Diabetes Drugs Market Research, 2033

Market Introduction and Definition

The global diabetes drugs market size was valued at $79.3 billion in 2023, and is projected to reach $157.9 billion by 2033, growing at a CAGR of 7.1% from 2024 to 2033. Diabetes drugs, also known as antidiabetic medications, play a crucial role in managing blood glucose levels in individuals with diabetes. They are typically categorized based on their mechanism of action and their impact on the body. For Type 1 diabetes, which involves an autoimmune destruction of insulin-producing cells in the pancreas, insulin therapy is the primary treatment. This can be administered through injections or an insulin pump. For Type 2 diabetes, which is characterized by insulin resistance and eventually insulin deficiency, a variety of medications are used. These include metformin, which decreases glucose production in the liver and improves insulin sensitivity; sulfonylureas, which stimulate insulin secretion from the pancreas; and SGLT2 inhibitors, which prevent glucose reabsorption in the kidneys, leading to glucose excretion through urine. The diabetes drugs market is driven by rising prevalence of diabetes globally, advancements in drug development, and an increased focus on personalized medicine. The growing aging population, coupled with lifestyle changes and high rates of obesity, contributes to a higher incidence of diabetes, boosting demand for effective treatments. Additionally, innovation in drug formulations and the development of new classes of diabetes medications enhance treatment options, fostering market growth. Increased awareness and improved healthcare infrastructure further support the expansion of the diabetes drugs market.

Key Takeaways

- The diabetes drugs market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major diabetes drugs industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

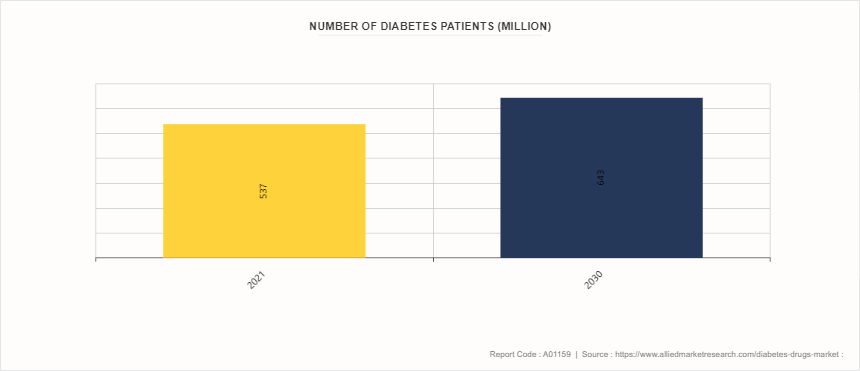

According to the diabetes drugs market forecast analysis, the key factors driving the growth of the market are rise in prevalence of diabetes, growing geriatric population, and rise in research and development activities of the diabetes drugs. According to data published by International Diabetes Federation in 2021, more than 90.0 million of the South-East Asia population between age of 20-79 years suffered from diabetes, and the number is expected to grow to 113.0 million in 2030 and 151 million by 2045. As diabetes rates continue to escalate globally, driven by factors such as rise in obesity, sedentary lifestyles, and aging populations, the demand for diabetes management solutions has surged. This chronic condition, characterized by elevated blood glucose levels, necessitates ongoing medical intervention, which propels the need for a broad spectrum of therapeutic options.

Rise in incidence of both type 1 and type 2 diabetes fuels the market for innovative drug treatments aimed at controlling blood sugar levels, managing complications, and improving overall patient outcomes. Thus, rise in prevalence of the diabetes is expected to drive the diabetes drugs market growth. Furthermore, according to diabetes drugs market opportunity analysis the aging population is a critical driver as diabetes prevalence increases with age, leading to a higher demand for effective diabetes management solutions. According to 2024 article by Center of Disease Control and Prevention, the percentage of adults with diabetes increased with age, reaching 29.2% among those aged 65 years or older. Older adults often face a range of health challenges, including diabetes, which necessitates a growing need for innovative and effective treatment options.

In addition, pharmaceutical companies and research institutions are increasing their focus on developing new and advanced therapies to address the complexities of diabetes, including novel drug formulations and personalized medicine approaches. This increased R&D activity not only fosters the introduction of cutting-edge treatments but also supports the ongoing improvement of existing therapies, enhancing overall patient outcomes, and contributing to growth of diabetes drugs market size.

Surge in Prevalence of Diabetes

Rise in prevalence of diabetes is a significant driver for the diabetes drug market. As global rates of diabetes continue to increase, driven by factors such as rise in urbanization, sedentary lifestyles, and dietary changes, the demand for effective diabetes management and treatment solutions has surged. This growing prevalence of diabetes creates a substantial market for diabetes medications, as individuals with the condition require ongoing pharmacological intervention to manage their blood glucose levels and mitigate the risk of associated complications. The increasing awareness of diabetes and the expanding patient population have led to heightened investment in research and development, fueling innovation in drug therapies and contributing to the growth of the diabetes drug market.

