Demand Side Platform (DSP) System Market Insight, 2032

The global demand side platform (DSP) system market was valued at $21 billion in 2022, and is projected to reach $228.4 billion by 2032, growing at a CAGR of 27.3% from 2023 to 2032.

The DSP system market is expected to witness notable growth owing to extensive adoption of smartphones and emergence of high-speed internet, surge in adoption of ai converging in AdTech, and rise in use of artificial intelligence. Moreover, the emergence of advertising automation and growing interest of business owners in online advertising to increase brand awareness are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, rising adoption of ad-blockers to avoid online advertising limits the growth of the DSP system market.

A demand-side platform, often abbreviated to DSP, is a programmatic advertising platform that allows advertisers and media buying agencies to bid automatically on display, video, mobile, and search ad inventory from a wide range of publishers. A demand-side platform automates the decision-making process on the amount to bid for an ad in real-time. DSPs make the ad-buying process significantly faster, cheaper, and more efficient. The key feature of demand-side platforms is buying inventory on publishers to reach specific audience segments based on the DSP targeting capabilities, across a range of publisher sites. Demand-side platforms are an evolution of ad networks, which have been incorporating capabilities such as real-time bidding into their offering as well.

Furthermore, emerging advanced ad-tech solutions such as AI/ML solve a variety of human errors and quality issues. Hence, many organizations such as healthcare, IT, retail, and other sectors have adopted DSP due to its benefits. This factor creates lucrative growth opportunities in the market. Moreover, DSPs often partner with third-party data providers, giving better tracking and reporting capabilities than a single network usually provides and in the planning process, the targeting options are more personalized. DSPs allow media buyers to purchase display, audio, and video ads, analyses, and manage them on various networks by using a single platform. The platforms provide ad buyers with information about ad purchases from a publisher. The expanding gaming industry and growing social media apps such as Facebook, WhatsApp and others create numerous opportunities for market growth in the upcoming years.

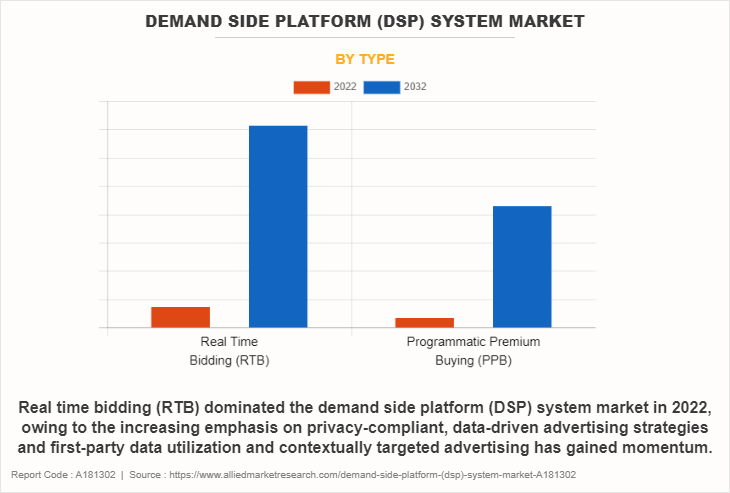

The demand side platform (DSP) system market is segmented on the basis of type, application, and region. On the basis of type, it is bifurcated into real time bidding (RTB) and programmatic premium buying (PPB). On the basis of application, it is fragmented into retail, automotive, financial, healthcare, telecom, and others. On the basis of region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

The report focuses on growth prospects, restraints, and analysis of the global demand side platform (DSP) system market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global demand side platform (DSP) system market analysis.

On the basis of type, the real-time bidding (RTB) segment dominated the demand side platform system market size in 2022, owing to increasing emphasis on privacy-compliant, data-driven advertising strategies and first-party data utilization and contextually targeted advertising has gained momentum. Moreover, DSPs to refines their targeting capabilities, focusing on contextual relevance and leveraging alternative data sources while prioritizing consumer privacy. However, the programmatic premium buying (PPB) segment is expected to witness the fastest growth, owing to access premium inventory automatically while still employing the efficiency and targeting capabilities of programmatic advertising. It involves a more accurate and selective approach, ensuring that ad placements are in reputable environments, typically on well-known websites or in specific ad positions on those websites.

