Defense Communication Intelligence Market Research, 2033

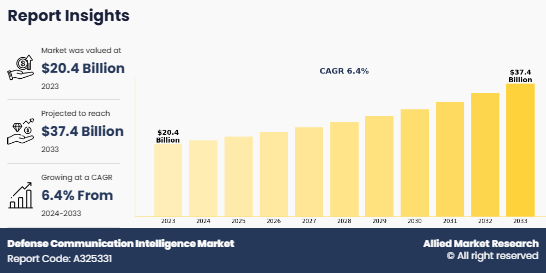

The global Defense Communication Intelligence Market Size was valued at $20.4 billion in 2023, and is projected to reach $37.4 billion by 2033, growing at a CAGR of 6.4% from 2024 to 2033.

The defense communication intelligence market is involved in gathering, analyzing, and interpreting communications signals and data, specifically for defense applications. This market provides critical support for national security, enabling military and defense agencies to monitor, intercept, and assess electronic communications from potential threats. COMINT solutions include specialized hardware, software, and services designed for real-time monitoring and analysis of intercepted signals, aiding decision-making processes in defense operations and intelligence activities. These systems are vital for governments to manage and secure sensitive information, conduct surveillance, and support mission-critical defense strategies.

Key Takeaways

- The Defense Communication Intelligence Market Share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major glucose monitoring devices industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious Defense Communication Intelligence Market Growth objectives.

Market Dynamics

The demand for real-time intelligence in defense and security sectors has surged significantly as global security threats evolve rapidly. Governments and organizations prioritize real-time data analysis to improve situational awareness and responsiveness, a trend evident in the increasing budget allocations for intelligence and surveillance. For instance, the U.S. Department of Defense (DoD) allocated $23.8 billion to intelligence-related programs in 2023, with a notable portion directed toward real-time data systems to enhance operational readiness and threat detection. Similarly, in 2024, NATO invested heavily in intelligence infrastructure to facilitate immediate communication across member countries. Additionally, a recent report showed a 14% annual growth rate in the adoption of AI-driven intelligence platforms worldwide, driven by the need to process large volumes of data swiftly. Real-time intelligence solutions have thus become indispensable, empowering agencies to act on current insights, make strategic decisions, and improve national and global security frameworks.

In addition, the expansion of communication infrastructure in defense is rapidly progressing, driven by increasing defense budgets and national security Defense Communication Intelligence Market Demand. In 2023, global defense spending reached a record $2.24 trillion, with nations investing heavily in advanced communication systems to ensure robust and secure information flow during operations. For instance, the U.S. Department of Defense has allocated significant funding to enhance its Joint All Domain Command and Control (JADC2) initiative, aimed at connecting sensors across military branches for real-time intelligence. Similarly, NATO has committed to modernizing its communication network through its Federated Mission Networking (FMN) program, which facilitates secure interoperability among member states. These developments reflect the global trend of enhancing military communication capabilities, especially with cyber threats on the rise. The push for resilient, scalable, and secure communication infrastructure underscores a shift towards integrated, tech-enabled defense strategies worldwide.

However, the implementation of communication intelligence systems comes with substantial operational costs and integration complexities, often deterring widespread adoption. These systems require sophisticated hardware, advanced software, and seamless integration across multiple platforms, which adds significant expenses for both installation and maintenance. For example, according to industry reports, the average cost of high-end electronic intelligence (ELINT) and communications intelligence (COMINT) equipment can range from hundreds of thousands to millions of dollars per unit, depending on capabilities and customization levels. In addition, integrating these systems into existing defense networks requires extensive compatibility testing and specialized expertise, contributing to long deployment times and increased expenses.

Moreover, the need for frequent updates and security enhancements to keep up with evolving threats adds to operational costs, with cybersecurity spending alone accounting for around 10% of overall defense budgets in some regions. This ongoing financial burden challenges resource-constrained agencies and organizations.

