Data Center Cooling Market Insights, 2033

The global data center cooling market was valued at $18.7 billion in 2023, and is projected to reach $80.1 billion by 2033, growing at a CAGR of 15.7% from 2023 to 2033.

The data center cooling market is a rapidly growing segment within the broader data center infrastructure industry, driven by the increasing demand for efficient solutions to manage the heat generated by high-density servers, storage systems, and networking equipment. As data traffic surges globally, fueled by the expansion of cloud computing, artificial intelligence (AI), big data analytics, and the Internet of Things (IoT), this propels the demand for data center cooling solutions.. Effective cooling ensures that equipment operates within optimal temperature ranges, preventing overheating that can lead to system failures, reduced performance, and costly downtime. With energy efficiency becoming a top priority for data center operators, cooling solutions have evolved significantly to meet the demands of modern, high-performance facilities.

The growing trend in data center cooling is immersion cooling, where servers are submerged in dielectric fluids that efficiently conduct heat away from the components. This type of cooling is gaining traction particularly in high-performance computing (HPC) environments, such as supercomputing centers or facilities running AI and machine learning workloads. The thermal management capabilities of immersion cooling not only improve performance but also reduce the overall environmental impact of cooling systems. Immersion cooling is more efficient than air-based cooling, as the liquid medium absorbs heat more effectively, and because the heat is removed at a much higher rate than air. Moreover, the system operates with minimal noise and significantly reduces the need for large, energy-consuming air conditioning units.

The data center cooling market demand continues to experience significant technological advancements, as operators seek to balance the need for high performance, low energy consumption, and sustainable operations. The ongoing development of AI-powered cooling systems, liquid immersion technologies, and increase in use of renewable energy sources is reshaping how data centers manage heat and operate in an environmentally conscious manner. As the digital economy grows and data centers become more complex and consume high energy, the demand for innovative, cost-effective, and sustainable cooling solutions is expected to remain a key priority for operators and service providers.

Rise in data center demand, rise in high-performance computing, including AI, machine learning, and big data analytics, and rise in adoption of hyperscale and edge data centers are the factors expected to drive the demand for data center cooling solutions. Moreover, growth in need of renewable energy integration, rapid urbanization, and increase in IT adoption are expected to provide data center cooling market opportunities during the forecast period. On the contrary, high implementation cost and cooling challenges during power outage hamper the growth of the data center cooling market. With these trends in place, share in the demand for data center cooling solutions is expected to shift toward more innovative, sustainable, and cost-effective technologies that meet the evolving needs of modern data centers.

Type Insights:

The data center cooling market is expected to witness substantial growth driven by technological innovations aimed at enhancing efficiency and sustainability. As global data consumption continues to rise dramatically, the need for effective data center cooling systems has become crucial to maintain optimal performance, decrease downtime, and lower energy usage. Conventional air conditioning systems fall short when it comes to controlling the significant heat generated by contemporary data center setups. Therefore, new cooling technologies have surfaced to tackle these issues.

For instance, in December 4, 2024, Schneider Electric announced a collaboration with Nvidia to design cooling systems for AI data centers. These designs will support Nvidia's new servers, which consume up to 132 kilowatts per rack and require liquid cooling. Nvidia's shift to liquid cooling has led to increased investment from data center cooling companies in new data center construction and reconfiguration. No financial details were disclosed.

One of the significant advancements is liquid cooling, offering more efficient and direct method of dissipating heat compared to traditional air-cooling methods. This method includes strategies like direct-to-chip cooling, where heat removal is focused directly on the processors and components, ensuring more effective cooling right at the source. In addition, the increase in the adoption of Immersion cooling, where components are placed in thermally conductive liquids, is gaining traction due to its capacity to accommodate high-density servers, minimizing both the space and energy needed for cooling. Furthermore, free cooling technology has progressed significantly, taking advantage of natural environmental conditions like ambient air temperatures to reduce reliance on mechanical refrigeration. This approach is particularly beneficial in cooler climates, where outside air can be employed to cool data centers, eliminating the energy expenses linked to conventional cooling systems.

