DC Fast Charging Stations Market Research, 2032

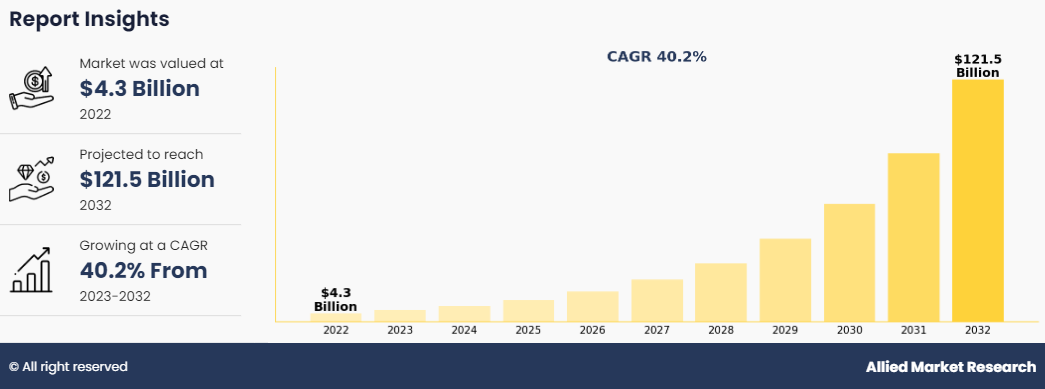

The global DC fast charging stations market size was valued at $4.3 billion in 2022, and is projected to reach $121.5 billion by 2032, growing at a CAGR of 40.2% from 2023 to 2032. Electric vehicle batteries store energy in direct current (DC), while the electric grid supplies power in alternating current (AC). Within an electric vehicle, an onboard charger converts AC power to DC before distributing it to charge the vehicle's battery. DC fast charging streamlines this process by bypassing the onboard charger, directly charging the battery and significantly reducing the charging time for an electric vehicle (EV).

This efficiency is achieved by converting AC to DC at the DC charging station before supplying it to the vehicle. Referred to as direct current fast charging (DCFC), level 3 charging, or commonly known as rapid or ultra-fast charging, DC fast charging offers a notably quicker charging experience compared to AC-type charging, contributing to the expeditious charging of EVs.

Key Takeaways of DC Fast Charging Stations Market Report

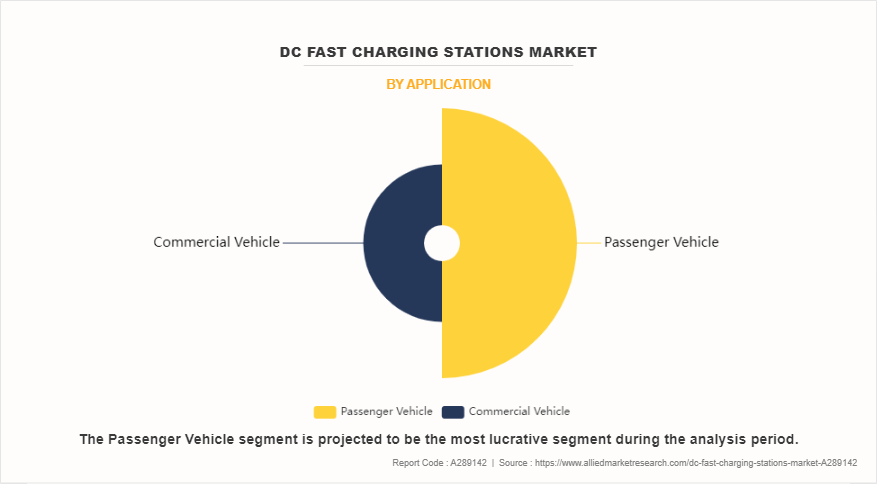

- Based on application, the passenger vehicle segment emerged as the global leader in 2022 and is anticipated to be the fastest growing during the forecast period.

