Cybersecurity For Critical Infrastructure In Financial Sector Market Research, 2032

The global cybersecurity for critical infrastructure in financial sector market size was valued at $9,012.96 million in 2022, and is projected to reach $17,465.33 million by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

Cybersecurity plays an important role in protecting computer systems, computer networks, computer software and computer database from unauthorized data accessibility, theft, damage and other dangerous attacks. The process comprises of various technologies, processes and practices that are useful for safeguarding digital information and are helpful in preventing against cyber attacks that can harm data confidentiality, data integrity, data availability and computer resources.

Critical infrastructure comprises of physical ystem, virtual system, assets and networks that are important for society functioning, economy functioning and nationals security functioning. The infrastructure helps in energy operations, transportation operations, water supply operations, communication operations, healthcare operations, financial service operations and government service operations. The infrastructure helps in providing relevant services and resources that helps in uninterrupted economic growth.

The financial sector basically involves investment dealing, money allocation, capital allocation and financial resource management. The sector is a combination of broad range of institutions, businesses and activities that helps in facilitating the movement of funds among individuals, businesses, corporations, governments, and other entities to enhance economic growth, investment, and financial stability.

The report focuses on growth prospects, restraints, and trends of the cybersecurity for critical infrastructure in financial sector market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the cybersecurity for critical infrastructure in financial sector market share.

Key Takeaways

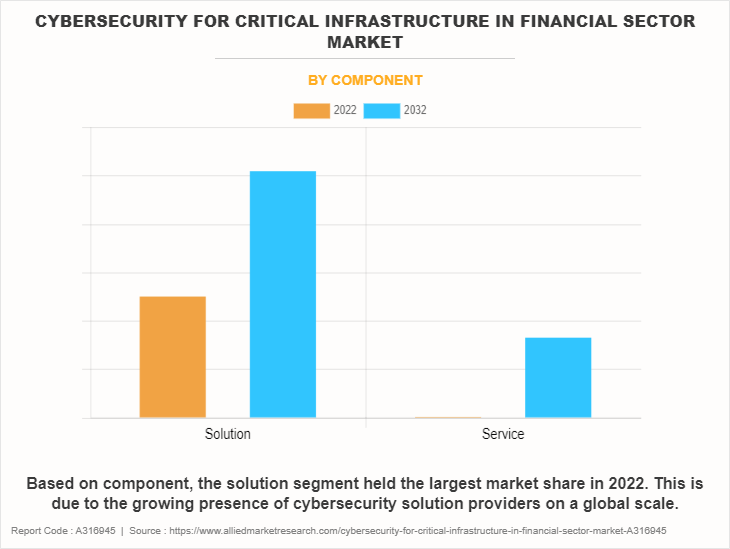

Based on component, the solution segment held the largest market share in 2022

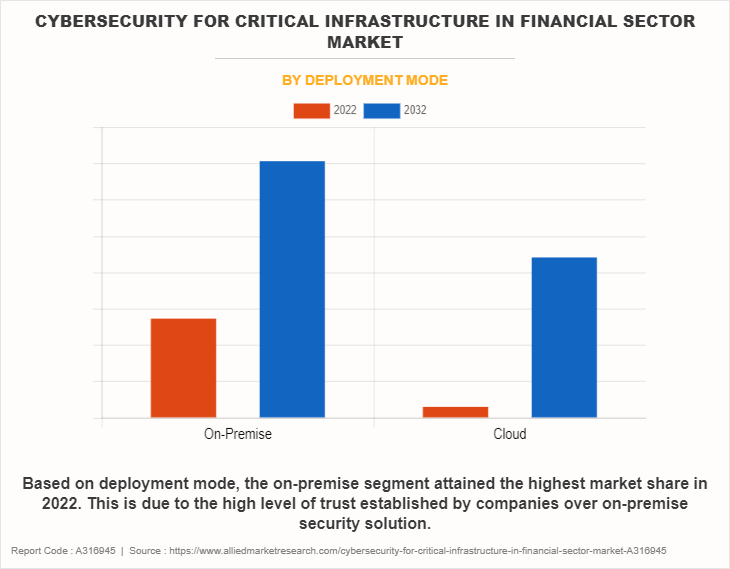

Based on deployment mode, the on-premise segment held the largest market share in 2022.

