Data Loss Prevention Market Insights, 2032

The global data loss prevention market size was valued at USD 2.1 billion in 2022, and is projected to reach USD 12 billion by 2032, growing at a CAGR of 19.2% from 2023 to 2032.

Data loss prevention (DLP) enables businesses to discover, classify, monitor, and protect data intuitively with zero friction to the user experience. The DLP term refers to defending organizations against both data loss and data leakage prevention. Data loss refers to an event in which important data is lost to the enterprise, such as in a ransomware attack. Data loss prevention focuses on preventing the illicit transfer of data outside organizational boundaries.

Top Impacting Factors

Rise in Significance of Data Protection Regulations

The rising significance of data protection solutions for improving security and optimizing operations is directly influencing the growth of the global market. The need for secure and efficient cloud-based solutions for security is increasing, due to the growing interconnection between operational technology systems information technology (IT) systems, and the internet. Governments and regulatory agencies have imposed strict data protection regulations in response to growing worldwide concerns about data security and privacy. Thus, these factors are likely to contribute to the increased installation of data loss prevention industry globally.

Furthermore, the integration of data protection solutions allows organizations to collect and analyze security data from several IT systems, including logs, network traffic, and security alerts, in a centralized cloud-based platform. Security rules, which sometimes include harsh penalties for non-compliance, are intended to guarantee the appropriate handling, processing, and storage of sensitive information. Hence, these multiple benefits offered by security solutions will boost demand for the market. Moreover, private and public companies are continuously involved in promoting digitalization in security operations and maintenance.

For instance, in October 2021, HelpSystems acquired Digital Guardian, Digital Guardian's solutions give customers visibility and protection of their data across many operating systems and applications. The company also provides a popular managed service that operates as an extension of the customers' security teams to protect sensitive data from threats originating inside and outside the organization. Such investment pooling in the digitalization of the security solution will fuel the demand for data loss prevention, which in turn will augment market growth on a global scale.

Complexity in Integrating with Existing Cybersecurity Infrastructure

The major challenge for the growth of the global data loss prevention industry is the complexity of advanced threats and the fluctuating regulatory landscape. The increasing employment of advanced techniques such as polymorphic malware, zero-day exploits, and social engineering, is certainly restraining the adoption of data loss prevention solutions across the globe. Further, the integration of highly sophisticated technologies and components to provide efficient, reliable, and secure services is expected to limit global market growth.

However, the combination of attack vectors, such as exploiting vulnerabilities, leveraging insider threats, and utilizing malware has become a key barrier for some organizations especially smaller ones, such factors can limit the growth of the global market. Therefore, both the complexity of advanced threats and the fluctuating regulatory landscape for the installation and development of data loss prevention solutions in security systems would prove to be the major obstacle to this market growth across the globe.

Enterprise-wide Shift Towards Remote and Hybrid Work Models

The rise in the adoption of remote and hybrid workforces propels growth opportunities for the global market. The remote and hybrid teams often need to collaborate on projects and tasks from different locations, which in turn has surged the demand for data loss prevention solutions among end users. Data loss prevention solutions provide a centralized platform for team members to access, track, and contribute to projects in real-time, fostering collaboration despite physical distances.

The growing adoption of the internet and mobile devices enables organizations to increase their data loss prevention solution adoption. This flexibility empowers organizations to support a business operation efficiently, improving productivity and work-life balance. These aforementioned factors are significantly contributing to the huge potential for the growth and development of the market.

In addition, the emerging trend of remote working mode has fueled the bring your own device (BYOD) shift. In corporate organizations, data loss prevention solutions accommodate BYOD policies by enabling users to access virtual desktops and corporate resources securely from their personal devices. This reduces the need for organizations to provide company-owned devices, saving costs and increasing employee satisfaction. It also increases the quality of life of the entire organization by responding to the comprehensive challenges of sustainability. Thus, the public and private sectors are increasingly using and implementing data loss prevention solutions.

