Decorative Laminates Market Overview

The global decorative laminates market size was valued at $7.0 billion in 2021, and is projected to reach $10.0 billion by 2031, growing at a CAGR of 3.4% from 2022 to 2031. This market is driven by increased spending on building construction in developed countries and rising demand from the furniture industry. To strengthen their presence in the global market, several companies in the decorative laminates sector are actively expanding their operations.

Market Dynamics & Insights

- The decorative laminates industry in Asia-Pacific held a significant share of over 42% in 2021.

- The decorative laminates industry in UK is expected to grow significantly at a CAGR of 2.6% from 2022 to 2031

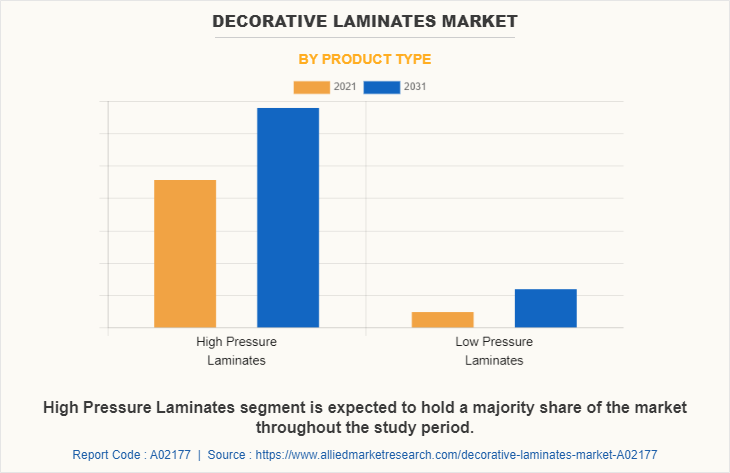

- By product type, high pressure laminates segment is one of the dominating segments in the market and accounted for the revenue share of over 79% in 2021.

- By end-user, the commercial segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2021 Market Size: $7 Billion

- 2031 Projected Market Size: $10 Billion

- CAGR (2022-2031): 3.4%

- Asia-Pacific: Largest market in 2021

- LAMEA: Fastest growing market

What is Meant by Decorative Laminates

Decorative laminates are furnishing products used for providing greater aesthetic appeal to the external surface of furniture, walls, and other static and movable building components such as floors and doors & windows. They are manufactured using resins and high-quality kraft paper, pressed at high amount of heat and pressure, which make it durable and resistant to moisture.

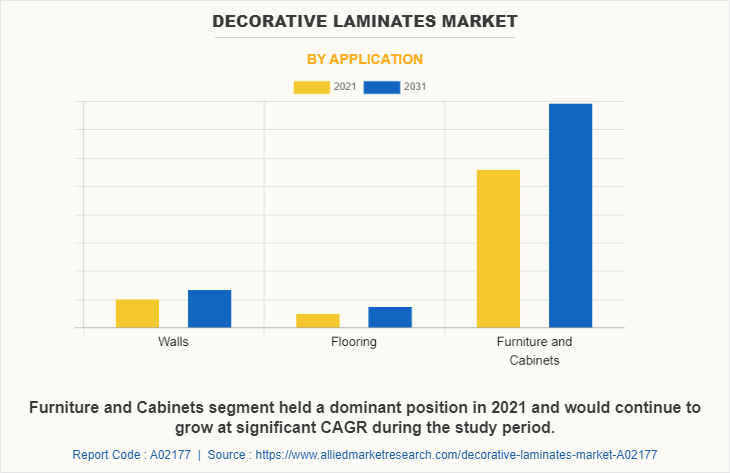

Rise in global population and increase in trend of living in nuclear families have significantly increased the demand for residential infrastructure. This has fueled the use of decorative laminates, as they are extensively applied on floors, walls, doors, windows. Furthermore, the furniture & cabinets industry is witnessing significant growth, owing to rise in number of dwellings and other residential and non-residential buildings. Moreover, the COVID-19-induced work-from-home culture is fueling the demand for furniture & cabinets by home owners. Therefore, expansion of the furniture & cabinets industry has significantly increased the demand for decorative laminates, as they are extensively used in furniture & cabinets manufacturing to enhance aesthetical appearance and durability. Moreover, decorative laminate offers many advantageous features as compared to other similar surface finishing products. For instance, they are moisture-proof, abrasion- & impact-resistant, and require little to no maintenance. Such features make them a cost-effective option over a longer period. In addition, the availability of a wide range of decorative laminates having varied thickness, durability, patterns, appearance, and prices is driving their demand, thus propelling the decorative laminates market growth.