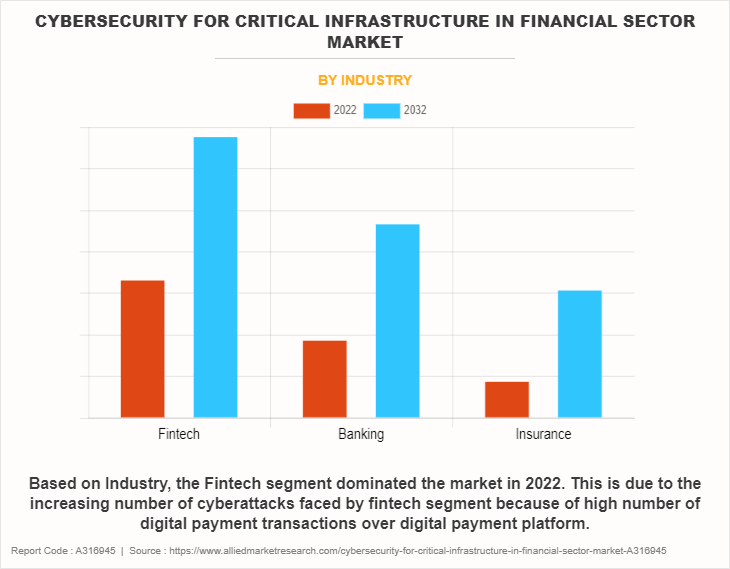

Based on industry, the fintech segment held the largest market share in 2022.

Based on region, the North America segment held the largest market share in 2022.

Segment Review

The global cybersecurity for critical infrastructure in financial sector market is segmented into component, deployment mode, industry, and region. By component, the market is bifurcated into solution and service. Depending on deployment mode, the market is bifurcated into on-premise and cloud. As per industry, the market is categorized into banking, insurance and fintech. Region-wise, the cybersecurity for critical infrastructure in financial sector market is studied across North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Based on component, the solution segment held the largest market share in 2022. This is due to the growing presence of cybersecurity providers on a global scale.

Based on deployment mode, the on-premise segment held the largest market share in 2022. This is due to the high level of trust established by companies over on-premise security solution.

Based on industry, the fintech segment held the largest market share in 2022. This is due to the increasing cyber-risk exposed for online payment transactions, user accounts and banking infrastructure.

Based on region, the North America segment held the largest market share in 2022. This is due to the increasing cancer cases in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the cybersecurity for critical infrastructure in financial sector market include Accenture, Broadcom Inc., Zscaler, HCL Technologies, Rapid7, Wipro Inc., Okta Inc., Tata Consultancy Services, L&T Technology Services Limited, and Infosys. These players have adopted different strategies to increase their market penetration and strengthen their position in the cybersecurity for critical infrastructure in financial sector industry.

Recent Product Launch in the Cybersecurity for Critical Infrastructure in Financial Sector Market

In January 2022, Safe Security strategically collaborated with Infosys to provide risk quantification solutions in the cybersecurity market. This move will allow the organization to achieve a broad view of overall cyber risk solutions. The strategy will also use the SAFE’s proprietary algorithm and will identify the potential financial impact of cyberattack before occurrence.

In October 2023, Okta Inc., launched cybersecurity workforce development initiative to bridge the gap between technology and cybersecurity skills. Okta focuses on two key areas. The second focus consists of 5,000 educational grants for jobless individuals who want to advance their Okta skills in order to transfer into cybersecurity. The program's target audience includes military spouses, veterans, and IT employees affected by recent layoffs.

