strategies to increase their market penetration and strengthen their position in the cryptocurrency hardware wallet industry.

COVID-19 Impact Analysis

The COVID-19 outbreak had a positive impact on the growth of the cryptocurrency hardware wallet market, as the adoption of cryptocurrency has increased in the face of unprecedented circumstances. COVID-19 pandemic has significantly fueled the growth rate of the cryptocurrency hardware wallet market, owing to the significant rise in adoption of cryptocurrency by banks and financial institutions has been observed, owing to increase in need to share financial details with consumers during the COVID-19 outbreak. In addition, banks and fintech industries were showing more interest on crypto currencies for enhancing their business processes and providing secure contactless payments to speed up their payment transaction process. Furthermore, various banks in the U.S. are creating their own blockchain-based systems, to enable B2B cryptocurrency payments between their customers

Top Impacting Factors

Rise in need for Transparency in the Payment System

The cryptocurrency hardware wallet market is expected to witness promising growth in the coming years, owing to improved data transparency and independency across payments in banks, financial services, insurance, and various other business sectors. The use of crypto hardware wallet across banking industries provides various benefits such as sending and receiving payment transparently and storing customers detail information securely for next purpose. Furthermore, innovative blockchain distributed technology protocols are expected to replace the need for certain organizational solutions and allow diverse players to share payment transparently across the company. Such systems bring transparency to supply chains, helping in elimination of environmental crimes and others. This boosts the adoption of cryptocurrency hardware wallet in the future. Therefore, rise in need for transparency in the payment system one of the major driving factor of the cryptocurrency hardware wallet market.

Lack of Awareness about Cryptocurrency Hardware Wallet Among People

Lack of awareness about cryptocurrency hardware wallet among various emerging countries restricts growth of the market across the globe. The global economy sector is moving toward a digital eco-system, which includes lending services, money transfer, and investment services. The newest and most promising digital payment system, which is cryptocurrency, is emerging across the globe. Blockchain is a currency exchange platform that allows people to use cryptocurrency for tracking transactions and enables the transfer of information and value. Distributed ledger technology has spread from cryptocurrency to a wide number of applications in the financial and government industry. However, numerous people and financial & government industries across developing nations such as India, Africa, and Australia are less aware regarding transactions made using cryptocurrency and blockchain, which hampers growth of the cryptocurrency hardware wallet market outlook across the globe.

Untapped Potential on Emerging Economies

Developing economies offer significant opportunities for crypto hardware wallet to expand their business by offering easier access to capital and financial services. Bitcoin, the most famous of these cryptocurrencies, has already permitted many people and companies to develop and flourish, as their source of income. The economy is slowly shifting to adapt to these needs and cryptocurrencies have a great potential in satisfying them. Evolving demographics, rise in consumerism and openness toward new technologies such as IoT, Blockchain, and others provide lucrative opportunities for cryptocurrency across developing nations. According to Oxford Business Group, Nigeria is the leading country for Bitcoin and crypto hardware wallet adoption due to use it as a means of sending remittances. Furthermore, rise in smartphone penetration in Latin America and Africa enables mobile payment service providers to offer sophisticated services on mobile phones. This is considered as an important opportunity for the cryptocurrency hardware wallet market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cryptocurrency hardware wallet market share from 2021 to 2031 to identify the prevailing cryptocurrency hardware wallet market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cryptocurrency hardware wallet market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global cryptocurrency hardware wallet market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cryptocurrency hardware wallet market trends, key players, market segments, application areas, and market growth strategies.

Cryptocurrency Hardware Wallet Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.6 billion |

| Growth Rate | CAGR of 23.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 293 |

| By Hardware Component |

|

| By Security Method |

|

| By Type |

|

| By Region |

|

| Key Market Players | CryoBit LLC, SafePal, BC VAULT, ELLIPAL, OpenDime, Shift Crypto AG, Etherbit Private Limited, BitLox, SecuX Technology Inc., Sugi, CoolWallet, Trezor, Keystone, Ledger SAS, ShapeShift, Prokey, Cryptomeister |

Analyst Review

A cryptocurrency hardware wallet is a type of wallet that uses a secure encrypted hardware device to hold user's private keys. As a result, hardware wallets are designed to allow users to store private keys in a secure section of the microcontroller while safeguarding sensitive data. Computer viruses that steal or damage data in a software wallet are supposed to be impervious to hardware devices. The hardware wallet, which runs on open-source software, allows users to authenticate the device's whole functionality. Furthermore, to communicate with electronic applications, the hardware wallet gadget uses technologies such as near-field communication and Bluetooth. Owing to growth in demand for digital currencies or cryptocurrencies for trade, this gadget is widely used by businesses. Moreover, the wallet programs have been updated with a hacked and theft-free module, making devices impervious to any potential threats. Therefore, the surge in demand across many economies is expected to boost the growth of the cryptocurrency hardware wallet market size in the upcoming years.

Furthermore, market players have adopted partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, on August 2022 CoolWallet partnered with the leading crypto payment platform MoonPay to offer a safe and convenient crypto purchasing service. With the help of this partnership, users can purchase crypto via MoonPay’s service in the CoolWallet App worry-free, knowing that information is protected by MoonPay’s security mechanism. As soon as the transaction is successfully completed, users’ crypto is sent directly to their CoolWallet, where it remains in safe cold storage.

The report analyzes the profiles of key players operating in the cryptocurrency hardware wallet market such as BC VAULT, BitLox, CoolWallet, Cryptomeister, CryoBit LLC, Etherbit Private Limited, Keystone, Ledger SAS, OpenDime, SafePal, SatoshiLabss.R.O., SecuX Technology Inc., ShapeShift, Shift Crypto AG, Sugi, OPOLO SARL, and ELLIPAL LTD. These players have adopted various strategies to increase their market penetration and strengthen their position in the cryptocurrency hardware wallet industry.

Increased use of NFC in cryptocurrency wallets and technological advances to enhance the security of cryptocurrency hardware wallets are some of the major trends in the market.

By hardware component, the ASIC segment attained the highest growth in 2021. This is attributed to the fact that ASICs can offer greater performance, lower power, higher voltages, reduced footprint/bill of materials and thus increased reliability. In addition, ASICs offer higher IP security, as an ASIC is far harder to reverse engineer than a microcontroller or FPGA design, where the IP is stored in easy-to-read memory.

By region, Asia-Pacific attained the highest growth in 2021. This is attributed to the fact that the region has witnessed significant growth in cryptocurrency transactions and is expected to exhibit the noteworthy growth the developing nation. The region has witnessed a surge in malware attacks among online wallets, which is a major driving factor for the projected growth.

The global cryptocurrency hardware wallet market size was valued at $442.56 million in 2021, and is projected to reach $3,642.62 million by 2031, growing at a CAGR of 23.7% from 2022 to 2031.

CoolWallet, Cryptomeister, CryoBit LLC , Etherbit Private Limited, Keystone, and Ledger SAS hold the market share in cryptocurrency hardware wallet market.

Loading Table Of Content...

Loading Research Methodology...