For instance, in November 2021, CrowdStrike Holdings, Inc. acquired SecureCircle, a SaaS-based cybersecurity service that extends Zero Trust security to data on, from and to the endpoint. Therefore, such development strategies further pave the way for the deployment of data loss prevention, which eventually drives market growth.

The data loss prevention market is segmented into Solution Type, Deployment Mode, Application and End Use Industry.

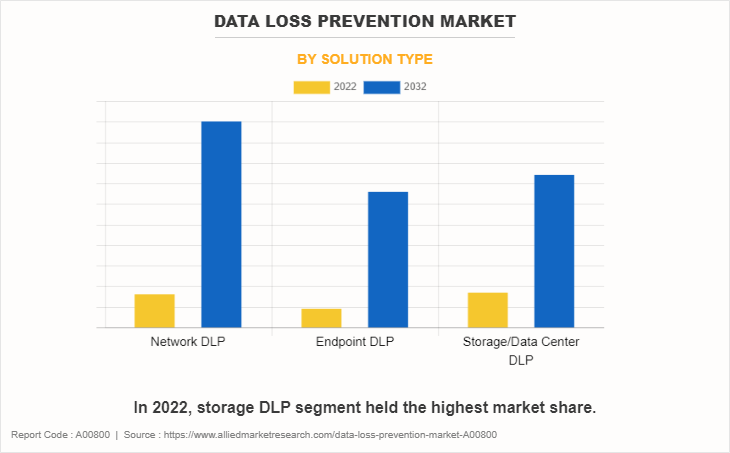

On the basis of type, the market is segmented into network DLP, endpoint DLP, and storage DLP.endpoint DLP is expected to exhibit the highest growth during the forecast period owing to growing demand across large enterprises.

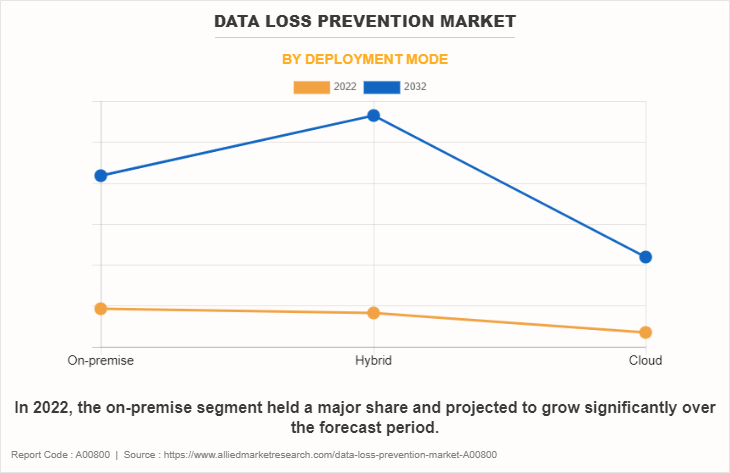

On the basis of deployment mode, the market is segmented into on-premise, hybrid, and cloud. Hybrid segment is projected to grow at an exponential rate due to several advantages such as reducing costs, supporting business, and effectively controlling the business environment.

