Cylindrical Li-ion Battery Market Research, 2033

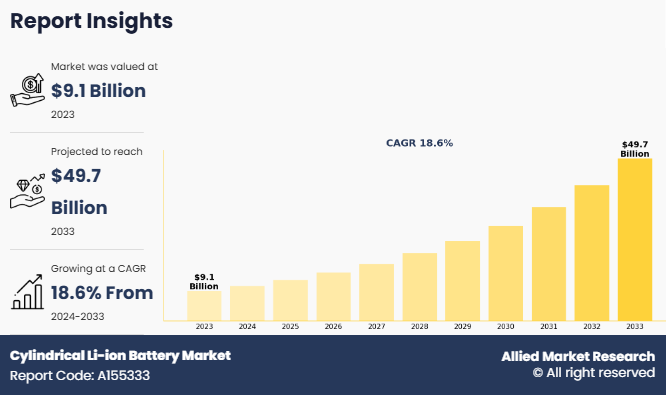

The global cylindrical li-ion battery market was valued at $9.1 billion in 2023, and is projected to reach $49.7 billion by 2033, growing at a CAGR of 18.6% from 2024 to 2033. The increase in demand for electric vehicles (EVs) is a significant driver of the cylindrical lithium-ion battery market, as automakers prioritize these batteries for their superior energy density, cost-effectiveness, and durability. Alongside the EV boom, rising adoption of cylindrical lithium-ion batteries in power tools and industrial applications, such as cordless equipment and energy storage systems fuels demand due to their robust performance, longer life cycles, and ability to deliver high power output that makes them ideal for a wide range of high-drain applications.

Introduction

A cylindrical lithium-ion battery is a type of rechargeable battery characterized by its cylindrical shape. It consists of a cylindrical cell housing, typically made from metal, which contains a positive electrode (cathode), a negative electrode (anode), and an electrolyte that facilitates the movement of lithium ions between the electrodes. The cylindrical design offers robust structural integrity that makes these batteries well-suited for various applications, including consumer electronics, power tools, and electric vehicles. The shape and configuration of cylindrical li-ion batteries enable efficient packing and thermal management, contributing to their widespread use in high-power and high-energy-density applications.

Key Takeaways

The global cylindrical li-ion battery market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of type, capacity, end-use, 4 major regions, and more than 15 countries.

The global report includes a detailed study covering underlying factors influencing the cylindrical lithium ion battery industry opportunities and trends.

The key players in the cylindrical li-ion battery market are Panasonic Energy Co. Ltd., Tianneng rechargeable battery manufacturers, Murata Manufacturing Co., Ltd., Xiamen Tmax Battery Equipment Limited., EVE Energy Co., Ltd., Sony Corporation, LG Chem, Hitachi, Ltd., Contemporary Amperex Technology Co., Limited., and Samsung SDI Co., Ltd.

The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

Countries such as China, the U.S., Canada, Germany, and Brazil hold a significant share in the global cylindrical li-ion battery market.

Market Dynamics

Surge in demand for electric vehicles (EVs) has significantly driven the demand for cylindrical lithium-ion batteries. According to the International Energy Agency (IEA), electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. As the automotive industry increasingly shifts towards electrification, EV manufacturers require high-performance batteries that provide substantial energy storage and reliability. Cylindrical lithium-ion batteries, known for their robust design and efficient energy density, are well-suited to meet these needs. Their cylindrical shape allows for efficient packing and thermal management, crucial for the high power and energy requirements of modern electric vehicles. All these factors are expected to drive the demand for the cylindrical li-ion battery market during the forecast period.

However, the high cost of raw materials is a significant factor that hampers the growth of the cylindrical lithium-ion batteries. The primary raw materials used in these batteries, such as lithium, cobalt, and nickel, are essential for their performance but are also subject to volatile pricing and supply constraints. The extraction and processing of these materials are resource-intensive and environmentally challenging, contributing to their elevated costs. This affects the overall production expenses of cylindrical li-ion batteries that makes them more expensive compared to other energy storage solutions. All these factors hamper the cylindrical li-ion battery market growth.

Technological advancements in battery design and manufacturing create significant opportunities for cylindrical lithium-ion batteries. Innovations in materials science such as the development of advanced cathode and anode materials, are enhancing the performance and efficiency of these batteries. For instance, the use of high-energy-density materials increases the capacity and lifespan of cylindrical li-ion batteries that makes them preferable choice for a variety of applications, from consumer electronics to electric vehicles. These advancements improve the overall performance and enable manufacturers to produce batteries with greater energy density and longer cycle life, meeting the growing demands of modern technology. All these factors are anticipated to offer new growth opportunities for the cylindrical li-ion battery market during the forecast period.

