Dental 3D Printing Devices Market Overview

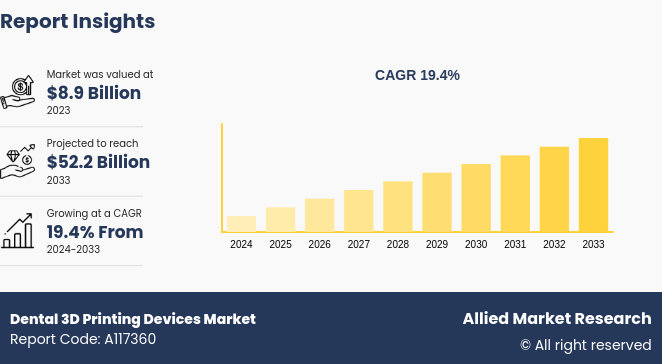

The global dental 3D printing devices market size was valued at $8.9 billion in 2023, and is projected to reach $52.2 billion by 2033, growing at a CAGR of 19.4% from 2024 to 2033. The growth of dental 3D printing devices is driven by increasing demand for customized dental solutions, such as crowns, bridges, aligners, and dentures, which require precision and personalization. Advancements in 3D printing technologies have improved the accuracy, speed, and material compatibility of devices, making them more suitable for dental applications.

Market Size & Future Outlook

- 2023 Market Size: $8.9 billion

- 2033 Projected Market Size: $23.89 million

- CAGR (2024-2033): 19.21%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The major factors driving the growth of the dental 3d printing devices market are growing demand for personalized dental care and the increasing adoption of digital dentistry solutions. Advances in 3D printing technology have enabled faster, more accurate, and cost-effective production of dental prosthetics, implants, and orthodontic devices. Additionally, the rising prevalence of dental disorders and the expanding elderly population, who require more dental interventions, further boost the market.

Market Introduction and Definition

Dental 3D printing devices is revolutionizing the field of dentistry by enabling precise, efficient, and customizable solutions for various dental procedures. Utilizing advanced additive manufacturing technologies, dental 3D printers can create detailed and accurate dental models, crowns, bridges, dentures, surgical guides, and even clear aligners. The process begins with digital scans of a patient's mouth, which are then used to design a 3D model through specialized software. These digital models are printed layer by layer using biocompatible materials, such as resin or ceramics, ensuring both safety and durability. This technology significantly reduces the time required for dental restorations and prosthetics, often allowing for same-day production. Additionally, the precision of 3D printing minimizes errors and enhances the fit and comfort of dental appliances, leading to better patient outcomes. Dental 3D printing is also cost-effective, reducing material waste and labor costs associated with traditional manufacturing methods.

Key Takeaways

- The dental 3D printing devices market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major dental 3D printing devices industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Key factors driving the dental 3D printing devices market growth include increased adoption of 3D printing technology by dental professionals, growing dental disorders, aging population and technological advancements. The dental 3D printing market is experiencing substantial growth, primarily driven by the increased adoption of 3D printing technology among dental professionals. This surge in utilization stems from the numerous advantages that 3D printing offers over traditional methods, including enhanced precision, customization, and efficiency. Dental professionals are leveraging 3D printing to produce highly accurate dental prosthetics, implants, and orthodontic devices, which are tailored to the unique anatomical features of each patient. This personalized approach not only improves patient outcomes but also reduces the time and cost associated with dental procedures. For instance, according to a 2022 article by Dentsply Sirona, a global dental equipment manufacturer, it was reported that in dentistry, 3D printers and other tools such as intraoral scanners are allowing dentists to adopt digital workflows which make practices more efficient and improve patient treatment outcomes. Thus, the rising adoption of the 3D printing technology by the dentists is expected to drive the growth of the dental 3D printing devices market size.

Furthermore, according to dental 3D printing devices market forecast analysis the escalating prevalence of dental disorders is a major driver for the dental 3D printing market. Conditions such as tooth decay, periodontal disease, malocclusions, and edentulism are becoming increasingly common, fueled by factors like aging populations, poor dietary habits, and inadequate oral hygiene practices. As the demand for effective and timely dental treatments rises, 3D printing technology emerges as a crucial solution, offering precision and customization that traditional methods often lack. In addition, the aging population and technological advancements such as new advance biocompatible materials are expected to drive the growth of the market. Thus, the rise in prevalence of the dental disorders and surge in global population is expected to drive the growth of dental 3D printing devices industry

Dental 3D Printing Devices Market Segmentation

The dental 3D printing devices market is segmented into equipment, technology, material, application, end user, and region. By equipment, the market is divided into 3D scanner and printer. As per technology, the market is classified into stereolithography, LCD, FDM, SLS. By material, the market is divided into plastics and metals. Depending on application, the market is divided into prosthodontics, orthodontics and implantology. By end user, it is categorized into dental labs, hospitals and clinics. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA

Regional/Country Market Outlook

North America dominated the dental 3D printing devices market share in 2023, owing to early adoption of advanced dental technologies, robust healthcare infrastructure, and the presence of key industry players. The region's high prevalence of dental disorders and strong investment in research and development further propel market growth. According to dental 3D printing devices market opportunity analysis, the Asia-Pacific region is expected to register rapid growth in the forecast period, owing to rising prevalence of dental diseases, increasing healthcare expenditure, and the growing adoption of cutting-edge dental technologies. Countries such as China, Japan, and India are emerging as significant contributors, driven by their large populations and improving healthcare infrastructure. The region also benefits from a growing number of dental professionals trained in 3D printing applications. Furthermore, in LAMEA region market has experienced steady growth owing to improving economic conditions, rising healthcare awareness, and increasing investments in healthcare infrastructure.