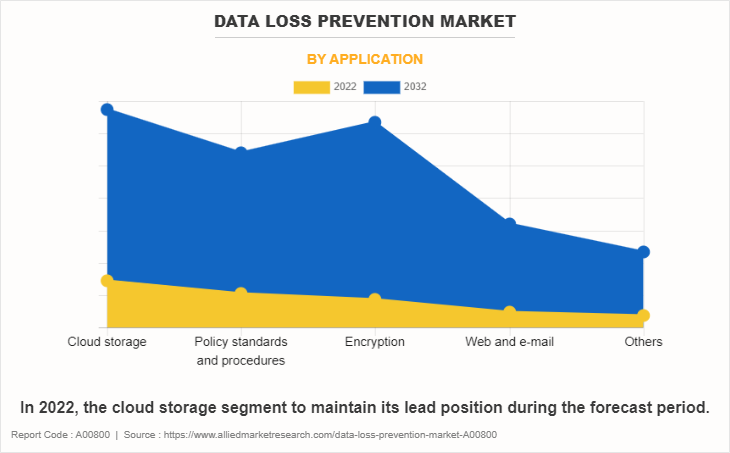

On the basis of application, the market is segmented into cloud storage, policy standards and procedures, encryption, web and e-mail, and others. Encryption segment is projected to grow at a higher growth rate owing to enterprise-wide demand to secure critical databases.

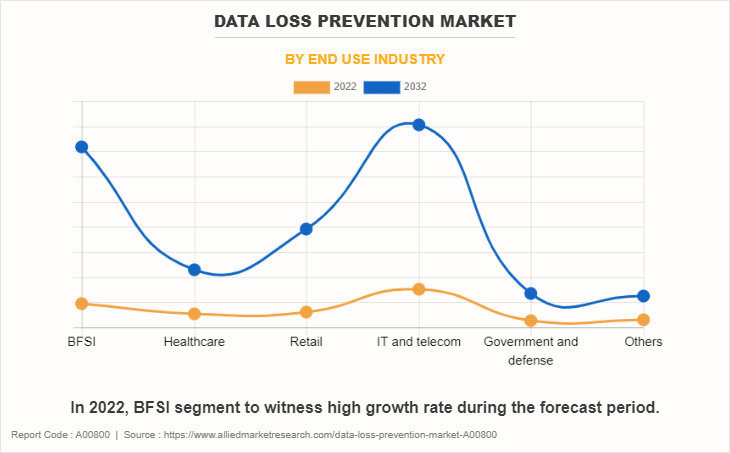

On the basis of the end-use industry, the market is segmented into BFSI, healthcare, retail, IT and telecom, government and defense and others. BFSI segment is projected to grow exponentially at a growth rate of 22.6% over the forecast period. This is attributed to the increase in the adoption of digital solutions in the BFSI sector has led to the development of completely advanced programs that adhere to the maintenance of security systems, which further contribute the global market growth in this sector.

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. By region, North America accounted for the largest market share in 2022 for the market. The presence of prominent players such as Oracle Corporation, IBM Corporation and others is influencing the growth of the market in North America. Moreover, a rise in government initiatives to strengthen security infrastructure across the region is further expected to drive the demand for data loss prevention and services further anticipated to propel the growth of the market.

However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increase in penetration of digitalization and higher adoption of advanced technology are expected to provide lucrative growth opportunities for the market in this region.

The global market is currently experiencing significant growth, primarily driven by rising significance of data protection regulations. The need for secure and efficient cloud-based solutions for security is increasing, due to the growing interconnection between operational technology systems information technology (IT) systems, and the internet. Governments and regulatory agencies have imposed strict data protection regulations in response to growing worldwide concerns about data security and privacy. The adoption of data loss prevention solutions for compliance is further fueled by growing data breach incidents.

However, a significant challenge in this market is the lack of awareness regarding DLP solutions. The high cost of implementation in organizations is mostly viewed in small & medium size organizations. In addition, concerns regarding the unavailability of capital expenditure, and the complexity in integrating with existing cybersecurity infrastructure, these measures are expected to limit market growth.

Consequently, the cost factor impedes the wider adoption of these solutions, particularly among organizations with limited capital means. However, the enterprise-wide shift towards remote and hybrid work models and the growing adoption of cloud services across sectors is anticipated to emerge as a lucrative opportunity for the growth of the market.

The report focuses on growth prospects, restraints, and trends of the data loss prevention market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the market.

