Detonator Market Research, 2032

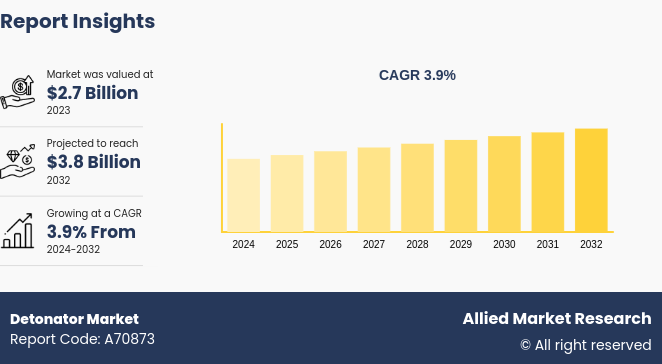

The Global Detonator Market was valued at $2.7 billion in 2023 and is projected to reach $3.8 billion by 2032, growing at a CAGR of 3.9% from 2024 to 2032. Detonators are specialized devices used to detonate explosive materials in a variety of applications, including mining, construction, military, and demolition. They are critical components in explosive systems, offering precise timing and control to start explosions safely and effectively. Detonators are generally made up of main explosives, initiation devices, delay detonators, and booster charges enclosed in a protective casing. They can be activated electrically, mechanically, or chemically, depending on the needs of the application. The detonator market is driven by the need for explosive materials in sectors like mining, quarrying, and construction for operations including blasting, rock fragmentation, and excavation.

Furthermore, the military and defense industries rely on detonators for ordnance disposal, explosive ordnance identification, and military operations. Additionally, military and defense sectors rely on detonators for ordnance disposal, explosive ordnance detection, and military operations. The market is also influenced by advancements in detonator technology, including enhanced safety features, improved reliability, and compatibility with automated systems. Moreover, stringent safety regulations and standards governing explosive materials usage contribute to the growth and regulation of the detonator market.

Key Takeaways

On the basis of type, the electronic and electric detonators segment dominated the detonator market share in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

By assembly type, the detonator market size by country is dominated by wireless detonators segmentation during the base year of 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

On the basis of the application, the coal mine segment dominated the detonator market in terms of revenue in 2023. However, the railway and road segment is anticipated to grow at the fastest CAGR during the forecast period.

Region-wise, Asia-Pacific generated the largest revenue in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

On October 05, 2023, the Australian government announced new safety regulations for the mining industry, requiring the use of electronic detonators in all blasting operations. This move aims to improve safety and reduce the risk of accidents in the mining sector, as electronic detonators offer more precise control and timing compared to traditional pyrotechnic detonators. The government is working with industry stakeholders to ensure a smooth transition to electronic detonators and is providing funding for training and education programs.

On March 18, 2023, the Canadian government invested $20 million in the research and development of advanced detonator technologies for the mining and construction industries. The funding will support projects aimed at developing safer, more reliable, and environmentally friendly detonators. This initiative aligns with the government's goal of promoting sustainable mining practices and reducing the environmental impact of resource extraction activities.

On September 30, 2022, the South African government launched a national program to improve safety in the mining industry, with a focus on the use of detonators. The program includes stricter regulations on the storage, transportation, and handling of detonators, as well as enhanced training for miners and blasters. The government is also working with detonator manufacturers to develop safer and more reliable products for the South African market.

On February 14, 2022, the Brazilian government announced new regulations for the use of detonators in the construction industry, requiring the use of certified detonators that meet strict safety standards. This move aims to reduce the risk of accidents and injuries in the construction sector, as detonators are frequently used in demolition and excavation projects. The government is also working to raise awareness among construction workers about the safe handling and use of detonators.

Key Market Dynamics

The detonator market growth is driven by various factors, such as the increased need for explosive materials in industries such as mining, building, the military, and demolition. Detonators are critical components used in a range of industries to start controlled explosions necessary for a variety of operational procedures. Demand is likely to increase as these sectors grow and require more accurate and efficient explosive solutions.

Additionally, the industry is growing quickly because of advancements in detonator technology. The reliability, safety precautions, and automated system interoperability have all increased due to ongoing technological improvements. Better performance and safety are further ensured by the development of novel detonator designs and materials, which increases their market attractiveness. Moreover, the necessity of detonators is mostly driven by strict safety regulations. Compliant detonators must be used by increasingly strict standards governing the use of explosives. These limitations are meant to guarantee compliance with safety protocols and lower the possibility of mishaps and accidents in industries that use explosives. Therefore, to meet these strict requirements, businesses must utilize high-quality, regulated detonators, which leads to a market increase.

However, the market is also constrained, mostly because of environmental concerns. The usage of explosives creates severe environmental issues, affecting ecosystems and adjacent communities. These problems raise regulatory concerns and highlight the need for sustainable procedures in explosive activities, which may restrict market expansion. In contrast, the military and defense industry have enormous growth potential. The market for detonators has enormous potential due to the expansion of military and defense applications such as explosive ordnance identification, military operations, and ordnance disposal. Rising defense spending and shifting security concerns throughout the world are driving demand for complex detonators, making this a viable market development opportunity.