For instance, in February 28, 2024, SK Enmove signed an MOU with Iceotope Technologies and SK Telecom for next-generation cooling solutions. The agreement, announced at the Mobile World Congress in Barcelona, involved cooperation on data center liquid cooling technology. They planned to use SK Enmove’s thermal fluids in Iceotope’s Precision Liquid Cooling (PLC) solution for SK Telecom’s AI Data Center Testbed. Liquid cooling, using non-conductive thermal fluids, offers improved power consumption and cost savings over air-cooling. SK Enmove aimed to develop optimized thermal fluids for various liquid cooling solutions.

Another key technological trend is the integration of artificial intelligence (AI) in cooling management. AI-driven solutions can monitor and predict temperature fluctuations in real-time, adjusting cooling operations dynamically to optimize energy efficiency. By continuously analyzing data and learning from system behavior, AI can help reduce cooling costs and improve overall system reliability. Moreover, the surge in the implementation of cutting-edge technologies in the data center cooling sector has led to the development of solutions that are more energy-efficient, environmentally friendly, and cost-effective solutions, ultimately supporting the expansion of the digital economy while minimizing environmental impact.

For instance, on November 19, 2024, Accelsius and iM Data Centers partnered to deliver sustainable data center cooling solutions for HPC and AI workloads at iM’s Miami data center, opening in Q1 2025. The facility will feature Accelsius’ NeuCool™ system for efficient direct-to-chip liquid cooling. This collaboration aims to support high-performance computing with minimal environmental impact.

Key Takeaways:

By component, the solution segment accounted for the largest data center cooling market share in 2023.

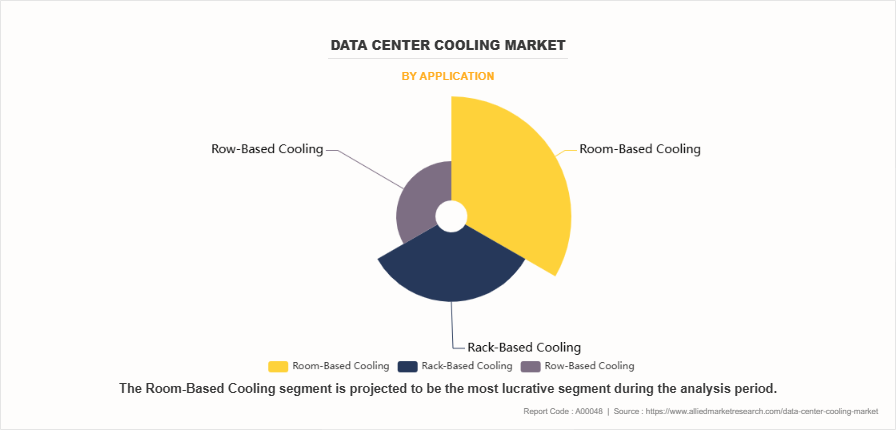

By cooling type, the room-based cooling segment accounted for the largest data center cooling market share in 2023.

By industry vertical, the manufacturing segment accounted for the largest data center cooling market size in 2023.

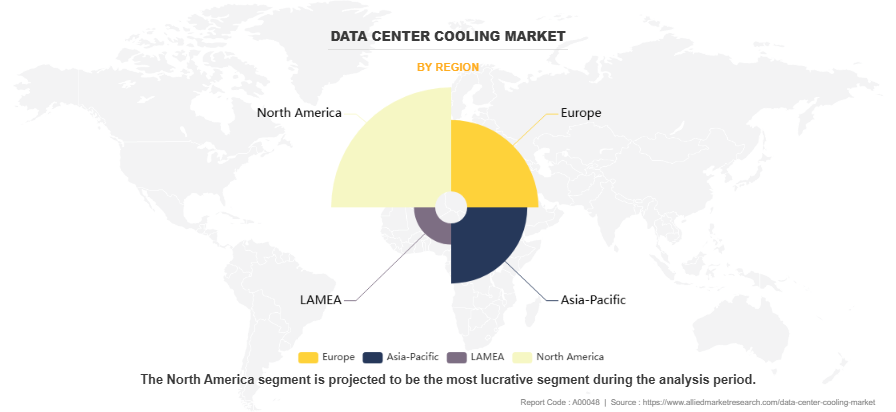

Region wise, North America generated the highest revenue in 2023.