The major decorative laminate manufacturers such as Panolam Industries International, Inc., Greenlam Industries Limited, and Fletcher Building offer a wide variety of high- and low-pressure laminates to consumers. Furthermore, a few manufacturers offer customized printed laminates to the end users. Moreover, various development strategies are adopted by the decorative laminates manufacturers to sustain harsh competition in the market. For instance, in August 2021, Century Laminates, a part of Century Plyboards Ltd., launched a new range of gloss laminates. Similarly, business expansion strategy helps in gaining a significant market share. For instance, in December 2021, Greenlam Industries Ltd., an India-based laminate manufacturer, announced its plans for establishing its manufacturing facility in Naidupeta, in Andhra Pradesh. This facility will manufacture laminates sheets and ply and particle boards.

The novel coronavirus has rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and later became a significant threat to global trade, economy, and finance. The COVID-19 pandemic had halted the production of many components of decorative laminates due to lockdown. The economic slowdown initially resulted in reduced spending on various applications of decorative laminates by residential and commercial users. However, after lifting of initial lockdowns, demand for residential furniture was positively influenced owing to rise in work from home culture. Furthermore, owing to the introduction of various vaccines, the severity of COVID-19 pandemic has significantly reduced. As of mid-2022, the number of COVID-19 cases have diminished significantly. This has led to the full-fledged reopening of decorative laminates manufacturing companies at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Furthermore, expansion of the tourism industry across the world fueled by rise in globalization, reduced air fares, and increase in purchasing capacity of masses is anticipated to boost the growth of the decorative laminates industry. In addition, improvement in standard of living and increase in spendings on home remodeling projects, especially in high income countries, are anticipated to positively influence the decorative laminates market throughout the forecast period.

Decorative Laminates Market Segment Overview

The decorative laminates market is segmented into Product Type, Application and End Use. On the basis of product type, the market is bifurcated into high-pressure laminates and low-pressure laminates. Depending on application, it is categorized into walls, flooring, and furniture & cabinets. By end-user industry, it is segregated into commercial and residential. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific held the major decorative laminates market share in 2021, followed by North America and Europe. This is attributed to increase in construction and home remodeling activities.

Competition Analysis

The key companies profiled in the decorative laminates market forecast report include Abet Laminati S.p.A., Archidply, Broadview Holding, Fletcher Building, Greenlam Industries Limited, Merino Industries Limited, Panolam Industries International, Inc., Stylam Industries Ltd., Synthomer Plc., and Wilsonart LLC.

What are the Key Benefits for Stakeholders

- This report provides decorative laminates market analysis of segments, current trends and estimations from 2021 to 2031 to identify the prevailing decorative laminates market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the decorative laminates market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global decorative laminates market trends, key players, market segments, application areas, and market growth strategies.

Decorative Laminates Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Merino Laminates Ltd., Archidply, Broadview Holding, Abet Laminati S.p.A, Greenlam Industries Limited, Stylam Industries Ltd., Illinois Tool Works, Panolam Industries International, Synthomer plc, Fletcher Building |

Analyst Review

The decorative laminates market has witnessed significant growth in past few years, owing to surge in construction and maintenance activities of residential and commercial buildings.

The highly sought features of decorative laminates such as moisture resistance, durability, and abrasion & impact resistance make it far superior to the other surface finishing products, such as, wallpapers, veneer, wall paint, and others. Furthermore, rise in demand for luxurious interior of homes especially in high-income countries such as the U.S, Canada, the UK, and Germany is fueling the demand for decorative laminates. Furthermore, increase in building construction activities in countries such as China and India have increased the demand for decorative laminates from residential and non-residential users. In addition, rise in demand for furniture & cabinets across the world is anticipated to drive significant demand in decorative laminates market.

Moreover, increase in trend of home renovation activities in high- and mid-income countries is expected to provide lucrative opportunities for the growth for the market.

Development of cost effective and sustainable laminates is a major trend in the market.

Decorative laminates are extensively used for increasing the aesthetical appearance of furnishing products such as beds, cupboards, cabinets and others.

Asia-Pacific is the largest regional market for Decorative Laminates

$7,049.4 Million is the estimated industry size of Decorative Laminates in 2021.

Abet Laminati S.p.A, Archidply, Broadview Holding, Fletcher Building, Greenlam Industries Limited, Merino Industries Limited, Panolam Industries International, Inc. and Stylam Industries Ltd., are some of the top companies to hold the market share in Decorative Laminates

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Residential and commercial furnishing projects are the major end users of the Decorative Laminates Market.

Product launch is the key growth strategy of Decorative Laminates industry players

Loading Table Of Content...