Digestive Enzymes Market Research, 2031

The global digestive enzymes market size was valued at $699.40 million in 2021, and is projected to reach $1.64 billion by 2031, growing at a CAGR of 8.7% from 2022 to 2031. Digestive enzyme supplements have gained popularity for their claims of treating common forms of gut irritation, heartburn and other ailments. Digestive enzymes are the enzymes that break down polymeric macromolecules into smaller building blocks to facilitate their absorption by the body. Digestive enzymes convert the food into smaller molecules that your tissues, cells, and organs utilize for many metabolic functions. It takes some time to complete this process and results in amino acids, glycerol, fatty acids and simple sugars. Although amylase, lipase, and protease are the major enzymes that the body utilizes to digest food, there are many other specialized enzymes also contributing to the process. A variety of health conditions, especially those that affect the pancreas, can lead to deficiencies in digestive enzymes. This is because the pancreas secretes several key enzymes.

Growth of the digestive enzymes market size is driven by increase in prevalence of digestive problems, increase in the unhealthy lifestyle by population and rise in geriatric population.

In addition, surge in number of fitness centers and gymnasiums has also increased demand for dietary supplements, increase in awareness about GI health, and focus on preventive disease management would further supplement the digestive enzymes market growth. On the other hand, lack of knowledge about appropriate dosage amounts and presence of substitutes for digestive enzyme supplements are expected to hinder growth of the market. Conversely, development of customized digestive enzymes offer lucrative digestive enzymes market opportunity.

Impact of COVID-19 Pandemic on Digestive Enzymes Market

The COVID-19 pandemic affected the digestive enzymes industry in a fairly negative way, like various other enzyme industries were affected. For instance, according to a review article by Wiley Online Library first published in June 2022, furin is a protease related to coronavirus cell entrance as it is responsible for cleavage of SARS-CoV-2 S protein in lung cells and primary human airway epithelial cells in a transmembrane serine protease-2 (TMPRSS2)-expression dependent manner. However, physiological consequences of inhibiting that enzyme are not known yet. Moreover, according to a study published in the American Journal of Gastroenterology in July 2020, as compared with non-severe COVID-19 patients, severe COVID-19 patients have higher levels of aspartate aminotransferase, alanine aminotransferase, and total bilirubin (TBL).

Overall, the COVID-19 pandemic had a fairly negative impact on the digestive enzymes market share owing to various restrictions imposed on the production and transport of products. However, this situation is expected to change during the digestive enzymes market forecast period.

Digestive Enzymes Market Segmentation

The digestive enzymes market is segmented into Origin, Enzyme Type and Applications. The digestive enzyme market is segmented into origin, enzyme type, application, and region. By origin, the market is categorized into animals, microbial, and plants. Further, the animals segment is categorized into prescription medicine, sports nutrition, and infant nutrition. The sports nutrition segment for animals is classified into sports drink and other sport supplements. Further, the microbial segment is categorized into prescription medicine, sports nutrition, and infant nutrition. In addition, the sports nutrition segment for microbial is classified into sports drink and other sport supplements. The plants segment is further categorized into prescription medicine, sports nutrition, and infant nutrition. The sports nutrition for plants is classified into sports drink and other sport supplements. By enzyme type, the market is divided into carbohydrase, protease, lipase, and others. By application, it is divided into prescription medicine, sports nutrition, and infant nutrition. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