Segments Overview

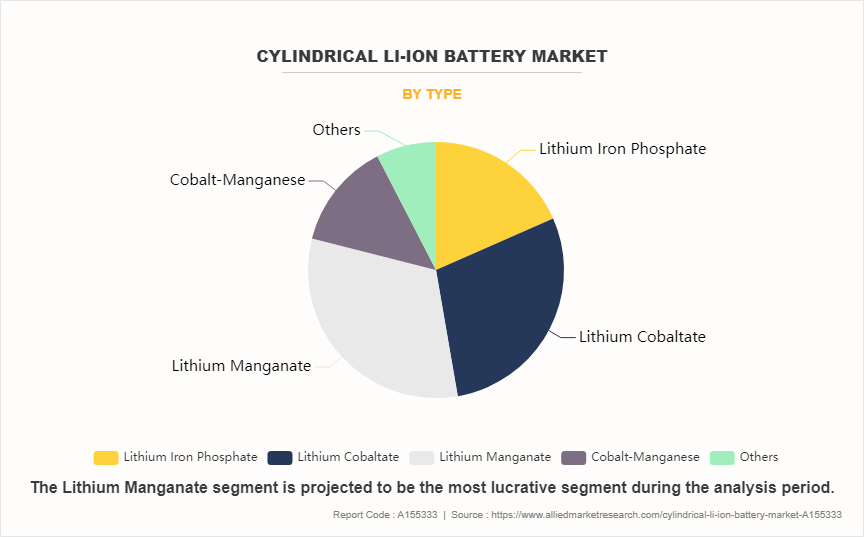

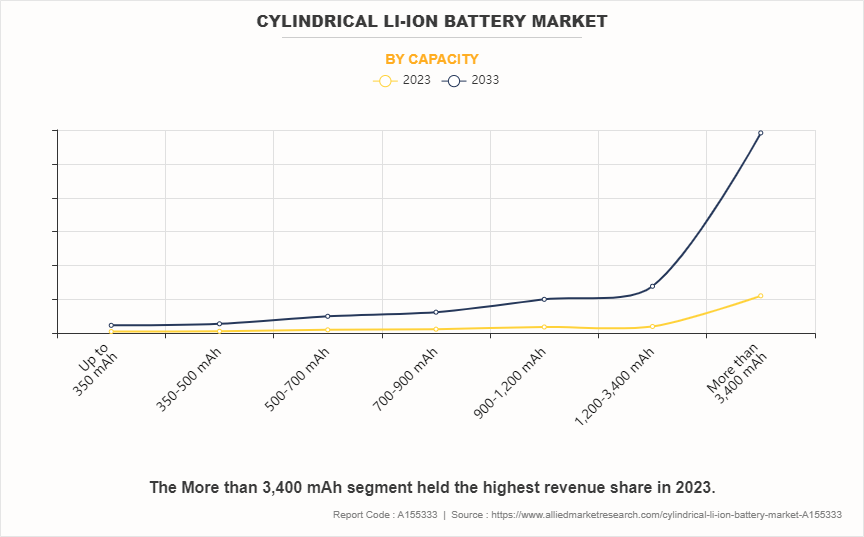

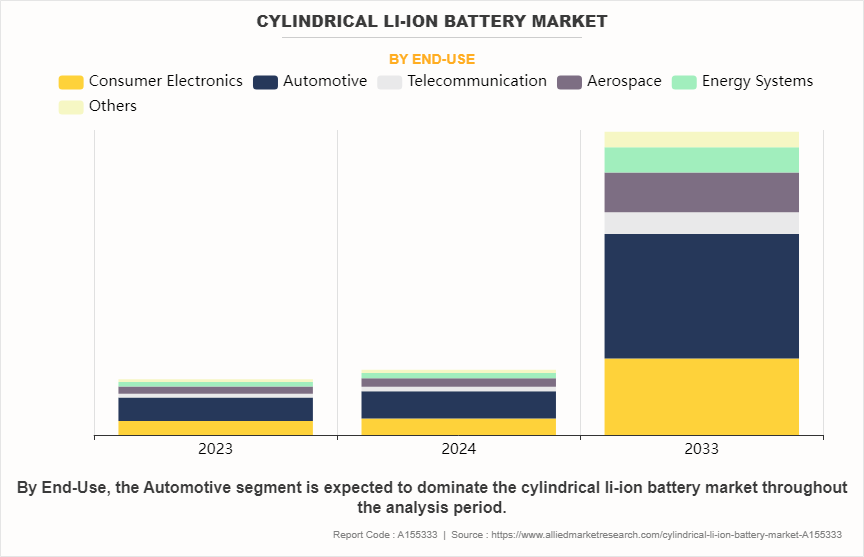

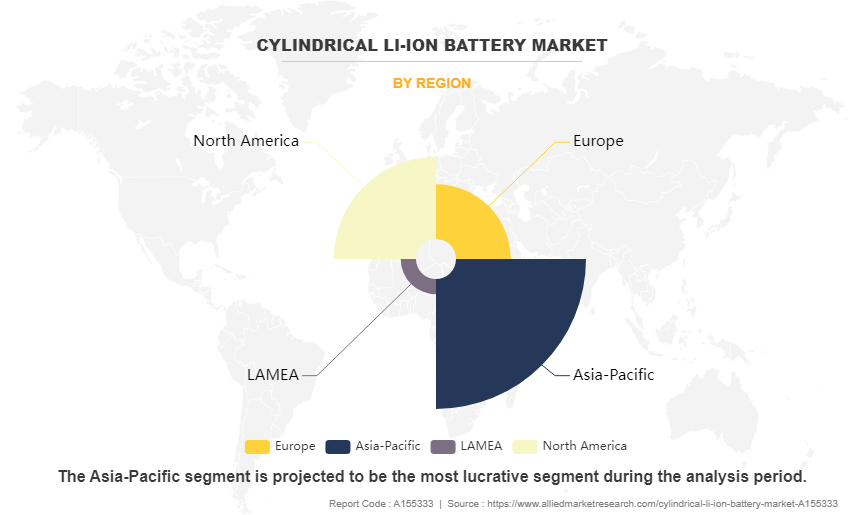

The cylindrical li-ion battery market is segmented into type, capacity, end use, and region. On the basis of type, market is classified into lithium iron phosphate, lithium cobaltate, lithium manganate, cobalt-manganese, and others. On the basis of capacity, the market is segmented into up to 350 mAh, 350-500 mAh, 500-700 mAh, 700-900 mAh, 900-1,200 mAh, 1,200-3,400 mAh, and more than 3,400 mAh. On the basis of end use, the market is classified into consumer electronics, automotive, telecommunication, aerospace, energy systems, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, market is classified into lithium iron phosphate, lithium cobaltate, lithium manganate, cobalt-manganese, and others. The lithium manganate segment accounted for less than one-third of the cylindrical li-ion battery market size, in 2023 and is expected to maintain its dominance during the forecast period. Lithium manganate is known for its superior thermal stability, which enhances the overall safety of cylindrical lithium-ion batteries. This is crucial in applications where the risk of overheating or thermal runaway is a concern, such as electric vehicles (EVs) and grid energy storage.

On the basis of capacity, the market is segmented into up to 350 mAh, 350-500 mAh, 500-700 mAh, 700-900 mAh, 900-1,200 mAh, 1,200-3,400 mAh, and more than 3,400 mAh. The more than 3,400 mAh segment accounted for more than three-fifths of the cylindrical li-ion battery market share in 2023 and is expected to maintain its dominance during the cylindrical li-ion battery market forecast period. The rapid growth of renewable energy sources, particularly