Cyber Security in BFSI Market Statistics, 2031

The global cyber security in BFSI market was valued at $39.9 billion in 2021, and is projected to reach $214.5 billion by 2031, growing at a CAGR of 18.6% from 2022 to 2031.

Surge in adoption of digitalization in BFSI sector, increase in adoption of IoT & BYOD trend, and increase in physical & virtual threat in the BFSI sector are the key factors that drive of the growth of the cyber security in BFSI market trends. Additionally, increase in adoption of mobile device applications and platforms boost the adoption of cyber security in BFSI industry. However, expensive to adopt technical security measures are expected to hinder the growth of the market.

Cyber security refers to technologies, procedures, and methods designed to prevent networks, devices, programs, and data from attack, damage, malware, viruses, hacking, data thefts or unauthorized access banking, financial services, and insurance (BFSI) sector have aggressively transformed themselves and leveraged technology to meet the evolving requirements of their customers. From managing records on paper to component, various digital services such as online purchases and premium payments are all done to match the customer’s needs. Banking, Financial Services, and Insurance (BFSI) sector have aggressively transformed themselves and leveraged technology to meet the evolving requirements of their customers.

From managing records on paper to component, various digital services such as online purchases and premium payments are all done to match the customer’s needs. While this digital transformation has improved the customer experience and increased the bottom-line, the security concerns for BFSI sector have increased too. The sector is subjected to several attacks ranging from phishing attacks, DoS attacks, spear-phishing, ransomware, and malware attacks that try to steal money and sabotage the brand’s reputation. Governments and regulatory bodies across the world have emphasized heavily on strict security protocols and technology to stop these attacks. The cyber security in bfsi market is segmented into Component, Deployment Model and Enterprise Size.

Segment Review

The cyber security in BFSI market is segmented on the basis of component, deployment model, enterprise size, and region. By component, it is bifurcated into solution and services. By solution, it is further fragmented into identity & access management, infrastructure security, governance risk & compliance, unified vulnerability management service component, data security & privacy service component, and others. By deployment model, the market is categorized into on-premises and cloud. By enterprise size, the market is classified into large enterprise and SMEs. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

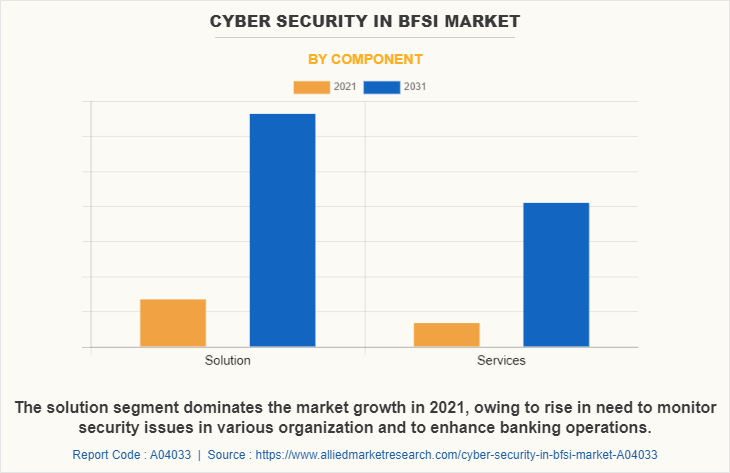

Depending on component, the solution segment dominated the cyber security in BFSI market growth in 2021 and is expected to continue this trend during the forecast period, owing to rise in need to monitor security and management services to enhance banking operations and surge in need to manage large risk in banks drive growth of the market. In addition, availability of advanced security solutions such as silent alarm notification, advanced anti-skimming technology, ATM lighting, video surveillance and remote video monitoring is anticipated to boost banks and financial institutions to adopt security solution, thereby supplementing growth of the global cyber security in BFSI market.

Region-wise, North America dominated the cyber security in BFSI market size in 2021 and is expected to retain its position during the forecast period, owing to rise in awareness regarding data security among banks, insurance firms, and financial institutions and rise in number of cyberattacks are some of the major factors that drive the market growth in this region. Furthermore, several major cyber security in BFSI solution providers including Cisco Systems, Inc., IBM Corporation, and Microsoft are introducing new products & services to protect cyber-attacks & other data thefts in the BFSI sector. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to adopting of security solutions to implement new technologies and to overcome online frauds, which is expected to fuel the market growth in this region. Moreover, massive use of technologies & software involvement has led to huge security concerns among firms operating in the BFSI sector.

The key players profiled in the cyber security in BFSI market analysis are Cisco Systems, IBM Corporation, Microsoft Corporation, BAE Systems, Check Point Software Technologies, DXC Technology, Trend Micro Inc., FireEye Inc., Broadcom Inc., and MacAfee Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the cyber security in BFSI industry.

Top Impacting Factors

Surge in adoption of digitalization in BFSI sector

Rapid adoption of technologies such as artificial intelligence, machine learning, and block chain in the BFSI sector has led to massive threat issues for secured data. In addition, with increase in digitalization, demand for security of data due to cyber-attacks & thefts continue to rise in the BFSI security market.