Rise in adoption of cloud-based intelligence solutions is transforming the communication intelligence landscape, driven by advantages of scalability, real-time data processing, and cost-effectiveness. For instance, cloud-based systems enhance data accessibility, enabling intelligence agencies to streamline their operations across regions and access information swiftly. According to the U.S. Government Accountability Office (GAO), over 60% of federal agencies have migrated their intelligence data operations to cloud environments, enhancing operational efficiency and inter-agency data sharing [GAO]. Moreover, the European Union Digital Compass 2030 strategy emphasizes the role of cloud computing in bolstering data sovereignty and security across member states, supporting initiatives that aim to secure communication infrastructure and intelligence solutions [European Commission]. The push towards cloud-based intelligence systems is further reinforced by NATO cloud strategy, which aims to consolidate data networks and improve intelligence capabilities across allied nations, underscoring the strategic value of cloud adoption in defense and security domains [NATO].

Segmental Overview

The defense communication intelligence market is segmented on the basis of component, platform, installation, and region. By component, the market is categorized into hardware, software, and service. By platform, the market is categorized into land, airborne, naval, and space-based platforms. By installation, the market is divided into handheld, vehicle mounted, and fixed. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Component

Based on the component, the hardware Information System segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the rising demand for advanced hardware solutions that ensure seamless integration, reliability, and efficient processing of data in various applications. The hardware components are often considered the backbone of information systems, offering enhanced performance, durability, and scalability, which are critical for meeting the growing needs of businesses and industries.

By Installation

Based on installation, the handheld segment System segment dominated the global market in the year 2023 and is likely to remain dominant during the Defense Communication Intelligence Market Forecast period. This is attributed to the increasing adoption of portable and user-friendly devices that offer flexibility and convenience in diverse operational environments. Handheld systems provide mobility and real-time access to data, making them ideal for field operations, on-the-go tasks, and industries requiring quick decision-making.

By Platform

Based on platform, the land segment System segment dominated the global Defense Communication Intelligence industry in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the widespread use of land-based platforms in industries such as logistics, transportation, and defense, where ground operations are critical. Land platforms often offer greater stability, accessibility, and cost-effectiveness, making them a preferred choice for a range of applications.

By Region

The North America region System segment dominated the global Defense Communication Intelligence industryin the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the widespread use of land-based platforms in industries such as logistics, transportation, and defense, where ground operations are critical. Land platforms often offer greater stability, accessibility, and cost-effectiveness, making them a preferred choice for a range of applications.

Competition Analysis

The key players involved in the defense communication intelligence market analysis include Thales, Lockheed Martin Corporation, Northrop Grumman, AIRBUS, Rohde & Schwarz, Leonardo S.p.A., HENSOLDT, IAI (Israel Aerospace Industries), Elbit Systems Ltd., L3Harris Technologies, Inc., General Dynamics Corporation, Cubic Corporation, BAE Systems, and Ultra.

- September 2024, Partnership - Lockheed Martin Corporation partnered with Australian Defense Force and Indo-Pacific allies to support evolving next-generation defense solutions for unique challenges such as geopolitical tensions, maritime security, cyber threat of this region. Lockheed Martin working on a range of next-generation defense projects in Australia. These innovations will further enhance the Indo-Pacific allies' ability to deter and defend against potential threats.

- April 2024, Product Launch - Elbit Systems Ltd. launched Air Keeper, an advanced airborne platform combining Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR) capabilities with Electronic Warfare (EW) functions. It is equipped with Elbit's elite modular systems. Integration of ELINT, COMINT technology, VISINT, and RADAR creates a single, real-time visual intelligence display, transmitted directly to central command via satellite.

- May 2023, Product Launch - Rohde andamp; Schwarz developed and launched Randamp;SCA210DNG (Detector Next Generation) deep learning high frequency (HF) signal detection solution. It uses next generation artificial intelligence (AI) technology to expand on the Randamp;SCA210 signal analysis software from Rohde andamp; Schwarz. The Randamp;SCA210DNG automatically performs most routine COMINT tasks that helps analysts to focus on important intelligence work.