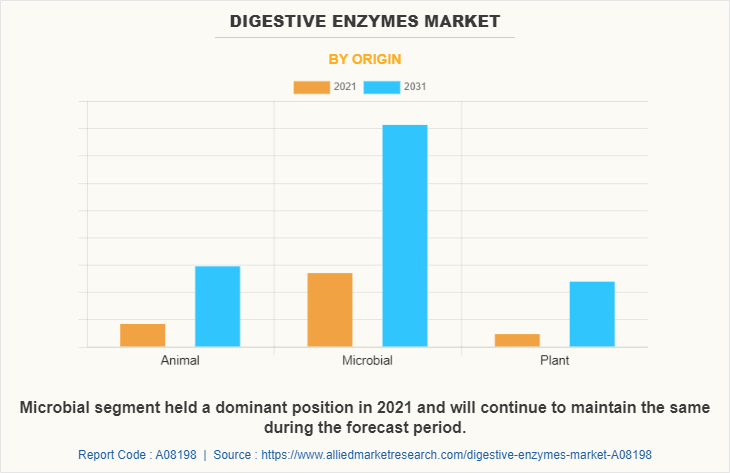

Market By Origin Segment Review

By origin, the market is categorized into animals, microbial, and plants. The microbial segment dominated the market in 2021, and is anticipated to continue this trend during the forecast period owing to the trends such as rise in demand for microbial enzymes and surge in patient awareness toward effective & advanced technologies. In addition, the microbial segment is also expected to exhibit fastest growth during the forecast period owing to rise in number of cases of digestive disorders leading to the increase in demand of enzymes. Moreover, the launch of effective products, which are tested under clinical trials by the companies that ensure better therapeutic outcomes also contributes to the growth of the market.

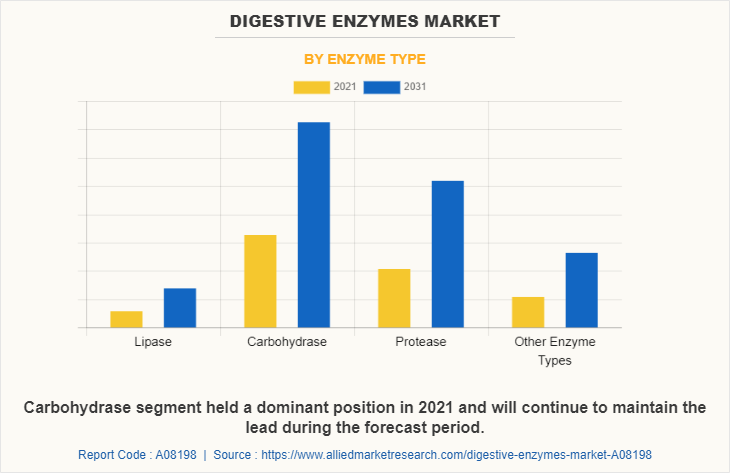

Market By Enzyme Type Segment Review

By enzyme type, the market is segregated into carbohydrase, protease, lipase, and others. The carbohydrase segment accounted for majority of the market share in 2021, owing to rise in number of products available with carbohydrase enzyme and surge in geriatric population facing digestive problems. Moreover, the protease segment is expected to exhibit fastest growth rate, registering a CAGR of 9.4% from 2022 to 2030, owing to increase in demand for protease-based enzymes in the market.

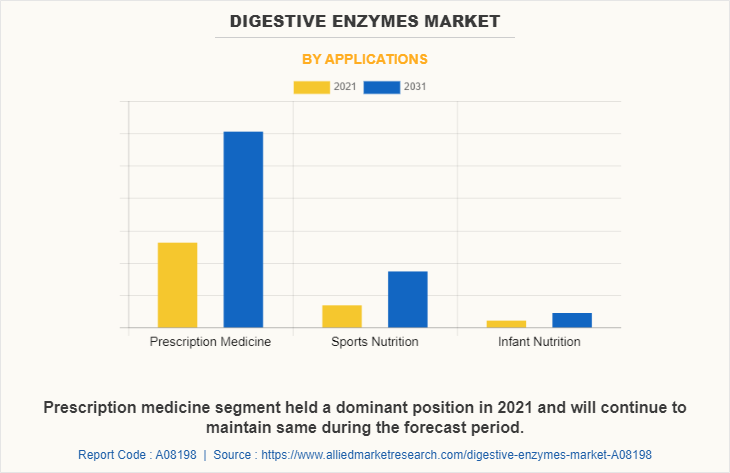

Market By Application Segment Review

By application, the market is segregated into prescription medicine, sports nutrition, and infant nutrition. The prescription medicine segment accounted for majority of the market share in 2021, owing to rise in prevalence of digestive disorders leading to rise in use of prescription medicines as supplemental aid and increase in focus on preventive disease management. Moreover, the sports nutrition segment is expected to exhibit fastest growth rate, registering a CAGR of 9.4% during the forecast period, owing to surge in number of fitness centers & gymnasium and increase in awareness about gastrointestinal (GI) health.