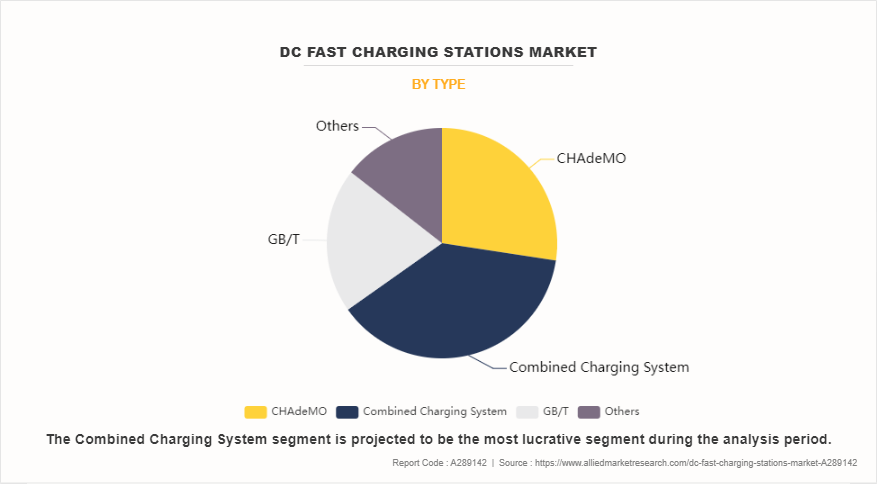

- Based on type, the combined charging system segment emerged as the global leader in 2022 and is predicted to show the fastest growth in the upcoming years.

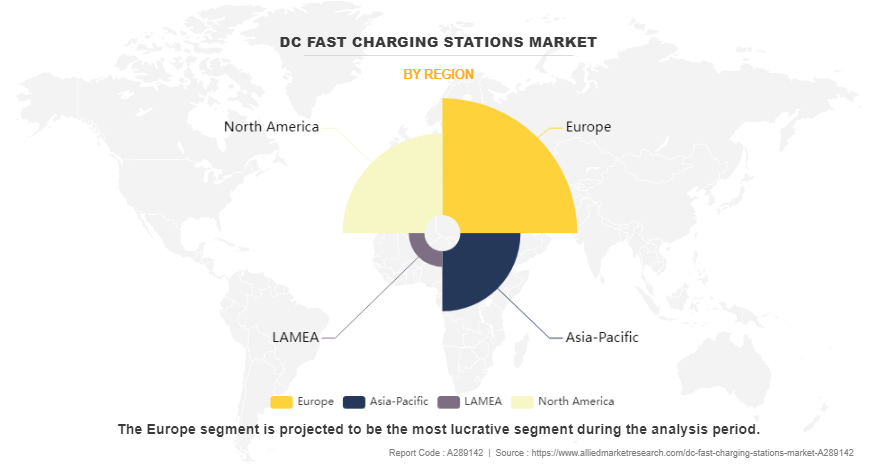

- Based on region, Europe registered the highest market share in 2022; however, is Asia-Pacific projected to maintain its position during the forecast period.

- The report on dc fast charging stations industry comprehensively analyzes over 16 countries, conducting a segment analysis for each country based on value ($ billion) during the forecast period of 2023-2032.

- The research incorporates high-quality data, key industry participant's opinions, and crucial growth-driving factors to offer a balanced view of global markets.

- The objective of this study is to assist stakeholders in making well-informed decisions to achieve ambitious growth trends. Also, to gain deeper insights into the market, the study reviewed more than 3,700 product literature, annual reports, industry statements, and similar research materials from key industry participants.

Segment Overview

The DC fast charging stations market is segmented into Type and Application.

By type, the combined charging system segment dominated the global DC fast charging stations market share in 2022. The penetration of the combined charging system (CCS) is notably driven by its endorsement and adoption by leading North American and European EV manufacturers. With CCS2 emerging as the predominant standard in Europe and being mandated by the EU for EV charging networks, its influence extends globally. CCS2 is widely used beyond Europe due to its versatility and compatibility with various electric vehicle models, making it a globally adopted standard for DC fast charging as well as facilitating interoperability and streamlined infrastructure development across diverse countries such as Greenland, Iceland, South America, South Africa, Arabia, India, Singapore, Taiwan, Hong Kong, Oceania, and Australia. The widespread acceptance of CCS, with its robust and standardized features, solidifies its position as the frontrunner in the evolving landscape of DC fast charging stations.

By application, the passenger vehicle segment was the major share contributor in 2022. As the global count of electric cars reaches an impressive 26 million, BEVs continue to dominate, constituting over 70% of the market. This surge in EV popularity is steering the need for efficient and high-speed charging infrastructure, making DC fast charging stations indispensable. The advancements in battery technology, contributing to enhanced driving ranges and faster charging capabilities, further amplify the demand for these stations. The passenger cars segment, benefiting from the increasing efficiency and convenience of electric vehicles, holds a significant market share in the dynamic and evolving landscape of DC fast charging stations market growth.

Region wise, Asia-Pacific is projected to have a dominant market share during the forecast period. In the context of the Asia-Pacific DC fast charging stations market forecast, China stands out as a key driver of rapid deployment. The country has experienced a notable increase in fast charging installations, with a remarkable 50% surge to 470,000 fast chargers in 2021. This growth, while slightly slower than the peak in 2019, outpaced the 44% rise in 2020. Importantly, fast charging is gaining momentum over slow charging in China, with over 40% of publicly available charging units being fast chargers, surpassing other major EV markets.

