Decentralized Finance Market Research, 2032

The global decentralized finance market was valued at $13.8 billion in 2022, and is projected to reach $497.9 billion by 2032, growing at a CAGR of 43.4% from 2023 to 2032.

In a decentralized finance market, technology enables investors to deal directly with each other instead of operating from within a centralized exchange. Virtual markets that use decentralized currency, or cryptocurrencies, are examples of decentralized finance solutions. A decentralized finance market uses various digital devices to communicate and display bid/ask prices in real-time. In this way, buyers, sellers, and dealers do not need to be located in the same place to transact securities.

Increasing access for unbanked individuals can significantly contribute to the growth of the decentralized finance (DeFi) market. DeFi, a flourishing sector built on blockchain technology, offers a range of financial services without traditional intermediaries. By onboarding the unbanked, DeFi gains a broader user base and enhances its inclusivity. This increases access and empowers unbanked individuals to access financial services such as lending, borrowing, and trading, which were previously unavailable to them due to barriers like lack of documentation or credit history, driving the growth of the decentralized finance market share.

However, Interoperability challenges among various DeFi platforms pose a significant obstacle to the growth of the DeFi market. When different platforms cannot easily communicate and share data or assets, users face hurdles in transferring value seamlessly. This lack of compatibility leads to fragmented liquidity pools, inhibiting efficient capital allocation and limiting trading opportunities. further, data privacy and regulatory concerns are major factors that hamper the decentralized finance market growth. On the contrary, the rise of synthetic assets and decentralized derivatives markets within the DeFi landscape has unlocked new investment opportunities. These platforms enable users to gain exposure to traditional and non-traditional assets without owning the underlying asset, leading to increased diversification and risk management strategies. Thus, it will provide major lucrative opportunities for the growth of the decentralized finance market size.

The report focuses on growth prospects, restraints, and trends of the decentralized finance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the decentralized finance industry.

Segment Review

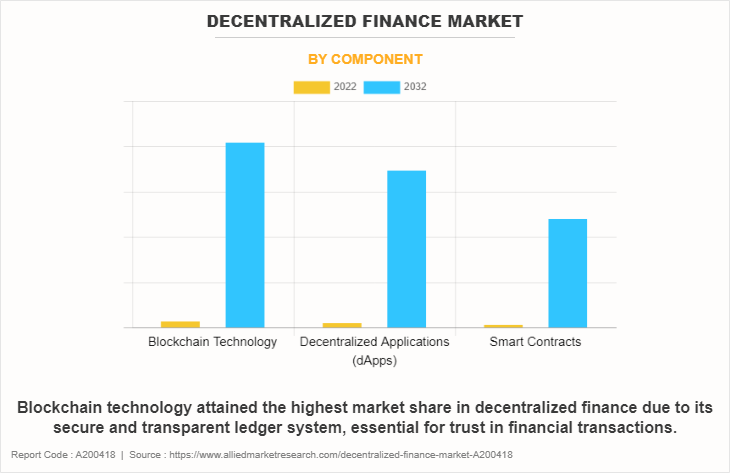

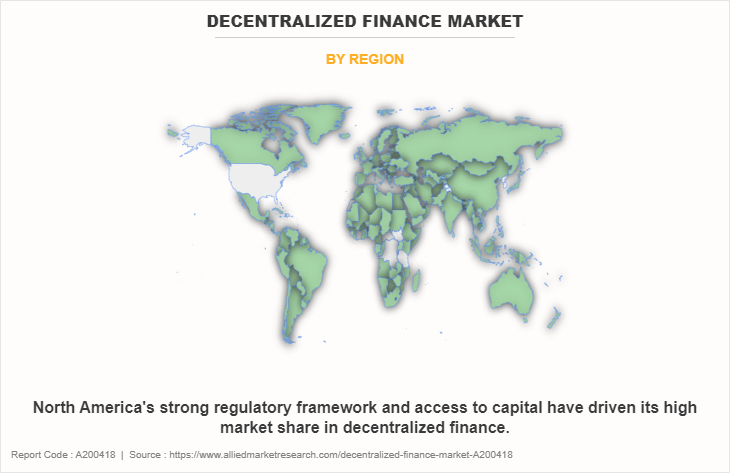

The decentralized finance market outlook is segmented on the basis of component, application, and region. Based on component, the market is segmented into blockchain technology, decentralized applications (dApps), and smart contracts. On the basis of application, it is segmented into decentralized exchanges, compliance and identity, marketplaces and liquidity, payments, data and analytics, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, blockchain technology attained the highest growth in 2022. This is attributed due to the growth of the blockchain technology segment in the DeFi market fueled by several factors such as its ability to enhance security and eliminate single points of failure to attract both users and developers. In addition, interoperability among different blockchain networks is improving, enabling seamless movement of assets and data.