- According to 2022 National Dental Epidemiology Programme survey (UK) , it was reported that national prevalence of children with enamel and/or dentinal decay was 29.3%.

- According to 2023 article by National Library of Medicine, it was reported that overall prevalence of periodontal disease was 50% in southern part of India.

- According to 2023 article by World Health Organization, it was reported that oral diseases affect nearly 3.5 billion people globally

Industry Trends

- According to World Health Organization (WHO) 2023, about 2 billion people worldwide suffer from dental cavity.

- For instance, World Health Organization (WHO) , in March 2023, estimated that oral diseases affect nearly 3.5 billion people across the world.

- According to 2023 article by American Dental Association, 17% of dentists use 3D printer. Furthermore, among nonusers, 21% of dentists were considering investing in a 3D printer.

Statement from Industry leader

Statement from Industry leader |

In a recent interview (November 2023), Chuck Stapleton, the Vice President and General Manager for Dental at 3D Systems, outlined the company's strategy for advancing 3D printing in the dental industry. 3D Systems aims to collaborate with large dental producers like Glidewell as well as maintain relationships with various-sized labs to drive mainstream adoption of 3D printing for dental production. Stapleton highlighted their partnership with Align Technology, the leading provider of clear aligners, acknowledging the pandemic-induced challenges but emphasizing a positive market outlook with growth currently. He mentioned optimistic market forecasts indicating a return to a steady growth trend. 3D Systems has an extensive portfolio tailored for dentistry, with applications ranging from orthodontics to prosthetics, including dental models, surgical guides, and more. Stapleton acknowledged that 3D printing has vastly expanded in dental applications, now encompassing the production of crowns and dentures. He expressed that the digital route results in a more accurate product, enhancing patient comfort compared to traditional manual methods. To sustain a competitive edge in the escalating dental 3D printing market, 3D Systems has outlined a multi-pronged strategy. This includes a relentless focus on engineering disruptive materials, exploring fresh business models and partnerships, and tapping into previously underutilized technologies such as jetting to unveil new applications. Looking ahead, Stapleton is optimistic about the transformative impact of 3D printing on dental care delivery, envisioning a future where dental product production will decentralize, moving closer to the patient |

Competitive Landscape

The major players operating in the dental 3D printing devices market include 3D Systems, Inc., Formlabs, Nexa3D, Zortrax, Quoris3D, Dentsply Sirona, NextDent B.V., Renishaw plc., Desktop Metal, Inc. (EnvisionTEC) , and Institut Straumann AG. Other players in dental 3D printing market includes General Electric, SprintRay Inc., Rapid Shape GmbH, Stratasys, Ackuretta, and Asiga.

What are the Recent Key Strategies and Developments

- In March 2022, Dentsply Sirona, a multinational dental product manufacturer, announced the launch of new Primeprint 3D printer and post-processing unit. Powered by a 385nm light engine, the newly-unveiled printer is designed to enable dentists to produce accurate models, guides, provisionals, or splints as simply as possible.

- In February 2022, Desktop Health announced the launch of its 'Einstein' series of dental 3D printing systems based on the digital light processing technology (DLP) Desktop Metal acquired through its takeover of EnvisionTEC.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dental 3d printing devices market analysis from 2024 to 2033 to identify the prevailing dental 3d printing devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dental 3d printing devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dental 3d printing devices market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- World Health Organization

- National Dental Epidemiology Programme survey (UK)

- Center of Disease Control and Prevention

- National Library of Medicine

- American Dental Association

- Indian Dental Association

- British Dental Association

Dental 3D Printing Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 52.2 Billion |

| Growth Rate | CAGR of 19.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Equipment |

|

| By Technology |

|

| By Material |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | NextDent B.V., Zortrax, Quoris3D, Desktop Metal, Inc, Renishaw plc., Institut Straumann AG, 3D Systems, Inc., Formlabs, Dentsply Sirona, Nexa3D |

The base year is 2023 in Dental 3D Printing Devices Market

The total market value of Dental 3D Printing Devices Market is $8.9 billion in 2023.

The forecast period for Dental 3D Printing Devices Market is 2024-2033.

The market value of Dental 3D Printing Devices Market is projected to reach $52.2 billion by 2033

Major key players that operate in the Dental 3D Printing Devices Market are 3D Systems, Inc., Formlabs, Nexa3D, Zortrax, Quoris3D, and Dentsply Sirona

Loading Table Of Content...