Region-wise North America dominated the demand side platform system market share in 2022, owing to the rising demand for interactive ad formats, such as shoppable ads and immersive experiences, reflects the evolving preference for engaging content. Moreover, the increasing need for socially and environmentally conscious advertising, which has prompted DSPs to assist marketers in matching their brand values with ethical and ecologically conscious actions. However, Asia-Pacific is expected to witness the fastest growth in the upcoming year, owing to connected TV (CTV), hyper-personalization, geotargeting, augmented reality & virtual reality (AR/VR), and integrated consumer journeys.

Competition Analysis

Competitive analysis and profiles of the major players in the demand side platform system industry include Amazon, The Trade Desk, Adobe, Meta, Mediamath, Microsoft Corporation, Pubmatic, Inc., Magnite, Inc., Simpli.Fi, Google LLC. Major players have adopted product launch, partnership, collaborations, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the demand side platform system industry.

Top Impacting Factors

Extensive Adoption of Smartphones and Emergence of High-speed Internet

The use of smartphones has grown rapidly, and the way consumers interact with various brands or sellers have transformed, owing to the accessibility of high-speed internet on smartphones. This factor is expected to fuel the market as it has become crucial for the brands to understand consumers’ interests with the help of smartphone advertisements and stimulate their decision to purchase.

Smartphones are providing real-time marketing opportunities for advertisers to engage with the users who truly want to associate with their brands. In addition, the market players are offering new digital advertising solutions due to the rapidly growing demand for smartphone-based advertising, which is expected to further drive the market. For instance, in October 2019, Tech Mahindra, an IT services provider, collaborated with InMobi, a marketing cloud firm, to offer a video advertising solution. The solution is expected to enable advertisers to develop and distribute engaging and innovative video advertisements on mobile phones.

Surge in Adoption of AI Converging in Adtech

Digital advertising adopted artificial intelligence (AI) as a solution to the mounting difficulties faced by publishers and advertisers when attempting to predict future consumption habits. Although businesses have historically relied on a variety of technology advertising and solutions to analyze data and monitor performance measurements, they have nevertheless had difficulty keeping up with the fast-paced changes in the market. As a result, businesses are expected to keep using AI solutions to produce better results as a result of big data analytics. This enables businesses to predict events more accurately and make more strategic choices.

There is a growing interest in utilizing AI for both publishers and marketers due to the significance of advertising data. Publishers are looking for the best demand side platform (DSP) system investment trends that monetize their ad space at the most competitive price and with the most relevant content, while advertisers are looking for the best solution that fits their audience. Such trends are expected to propel the growth of the market during the forecast period.

Recent Developments in the Demand Side Platform (DSP) System Market

Recent Partnership

On June 2023, Adelaide partnered with Adobe Advertising the industry’s first end-to-end, independent platform for managing connected advertising across marketing and advertising customer journeys, to launch advanced solutions, InstantAU, which enables advertisers to measure media quality with a single click, and attention-based pre-bid segments, designed to help advertisers secure the highest-quality inventory within their budgets.

On October 2023, Meta-DSP company Genius Monkey partnered with StatSocial, an industry leading social audience insights platform, to empower marketers and researchers to make more informed decisions. StatSocial leverages a comprehensive set of self-declared social audience data for a deeper understanding of consumer audiences, brand measurement, and social and influencer ROI.

On July 2023, Scibids, the global leader in artificial intelligence (AI) for customizable bidding solutions, partnered with Google Display & Video 360. Through this partnership it intends to customize the bidding algorithm so that it aligns more closely with the desired business outcome.