Moreover, ongoing advancements in consensus mechanisms and scalability solutions address the challenges faced by early blockchain systems. On other hand, smart contracts segment is attributed to be the fastest-growing segment during the forecast period. The growth of smart contracts in the decentralized finance market is attributed to their efficiency, accuracy, and cost-effectiveness. They eliminate the need for traditional intermediaries, reducing transaction costs and increasing transaction speed. Moreover, the development of customizable and interoperable smart contract platforms paves the way for the creation of innovative financial products and services.

On the basis of region, North America attained the highest growth in the decentralized finance market in 2022. This is attributed to the fact that the increasing adoption of blockchain technology and smart contracts, which form the foundation of many DeFi platforms. These platforms offer a range of financial services such as lending, borrowing, trading, and yield farming, all without the need for intermediaries like traditional banks. This trend is reshaping how individuals and institutions interact with financial instruments, enabling greater accessibility and control over their assets.

Meanwhile, the Asia-Pacific is considered to be the fastest-growing region during the forecast period. As Asia Pacific region witnessing a surge in DeFi adoption due to its tech-savvy population, interest from governments in fostering financial inclusion, and the potential for more efficient cross-border payments. Entrepreneurs are leveraging these trends to create innovative solutions, but regulatory hurdles must be addressed to unlock the full potential of decentralized finance market in the region.

The report analyzes the profiles of key players operating in the decentralized finance market such as Accenture, Binance, BlockFi, Coinbase, Compound Labs, Inc., Gemini Trust Company, LLC., IBM Corporation, Payward, Inc., RisingMax, and TATA Consultancy Services Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the decentralized finance market.

Market Landscape and Trends

The decentralized finance market has witnessed remarkable growth and innovation in recent years. DeFi refers to a range of blockchain-based financial services that operate outside traditional intermediaries. Its trends include yield farming, lending and borrowing platforms, decentralized exchanges, and synthetic assets. In addition, the DeFi sector has experienced exponential expansion, with TVL (Total Value Locked) reaching billions of dollars. However, challenges such as security vulnerabilities and regulatory uncertainties persisted. DeFi's potential to democratize finance, offer higher yields, and increase financial inclusion fueled its popularity. The market landscape remained dynamic, with new protocols, projects, and collaborations emerging regularly.

Top Impacting Factors

Increasing Spending on Blockchain Technology

The exponential growth of the decentralized finance market can be attributed to the simultaneous increase in spending and adoption of blockchain technology. DeFi leverages blockchain's fundamental features, including transparency, security, and immutability, to create a decentralized ecosystem that offers financial services without intermediaries. As spending on blockchain technology rises, more robust and scalable platforms are developed, facilitating the expansion of DeFi applications. This, in turn, attracts a wider user base, driving adoption. Blockchain's ability to ensure trustless transactions and automate processes enhances the efficiency of DeFi protocols, attracting both individual users and institutional players seeking streamlined, cost-effective financial solutions.

Moreover, the adoption of DeFi is further propelled by its inclusivity and accessibility. Individuals without traditional banking access can participate in financial activities, such as lending, borrowing, and trading, through user-friendly interfaces and decentralized apps. Moreover, the DeFi space continuously innovates, offering new services like yield farming, decentralized exchanges, and synthetic assets, all of which contribute to its expanding popularity. Furthermore, as technology improves, DeFi becomes more user-friendly and efficient, leading to higher adoption rates, which in turn attracts more investment and drives the continued expansion of the decentralized finance market.