Market Segmentation

The diabetes drugs industry is segmented on the basis of drug class, diabetes type, route of administration, distribution channel, and region. By drug class, the market is classified into insulin, GLP-1 receptor agonists, DPP-4 inhibitors, SGLT2 inhibitors, and others. By diabetes type, the market is divided into type 1 and type 2. By route of administration, the market is divided into oral, subcutaneous, and intravenous. By distribution channel, it is segregated into online pharmacies, hospital pharmacies, and retail pharmacies. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

- North America dominated the diabetes drugs market share in 2023 owing to substantial research and development activities, strong presence of major key players, well-established healthcare infrastructure, and surge in prevalence of diabetes. In the Asia-Pacific region, rapid market expansion is anticipated due to improving healthcare infrastructure, growing pharmaceutical and biopharmaceutical industry, and rise in geriatric population.

- In January 2023, Eli Lilly and Company announced to invest an additional $450.0 million in expansion of its manufacturing facility in North Carolina. The expansion includes additional parenteral filling, device assembly, and packaging capacity to support increased demand for Lilly's incretin products that treat diabetes.

- In September 2021, Sanofi started supplies of its next-generation basal insulin Toujeo Solostar to the European Union countries.

- According to data published by International Diabetes Federation in 2021, more than 90.0 million of the South-East Asia population between age of 20-79 years suffered from diabetes, and the number is expected to grow to 113.0 million in 2030 and 151 million by 2045.

- According to an article published by American Medical Association in April 2021, which is based on data published by IDF, more than 60.0% of people suffering from type 2 diabetes across the globe are living in Asia, primarily in China and India.

Industry Trends

- According to the Diabetic Statistics report published by the Centers for Disease Control and Prevention (CDC) in 2022, more than 130.0 million people in the U.S., were suffering from diabetes or prediabetes.

- According to data published by the American Heart Association in February 2021, annually around 30-53% of the new diabetes cases are associated with obesity in the U.S.

- According to the report published in April 2023 by Providence Veterans Affairs Medical Center, the adoption of SGLT2Is (GLP-1 analogs) by prescribers is increasing over time, compared with sulfonylureas and other diabetes drugs.

- According to an article published by Komodo Health, Inc., in February 2023, more than 5.0 million prescriptions were filled in 2022 for diabetes drugs such as for Ozempic, Mounjaro, Rybelsus, or Wegovy in the U.S.

- As per data published by the American Diabetes Association in November 2023, the cost of diagnosed diabetes in the U.S. was $412.9 billion, out of which $306.6 billion was direct medical cost and $106.3 billion was indirect cost in 2022.

Competitive Landscape

The major players operating in the diabetes drugs market include Novo Nordisk A/S, Sanofi, Merck & Co., Inc., Eli Lilly and Company, AstraZeneca, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Novartis AG, Johnson & Johnson, and Bayer AG. Other players in the diabetes drugs market are Cipla Ltd. and Dr. Reddy's Laboratories Ltd.

Recent Key Strategies and Developments

- In January 2024, Glenmark Pharmaceuticals Ltd. introduced Lirafit, a biosimilar of the anti-diabetic drug, Liraglutide, in India. The per day price of this drug is approximately $1.21 for a standard dose of 1.2 mg.

- In June 2023, Pfizer Inc. announced that the company continued the clinical development of its oral GLP-1-RA candidate for the treatment of adults having type 2 diabetes and obesity.

- In March 2023, Sanofi (India) received marketing authorization for its diabetes drug Soliqua (in a pre-filled pen) from the Central Drugs Standard Control Organization (CDSCO) in India.

- In February 2023, Akums Drugs and Pharmaceutical Limited, a contract drug manufacturing company, announced the launch of the ‘Lobeglitazone’ drug for the treatment of type 2 diabetes in India.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the diabetes drugs market analysis from 2024 to 2033 to identify the prevailing diabetes drugs market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the diabetes drugs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global diabetes drugs market trends, key players, market segments, application areas, and market growth strategies.

Diabetes Drugs Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 157.9 Billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Drug Class |

|

| By Diabetes Type |

|

| By Route Of Administration |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Sanofi, AstraZeneca, Takeda Pharmaceutical Company Limited, Novo Nordisk A/S, Bayer AG, Johnson & Johnson, Merck & Co., Inc., Eli Lilly and Company., Boehringer Ingelheim International GmbH, Novartis AG |

The global diabetes drugs market size was valued at $79.3 billion in 2023

The market value of Diabetes Drugs Market is projected to reach $157.9 billion by 2033

The forecast period for Diabetes Drugs Market is 2024-2033.

The base year is 2023 in Diabetes Drugs Market

Major key players that operate in the Diabetes Drugs Market are Novo Nordisk A/S, Sanofi, Merck & Co., Inc., Eli Lilly and Company, AstraZeneca, Takeda Pharmaceutical Company Limited.

Loading Table Of Content...