Debit Card Market Research, 2032

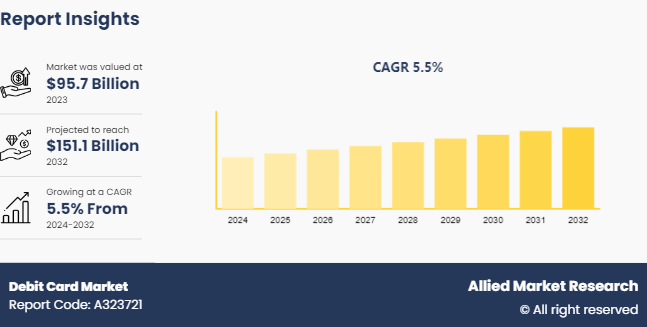

The global debit card market was valued at $95.7 billion in 2023, and is projected to reach $151.1 billion by 2032, growing at a CAGR of 5.5% from 2024 to 2032.

The debit card market is a vital component of the financial services sector, characterized by robust growth due to rise in shift towards electronic payments. Driven by technological advancements, enhanced banking infrastructure, and consumer preference for cashless transactions, the market is expanding globally. Debit cards offer a convenient, secure method for accessing bank funds, widely accepted for everyday purchases and online transactions.

Market Introduction and Definition

A debit card is a payment instrument that allows direct deduction of funds from a cardholder’s checking or savings account to complete a purchase. Unlike credit cards, which offer a line of credit, debit cards use pre-existing funds in the user’s bank account. They support ATM withdrawals, online transactions, and contactless payments, equipped with security features such as PINs and EMV chips to prevent fraud. Issued by banks, these cards facilitate cashless payments and help consumers manage spending by limiting transactions to available account balances.

Key Takeaways

The market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1, 500 product literatures, the industry releases, annual reports, and other such documents of major debit card industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global debit card market markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Report Coverage & Deliverables

Regional Insights: Debit Card Market Size

North America: Dominates with high adoption rates and significant debit card market share, driven by widespread use and digital payment solutions.

Europe: Shows strong growth due to cashless initiatives and high debit card usage in key countries like the UK, Germany, and France.

Asia-Pacific: Rapid expansion, particularly in China and India, driven by government initiatives and increasing financial inclusion in debit card market share.

Latin America: Growing adoption in Brazil and Mexico, with rising preference for card-based payments over cash.

Middle East & Africa: Emerging market with increasing debit card usage, particularly in the UAE and South Africa, driven by digital payment adoption.

Solution Insights: Debit Card

Debit cards are evolving with contactless payments, chip & PIN security, and digital wallet integration. Solutions include real-time payments, multi-currency functionality, and customizable options to enhance user convenience and security.

Key Companies & Market Share Insights

October 2023: Visa launched its new contactless payment technology in the U.S. and Canada, enhancing the security and speed of transactions. This move aims to capture a larger share of the growing contactless payment market, reflecting Visa’s commitment to innovation and customer convenience.

March 2023: Mastercard announced a strategic partnership with Apple Pay to integrate its debit cards with Apple’s digital wallet. This collaboration focuses on enhancing mobile payment experiences and expanding Mastercard’s reach in the digital payments sector.

Key market dynamics

Rise in demand for contactless payments by customers as well as small businesses is expected to drive the market growth. Moreover, rise in the number of partnerships to launch contactless credit cards specifically designed for small businesses is expected to create growth opportunity for the debit card market. For instance, in June 2022, Verizon announced its partnership with MasterCard and FNBO. This partnership was aimed at introducing small-scale business credit cards. The small business enterprises with these newly launched cards would be gaining Verizon Business Dollars against gadgets or apparel for their company.

Rise in demand for dual interface payment cards integrated with biometric sensors for payment verification in the banking sector is anticipated to drive the industry growth during the forecast period. Furthermore, the market players are involved in partnerships to manufacture and launch such biometric payment cards to offer high security and safety to their customers while processing payments. For instance, in February 2022, Swedish banking firm Rocker joined forces with the IDEMIA and IDEX. This collaboration was aimed at introducing Rocker Touch, a payment card leveraging biometric technology. However, the increasing concern for payment security due to the contactless payment method in the dual interface card is one of the challenges hindering the growth of the industry. At the same time, the growing need for hardware upgrades at the point-of-sale terminals to support such payment technology is expected to hinder the growth of the market. Furthermore, the high cost incurred for manufacturing the dual interface card is another factor expected to restrain the market growth. Such challenges can be overcome by advancing in technologies and making the manufacturing process efficient.

Government Policies of the Global Debit Card Market

Government policies in the debit card market focus on enhancing security, increasing financial inclusion, and regulating fees. These policies often include regulations that mandate transparency in fees, protect against fraudulent activities, and ensure customer privacy. Here are a few regulations from various countries.

- For instance, in April 2021: The Federal Reserve proposed updates to Regulation II, which governs debit card interchange fees and network routing requirements. These updates aimed to ensure merchants can choose between multiple networks for card transactions, promoting competition and potentially lowering costs for businesses and consumers.

- In June 2022: The European Commission launched a new regulation to enhance the security of electronic payments. This regulation includes measures to strengthen customer authentication processes and reduce fraud in debit card transactions, ensuring safer online and offline transactions for consumers across the EU.

- In August 2022: The Canadian government announced changes to the Code of Conduct for the Credit and Debit Card Industry to better protect merchants from excessive fees. This includes measures to ensure transparency in fee structures and to prevent card issuers from imposing unfair terms on small businesses. These reforms aimed to reduce the cost burden on merchants and encourage competition among card issuers.

