Digital Gift Card Market Research, 2032

The global digital gift card market was valued at $341.9 billion in 2022, and is projected to reach $1.5 trillion by 2032, growing at a CAGR of 16.3% from 2023 to 2032.

A prepaid digital wallet, such as digital gift card, contains a set amount of money, which is utilized to make purchases. The minimum and maximum loading amounts on digital gift cards are $10 and $500, respectively. Digital gift cards are used to cover a portion of a transaction via mobile banking, debit, or credit to balance the cost. Many digital gift cards are registered online as a safety measure to reduce the risk of losses; this enables the remaining amount to be tracked and frozen in the event that a card is misplaced. Digital gift cards are easier to track and offer greater protection than cash, helping to prevent fraudulent transactions.

The growth of the global digital gift card market is majorly driven by increase in use of cutting-edge technology in the payments industry and rise in global awareness of digital payments. The digital gift card market is further fueled by surge in penetration of smartphones and increase in popularity of gift cards among businesses and financial institutions.

However, gift card fraud issues such as refund fraud, card number theft, and physical tampering restrain the digital gift card market expansion. On the contrary, it is anticipated that in the next years, the digital gift card market would benefit greatly from technological advancements and spike in demand for gift cards originating from developing nations. Furthermore, rise in corporate organizations' preference for digital gift cards over cash when rewarding their employees supports the market expansion. In addition, high growth potential in the developing countries such as China and India is anticipated to open new avenues for the digital gift card market expansion during the forecast period.

Furthermore, the key factors that impact the global digital gift card market growth is acceptance of smartphones and increase in demand for advanced payment options. However, security issues affect the market growth to some extent. Conversely, increased enthusiasm in revolutionary products is expected to influence the digital gift card market during the forecast period.

Segment Review

The digital gift card market is segmented into Channel, Transaction Type, Card Type, Application Area and End Users.

The global digital gift card market is segmented into form, channel, transaction type, card type, application area, end user, and region. On the basis of form, the market is bifurcated into physical card and digital card. As per channel, it is divided into brick and mortar, and digital. Further, digital segment is sub-divided into e-commerce and loyalty. Depending on transaction type, it is fragmented into B2B and B2C. By card type, it is segregated into open loop and closed loop. Further, closed loop is divided into dining, fashion, travel, gaming, betting, and others. Furthermore, open loop segment is bifurcated into visa card, master card, and others. By application, it is categorized into consumer goods, health wellness, restaurants and bar, travel and tourism, media and entrainment, and others. On the basis of end user, it is fragmented into retail establishment and corporate institution. Further, retail establishment is sub-divided into generation Z or millennials, generation X, and baby boomers. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

This report gives an in-depth profile of some key players in the digital gift card industry are Amazon.com, Inc., Apple Inc., Blackhawk Network, Fiserv, Inc., Incomm Payments Llc, Loop Commerce, Inc., NGC US, LLC., Paypal Holdings, Inc., Target Brands, Inc., and Walmart. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the digital gift card market.