Recent Acquisition in the Cybersecurity for Critical Infrastructure in Financial Sector Industry

In February 2023, Zscaler, a cloud security company acquired canonic security, an Israel based SaaS application security platform. The aim is to reduce SaaS supply chain attacks. ZScaler will improve its cloud access security broker product and SaaS security posture management (SSPM) product by utilizing latest supply chain capabilites into its data protection techniques. This acquisition will improve ZScaler postion in the cybersecurity market by providing it with a combination of supply chain and data protection capabilities.

In March 2023, Rapid7 acquired cybersecurity startup Minerva Labs for $45 million. The deal includes $38 million in cash. Minerva employs just 14 people, who are all based in Israel, and they will all join Rapid7. The company has raised a total of only $7.5 million to date.

Market Landscape and Trends

The authority is imposing regulation for financial institutions to defend customer data and to keep the financial situation stable. Complying with regulations such as general data protection regulation (GDPR), California consumer privacy act (CCPA), and revised payment services directive (PSD2) is becoming increasingly important. Cloud services are being increasingly adopted by financial institutions for improving cost and scalability. Moreover, the trend offers better security challenges such as securing cloud environments, data protection, and ensuring compliance in the cloud.

Top Impacting Factors

Growing Complex Cyber Threats

Complex cyber intruders such as nation-state actors, organized cyber-criminal groups, possess the ability to launch advanced persistent threat (APT) against critical infrastructure. The infiltrators are utilizing strategic and advanced means such as zero-day exploits, custom malware, and stealthy tactics, to intrude the critical points within the critical infrastructure network, that remain unmapped for a longer period. Therefore, to deal with such kind of infiltrators advanced cybersecurity solutions with capabilities like threat hunting, behavioral analysis, and anomaly detection are required. Cyberattacks basically and importantly targets critical infrastructure assets due to the strategic importance the assets possess and the potential impact assets have over national security, public safety and economic stability. The cybersecurity solutions are basically designed for important infrastructure to protect against cyber-attacks by offering comprehensive threat detection, incident response, and resilience capabilities. Therefore, all these factors are expected to escalate the cybersecurity for critical infrastructure in financial sector market forecast growth during the forecast region.

Increasing Interconnectedness and Interdependence

The increasing interconnectedness between different sectors of critical infrastructure is leading to an expanded attack surface. In addition, cyber attackers are taking advantage of loopholes and weak points to attain accessibility to interconnected systems in other sectors. For instance, the increasing attack on utility of the network of the company can also harm the system of transportation that is dependent on the utility supply. Hence, this kind of attack surface is accelerating comprehensive cybersecurity solutions to defend against interconnected systems and defend against the failure risk. Furthermore, interconnectedness among critical infrastructure sectors is causing a simultaneous effect on other sectors. For instance, cyberattack on financial institution results in the disruption of payment processing systems thus impacting other sectors such as healthcare, transportation, and energy. Therefore, to deal with all these issues cybersecurity solutions play an important role to act as a shield for the critical infrastructure and this will drive the cybersecurity for critical infrastructure in financial sector market industry for the forecast period.

Technical Debt caused by Legacy Systems

The lack of modern security features and protocols are making legacy systems more vulnerable and more exposed to the cyberattacks. Legacy systems might or might not support encryption, multi-factor authentication and other security measures that are generally found in the latest technologies, thus financial institutions that heavily rely on legacy systems find it difficult to implement cybersecurity solution to defend against critical infrastructure. Furthermore, legacy systems are not often collaborative and supportive with cyber solutions and hence it becomes a complex and costly situation demanding customizations, workarounds, and additional investments in middleware or interoperability solutions. Technology providers do not support older versions of software and hardware and due to this financial institution utilizing legacy systems face challenges to receive up-dation of security, patches, and vendor support. Non supporting systems are very much damaged because of security vulnerabilities and exploitation by cyber attackers. Furthermore, without the support of vendor, financial institution struggle to maintain security and integrity of their critical infrastructure assets. Therefore, all these factors are expected to hamper the cybersecurity for critical infrastructure in financial sector industry growth for the forecast period.

