Digital Biomarkers Market Research, 2032

The global digital biomarkers market size was valued at $2.1 billion in 2022, and is projected to reach $14.7 billion by 2032, growing at a CAGR of 21.3% from 2023 to 2032. Digital biomarkers are objective, quantifiable measurements collected from digital devices or platforms that provide insights into an individual's health or behavior. These biomarkers are derived from various sources, such as wearable devices, mobile applications, sensors, or other digital health technologies. Digital biomarkers can encompass a wide range of physiological, behavioral, or biometric data. Examples of digital biomarkers include heart rate, blood pressure, sleep patterns, physical activity levels, cognitive function, speech patterns, medication adherence, or even social media activity. These biomarkers can be collected continuously or intermittently, allowing for real-time monitoring and analysis of an individual's health status.

Historical Overview

The digital biomarkers market share was analyzed qualitatively and quantitatively from 2022 to 2032. The market experienced growth at a CAGR of around 21.3% from 2022 to 2032. Most of the growth during this period was derived from North America owing to high presence of market players who manufacture digital biomarkers and increase in of population suffering from chronic diseases such as cardiovascular diseases, respiratory disorders, neurological diseases, and others.

Market Dynamics

Growth of the global digital biomarkers market size is majorly driven by high presence of market players who manufacture digital biomarkers, and technological advancements for development of digital biomarkers. Moreover, rise in prevalence of chronic diseases such as cardiovascular diseases, diabetes, mental health disorders, neurodegenerative diseases and chronic pain conditions is anticipated to drive the demand for digital biomarkers, and drive the growth of the market. Moreover, these biomarkers are used in assessment and diagnosis in neurodegenerative diseases such as Alzheimer's disease and Parkinson's disease. Technologies like wearable sensors, smartphone-based assessments, and digital cognitive tests can aid in tracking disease progression, motor symptoms, cognitive decline, and response to interventions.

Thus, rise in prevalence of Parkinson's disease is anticipated to fuel the demand for digital biomarker and boost the growth of the digital biomarker market. For instance, according to Parkinson's Foundation, in 2022, nearly 90,000 people were reported to have been diagnosed with Parkinson’s disease in the U.S. each year. This represents a steep 50% increase from the previously estimated rate of 60,000 diagnoses annually. Moreover, digital voice biomarkers are being investigated as a potential tool for assessing and monitoring Parkinson's disease (PD). These biomarkers analyze speech characteristics and vocal patterns to detect changes that may be indicative of Parkinson's-related motor and non-motor symptoms.

Moreover, rise in product provision of digital biomarker for neurological disorders is anticipated to drive the digital biomarkers market growth. For instance, Koneksa, the leader in digital biomarker development and implementation provides digital biomarkers for Parkinson’s disease patients, which is a cloud-based software as a service (SaaS) used in Parkinson’s disease. In addition, ActiGraph LLC, a biotechnology research company, provides ActiGraph wGT3X-BT which is applicable for gait analysis and fall detection.

Rise in geriatric population is anticipated to drive the prevalence of chronic diseases such as neurological disease, cardiovascular disorders, respiratory diseases, and others. Thus, this factor is anticipated to boost the demand for digital biomarkers in geriatric population and boost the growth of the market. For instance, digital biomarkers are used in geriatric population to monitor or diagnose different diseases such as Alzheimer's disease and dementia, gait disorders, falls and fall risk assessment, cardiovascular health, and others.

In addition, according to World Health Organization (WHO), in 2023, currently more than 55 million people have been reported to suffer from dementia worldwide. Alzheimer’s disease is the most common form of dementia and may contribute to 60–70% of cases. Moreover, according to PM&R Knowledge, in July 2023, the prevalence of gait disorders was estimated to be 10% in individuals 60-69 years old increasing to more than 60% for those older than 80 years old and 82% for those older than 85 years old. Thus, rise in Alzheimer’s disease, gait disorders and other neurological diseases is anticipated to boost the demand for digital biomarkers and boost the growth of the market.

Health benefits associated with digital biomarkers is anticipated to drive the digital biomarkers market opportunity. For instance, digital biomarkers, enable early detection and prompt treatment of medical disorders. Digital biomarkers can detect problems far sooner than traditional ones, enabling early treatment. Wearable biomarkers and cellphones continually collect health data. For instance, Element Science, manufacturer of next-generation wearable digital platform, provided the patch-based wearable cardioverter defibrillator (WCD) continually tracks patients' cardiac activity.