solar and wind, drives the demand for high-capacity cylindrical lithium-ion batteries in grid-level energy storage systems (ESS). Batteries with capacities above 3,400 mAh are well-suited for large-scale storage, as they store more energy, stabilize the grid, and ensure a consistent power supply during periods of low energy generation.

On the basis of end use, the market is classified into consumer electronics, automotive, telecommunication, aerospace, energy systems, and others. The automotive segment accounted for more than two-fifths of the cylindrical li-ion battery market share in 2023 and is expected to maintain its dominance during the forecast period. Cylindrical lithium-ion batteries, known for their robust design, cost-effectiveness, and ease of manufacturing, have become a popular choice for EV applications. As automakers strive to meet environmental standards, the need for efficient and scalable battery solutions such as cylindrical cells are becoming increasingly critical, particularly as they are suitable for mass production, helping to lower overall vehicle costs.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region accounted for less than half of the cylindrical li-ion battery market share in 2023 and is expected to maintain its dominance during the forecast period. Governments across the region, especially in China, Japan, South Korea, and India, are actively promoting the transition to clean energy by offering incentives for EV adoption. Cylindrical Li-ion batteries, known for their high energy density and cost-effectiveness, are favored in EV manufacturing, particularly for entry-level models and electric two-wheelers. This surge in EV production, coupled with government support, has significantly bolstered the demand for cylindrical li-ion batteries in the region.