- In March 2023: The Reserve Bank of Australia (RBA) introduced further reforms to reduce interchange fees and enhance the transparency of debit card fees. These changes are designed to lower the cost of electronic payments for merchants, thereby promoting greater use of debit cards among consumers.

Market Segmentation

The debit card market is segmented into type, end user, and region. On the basis of type, the market is divided into plastic and metal. As per end user, the market is segregated into retail, hospitality, transportation, healthcare, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The debit card market is experiencing significant developments across various regions. In Indonesia, the market is evolving with regulatory changes such as the National Payment Gateway (GPN) mandate, which ensures that all debit card transactions are processed domestically, enhancing transaction security and efficiency. Also, the transition to EMV standards for ATM and debit cards has improved security features, with full compliance?. In Germany, there is a notable increase in contactless payment adoption, especially in public transportation with systems like BONNsmart, which allows for fare payments using contactless debit cards and NFC-enabled mobile wallets. The market has significant consolidation among payment providers, exemplified by mergers such as those involving PAYONE and Ingenico, which strengthen the card payment infrastructure?.

For instance, according to a Mastercard study published in 2020, the tap-and-go card payments across pharmacies and grocery stores in Asia-Pacific increased by 2.5 times faster than non-contactless transactions. Moreover, the increasing partnerships between the market players to launch new dual interface cards for payments are also propelling the growth of the industry.

In September 2022, India released its draft National Electricity Plan, setting out ambitious targets for the development of battery energy storage, with an estimated capacity of between 51 to 84 GW installed by 2031-2032.

The Federal Reserve has proposed significant decreases in the caps on debit card interchange fees. This regulatory action aims to reduce the costs for merchants but could impact the revenue models of card issuers.

In February 2020, IDEX Biometrics ASA, a smart card manufacturing company, introduced TrustedBio, a solution built for reducing biometric smartcard costs. This cost reduction is aimed at accelerating the adoption of smart dual interface cards.

In December 2020, PayTM and SBI Card selected DZcard, a South Asian smart card manufacturer to deliver the dual interface credit card. These cards will allow customers to process contactless payments and gain cashbacks through the Paytm application.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing debit card market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the debit card market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as debit card industry, key players, market segments, application areas, and market growth strategies.

Industry Trends

In September 2022, JP Morgan acquired Renovite Technologies to advance its payment processing capabilities, highlighting the strategic moves by major financial institutions to enhance their debit card services?.

In March 2022, Thales Gemalto Bio-sourced (PLA) card received the certification for the bio-based content. Through this certification, the Thales Gemalto Bio-sourced (PLA) card was validated to contain bio-based content in its cards.

In November 2020, IDEMIA announced its dual interface metal payment card for the Middle East & Africa (MEA) region. This step has assisted the company in broadening its product offering and market reach in MEA.

In July 2020, BPC designed an automated solution for fare collection O-CITY. This aims at using these contactless cards on buses, subways, and trains, at parking lots and bike rentals.

Competitive Landscape

The major players operating in the debit card market include Thales Group, IDEMIA, VALID, Giesecke+Devrient GmbH, Eastcompeace Technology Co., Ltd., and DATANG. Other players in debit card market include Paragon Group Limited, CPI Card Group Inc., Watchdata Co., Ltd., and Wuhan Tianyu.

Recent Key Strategies and Developments

In January 2024, the U.S. debit card market witnessed increased consumer demand for digital payment technologies, with a notable shift towards credit for everyday payments due to rising prices. Debit issuers are focusing on Generation Z, offering products that cater to their digital preferences to build long-term relationships.

In March 2023, the Federal Reserve in the U.S. proposed significant reductions in debit card interchange fee caps. This regulatory change aims to lower transaction costs for merchants, potentially impacting the revenue structure for card issuers.

In May 2022, Visa partnered with Spain-based fintech Pecunpay to launch Visa Direct, a solution designed to enhance payment capabilities across Europe

In July 2022, Mastercard expanded its network to include Web3 and NFTs, enabling users to purchase NFTs with their Mastercard cards on various marketplaces.

Key Sources Referred

NerdWallet

PaymentsJournal

Reuters

Bloomberg

PYMNTS.com

Key Benefits for Stakeholders

This report provides a quantitative analysis of the debit card market outlook, debit card market segments, current trends, estimations, and dynamics of the debit card market analysis from 2022 to 2032 to identify the prevailing debit card market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the debit card market segmentation assists to determine the prevailing debit card market size, debit card market share, debit card market growth, and debit card market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global debit card market Statistics and debit card market forecast.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global debit card market trends, key players, market segments, application areas, and market growth strategies.

Debit Card Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 151.1 Billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 230 |

| By Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | IDEMIA, Cangzhou Datang Steel Pipe Co., Ltd., VALID, CPI Card Group Inc., Watchdata Co., Ltd., Eastcompeace Technology Co., Ltd., wuhan tianyu information co. ltd, Thales Group, Giesecke+Devrient GmbH, Paragon Group Limited |

Increased adoption of tap-and-go technology for quick transactions is the upcoming trend in the Debit Card Market globally.

The leading application of the debit card market is facilitating secure and convenient point-of-sale transactions for consumers.

Asia-Pacific is the largest regional market for Debit Card.

$151.1 Billion is the estimated industry size of Debit Card by 2032.

The major players operating in the debit card market include Thales Group, IDEMIA, VALID, Giesecke+Devrient GmbH, Eastcompeace Technology Co., Ltd., and DATANG. Other players in debit card market include Paragon Group Limited, CPI Card Group Inc., Watchdata Co., Ltd., and Wuhan Tianyu.

Loading Table Of Content...