Segment review

The data center cooling market is segmented on the basis of component, cooling type, industry vertical, and region. In terms of component, the market is bifurcated into solution and service. By cooling type, it is classified into room-based cooling, rack-based cooling, and row-based cooling. In terms of industry vertical, it is classified into BFSI, manufacturing, IT & telecom, media & entertainment, retail, government & defense, healthcare, energy, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on cooling type, the room-based cooling segment dominated the data center cooling market share in 2023 and is expected to continue this trend during the forecast period owing to least use of pipes and ducts compared to other cooling types. Air-conditioners and other air-based cooling circulate air in data centers to maintain temperature within permissible limit. room-based cooling is utilized more due to its energy-efficient cooling. However, the rack-based cooling segment is expected to witness the highest growth in the upcoming years, owing to the increasing demand for more efficient cooling solutions in high-density environments. As data centers evolve and handle more advanced IT workloads like cloud computing and artificial intelligence there is a need for more targeted and efficient cooling.

Region wise, the data center cooling market was dominated by North America in 2023, and is expected to retain its position during the forecast period, owing to technological advancements and recent developments pertaining to the market. Moreover, companies in this region are focusing more on implementation of cost-effective and environment-friendly cooling solutions, which is expected to drive the data center cooling industry during the forecast period. However, Asia-Pacific is expected to witness significant growth during the data center cooling market forecast period, owing to increasing demand for cloud computing, data processing, and the rise of emerging technologies such as AI, big data, and IoT. Furthermore, the Asia-Pacific region has a growing number of hyperscale data centers, which require efficient cooling solutions to handle high-density IT infrastructure.

For instance, on November 13, 2024, Lennox Data Centre Solutions launched its stand-alone business to provide innovative, sustainable cooling solutions for data centers across Europe, the Middle East, and Africa. Lennox aimed to offer precision, efficiency, and reliability in heat rejection products to meet demanding energy and performance standards. Lennox leveraged its manufacturing facilities in France and Spain to ensure quality and reliability in its products.

Application Insights:

The data center cooling solutions in the data center cooling market are widely utilized across various sectors such as IT infrastructure, telecommunications, and cloud computing In the IT infrastructure sector, data center cooling systems effectively manage temperature to avoid overheating of servers and equipment, thereby improving operational efficiency. In the telecommunications field, these solutions help sustain the optimal functionality of networking devices, guaranteeing uninterrupted service. The cloud computing industry gains from data center cooling by maximizing resource usage and ensuring that cloud servers operate at their highest performance levels.

Moreover, data center cooling solutions are increasingly being integrated with advanced technologies such as artificial intelligence (AI) and machine learning (ML), allowing for predictive cooling and real-time adjustments based on workload demands. This helps reduce energy consumption and operational costs. With the surge in the need for more powerful computing, effective cooling solutions for data centers are essential for prolonging equipment life, enhancing performance, and promoting sustainability. As the industry develops, these solutions provide enhanced scalability and efficiency of modern data centers.

For instance, in February 27, 2025, Modine announced $180 million in orders for Airedale by Modine™ data center cooling systems from a leading AI infrastructure developer. The equipment was designed to provide scalable, cost-effective, and sustainable solutions for AI applications. The products will be manufactured in Virginia and Mississippi, with delivery expected throughout 2025 and early 2026. Eric McGinnis, President of Climate Solutions, highlighted the strategic value and long-term partnership potential of these orders.

The report focuses on growth prospects, restraints, and analysis of the global ERP market trend. The study provides Porter‐™s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global ERP market share.

Competition Analysis:

Competitive analysis and profiles of the major players in the data center cooling market are Schneider Electric Se; Black Box Corporation; Nortek Air Solutions, LLC; Airedale International Air Conditioning Ltd; Hitachi, Ltd.; Rittal GmbH & Co. Kg; Fujitsu Ltd.; Stulz GmbH; Vertiv; and Asetek. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help drive the growth of the data center cooling market globally.

Report Coverage & Deliverables:

The data center cooling market report provides comprehensive analysis, including global and regional market size estimates, growth projections, and key trends. It covers market drivers, challenges, and opportunities, with insights into strategic partnerships and technological advancements. Deliverables include detailed forecasts and competitive strategies from major market players.