Lack of Cybersecurity Skills and Professionals

Companies are observing it challenging to search for and hire cybersecurity professionals and therefore the organizations are turning towards managed security service providers (MSSPs) in order to outsource their cybersecurity needs. MSSPs offer various range of features and services such as threat monitoring, incident response, vulnerability management and compliance assistance, thus helping financial institutions to enhance cybersecurity posture irrespective of resource constraints. The lack and scarcity of cybersecurity techniques are resulting in an increased demand for automatic security solutions that helps in implementing and replacing manual processes. Technologies like artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) are being utilized to automate daily operations such as threat detection, incident response, and security policy enforcement, enabling financial institutions to operate more efficiently and effectively. Therefore, all these factors are providing a significant opportunity for Cybersecurity for Critical Infrastructure in Financial Sector Market Growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cybersecurity for critical infrastructure in financial sector market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cybersecurity for critical infrastructure in financial sector market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cybersecurity for critical infrastructure in financial sector market trends, key players, market segments, application areas, and market growth strategies.

Cybersecurity for Critical Infrastructure in Financial Sector Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.5 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Deployment Mode |

|

| By Industry |

|

| By Component |

|

| By Region |

|

| Key Market Players | Infosys Limited, HCL Technologies, Broadcom Inc., Wipro Inc., Zscaler, Accenture, Rapid7, Tata Consultancy Services (TCS), Okta Inc., L&T Technology Services Limited (LTTS) |

Analyst Review

Cybersecurity uses different techniques to protect the confidentiality, integrity and availability of computer systems, networks and data from cyber threats and unauthorized accessibility. The main purpose behind the cybersecurity is to protect the organization assets from external and internal thefts and attacks that have a large possibility to harm the organization's critical infrastructure.

Key players in the cybersecurity for critical infrastructure in the financial sector market adopted different strategies to sustain their growth in the market. For instance, in October 2020, McAfee launched cybersecurity solution for the education sector. Only McAfee's school clients are eligible to purchase the new solutions, McAfee Secure School Suites and McAfee MVISION Mobile Advanced, which are designed to safeguard all devices against malware like ransomware and fileless attacks, which exploit legitimate programs to infect a computer.?The new suites are intended to help educational institutions save operational costs and simplify the process of keeping students safe online. They do this by providing a cloud-delivered, unified endpoint solution.

Furthermore, in December 2023, IBM Consulting entered a strategic partnership with Palo Alto Networks to manage changing threats in relation to security and improving end to end security postures. Leading cyber companies such as Palo Alto Networks and IBM Consulting will assist each other by becoming partners and providing security services. Moreover, in April 2021, Broadcom Inc. collaborated with Google Cloud to accelerate digital transformation for the enterprise. The aim is to accelerate innovation and strengthen cloud services integration within the core software franchises of Broadcom. Under this partnership, Broadcom will deliver its suite of security and enterprise operations software on Google Cloud, enabling businesses to deploy Broadcom solutions in security, DevOps and more on Google Cloud’s trusted, global infrastructure. These players have adopted product launch, collaboration and strategic alliance strategy to increase their market penetration and strengthen their position in the cybersecurity for critical infrastructure in the financial sector industry.

The authority is imposing regulation for financial institutions to defend customer data and to keep the financial situation stable. Complying with regulations such as general data protection regulation (GDPR), California consumer privacy act (CCPA), and revised payment services directive (PSD2) is becoming increasingly important. Cloud services are being increasingly adopted by financial institutions for improving cost and scalability. Moreover, the trend offers better security challenges such as securing cloud environments, data protection, and ensuring compliance in the cloud.

On-Premise and Solution

North America

$9,012.96 Million

Accenture, Broadcom Inc., Zscaler, HCL Technologies, Rapid7, Wipro Inc., Okta Inc., Tata Consultancy Services, L&T Technology Services Limited, and Infosys.

Loading Table Of Content...

Loading Research Methodology...