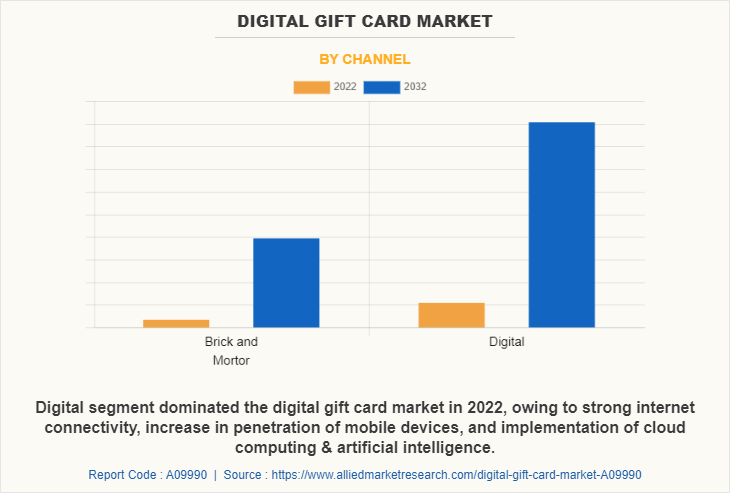

Depending on channel, the digital gift card market share was dominated by the digital segment in 2022 the same segment is expected to witness the fastest growing, owing to strong internet connectivity, increase in penetration of mobile devices, and implementation of cloud computing & artificial intelligence. These advancements have made digital channels more accessible, convenient, and user-friendly, thus boosting the market growth. As online purchase continues to increase, consumers are increasingly seeking digital options that align with their online purchasing habits. Therefore, with increase in use of digital channels, the demand for digital gift cards increases simultaneously. This is attributed to the convenience provided by digital gift cards services that allow recipients to shop online or use them in online marketplaces, providing a seamless integration with the digital shopping experience.

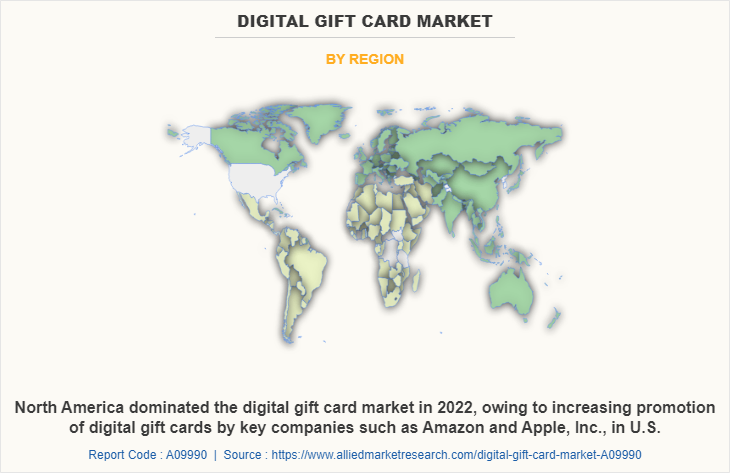

On the basis of region, North America dominated the digital gift card market size in 2022, owing to rise in demand for digital gift cards. Due to rapid digitization and surge in adoption of smart devices, North America has a strong potential for growth. Additionally, the growing e-commerce industry has sparked a rise in the use of digital gift cards to offer distinctive and alluring product offerings. However, Asia-Pacific is expected to be the fastest growing for digital gift card market outlook, owing to the increased demand during the holiday and shopping seasons, the market for digital gift cards has witnessed significant expansion in this area over the last several years. In addition, with rise in digital gift card purchasing at online shops and investments in Al to give personalized digital gift cards, the usage of digital gift cards has increased substantially and is expected to continue in China.

Top Impacting Factors

Rapid Penetration of smartphones

With the rising adoption of smartphones, the digital gift card market is anticipated to grow significantly as now costumers have more convenient and resident options for payment. Considering how quickly smartphones have developed, digital gift cards/digital voucher have gotten more inventive. Modern marketing techniques and technological advancements have produced a variety of ways for smartphone users and fans of digital gift cards to combine everything into a handy package.

The market for digital gift cards is likely to grow as more people adopt smartphones since they provide flexible and quick payment options for consumers. Furthermore, owing to the growing adoption of contemporary technology and marketing strategies, gift card consumers and smartphone users now have a choice of options for combining everything into one useful bundle. For instance, one of the most well-liked options is Gyft, which is accessible on both iPhone and Android. The app allows users to load digital gift cards that they may spend whenever they go shopping. Thus, rapid penetration of smartphones notably contribute toward the growth of the market.

Increase in Demand for Advanced Payment Options

Prepaid debit cards and digital gift cards are often considered similar. These cards are now increasingly used for payments by customers owing to their convenience, adaptability, dependability, and security. These cards are a crucial component of online payments. This explosive growth in digital commerce presents a chance for merchants and issuers to adopt an increasing number of new technologies that give their customers cutting-edge and seamless payment options. Consumers are constantly involved in shopping and pay through various ways, such as mobile apps.

