Diagnostic ENT Devices Market Research, 2033

The global diagnostic ENT devices market size was valued at $24.4 billion in 2023, and is projected to reach $44.1 billion by 2033, growing at a CAGR of 6.1% from 2024 to 2033. Improved awareness and early diagnosis are crucial for effective treatment, leading to a higher adoption of diagnostic ENT devices.

Market Introduction and Definition

Diagnostic ENT devices are specialized instruments used for examining and diagnosing conditions affecting the ear, nose, and throat. These devices include otoscopes for inspecting the ear canal, endoscopes for visualizing the nasal passages and throat, audiometers for hearing tests, and laryngoscopes for examining the larynx. They play a crucial role in the early detection and assessment of ENT disorders such as infections, tumors, and structural abnormalities. By providing detailed images and measurements, diagnostic ENT devices aid healthcare professionals in making accurate diagnoses and formulating effective treatment plans. Their advancements enhance diagnostic accuracy and patient care in ENT practices.

Key Takeaways

- The diagnostic ENT devices market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected diagnostic ENT devices market forecast period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major diagnostic ENT devices industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The diagnostic ENT Devices market growth is significantly driven by the increasing prevalence of ear, nose, and throat disorders, such as sinusitis, hearing loss, and throat cancers. The rise in these conditions, combined with a growing aging population, has heightened the demand for advanced diagnostic tools that can accurately detect and monitor ENT disorders. Additionally, technological advancements in imaging and diagnostic technologies, such as high-definition endoscopes and digital otoscopes, have enhanced the precision and functionality of these devices, further driving market growth.

However, one notable restraint for the diagnostic ENT devices market is the high cost associated with advanced diagnostic equipment. The initial investment required for purchasing and maintaining sophisticated ENT devices can be substantial, particularly for small and mid-sized clinics or practices. This high cost can limit the accessibility of these devices, particularly in developing regions or for smaller healthcare providers. Additionally, the need for ongoing training and maintenance can add to the overall expenses, potentially hindering market growth in price-sensitive segments.

A significant opportunity in the diagnostic ENT devices market lies in the growing trend of integrating digital health technologies and telemedicine. The development of portable and connected diagnostic devices enables remote consultations and real-time data sharing, improving access to ENT diagnostics for patients in underserved areas. Innovations in wearable technology and mobile health modalities can further enhance the convenience and efficiency of ENT diagnostics. This shift towards digital health and telemedicine presents a substantial growth opportunity by expanding the reach of diagnostic services and addressing the limitations of traditional in-person consultations.

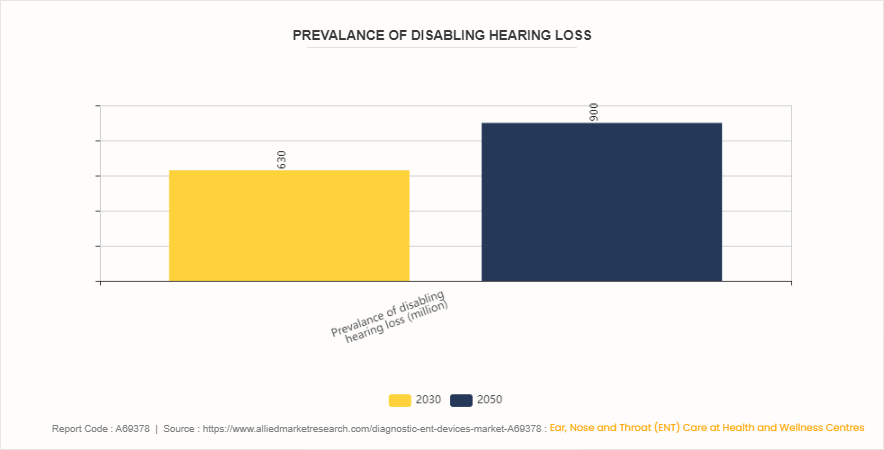

Prevalence of disabling hearing loss for Diagnostic ENT Devices Market

The World Health Organization (WHO) projects a substantial rise in disabling hearing loss, predicting nearly 630 million cases by 2030 and over 900 million by 2050 if no preventive measures are implemented. This escalating burden underscores a critical demand for advanced Diagnostic ENT devices. The growing prevalence highlights the urgent need for early detection and management solutions, driving market growth. As hearing loss becomes more widespread, the Diagnostic ENT devices market is expected to expand significantly, with increased investments in innovative technologies and enhanced diagnostic tools to address the rising number of affected individuals globally.