Recent Developments in the data center cooling Industry:

In October 2024, Schneider Electric acquired an initial 75% controlling interest in Motivair for $850 million with the deal designed to strengthen its energy management solutions. The deal strengthens Schneider's offering of direct-to-chip liquid cooling and high-capacity thermal systems. The increasing use of generative-AI and large language models such as Chat-GPT calls for more efficient cooling solutions in data centers, particularly liquid cooling as traditional air cooling cannot disperse the greater heat, the company added.

In March 2024, Schneider Electric collaborated with NVidia to optimize data center infrastructure. Schneider Electric introduced cutting-edge data center reference designs tailored for NVIDIA accelerated computing clusters and built for data processing, engineering simulation, electronic design automation, computer-aided drug design, and generative AI. Special focus was placed on enabling high-power distribution, liquid-cooling systems, and controls designed to ensure simple commissioning and reliable operations for the extreme-density cluster, the statement added.

In January 2022, Tech Data, a TD SYNNEX company, expanded its partnership with Schneider Electric, the global leader in digital transformation in energy management and automation. With the enhancement of this go-to-market (GTM) partnership, Tech Data empowered businesses by making Schneider Electric™s net-zero data center solutions accessible for enterprises.

In February 2025, Carrier Global Corporation announced its investment and technology partnership with ZutaCore, a leader in two-phase direct-to-chip liquid cooling technology for data centers. This move aligned with Carrier's strategy to provide advanced cooling solutions. The global data center cooling market was projected to reach $20 billion by 2029, with liquid cooling expected to grow significantly. It emphasized the importance of direct-to-chip liquid cooling for AI-driven data centers. This partnership highlighted the partnership's significance in integrating their waterless liquid cooling technology with Carrier's expertise.

Recent Product Launches in the Market:

- On June 18, 2024, Petronas Lubricants International launched its new data center cooling fluid, Petronas Iona Tera, and partnered with Iceotope. They announced plans to jointly develop thermal management solutions for data centers, Edge computing facilities, and blockchain operations to enhance efficiency while reducing carbon emissions and water usage. Hezlinn Idris, MD and group CEO, highlighted the partnership's potential to improve data infrastructure performance without harming the environment.

- On April 18, 2024, Innventure announced that Accelsius unveiled its two-phase, direct-to-chip liquid cooling technology, NeuCool™, for data centers. The system promises top thermal performance for AI, machine learning, and high-performance computing, with potential savings of 50% in energy costs, an 80% reduction in CO2 emissions, and zero water usage. Accelsius CEO Josh Claman introduced NeuCool™ at Data Center World 2024, while Innventure CEO Bill Haskell highlighted their model of bringing breakthrough technologies to market through multinational partnerships.

Top Impacting Factors:

Increase in data center demand

As the world becomes more digitally connected and data-driven, businesses are relying increasingly on data centers to store, process, and manage vast amounts of data. The rise of cloud computing, big data analytics, artificial intelligence (AI), machine learning, and the Internet of Things (IoT) has led to exponential data generation, creating a parallel surge in the demand for data centers. This growing reliance on data centers has prompted operators to build larger and more powerful facilities to support the expanding data needs of businesses and consumers.

With the expansion of these facilities, the density of IT equipment has also increased. More servers, storage systems, and networking devices are packed into smaller physical spaces, generating significant amounts of heat. As a result, cooling has become a critical factor in ensuring the proper functioning and longevity of the equipment. Data center operators are now faced with the challenge of cooling ever-more powerful servers in high-density environments while also keeping operational costs under control. Traditional cooling systems are often insufficient for managing the heat generated by modern, high-performance hardware. This is pushing operators to adopt advanced and more efficient cooling technologies, such as liquid cooling, AI-driven optimization, and hybrid cooling solutions, all of which contribute to the growth of the data center cooling market.

Demand for real-time insights and data sharing to enhance decision-making

Hyperscale data centers, which are massive facilities built to support the massive infrastructure required for cloud computing, big data analytics, and large-scale internet services, demand highly efficient and scalable cooling solutions due to their size and the immense computational power they house. These data centers are typically operated by major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, and they handle vast amounts of data traffic. As hyperscale data centers continue to grow in number and scale to accommodate ever-increasing data demands, the need for advanced cooling technologies becomes more critical.