- June 2022, Product Launch - Rohde andamp; Schwarz unveiled Randamp;S UMS400 lightweight universal monitoring system, new direction finding and monitoring antennas, and intuitive Randamp;S CEPTOR radio-monitoring software. The new sensor, software and two new antennas combine to form COMINT/CESM or military spectrum monitoring solutions. Randamp;S UMS400 is developed for spectrum monitoring and radio location from 8 kHz to 8 GHz (extendable up to 20 GHz) and features a compact outdoor housing with considered size, weight and power (SWaP) characteristics. Its spectrum performance brings value to advanced COMINT platform systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the defense communication intelligence market analysis from 2023 to 2033 to identify the prevailing defense communication intelligence market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the defense communication intelligence market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global defense communication intelligence market trends, key players, market segments, application areas, and market growth strategies.

Defense Communication Intelligence Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 37.4 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Component |

|

| By Installation |

|

| By Platform |

|

| By Region |

|

| Key Market Players | Northrop Grumman, Elbit Systems Ltd., Cubic Corporation, Thales, Leonardo S.p.A., AIRBUS, Ultra, HENSOLDT, Rohde & Schwarz, General Dynamics Corporation, Lockheed Martin Corporation, IAI (Israel Aerospace Industries), BAE Systems, L3Harris Technologies, Inc. |

Analyst Review

According to the CXO perspective, there is a clear emphasis on adopting advanced technologies to enhance national security measures. This sector is driven by a rise in need for secure, real-time data transmission across various communication platforms. According to a recent U.S. Department of Defense report, space-based communication intelligence is a growing priority, with the defense budget allocation to space operations set to exceed $33 billion in 2024, a 14% increase from 2023, reflecting heightened concerns over potential cybersecurity threats from foreign adversaries. This shift aligns with global trends, as other governments, such as Japan and the European Union, have also increased their funding for space-based intelligence, prioritizing secure communication lines to combat emerging threats in digital warfare.

The demand for robust hardware, software, and service components in the market is further underscored by the increasing integration of artificial intelligence and machine learning in defense communication intelligence systems. The U.S. Cybersecurity & Infrastructure Security Agency (CISA) notes that AI-driven analytics have been essential in detecting sophisticated communication-based threats, allowing for faster, more accurate threat assessments. In addition, vehicle-mounted and handheld devices are becoming indispensable, as real-time field communication is critical for tactical advantages. For instance, the development of secure handheld communication devices by Northrop Grumman, intended to provide seamless connectivity for ground troops, represents a key innovation supporting mobile intelligence gathering in field operations.

In Europe, the European Space Agency (ESA) has launched initiatives such as the Space Surveillance and Tracking (SST) support framework, designed to bolster defense communication intelligence in the European Union. This framework received over $76.3 million in funding, with plans for extensive satellite deployment and collaboration among EU member states to counter digital espionage. These developments indicate a focused effort across both NATO and non-NATO countries to achieve secure communication channels.

With geopolitical tensions driving demand for advanced defense intelligence capabilities, the defense communication intelligence market is poised for sustained growth, bolstered by government investments in advanced technologies and collaborative international efforts. CXOs recognize that fostering a secure intelligence ecosystem is not only vital for national defense but also a strategic imperative for operational continuity in increasingly volatile digital landscapes.

The global defense communication intelligence market was valued at $20,416.7 million in 2023, and is projected to reach $37,385.6 million by 2033, registering a CAGR of 6.4% from 2024 to 2033.

The Defense Communication Intelligence Market is product type, and region. 2024-2033 would be the forecast period in the market report.

The HandHeld segment held the largest market share in 2023 and is expected to grow at the fastest rate during the forecast period. The global Defense Communication Intelligence Market was valued at $20,416.7 million in 2023.

The Defense Communication Intelligence Market is analyzed across North America, Europe, Asia-Pacific, LAMEA. 2023 is the base year calculated in the Defense Communication Intelligence Market report.

The top companies that hold the market share are Thales, Lockheed Martin Corporation, Northrop Grumman, AIRBUS, Rohde & Schwarz, Leonardo S.p.A., HENSOLDT, IAI (Israel Aerospace Industries), Elbit Systems Ltd., L3Harris Technologies, Inc., General Dynamics Corporation, Cubic Corporation, BAE Systems, and Ultra.

Loading Table Of Content...

Loading Research Methodology...