Increasing Adoption of Digitized Financial Services

The growth of the decentralized finance market is intrinsically linked to the surging adoption of digitalized financial services. As more individuals and institutions embrace digital platforms for financial activities, the DeFi sector gains traction due to its unique advantages and innovative offerings. The adoption of digitalized financial services has propelled decentralized finance market by introducing a broader audience to the benefits of blockchain technology. This growing familiarity fosters greater acceptance of DeFi's decentralized nature, transparency, and enhanced security. In addition, digital finance users are already comfortable with virtual transactions, making the transition to DeFi platforms smoother.

Furthermore, the convenience of digitalized financial services drives interest in DeFi's accessible and inclusive ecosystem. Users can easily participate in DeFi activities such as lending, staking, and yield farming through user-friendly interfaces, attracting both traditional investors and newcomers seeking higher returns and diverse investment options. The increase in adoption of digitalized financial services also accelerates the development of interoperable solutions, bridging traditional finance with DeFi. This collaboration encourages further innovation, such as wrapped assets and cross-chain functionalities, expanding the decentralized finance market's scope and appeal.

High Access to People who are Unbanked

Increasing access for unbanked individuals can significantly contribute to the growth of the decentralized finance market. DeFi, a flourishing sector built on blockchain technology, offers a range of financial services without traditional intermediaries. By onboarding the unbanked, DeFi gains a broader user base and enhances its inclusivity. This increases access and empowers unbanked individuals to access financial services such as lending, borrowing, and trading, which were previously unavailable to them due to barriers like lack of documentation or credit history. This influx of new users can stimulate demand for DeFi protocols, leading to higher adoption rates and increased activity across the ecosystem.

In addition, unbanked users often reside in regions with limited or unreliable access to traditional financial infrastructure. DeFi's borderless nature allows these individuals to engage in financial activities without geographical constraints. This can drive the growth of decentralized finance market by creating a global network of users who can easily participate in various DeFi platforms. Furthermore, the inclusion of unbanked populations can promote innovation and the development of tailored DeFi solutions to cater to their specific needs. This diversification of use cases can lead to the creation of new DeFi products and services, attracting even more users and capital.

Data Privacy and Regulatory Concerns

Data privacy and regulatory concerns present significant hurdles to the growth of the decentralized finance market. In a landscape where transactions occur directly between users without intermediaries, privacy becomes a paramount concern. The transparent nature of blockchain, while enhancing security and traceability, poses challenges in safeguarding sensitive user information. This potential exposure of personal and financial data raises alarms about identity theft, fraud, and unauthorized access.

Moreover, the lack of clear regulatory frameworks for DeFi platforms creates uncertainty for both users and developers. The absence of established guidelines leads to ambiguity in compliance requirements, deterring institutional investors and traditional financial players from fully embracing DeFi. Concerns over anti-money laundering (AML) and know-your-customer (KYC) regulations further hamper adoption, hindering decentralized finance market potential to reach mainstream audiences.

Addressing these concerns is crucial for sustainable growth. Striking a balance between data privacy and transparency is vital. Projects that prioritize robust encryption techniques and user-centric privacy controls can mitigate risks. Additionally, collaboration between DeFi stakeholders and regulatory bodies to formulate adaptable frameworks will provide a more conducive environment for innovation, enabling decentralized finance market to thrive while maintaining the necessary safeguards. As the DeFi landscape evolves, addressing these challenges will be essential for unlocking its full potential and broadening its user base.

Interoperability Issues between Different DeFi Platforms

Interoperability challenges among various DeFi platforms pose a significant obstacle to the growth of the decentralized finance market. When different platforms cannot easily communicate and share data or assets, users face hurdles in transferring value seamlessly. This lack of compatibility leads to fragmented liquidity pools, inhibiting efficient capital allocation and limiting trading opportunities. Moreover, smart contract execution across platforms becomes complex and error-prone, potentially exposing users to security risks. This lack of interoperability also discourages innovation as developers need to build within the constraints of specific platforms, slowing down the creation of new DeFi solutions. Ultimately, these issues impede user adoption, deter institutional involvement, and constrain the overall expansion of the decentralized finance market. To foster a thriving decentralized finance market, addressing and resolving these interoperability challenges is crucial.