Segment Review

The data loss prevention market is segmented on the basis of type, deployment mode, application, end-use industry, and region. On the basis of type, the market is segmented into network DLP, endpoint DLP, and storage DLP. On the basis of deployment mode, the market is segmented into on-premise, hybrid, and cloud. On the basis of application, the market is segmented into cloud storage, policy standards and procedures, encryption, web and e-mail, and others. On the basis of the end-use industry, the market is segmented into BFSI, healthcare, retail, IT and telecom, government and defense and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Insights

The Data Loss Prevention (DLP) market is expanding rapidly across various regions, driven by the growing need to protect sensitive data and comply with regulatory frameworks. Key regional insights are as follows:

North America

North America holds a significant share of the DLP market, driven by stringent data privacy regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and California Consumer Privacy Act (CCPA). The region's strong presence of leading cybersecurity firms, advanced IT infrastructure, and increasing cases of data breaches push organizations to adopt DLP solutions. The U.S., in particular, leads the market due to the demand for robust data protection measures in sectors like finance, healthcare, and government.

Europe

Europe is experiencing substantial growth in the DLP market, largely due to the General Data Protection Regulation (GDPR) that mandates strict data security and privacy protocols for organizations operating in the region. Countries like Germany, France, and the UK are major contributors, with industries such as banking, insurance, and retail investing heavily in DLP technologies. The demand for cloud-based solutions is rising in Europe, with organizations increasingly turning to cloud DLP to protect data as digital transformation accelerates.

Asia-Pacific

Asia-Pacific is expected to witness the fastest growth in the DLP market, driven by increasing digitalization and the rising threat of cyberattacks. Countries like China, India, and Japan are key contributors, with sectors such as IT & telecommunications, BFSI (Banking, Financial Services, and Insurance), and healthcare adopting DLP solutions. In China, growing government initiatives focused on increasing awareness of data security, coupled with the large-scale adoption of cloud technologies, are expected to propel market growth. Meanwhile, India's growing IT outsourcing industry is driving demand for robust data protection tools.

Latin America and Middle East & Africa

Latin America and the Middle East & Africa are witnessing a steady rise in DLP adoption, primarily in industries like telecom, healthcare, and financial services. The increasing digitization and the growing regulatory landscape are pushing organizations to secure sensitive data. Countries such as Brazil, UAE, and South Africa are leading in this space, as businesses strive to align with global data protection standards.

Competition Analysis:

Competitive analysis and profiles of the major players in the Check Point Software Technologies Ltd., Cisco Systems, Inc., Forcepoint LLC., IBM Corporation, Microsoft Corporation, Next DLP, Inc., Palo Alto Networks, Inc., Proofpoint, Inc., Broadcom Inc. And Trend Micro Incorporated. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help drive the growth of the data loss prevention market globally.

Recent Partnerships in the Market:

For instance, in March 2022, Hanzo partnered with Nightfall. Hanzo leverages Nightfall’s ML-powered detection engine in order to provide message and file intelligence for content collected for internal investigations or discovery matters. Similar strategies by the market players operating at a global and regional level will help the market to grow significantly during the forecast period.

Recent Product Launches in the Market:

For instance, in September 2020, Proofpoint, Inc. launched multiple new Proofpoint innovations to ensure that organizations worldwide have end-to-end protection around the people—wherever and however employees are working and collaborating. Therefore, such strategies adopted by market players are increasing market competition and leading the growth of the market.

Market landscape and trends

The COVID-19 outbreak had a major effect on national economies, societal norms, and overall health which further impacted the growth of the market. To facilitate this transformation, businesses rushed to swiftly purchase and implement new technologies, which created new security concerns and demanded a change in how security providers conducted tests in their widely distributed settings.

Moreover, the pandemic compelled businesses globally to implement remote work policies and thoroughly rely on digital communication strategies. With the rise in remote work, the volume of confidential data being transmitted by communication channels has increased, leading to a surge in demand for data loss prevention solutions to ensure the security and privacy of remote communications. Consequently, small and medium sized businesses have adopted various strategies to expand their product offering in the market.