Digital biomarkers also provide effective self-management and personalized remote patient treatment at a cheaper cost. Patients can acquire a better understanding of their state and make better health decisions owing to the capabilities of smartphones and wearable technology to continually assess health data and to combine data from many sources. In addition, the clinician can deliver individualized care remotely after receiving this data. The expense is decreased since all of these tasks may be completed online without going to a clinic or hospital. Thus, advancement in technology and health benefits associated with digital biomarker are anticipated to boost the growth of the digital biomarkers market forecast.

On the other hand, data security issue is acting as restraining factor for the growth of the digital biomarker market. For instance, data security can be a significant concern in the context of digital biomarkers due to several reasons such as sensitivity of health data, increased data volume and complexity, data transmission and storage and others. Moreover, digital biomarker data is often transmitted and stored on various platforms, including cloud servers, mobile devices, or remote servers. Each point of data transfer or storage introduces potential vulnerabilities that could be exploited by cybercriminals. Moreover, connected software products may pose cybersecurity challenges exposing trial participants and patients to privacy breaches or even safety risks.

In addition, digital biomarkers generate large volumes of data due to continuous or frequent monitoring. The sheer quantity and complexity of this data make it challenging to secure and manage it effectively. Increased data volume also means a higher risk of potential breaches or unauthorized access. Thus, cyber security issues associated with digital biomarker is anticipated to hamper the growth of the market.

Segmental Overview

The digital biomarkers market share is segmented on the basis of type, application, end user and region. By type the market is divided into wearable, mobile application, software, and others (sensor, card, and implantable). By application, the market is classified into cardiovascular disease, sleep & movement disease, neurological disorders, and others (respiratory diseases, diabetes, psychiatric and musculoskeletal disorders). By clinical practice the market is classified into monitoring, diagnostic and prognostic.By end user, the market is divided into healthcare companies, hospitals, and others (payers and patients).

Region-wise, the digital biomarkers industry is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

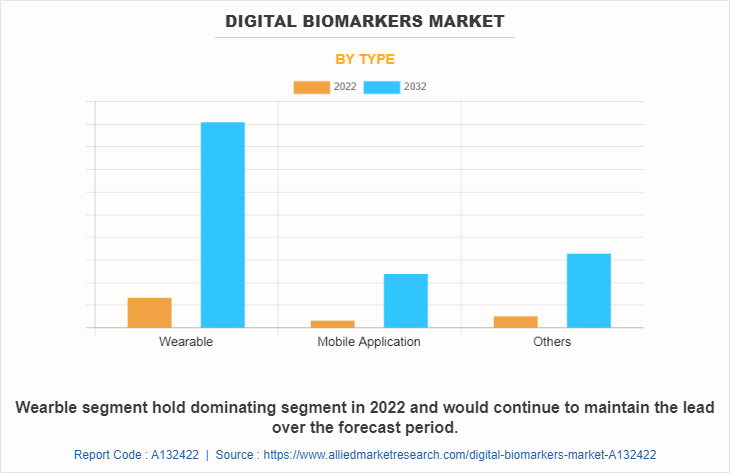

By Type

The market is classified into wearable, mobile application, software, and others. Others include sensor, card and implantable. The wearable segment is expected to be the fastest growing segment during the forecast period owing to rise in number of product approvals for wearable and rise in adoption of wearable digital biomarker by population.

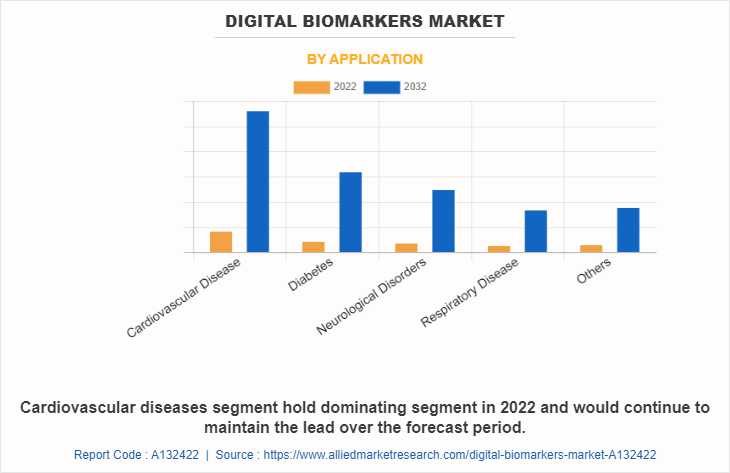

By Application

The market is classified into cardiovascular disease, sleep and movement disease, neurological disorders, and others. Others includes respiratory diseases, diabetes, psychiatric and musculoskeletal disorders. The cardiovascular disease segment is projected to be the fastest growing segment during the forecast period owing to rise in prevalence of cardiovascular diseases and enhanced product provision of digital biomarkers for cardiovascular disease monitoring and diagnosis.