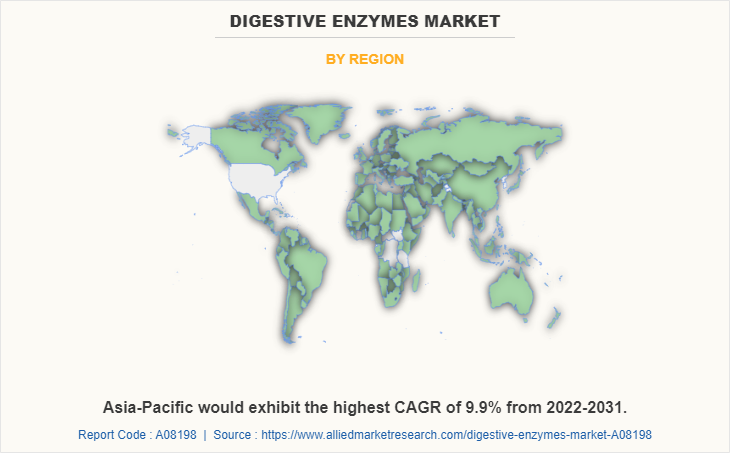

Market By Region Review

North America accounted for the highest revenue in the digestive enzyme market in 2021. The market growth in North America is supplemented by rapid advancements in enzyme products, increase in investments in research & development activities and rise in patient pool. However, Asia-Pacific is expected to emerge as the leading region by registering a CAGR of 9.9% during the forecast period. This is mainly attributed to rise in incidences of digestive disorders such as pancreatitis and pancreatic cancer leading the market growth.

Major companies profiled in the report include Abbott Laboratories, AbbVie Inc., Amway Corporation, Archer Daniels Midland Company, Biotics Research Corporation, Brain Group Co Ltd., Country Life, LLC, Douglas Laboratories, Garden of Life, International Flavors & Fragrances Inc, Johnson & Johnson, Metagenics Inc., Mimi's Rock Corporation, Otsuka Holding Co ltd, Soho Flordis International Health, The Enzymedica Group, Vox Nutrition.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digestive enzymes market analysis from 2021 to 2031 to identify the prevailing digestive enzymes market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digestive enzymes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global digestive enzymes market trends, key players, market segments, application areas, and market growth strategies.

Digestive Enzymes Market Report Highlights

| Aspects | Details |

| By Origin |

|

| By Enzyme Type |

|

| By Applications |

|

| By Region |

|

| Key Market Players | Garden Of Life Inc., Archer Daniels Midland Company (DeerLand Enzymes), Metagenics, Inc., Allergan PLC, Country Life LLC., Johnson & Johnson, Abbott Nutrition., Amway Corporation, Biotics Research Corporation, Abbvie Inc. |

Analyst Review

The digestive enzymes allow nutrients found in consumed foods to be absorbed into the blood stream. Enzymes obtained from different microorganisms display different efficacy in hydrolyzing biomolecules. The digestive enzymes market report consists data of revenues from sales of digestive enzymes that are used to ease up the digestion in gastrointestinal tract.

North America is expected to remain dominant during the forecast period, owing to increase in demand for enzyme products and presence of major key players along with R&D centers. Moreover, Asia-Pacific is expected to offer lucrative opportunities to key players during the forecast period, owing to increase in number of geriatric population, along with surge in utilization of digestive enzymes.

The total market value of digestive enzymes market calculated is $1,643.6 million in 2031.

The market value of digestive enzymes market in 2021 is $699.4 million.

The base year is 2021 in digestive enzymes market.

Increase in prevalence of digestive problems, increase in the unhealthy lifestyle by population and rise in geriatric population are the trends of digestive enzymes market growth.

Asia-Pacific has the highest growth rate of 9.9% during the forecast period. This is mainly attributed to rise in incidences of digestive disorders such as pancreatitis and pancreatic cancer leading the market growth.

Yes, the digestive enzymes market companies are profiled in the report.

Yes, the digestive enzymes market report provides PORTER Analysis

The forecast period for digestive enzymes market is 2022 to 2031

Loading Table Of Content...