For instance, in November 2020, Palo Alto Networks launched Enterprise Data Loss Prevention (DLP)—a cloud-delivered service that brings a fresh, simple, and modern approach to data protection, privacy, and compliance. Therefore, such developments after the pandemic are expected to overcome the growth of the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data loss prevention market forecast from 2022 to 2032 to identify the prevailing data loss prevention market growth opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the data loss prevention market share segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global data loss prevention market trends, key players, market segments, application areas, and market growth strategies.

Data Loss Prevention Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12 billion |

| Growth Rate | CAGR of 19.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Solution Type |

|

| By Deployment Mode |

|

| By Application |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Check Point Software Technologies Ltd., Forcepoint LLC, IBM Corporation, Proofpoint, Inc., Next DLP, Inc, Palo Alto Networks, Inc., Trend Micro Incorporated, Microsoft Corporation, Cisco Systems, Inc., Broadcom Inc. |

Analyst Review

The data loss prevention market is characterized by intense competition, which can be attributed to the strong presence of established vendors. It is expected that data loss prevention solutions and service providers, who possess extensive technical and financial resources, will have a competitive advantage over their competitors due to their ability to meet the global market needs. Furthermore, the competitive landscape within the market is anticipated to become even more intense as a consequence of technological advancements, product expansions, and various strategies employed by key vendors.

The data loss prevention market is anticipated to grow significantly during the forecast period. There are a few major trends in the data loss prevention market such as the growing adoption of data loss prevention solutions and surging emphasis on real-time data loss prevention information. These trends are positively impacting the overall data loss prevention market.

Moreover, managed data loss prevention services are witnessing an increase in popularity across diverse industry verticals and enterprises. These service operators help large enterprises manage their information technology infrastructure with the addition of advanced security frameworks. This is also expected to fuel competition in the data loss prevention market. In addition, continuous developments in data loss prevention platforms to cater to diverse customer requirements are expected to support overall market growth.

By region, the data loss prevention market trends have been analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America contributed the maximum revenue in 2022 and is expected to grow at a significant growth rate as compared to other regions. Factors such as the presence of prominent technology companies and industry consortiums focusing on cybersecurity infrastructure have contributed to the demand for advanced data loss prevention solutions and services. Asia-Pacific is the fastest-growing region in the market, which is mainly attributed to the growing focus of the market players to address the demands for advanced security frameworks with cost-effectiveness.

Major companies operating in the data loss prevention market are focusing on strategic partnerships to develop advanced data loss prevention solutions. For instance, in March 2022, Hanzo partnered with Nightfall. Hanzo leverages Nightfall’s ML-powered detection engine in order to provide message and file intelligence for content collected for internal investigations or discovery matters. Similar strategies by the market players operating at a global and regional level will help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Check Point Software Technologies Ltd., Cisco Systems, Inc., Forcepoint LLC., IBM Corporation, Microsoft Corporation, Next DLP, Inc., Palo Alto Networks, Inc., Proofpoint, Inc., Broadcom Inc. And Trend Micro Incorporated. These players have adopted various strategies to increase their market penetration and strengthen their position in the data loss prevention market.

The global data loss prevention market size was valued at $2.1 billion in 2022 and is projected to reach $12 billion by 2032.

The Data Loss Prevention market is projected to grow at a compound annual growth rate of 19.2% from 2023 to 2032.

Check Point Software Technologies Ltd., Cisco Systems, Inc., Forcepoint LLC., IBM Corporation, Microsoft Corporation, and Next DLP, Inc., are the top companies to hold the market share in data loss prevention.

North America is the largest regional market for data loss prevention.

Rise in cloud-native DLP solutions, increased focus on insider threat detection, integration of AI and machine learning for advanced threat detection are the upcoming trends of data loss prevention market in the world.

Loading Table Of Content...

Loading Research Methodology...