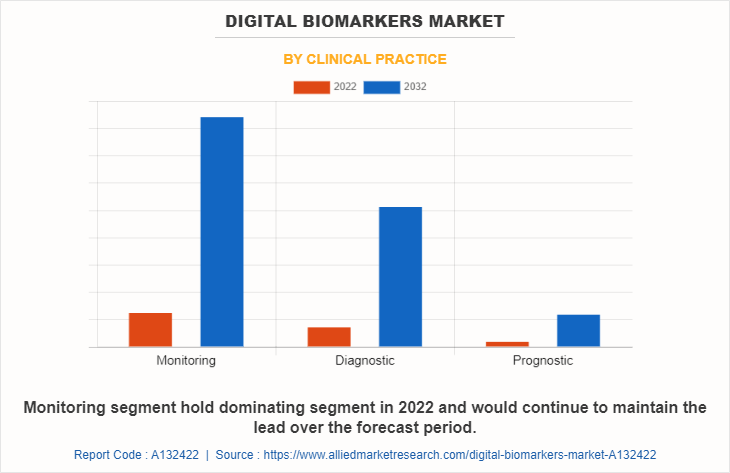

By Clinical Practice

The market is classified into monitoring, diagnostic and prognostic. The monitoring segment is anticipated to boost the growth of market during the forecast period owing to, rise in usage of digital biomarkers for monitoring purpose and high presence of market players who manufactures digital biomarkers.

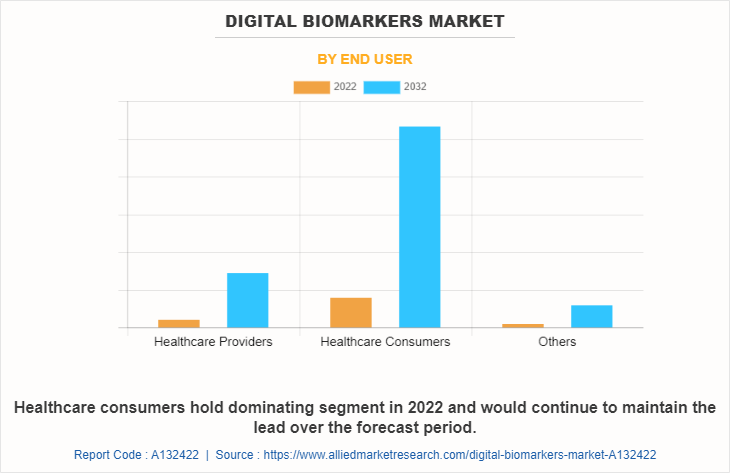

By End User

the market is classified into healthcare companies, hospitals, and others. others include payers and patients. The healthcare companies segment is projected to be the fastest growing segment during the forecast period owing to rise in number of clinical trials and research activities using digital biomarkers by healthcare companies.

By Region

North America is expected to grow during the forecast period, owing to high presence of market players who manufacture digital biomarkers and increase in number of product approvals for digital biomarkers. For instance, ActiGraph LLC., Verily Life Sciences, Alivecor, Koneksa, Amgen, Feel Therapeutics, Sonde Health, Inc., are major market players who manufacture technologically advanced digital biomarkers.

Moreover, in November 2022, Empatica, biotechnology research company, announced the clearance of the Empatica health monitoring platform by the U.S. Food and Drug Administration (FDA). The clearance provides healthcare professionals and researchers with a modern, intuitive, and reliable tool, and clinically validated digital biomarkers to remotely collect data that can be used to monitor electrodermal activity (EDA), SpO2, skin temperature and movement during sleep.

Moreover, increase in prevalence of cardiovascular disease in North America increase the demand for digital biomarkers and drive the growth of market. For instance, according to the American Heart Association (AHA), in 2020, it was reported that around 40% of the U.S. population between the age of 40 and 59 years is diagnosed with cardiovascular disease. Moreover, according to the American Heart Association (AHA), in 2020, around 75% of the U.S. population between the age of 60 and 79 years, and 86% of the U.S. population above the age of 80 was reported to have been diagnosed with cardiovascular disease (CVD).