Hyperscale data centers are characterized by their high density of servers, storage systems, and networking equipment, all of which generate a tremendous amount of heat. Traditional air-based cooling systems are becoming less effective at managing the heat generated by modern, high-performance IT equipment. As a result, these facilities are increasingly adopting more efficient and targeted cooling technologies such as liquid cooling and direct-to-chip cooling, which offer more efficient thermal management. Moreover, hyperscale operators are looking to improve energy efficiency to reduce operational costs and meet sustainability goals. This has spurred the adoption of cooling solutions like free cooling (which uses external air), AI-driven optimization, and immersion cooling, all of which are driving the growth of the data center cooling market.

Key Benefits For Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data center cooling market analysis from 2023 to 2033 to identify the prevailing data center cooling market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the data center cooling market segmentation assists to determine the prevailing market opportunities and data center cooling market size

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global data center cooling market trends, key players, market segments, application areas, and data center cooling market growth strategies.

Data Center Cooling Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 215 |

| By Component |

|

| By Industry Vertical |

|

| By Cooling Type |

|

| By Region |

|

| Key Market Players | Fujitsu Ltd, RITTAL GmbH & Co. KG, ASETEK, Schneider Electric SE, Black Box Corporation, Nortek Air Solutions, LLC, Hitachi, Ltd., Stulz GmbH, Vertiv, Airedale International Air Conditioning Ltd. |

Analyst Review

Owing to the increasing green initiatives and amid stringent environment regulations from government, data center operators are adopting cooling systems that emit least carbon footprints, thereby driving the growth of the global market. Moreover, data center cooling system manufacturers are introducing innovative products, which use less water while cooling the data centers. For instance, in June 2018, Microsoft has announced an eco-friendly data center that has been lowered into the sea waters near Orkney Island, Scotland, as a part of Phase 2 of Project Natick, which is expected to check the feasibility of systems on the seabed. Moreover, the data center operators are also focusing on using renewable source of energy such as geo-thermal energy to make data center cooling systems energy efficient and eco-friendly. Furthermore, data center operators are focusing to provide modular cooling and portable cooling to data centers present in mild temperature at reasonable pricing. With rise in number of data centers, the market is getting competitive.

Moreover, in Europe number of companies are majorly focusing on reducing the costs associated with data center operations, which has augmented the need for efficient data center cooling solutions. Additionally, in Europe, the demand for new data centers is continuously growing, which is opportunistic for the market. For instance, Apple, Inc. spent almost $1.9 billion to build two data centers in Europe that would be entirely powered by renewable energy. The company has declared that the data centers in Denmark and Ireland will power Apple's online services, including the App Store, iTunes Store, Maps, iMessage, and Siri for customers across Europe. The global data center cooling market is highly competitive due to the strong presence of the existing vendors. However, the data center cooling system vendors who have access to extensive technical and financial resources are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the global market requirements. Furthermore, the competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by the key vendors. Some of the major key players profiled in the report include Schneider Electric Se; Black Box Corporation; Nortek Air Solutions, LLC; Emerson Electric Co.; Hitachi, Ltd.; Rittal Gmbh & Co. Kg; Fujitsu Ltd.; Stulz Gmbh; Vertiv, and Asetek.

The global data center cooling market was valued at $18.7 billion in 2023 and is projected to reach $80.1 billion by 2033, growing at a CAGR of 15.7% from 2024 to 2033.

The rise in high-performance computing, including AI, machine learning, and big data analytics, is one of the upcoming trends in the data center cooling market.

Growth in the need for renewable energy integration is the leading application of the Data Center Cooling Market.

North America is the largest regional market for Data Center Cooling.

Schneider Electric Se, Black Box Corporation, Nortek Air Solutions, LLC, Airedale International Air Conditioning Ltd, Hitachi, Ltd., Rittal GmbH & Co. Kg, Fujitsu Ltd., Stulz GmbH, Vertiv, and Asetek are the top companies with market share in Data Center Cooling.

Loading Table Of Content...

Loading Research Methodology...