The accelerated deployment of public chargers in China can be attributed to government subsidies and proactive infrastructure development by public utilities. Regulatory controls on electricity prices, coupled with rising demand for public charging from urban residents and the increasing electrification of taxis, ride-sharing, and logistics fleets, have enhanced the profitability of EV charging businesses in the region. According to the International Energy Agency (IEA) publication in 2023, this trend is expected to continue, further solidifying China's role as a key player in the Asia-Pacific DC fast charging stations market.

Market Dynamics

The global shift toward electric mobility stands as a promising strategy for decarbonizing the transportation sector. A pivotal element in realizing this ambitious transition is the establishment of an accessible and robust network of EV charging infrastructure. Governments worldwide have introduced various policies such as Inflation Reduction Act, California Climate Commitment, and National Electric Vehicle Infrastructure Formula Program Fiscal Year 2022 in the U.S. to foster the development of this charging network. In the context of the emerging DC fast charging station market, it becomes imperative to tailor this infrastructure to align with the unique requirements of different transport ecosystems.

In addition, there is a pressing need to enhance the capacity of stakeholders, facilitating the on-ground expansion of DC fast charging stations. Adopting a contextual approach is crucial to ensure the efficient and timely implementation of this specialized infrastructure. By customizing solutions to meet local requirements, the DC fast charging station market can be optimally integrated within the electricity supply and transportation networks, thereby playing a vital role in advancing the adoption of electric vehicles globally.

However, the proliferation of big data in the EV charging industry acts as a key restraint of the market, intensifying privacy concerns. This is attributed to the fact that the extensive data collection facilitated by technologies such as smart chargers and smart grids raises the risk of unauthorized misuse. The intricate issues associated with big data and privacy require careful consideration within the regulatory framework of the EV policy. Acknowledging and addressing these concerns are crucial to foster trust among consumers and ensure the responsible use of data within the DC fast charging stations market overview.

Smart charging technology revolutionizes the EV charging landscape by establishing a seamless connection between charging points, users, and operators. When an EV is plugged in, the charging station transmits crucial information, such as charging time and speed, via Wi-Fi or Bluetooth to a centralized cloud-based management platform. This platform receives additional data, including details about the local grid's capacity and current energy usage at the charging site, whether it be a residence, office building, or supermarket.

The amassed data is automatically analyzed and visualized in real-time by the platform's software, empowering it to make automated decisions on how and when EVs are charged. This not only grants charging operators the ability to effortlessly control and regulate energy usage remotely through a unified platform but also facilitates enhanced features for EV owners. Through a mobile app, owners can conveniently monitor and pay for their charging sessions from any location, at any time, adding a layer of accessibility and user-friendly control to the evolving landscape of EV charging infrastructure.

Competitive Analysis

The key players profiled in DC fast charging stations market report include Telsa, Allego B.V., Fortum, Enel X Way S.r.l., Siemens, ABB, Schedier Electric, ChargePoint, Inc., Eaton Corporation Plc, and Lincoln Electric Holdings. These players are adopting product launch as their key developmental strategy to gain a strong foothold in the competitive market. For instance, in December 2023, Lincoln Electric Holdings Inc. unveiled the Velion DC Fast Charger for Electric Vehicles, a level 3 DC fast charging platform designed to provide rapid charging speeds while ensuring exceptional reliability for optimal performance and uptime.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dc fast charging stations market analysis from 2022 to 2032 to identify the prevailing dc fast charging stations market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dc fast charging stations market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dc fast charging stations market trends, key players, market segments, application areas, and market growth strategies.

DC Fast Charging Stations Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 121.5 billion |

| Growth Rate | CAGR of 40.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Fortum, Siemens, ABB, ChargePoint, Inc., Lincoln Electric Holdings Inc., Allego B.V., Schedier Electric, Enel X Way S.r.l., Tesla, Eaton Corporation plc |

The growth of the DC fast charging stations market is expected to be driven by increase in demand for seamless and accessible charging for electric vehicle globally. In addition, the market is driven by rising adoption of EV vehicles globally.

The major growth strategies adopted by the DC fast charging stations market players are product innovation and development of EV charging stations.

Asia-Pacific is anticipated to provide more business opportunities for the global DC fast charging stations market in the future.

Telsa, Allego B.V., Fortum, Enel X Way S.r.l., Siemens, ABB, Schedier Electric, ChargePoint, Inc., Eaton Corporation Plc, and Lincoln Electric Holdings are the major players in the DC Fast Charging Stations market.

The combined charging system segment acquired the maximum share of the global DC fast charging stations market in 2022.

Loading Table Of Content...

Loading Research Methodology...