Thus, rise in adoption of digital biomarkers by population suffering from chronic diseases such as cardiovascular diseases, is anticipated to boost the growth of the market. For instance, according to JAMA Network, in June 2023, in the U.S. 18% of people with established CVD and 26% at risk for CVD reported using wearable devices to track heart rates, physical activity, and sleep, and obtain electrocardiograms, and several other measures.

However, the Asia-Pacific digital biomarkers market is expected to grow during the forecast period, owing to rise in prevalence of chronic diseases such as neurological diseases, cardiovascular disorders, respiratory diseases, and others. Digital biomarkers are used in assessment, monitoring, and diagnosis of different neurological disorders such as dementia, Parkinson’s disease, and others. Thus, rise in prevalence of dementia and increase in awareness among population regarding availability of digital biomarkers are anticipated to boost the growth of the market.

For instance, according to National Library of Medicine, in January 2023, dementia prevalence for adults aged 60 years in India was estimated to be 7.4%. As per the same source, in 2023, an estimated 8.8 million Indians older than 60 years were reported to suffer from dementia.

Competition Analysis

Some of the major companies that operate in the global digital biomarkers industry include ActiGraph LLC, Verily Life Sciences, Alivecor, koneksahealth, Amgen, Pfizer, Feel Therapeutics, Sonde Health, Inc., Empatica.

Recent Product Approval in the Digital Biomarkers Market

In November 2022, Empatica, biotechnology research company, announce the clearance of the Empatica health monitoring platform by the U.S. Food and Drug Administration (FDA). The clearance provides healthcare professionals and researchers with a modern, intuitive, and reliable tool, and clinically validated digital biomarkers to remotely collect data that can be used to monitor electrodermal activity (EDA), SpO2, skin temperature and movement during sleep.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital biomarkers market analysis from 2022 to 2032 to identify the prevailing digital biomarkers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital biomarkers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global digital biomarkers market trends, key players, market segments, application areas, and market growth strategies.

Digital Biomarkers Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.7 billion |

| Growth Rate | CAGR of 21.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 438 |

| By Type |

|

| By Application |

|

| By Clinical Practice |

|

| By End User |

|

| By Region |

|

| Key Market Players | Empatica, Sonde Health, Inc., ActiGraph LLC, Feel Therapeutics, Verily Life Sciences LLC, Koneksahealth, Clario, AliveCor, Brainomix, Amgen Inc. |

Analyst Review

Digital biomarkers detect anatomical, psychological, and behavioral changes in the human body using a variety of sensors, machine learning (ML), and artificial intelligence (AI) techniques, making the data accessible to the wearer and other interested users. Digital biomarkers are used to personalize preventive care, evaluate risks, and manage mental health conditions and diseases. Rise in technological development in healthcare system and increase in number of product approvals for digital biomarkers are anticipated to drive the growth of the market.

For instance, in November 2022, Empatica, biotechnology research company, announce the clearance of the Empatica health monitoring platform by the U.S. Food and Drug Administration (FDA). The clearance provides healthcare professionals and researchers with a modern, intuitive, and reliable tool, and clinically validated digital biomarkers to remotely collect data that can be used to monitor electrodermal activity (EDA), SpO2, skin temperature, and movement during sleep.

In addition, rise in number of product launch for digital biomarkers is anticipated to boost the growth of the market. For instance, in September 2022, Feel Therapeutics Inc., a leading company of developing digital biomarkers and therapeutics, announced the launch of its digital precision medicine platform. Through its proprietary platform, Feel can collect clinically valuable data points passively and on a 24/7 basis to generate real-world evidence (RWE) and discover novel digital biomarkers and endpoints.

The top companies that hold the market share in digital biomarkers market are Anyang General Chemical Co., Ltd., Sandoo Pharmaceuticals, Evonik Industries AG, Shree Ganesh Remedies Limited, Pfizer, Cambrex Corporation, and Espee.

North America is anticipated to witness lucrative growth during the forecast period, owing to rise in expenditure by government organization to develop the healthcare sector, increase in the prevalence of chronic diseases and increase in the number of geriatric populations.

The key trends in the digital biomarkers market are high presence of digital biomarkers manufacturers and rise in number of populations suffering from chronic diseases.

The base year for the report is 2022.

10 digital biomarkers companies are profiled in the report.

The total market value of digital biomarkers market is $2,126.0 million in 2022.

The forecast period in the report is from 2023 to 2032.

High cost of digital biomarkers devices is restraining factor for digital biomarkers market.

Loading Table Of Content...

Loading Research Methodology...