Growing Innovation in Financial Products and Services

The decentralized finance market has been experiencing rapid growth due to the emergence of innovative financial products and developments. One key factor driving this expansion is the proliferation of yield farming protocols. These platforms allow users to provide liquidity to various liquidity pools and earn rewards in the form of tokens. As yield farming gains traction, it incentivizes greater participation and capital inflow into the decentralized finance market. Furthermore, the evolution of decentralized lending and borrowing platforms has revolutionized traditional finance. DeFi protocols enable users to lend out their assets and earn interest, while borrowers can access loans without intermediaries. This disintermediation not only increases efficiency but also expands access to financial services for individuals who are underserved by traditional institutions.

In addition, the rise of synthetic assets and decentralized derivatives markets within the DeFi landscape has unlocked new investment opportunities. These platforms enable users to gain exposure to traditional and non-traditional assets without owning the underlying asset, leading to increased diversification and risk management strategies. Cross-chain interoperability solutions, like blockchain bridges, are also fostering decentralized finance market growth by enabling seamless asset transfers between different blockchain networks. This opens up a broader range of assets and users to the DeFi ecosystem. Thus, the decentralized finance market is experiencing a surge in innovation and product development, with yield farming, decentralized lending, synthetic assets, and cross-chain interoperability acting as catalysts. These advancements are not only expanding the scope of financial offerings but also driving the widespread adoption of decentralized finance, creating ample opportunities for further growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the decentralized finance market forecast from 2022 to 2032 to identify the prevailing decentralized finance market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the decentralized finance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global decentralized finance market trends, key players, market segments, application areas, and market growth strategies.

Decentralized Finance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 497.9 billion |

| Growth Rate | CAGR of 43.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 336 |

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Binance Limited, Payward, Inc., BlockFi, Accenture, Compound Labs, Inc., IBM Corporation, Coinbase, RisingMax, Tata Consultancy Services Limited, Gemini Trust Company, LLC. |

Analyst Review

The DeFi market's landscape is characterized by rapid innovation and a diverse array of projects. Decentralized exchanges (DEXs) like Uniswap and SushiSwap gained traction for enabling peer-to-peer trading without intermediaries. Yield farming and liquidity mining became popular ways for users to earn rewards by providing assets to DeFi protocols. This led to the rise of automated market makers (AMMs) and liquidity pools. Lending and borrowing platforms like Aave and Compound allowed users to lend their assets and earn interest or borrow against their holdings. Synthetic assets, which mirror the value of real-world assets, gained attention for their potential to offer exposure to various markets.

Despite the potential, DeFi faced challenges including security vulnerabilities, smart contract risks, and regulatory scrutiny. As the market evolved, new layers like Layer 2 scaling solutions aimed to address scalability issues and reduce transaction costs. In recent times, trends in the DeFi market continue to evolve, so staying updated with the latest news and insights is crucial for a comprehensive understanding. Furthermore, emerging countries are ahead of every developed nation except the United States in adopting, mining, and trading cryptocurrencies. Many of these crypto-hungry countries have a high proportion of unbanked residents: four of the seven nations with the highest concentration of unbanked adults are the country’s leading crypto adoption (China, India, Pakistan, Nigeria). Globally, even in developed economies with advanced financial services industries such as the US, unbanked and underbanked populations have relatively higher adoption rates of cryptocurrency ownership compared to those that are fully banked will help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Accenture, Binance, BlockFi, Coinbase, Compound Labs, Inc., Gemini Trust Company, LLC., IBM Corporation, Payward, Inc., RisingMax, and TATA Consultancy Services Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the decentralized finance market.

The exponential growth of the decentralized finance (DeFi) market can be attributed to the simultaneous increase in spending and adoption of blockchain technology. DeFi leverages blockchain's fundamental features, including transparency, security, and immutability, to create a decentralized ecosystem that offers financial services without intermediaries.

North America is the largest regional market for Decentralized Finance

The global decentralized finance market was valued at $13,841.23 million in 2022, and is projected to reach $4,97,865.59 million by 2032, growing at a CAGR of 43.4% from 2023 to 2032.

Accenture, Binance, BlockFi, Coinbase, Compound Labs, Inc., Gemini Trust Company, LLC., IBM Corporation, Payward, Inc., RisingMax, and TATA Consultancy Services Limited.

Loading Table Of Content...

Loading Research Methodology...