For instance, a U.S.-based corporation called VISA Inc. is always developing new strategies to prevent payment disruptions and modernize how customers can pay. It offers services to customers in a variety of novel ways, such as mobile and loT via Visa Token Service, P2P via Visa Direct, and automated and optimized manual procedures via Connected Card. Such services are luring clients to accept digital payments all over the world, which propels the adoption of best digital gift cards, thus fostering the growth of the global digital gift card market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital gift card market analysis from 2022 to 2032 to identify the prevailing digital gift card market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital gift card market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global digital gift card market trends, key players, market segments, application areas, and market growth strategies.

Digital Gift Card Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.5 trillion |

| Growth Rate | CAGR of 16.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 503 |

| By Channel |

|

| By Transaction Type |

|

| By Card Type |

|

| By Application Area |

|

| By End Users |

|

| By Region |

|

| Key Market Players | InComm Payments LLC, Target Brands, Inc., Fiserv, Inc., Loop Commerce, Inc., Amazon.com, Inc., Apple Inc., Walmart, PayPal Holdings, Inc., NGC US, LLC., Blackhawk Network |

Analyst Review

Consumer acceptance of digital gift cards is rising due to shift in trend toward electronic payments as well as increase in penetration of digital technologies. Owing to growing local vendor rivalry in terms of features, quality, and price, global players are focusing on product development and expanding their geographic reach. Digital gift cards are similar to digital wallets, except they are funded in advance and go by the name of "stored value cards."

Moreover, these cards are preferred by users for payments because of their usability, adaptability, dependability, and security. According to the National Retail Federation in 2019, consumers planned to purchase three or four gift cards at an average amount of $47 per card, for a total of $27.5 billion during the 2019 holiday season. In addition, the industry growth is being driven by increase in penetration of digital e-commerce platform and spike in digitization among issuers and merchants to offer customers with cutting-edge and convenient payment solutions. For instance, a U.S.-based corporation called VISA Inc. is constantly looking for ways to prevent payment disruptions and modernize how consumers can pay more conveniently. Furthermore, due to government initiatives to encourage digital payments and surge in the adoption of digital gift cards in Saudi Arabia and the UAE for paying their employees online, the market for digital gift cards has gradually grown in across the Middle East and Africa. Digital gift cards are being used for salary payments in the African market, including South Africa, and this trend is anticipated to grow in the next years.

For instance, in September 2020, global branded payments provider, Blackhawk Network launched its issuance and program management solution, which enables brands to fully outsource their gift card and eGift programs. Gift cards can promote brand exposure and new customer acquisition through omnichannel distribution, increasing shopper frequency, spending, and basket sizes. By leveraging Blackhawk's resources expertise, brands can optimize their programs while limiting their internal costs and support structure. This offering is an extension of the gift card services Blackhawk has long provided as a leader in first- and third-party gift card and eGift solutions. Adding eGift and gift card issuance to Blackhawk's capabilities mix has created truly end-to-end services for its customers.

The upcoming trends of digital gift card market are acceptance of smartphones and increase in demand for advanced payment options.

The leading application for digital gift card market are increased enthusiasm in revolutionary products.

North America is the largest regional market for digital gift card.

The digital gift card market valued for $341.86 billion in 2022 and is estimated to reach $1,499.30 billion by 2032, exhibiting a CAGR of 16.3% from 2023 to 2032.

This report gives an in-depth profile of some key players in the digital gift card industry are Amazon.com, Inc., Apple Inc., Blackhawk Network, Fiserv, Inc., Incomm Payments Llc, Loop Commerce, Inc., NGC US, LLC., Paypal Holdings, Inc., Target Brands, Inc., and Walmart. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the digital gift card industry.

Loading Table Of Content...

Loading Research Methodology...