Competitive Analysis

Key players in the cylindrical li-ion battery market include Panasonic Energy Co. Ltd., Tianneng rechargeable battery manufacturers, Murata Manufacturing Co., Ltd., Xiamen Tmax Battery Equipment Limited., EVE Energy Co., Ltd., Sony Corporation, LG Chem, Hitachi, Ltd., Contemporary Amperex Technology Co., Limited., and Samsung SDI Co., Ltd.

In the global cylindrical li-ion battery market, companies have adopted agreement and acquisition strategies to expand the market or develop new products. For instance, in March 2024, Mazda Motor Corporation and Panasonic Energy Co., Ltd., a Panasonic Group Company, signed an agreement towards the supply of cylindrical automotive lithium-ion batteries. Through this agreement, both companies commit to tackling societal challenges like reducing global warming, promoting sustainable growth in the automotive and battery industries, creating local jobs, and developing talent. Moreover, in February 2024, Panasonic Energy Co., Ltd., a Panasonic Group Company, signed a long-term agreement with H&T Recharge, a leading battery component manufacturer, for the supply of cylindrical automotive lithium-ion battery cans in North America, with the aim of expanding its production of safe EV batteries. This agreement is expected to boost the production and supply of cylindrical lithium-ion batteries for electric vehicles (EVs) in North America, enhancing safety and availability.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cylindrical li-ion battery market analysis from 2023 to 2033 to identify the prevailing cylindrical li-ion battery market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cylindrical li-ion battery market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global cylindrical li-ion battery market trends, key players, market segments, application areas, and market growth strategies.

Cylindrical Li-ion Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 49.7 billion |

| Growth Rate | CAGR of 18.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 410 |

| By Type |

|

| By Capacity |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Xiamen Tmax Battery Equipments Limited., Murata Manufacturing Co., Ltd., Sony Corporation, Contemporary Amperex Technology Co., Limited., EVE Energy Co., Ltd., Tianneng rechargeable battery manufacturers, LG Chem, Hitachi, Ltd., Panasonic Energy Co., Ltd., Samsung SDI Co., Ltd. |

Analyst Review

According to the opinions of various CXOs of leading companies, the cylindrical li-ion battery market is expected to witness an increase in demand during the forecast period. Increase in demand for electric vehicles and rise in adoption in power tools and industrial applications are expected to increase the demand for cylindrical li-ion batteries during the forecast period. In the automotive sector, the shift towards electric vehicles is driving the need for high-performance batteries. Cylindrical Li-ion batteries are particularly well-suited for EVs due to their high energy density, long cycle life, and efficient thermal management. As more consumers and businesses opt for electric vehicles to reduce carbon emissions and embrace sustainable transportation, the demand for these batteries is expected to grow substantially.

Moreover, the adoption of cylindrical li-ion batteries in power tools and industrial applications is on the rise. These batteries are favored for their durability, high power output, and compact design, which make them ideal for use in tools and machinery that require reliable and sustained energy. As industries and professionals seek more efficient and powerful tools, the demand for cylindrical li-ion batteries is expected to increase. The continued expansion of these applications, combined with ongoing improvements in battery technology is expected to drive growth in the cylindrical li-ion battery market during the forecast period.

$49.7 billion is the estimated industry size of cylindrical li-ion battery market by 2033.

The cylindrical Li-ion battery market is projected to experience strong growth, driven by the rising demand for electric vehicles (EVs), energy storage solutions, and advancements in battery materials like high-energy-density cathodes. Key trends include innovations in thermal management, energy density improvements, and cost optimization, all aimed at enhancing battery efficiency and reducing manufacturing costs.

Electric vehicles (EVs) represent the leading application, as cylindrical batteries are well-suited for their energy density and reliability. They are increasingly used in consumer electronics and medical devices as well due to their compact design and durability.

Asia-Pacific currently holds the largest share in the cylindrical Li-ion battery market, driven by high production rates, technological advancements, and strong demand in EV and electronics manufacturing industries, especially in China, Japan, and South Korea.

Leading companies in the cylindrical Li-ion battery market include LG Chem, Panasonic, Samsung SDI, Murata Manufacturing, and Sony. These firms are known for their strong research and development in battery technology, substantial manufacturing capacities, and extensive market reach.

Loading Table Of Content...

Loading Research Methodology...