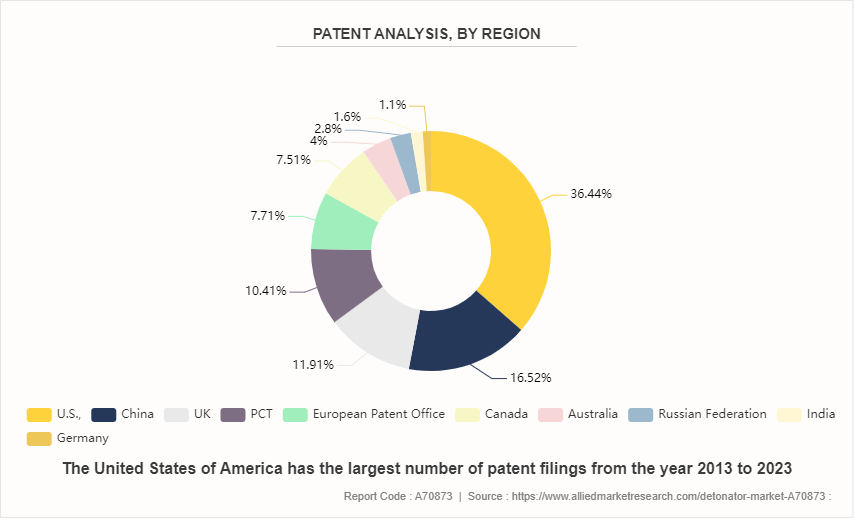

Patent Analysis of the Global Detonator Market

The global detonator market is segmented according to the patents filed in the U.S., China, the UK, PCT, European Patent Office, Canada, Australia, the Russian Federation, India, and Germany. The detonator for the US Market has the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed/accepted by registration authorities in many of the developing regions/countries.

Market Segmentation

The detonator industry report is segmented into type, assembly type, application, and region. Based on type, the market is divided into non-electric and electronic & electric. By assembly type, the market is segmented into wireless detonators and wired detonators. Based on application, the detonator market data is classified into coal mines, metal mines, non-metal mines, railway and road, hydraulic and hydropower, and others. Region-wise, the detonator market forecast is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Segment Outlook

Electronic and electric detonators outperform non-electric alternatives in terms of precision, safety, and efficiency, which has contributed to their popularity. Because these detonators have configurable time delays, blasting may be done more sequentially and controlled. This precision increases material fragmentation, reduces ground vibrations, and minimizes risks, all of which lead to greater overall efficiency in blasting activities such as mining and construction. Modern electronics enable remote initiation and monitoring, which improves safety and operational flexibility. Because of these advantages, various industries increasingly choose electronic and electric detonators.

Wireless detonators have eclipsed wired detonators in market share in recent years as a result of their rapid expansion. The primary driver of this shift is the inherent safety benefits of wireless technology. Wireless detonators eliminate the need for physical wires, lowering the risk of misfires and unintended starts. Because they are simple to put up and utilize in challenging terrain, they provide greater flexibility in blast design and execution. Wireless detonators are becoming increasingly popular in several applications due to their ability to precisely time the start of several detonations simultaneously, providing an additional degree of control and efficiency.

Based on application, the detonator sector analysis of the coal mining segment dominated the market, owing to a surge in coal mining solutions across Asia-Pacific, North America, and LAMEA regions. Detonators are crucial equipment in coal mines since removing large volumes of coal typically involves extensive blasting. This sector employs more detonators because of the growing need for coal as a fuel source, particularly in developing countries. Furthermore, high safety rules in coal mining operations necessitate the use of reliable and effective detonation devices, cementing this segment's dominance in the detonator market.

Regional/Country Market Outlook

Asia-Pacific dominates the detonator market insights, owing to the presence of robust economies that are rapidly expanding as a result of large investments in mining, construction, and infrastructure. These sectors are rapidly developing in countries such as China and India, increasing the demand for detonators. Large-scale mining activities are also prevalent, particularly for coal and other minerals, which contribute to the region's heavy use. Furthermore, the region's adoption of cutting-edge detonation technology is being fueled by a growing concern about the efficiency and safety of blasting operations.

Competitive Landscape

The detonator market share by companies is analyzed across Orica Limited (Australia), Dyno Nobel (US), AEL Intelligent Blasting (South Africa), MAXAM (Australia), Poly Permanente Union Holding Group Limited (China), Sichuan Yahua Industrial Group Co. Ltd (China), Enaex (Chile), BME South Africa (South Africa), Sasol (South Africa), Austin Detonator. Further, the detonator company list also includes Jinan Giant Eagle,

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the detonator market from 2024 to 2032 to identify the prevailing detonator market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the detonator market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global detonator market trends, key players, market segments, application areas, and market growth strategies.

Detonator Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.8 Billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Assembly Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Sasol, Dyno Nobel Inc, BME South Africa, Austin Detonator, Sichuan Yahua Industrial Group Co. Ltd, Orica Limited, Maxam, Enaex S.A., AEL Intelligent Blasting, Poly Permanente Union Holding Group Limited |

Loading Table Of Content...