Recent Upgrade/Product Launch

On April 2023, Simpli.fi, the advertising success platform for agencies, brands, and media companies launched Advertising Success Platform, to deliver the most relevant connections for advertisers and to drive efficiencies across advertising procurement workflows.

On June 2023, Global advertising technology leader The Trade Desk launched Kokai, a new approach to digital advertising innovation that incorporates major advances in distributed artificial intelligence (AI), measurement, partner integrations and a revolutionary, intuitive user experience.

Recent Agreement

On February 2020, Simpli.fi, the advertising automation platform for agencies, brands, and media companies, announced that it has entered into a definitive agreement to acquire Bidtellect, a leading contextual and native demand-side platform (DSP). Through this acquisition Simpli.fi wants to execute and scale performance for contextual and native campaigns.

On September 2023, Yahoo Advertising has entered into a strategic agreement with Comcast-owned ad tech outfit FreeWheel and tech provider Magnite for its streaming ad server SpringServe, and Publica by IAS. This agreement aims to enable direct server-to-server connections with direct-to-publisher offering Yahoo Backstage.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the demand side platform system market analysis from 2022 to 2032 to identify the prevailing demand side platform system market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the demand side platform system market growth to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global demand side platform system market trends, key players, market segments, application areas, and market growth strategies.

Demand Side Platform (DSP) System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 228.4 billion |

| Growth Rate | CAGR of 27.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 311 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Microsoft Corporation, Simpli.fi, Adobe, MediaMath, Magnite, Inc., The Trade Desk, Amazon, Meta, PubMatic, Inc., Google LLC |

Analyst Review

Demand-side platforms (DSPs) comprehensively evaluate these tools critical to digital advertising strategies. These assessments cover various pivotal aspects to gauge the DSP's effectiveness. This includes an in-depth analysis of the platform's usability and interface, emphasizing the importance of a user-friendly design for seamless campaign management. Evaluations include the range and depth of features and functionalities offered, such as real-time bidding, comprehensive analytics, diverse ad format support, and audience targeting capabilities. The DSP's ability to leverage data effectively, integrating first party and third-party data for precise audience targeting across multiple devices and channels, is closely scrutinized. Integration with other marketing technologies, performance metrics including ROI, customer support quality, and adherence to data privacy regulations are equally assessed. It is important to note that while these analyst reviews provide valuable insights, the choice of an ideal DSP should align with the specific needs and objectives of individual advertising campaigns, as the best-suited platform vary significantly based on these distinct requirements.

Moreover, rises in concerns around transparency and brand safety have led DSPs to develop advanced tools that allow advertisers more control over where their ads appear, ensuring brand-safe placements. In addition, with the impending demise of third-party cookies, contextual targeting has experienced a resurgence, allowing DSPs to target ads based on the context of content consumed by users. These shifts in the industry are prompting DSPs to consider innovative approaches, such as supporting sustainable and ethical advertising practices and addressing the growing interest in the in housing and self-serve platforms for advertisers seeking more control and cost-effectiveness in managing their campaigns. It is important to stay updated, as this landscape is continually evolving, and newer trends have emerged since my last available information.

The Demand Side Platform (DSP) System Market was valued at $21,011.98 million in 2022 and is estimated to reach $228,374.96 million by 2032, exhibiting a CAGR of 27.3% from 2023 to 2032.

North America is the largest regional market for Demand Side Platform (DSP) System

The global demand side platform (DSP) system industry is dominated by key players such as Amazon, The Trade Desk, Adobe, Meta, Mediamath, Microsoft Corporation, Pubmatic, Inc., Magnite, Inc., Simpli.Fi, Google Llc. These players have adopted various strategies to increase their market penetration and strengthen their position in the demand side platform (DSP) system market.

Emergence of advertising automation is the leading application of Demand Side Platform (DSP) System Market

Extensive adoption of smartphones and emergence of high-speed internet and surge in adoption of ai converging in AdTech are the upcoming trends of Demand Side Platform (DSP) System Market in the world

Loading Table Of Content...

Loading Research Methodology...