Moreover, banks, financial institutions, and other financing firms are rapidly switching toward digitalized business operations, thus, adoption & implementation of security solutions & services has increased tremendously. Therefore, the BFSI security market provides cyber-security services to protect the BFSI sector from such threat issues and as a result, is one of the major factors that propel the cyber security in BFSI market share.

Increase in adoption of IoT and BYOD trend

Devices and applications have become more vulnerable to advanced persistent threats (APTs) as a result of the growing IoT and BYOD trend among businesses. Furthermore, as the number of mobile devices within enterprises grows, IT staff is expected to find it more challenging to control and trace data flow in diverse systems. As a result, businesses are using cybersecurity systems to secure sensitive data by monitoring, classifying, and resolving various types of threats, fueling market growth.

For instance, in 2021, cyber criminals manipulated the COVID-19 crisis to launch 667% more phishing attacks and tried to take advantage of security vulnerabilities, which, in turn, boosted the growth of the market. Moreover, over 15% of employees accessed sensitive data from non-work devices in 2020. In addition, many businesses are aware that BYOD’s benefits in the workplace far outweigh any potential risks. Potential security threats can be neutralized in most situations. There are many benefits of having a BYOD policy, increased productivity, employee satisfaction, and reduced company costs; thus, foster the adoption of cybersecurity.

Technological Trends

Over the last decade, cyber security have been heavily used in BFSI organizations. BFSI firms appear to target cyber assaults since they handle significant volumes of sensitive data and manage large cash balances. The industry has accepted a few noteworthy trends and is now working on new solutions to mitigate possible concerns. This is attributed to the core principles of cyber security that help BFSI organizations to deal with malicious external attacks. Several useful features such as integrated security, where all components work and communicate together. Another option to prevent such threats is to use machine learning and big data analytics to store and analyze a large amount of security data in real-time.

In addition, increase in zero trust adoption has also become a priority for organizations. This model can identify high value assets and data within the network. Moreover, BFSI companies are also migrating to better cloud management software solutions to adopt their digital transformation strategy and incorporate cloud-based tools and services.

Government Initiatives:

The increase in digitization initiatives by a range of governments in developing countries is one of the major factors driving the market for cyber security in BFSI. For instance, ISO/IEC 27001 is a widely accepted worldwide standard for lowering security risks and safeguarding information systems. ISO/IEC 27001 is an internationally recognized set of security policies and processes that provide direction on how to improve a company's security posture in any industry. Financial institutions that want to demonstrate their exceptional cybersecurity procedures to stakeholders should pursue ISO/IEC 27001 accreditation, given its image as an internationally recognized benchmark for cyber-attack resilience.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the cyber security in BFSI market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on cyber security in BFSI trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential.

Cyber Security in BFSI Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 214.5 billion |

| Growth Rate | CAGR of 18.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 197 |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Cisco Systems Inc., Trend Micro Inc., BAE Systems plc, FireEye, Inc., Microsoft Corporation, Broadcom Inc., Check Point Software Technologies, DXC Technology, IBM CORPORATION, MACAFEE, INC. |

Analyst Review

In accordance with insights by CXOs of leading companies, sectors such as banks, insurance companies, and financial institutions are largely engaged in regulating environment with huge involvement of financial data & services. In addition, firms operating in the BFSI sector are facing increased data theft and unauthorized access occurrences, owing to non-compliance to various standards. As a result, demand for security solutions & services among banking & financial organizations has increased tremendously. This, as a result has become a major trend in the global cyber security in BFSI market. In addition, the COVID-19 outbreak has a significant impact on the cyber security in BFSI market as several firms in the sector aim at investing in technologies to ensure security of data & expansion of their components in the market.

In the digital era where artificial intelligence and internet of things have taken over the world, there seems to be a comparatively less growth rate of the cyber security in BFSI market than digital marketing. Increased awareness among enterprises of all kinds when it comes to securing their information as well as an increase in ransom-ware assaults among small businesses, charities, and government agencies, are developing trends in the cybersecurity sector. As a result, every firm is increasing its expenditure in order to preserve its sensitive and critical data.

However, a considerable number of companies perceive that they have minimum cyber security in BFSI solutions exposure. This scenario is changing, and 2019 has witnessed an increase in sales of cyber security in BFSI solutions, owing to rapid increase in number data thefts among financial transactions. As a result, firms in the sector are implementing security solution to protect consumer data and financial information, which has led to innovations & new trends in the cyber security in BFSI industry

There are numerous trends of cyber security in BFSI market such as adoption of AI for fraud detection, increased reliability on advanced blockchain systems, and digital-only banking, and so on.

The main objective of Cyber security in banking is to safeguard the user's assets. As individuals go cashless, further actions or transactions are done online

North America is the largest regional market in cyber security in BFSI market

Cyber Security in BFSi is estimated to reach $214,536.81 million by 2031

Cisco Systems, IBM Corporation, Microsoft Corporation, BAE Systems, Check Point Software Technologies, DXC Technology, Trend Micro Inc., FireEye Inc., Broadcom Inc., and MacAfee Inc

Loading Table Of Content...