Market Segmentation

The diagnostic ENT Devices industry is segmented into product type, modality, end user and region. On the basis of product type, the market is categorized into otoscopes, rhinoscopes, laryngoscopes, endoscopes, audiometers, nasal endoscopes, and others. As per modality, the market is categorized into hand-held devices, portable devices, and fixed devices. On the basis of end user, the market is segmented into hospitals, ENT clinics, diagnostic laboratories, ambulatory surgical centers, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The diagnostic ENT Devices market share demonstrates robust growth across various regions, driven by increasing prevalence of ENT disorders and technological advancements. North America leads the market due to a well-established healthcare infrastructure and high adoption of advanced diagnostic tools. Europe follows closely, with substantial investments in healthcare and rising awareness about early diagnosis. The Asia-Pacific region exhibits the fastest growth, propelled by large patient populations, improving healthcare facilities, and increasing medical tourism. Latin America and the Middle East & Africa show moderate growth, supported by gradually improving healthcare systems and growing awareness about ENT disorders. Overall, the market is poised for significant expansion globally.

- According to British Academy of Audiology report 2022, 1 in 6 of the UK adult population is affected by hearing loss, and 8 million of these are aged 60 and over.

Industry Trends

According to World Health Organization (WHO) report in February 2024, an annual additional investment of less than US$ 1.40 per person is needed to scale up ear and hearing care services globally.

Competitive Landscape

The major players operating in the Diagnostic ENT Devices market size include Siemens Healthineers, Rion Co., Ltd., Welch Allyn, Ambu A/S, Atos Medical Ab, Boston Scientific Corporation, Cochlear Limited, Demant A/S, Eckert & Ziegler AG, HOYA Corporation. Other players in the Diagnostic ENT Devices market include Johnson & Johnson, Karl Storz SE& Co. KG, Medtronic plc, Olympus Corporation, Richard Wolf GmbH and so on.

Recent Key Strategies and Developments

- In September 2021, Acclarent, Inc., part of the Johnson & Johnson Medical Devices Companies, and a leader in developing minimally-invasive Ear, Nose & Throat (ENT) technologies, announced the U.S. launch of its first-ever AI-powered ENT technology, designed to simplify surgical planning and provide real-time feedback during ENT navigation procedures.

Key Sources Referred

- World Health Organization (WHO)

- Centers for Medicare & Medicaid Services (CMS)

- American Society of Plastic Surgeons (ASPS)

- National Health Service (NHS)

- British Academy of Audiology

- National Health Mission (NHM)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the diagnostic ent devices market analysis from 2024 to 2033 to identify the prevailing diagnostic ent devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the diagnostic ent devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global diagnostic ent devices market trends, key players, market segments, application areas, and market growth strategies.

Diagnostic ENT Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 44.1 Billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Product Type |

|

| By Modality |

|

| By End User |

|

| By Region |

|

| Key Market Players | Johnson & Johnson, Stryker Corporation, Karl Storz, Sonova, Natus Medical, Olympus Corporation, Cochlear Limited, Medtronic, Hoya Corporation, Smith & Nephew |

The total market value of Diagnostic ENT devices market was $24.4 billion in 2023.

The forecast period for Diagnostic ENT devices market is 2024 to 2033

The market value of Diagnostic ENT devices market is projected to reach $44.1 billion by 2033

The base year is 2023 in Diagnostic ENT devices market .

Diagnostic ENT devices are specialized instruments used for examining and diagnosing conditions affecting the ear, nose, and throat. These devices include otoscopes for inspecting the ear canal, endoscopes for visualizing the nasal passages and throat, audiometers for hearing tests, and laryngoscopes for examining the larynx.

Loading Table Of Content...